Analys

SEB – Råvarukommentarer vecka 20 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: – 2%

Brett råvaruindex: – 2%

UBS Bloomberg CMCI TR Index- Energi: – 0,34%

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: – 3,96%

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: – 1,81%

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: – 3,35%

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral/köp

- Olja: Neutral/sälj

- Koppar: Neutral

- Majs: Sälj

- Vete: Sälj

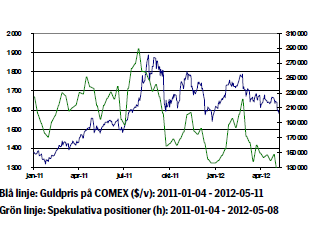

Guld

- Valet i Grekland skapade turbulens. Försöken att bilda regering har misslyckats. Mycket talar för nyval i juni. I slutet av juni är Grekland i behov av nya utbetalningar, men det kräver politiska beslut om nya besparingar för 2013 och 2014.

- Oro över utvecklingen i Grekland och eventuella spridningseffekter har tyngt marknaderna. Spanska 10-åriga obligationer ligger över 6 procent och oron för Spaniens ekonomi är påtaglig. Även i Tyskland ser man nu ett utbrett missnöje med åtstramningar.

- Tyska Bundesbank är villig att acceptera högre tysk inflation i relation till andra euroländers inflation. Detta för att undvika deflation i södra Europa och för att komma till rätta med eurozonens obalanser.

- Guldet föll 3,4 procent och det är uppenbart att guldet inte finner stöd i den systemrisk vi ser i Europa eller i möjligheten till ökad stimulans i form av ökad likviditet. En starkare dollar kan förklara en del av guldets ras men det räcker inte som den enda förklaringen. Vi har sett att utflödet ur guldpositioner skedde i terminsmarknaden medan vi inte såg större utflöden ur fysiska guld ETF: er.

- Korrelationen med andra risktillgångar som råvaror och aktier är hög. Vi tror att vi kan komma att se ytterligare prisfall i denna osäkra makroekonomiska miljö men är benägna att köpa vid större prisfall. Denna vecka är vi neutrala till försiktigt positiva till guldet.

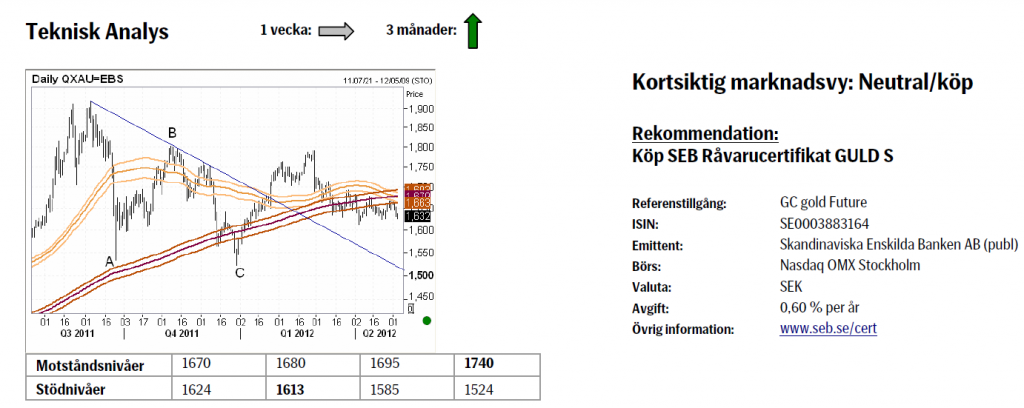

- Teknisk Analys: Fortsatt endast marginella rörelser noterade inom ett redan ganska väl utstakat intervall där under $1620 verkar ”för lågt” och over $1690 ”för högt”. Priset håller sig under ett rullande 55-dagars genomsinittsband. Bandet är svagt i fallande och är på marginalen ett uttryck för visst nedåttryck, men marknaden svarar samtidigt bra på nedställ och i en större positiv bild ser eventuell svaghet ut at vara temporär. Över $1670 & $1695 skulle påvisa efterfrågan och ses som positivt.

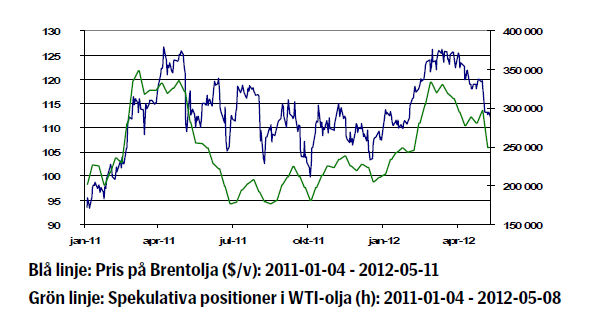

Olja

- Oljepriset föll 5,3 Saudiarabiens oljeminister poängterade precis som Opecchefen att man önskar se ett lägre oljepris och att man eventuellt kommer att diskutera en höjning av medlemsländernas produktionskvoter på Opec mötet i juni.

- Saudiarabien kommer att garantera oljeimport till Japan. Japan har starkt behov av oljeimporten eftersom man nu stängt landets alla kärnkraftsverk.

- Även Indien kommer att minska oljeimporten från Iran för att undgå de sanktioner som USA inför i juni. Importen kommer efter ett år att ha minskat med 65 000 fat per dag vilket motsvarar ungefär tre procent av Irans oljeexport.

- Enligt American Petroleum Institute (API) steg råoljelager med 7,8 miljoner fat. Samtidigt bör noteras att lager av oljeprodukter minskade i samma proportion. Även Department of Energy (DOE) visare på onsdagen att råoljelager steg med 3,6 miljoner fat.

- Det dåliga makroekonomiska sentimentet i takt med att situationen i Europa försämras samtidigt som utbudet av olja i marknaden är stort bidrog till oljeprisets fall. Priset verkar ha stabiliserats vid 112 dollar per fat och vi tycker det är svårt att vara positiva på kort sikt.

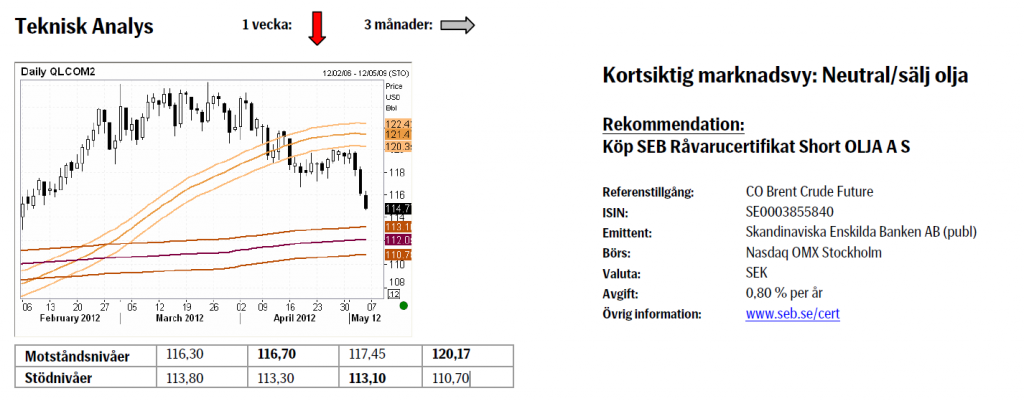

- Teknisk Analys: Undersidan av 55-dagars bandet (som efter kraftigt nedställ denna vecka är satt i fallande) agerar som dynamisk motstånd (borde inte återtestas under de kommande veckorna). Rörelsen ner är som sagt hård och ska väntas fortsätta för att testa 233-dagars bandet som just nu börjar vid $113.

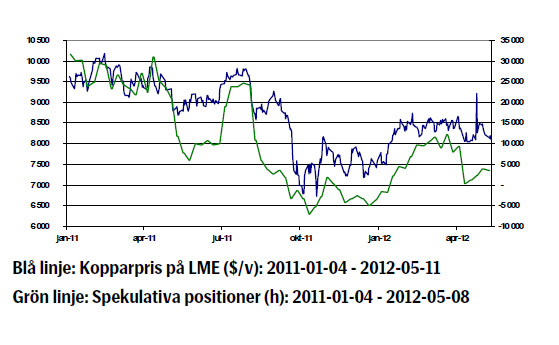

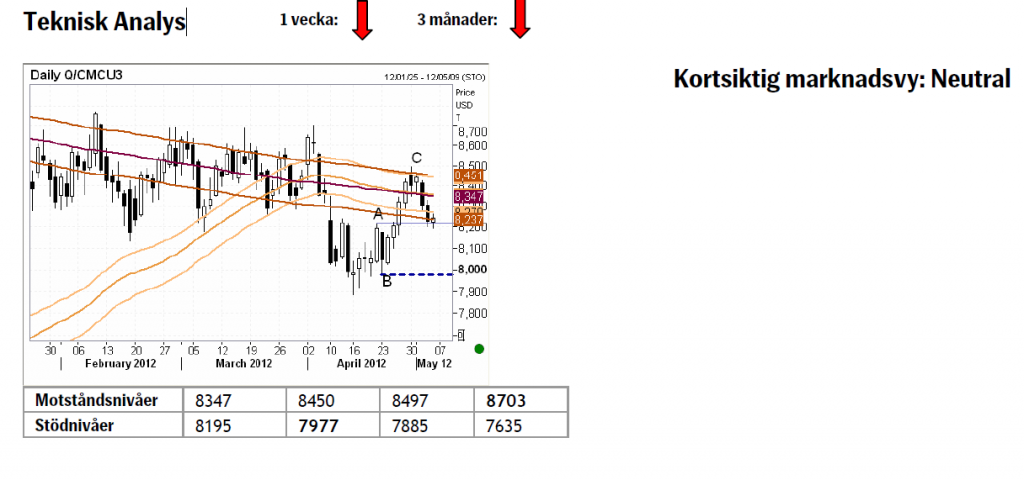

Koppar

- Kina sänkte i lördags reservkraven för sina största banker med en halv procentenhet till 20 %. Detta var den tredje sänkningen på 6 månader. Denna stimulans väntas öka likviditeten i systemet och kan ge stöd åt kopparpriset. Kinesisk inflationstakt dämpades till 3.4 procent i april från 3.6 procent i mars. Pristrycket är lågt för närvarande och tillväxttakten låg under första kvartalet på den lägsta nivån sedan början av 2009. Kopparpriset föll med 0,8 procent veckan som gick och handlade kort under den viktiga 8000 dollar nivån.

- Kinas handelsstatistik för april var svag. Handelsbalansen steg förvisso men både export och framförallt import föll långt mer än förväntat. Exporten ökade med 4,9 procent jämfört med samma månad året före, väntat var en ökning med 8,5 procent. Importen ökade samtidigt med 0,3 procent, väntat var en ökning med 10,9 procent.

- Industriproduktionen för april steg 9,3 procent jämfört med samma period föregående år. Den var en inbromsning från uppgången om 11,9 procent som noterades i mars, och betydligt under förväntningarna om en uppgång med 12,2 procent.

- Kinas kopparlager föll för femte månaden i rad och föll med 9178 ton till 187449 ton, den lägsta nivån sedan februari. Istället för att importera använder man koppar som finns i lager i landet. Utanför Kina är koppartillgången däremot begränsad och de höga lagernivåerna i Shanghai är en osäkerhetsfaktor.

- Kopparpriset kan fortsätta att pressas eftersom hög kinesisk import tidigare gett stöd åt priset men nu uteblir. Samtidigt kan priset stiga om vi ser att Kina behåller all koppar i landet och den globala marknaden uppvisar en minskad tillgång.

- Teknisk Analys: Rörelsen högre gick något längre än vad som tidigare var trott, men uppsidan av 55-, & 233-dagars ”banden” höll köpare över $8500 nivån borta. Den nuvarande överlappningen under 20 april toppen vid $8218 har ökat sannolikheten att apr/maj rörelsen verkligen är den korrektion vi antagit att den är. Under $$7977 skulle helt bekräfta detta och starkt argumentera för fortsatt rörelse under apr botten vid 7885.

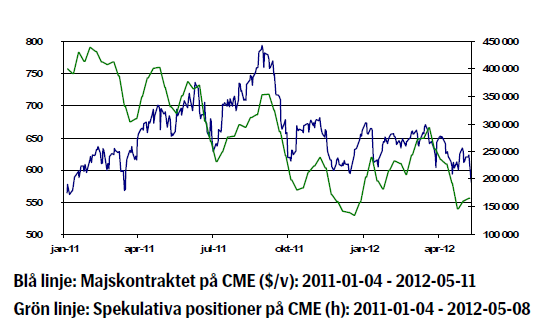

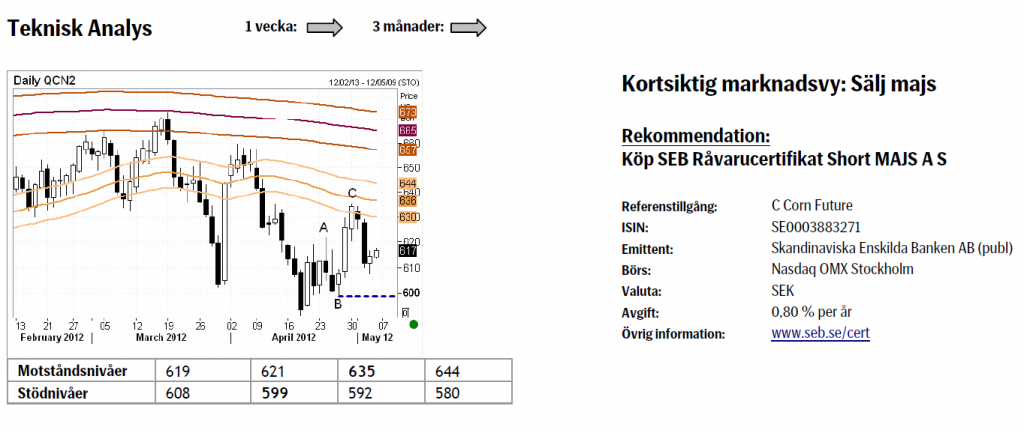

Majs

- Efter att ha handlats över 6 USD/bushel de senaste veckorna föll julikontraktet kraftigt under veckan för att slutligen stänga på 5,81 USD/bushel, en nedgång med 6,33 procent.

- Som vi nämnt i tidigare veckobrev har särskilt den goda efterfrågan från kinesiska boskapsuppfödare agerat stöd den senaste tiden. Torsdagens WASDErapport från det amerikanska jordbruksdepartementet (USDA) fick dock även detta stöd att ge vika.

- I sin rapport justerade USDA upp sin prognos rejält för den amerikanska skörden, där prognosen för landets lagernivå avseende innevarande skördeår justerades upp med över 6 procent jämfört med april månads estimat. Då marknaden förväntade sig en minskning blev följaktligen effekten av rapporten ett rejält prisfall för majsen.

- Fundamentalt ser vi fortsatt ingen anledning att tro på en uppgång för majspriset. Oron i Sydeuropa ökar riskaversionen från investerarkollektivet samtidigt som den goda produktionen minskar intresset från konsumenterna. Vi behåller med detta vår säljrekommendation för majsen.

- Teknisk Analys: Rörelsen upp från apr botten har kommit av sig och börjat se ut som en korrektiv ”3-vågs” rörelse där A-, & C-vågorna nu är symmetriska i storlek och hastighet. Tillbaka under 599 skulle till fullo bekräfta detta och den lätt negativa lutningen på 55-dagars bandet och då argumentera för rörelse under 592, möjligtvis ner mot 580-området.

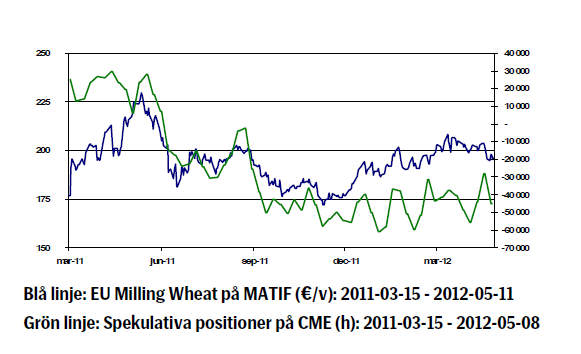

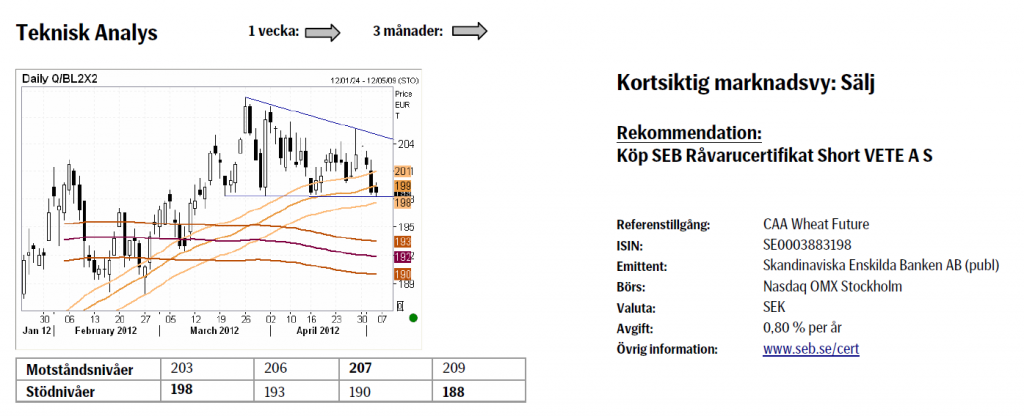

Vete

- Till skillnad mot sin amerikanska motsvarighet gick vetet i Europa upp något under förra veckan. Detta till stor del baserat på USDA:s jordbruksrapport, i vilken man bedömer att framförallt produktionen i Europa kommer att vara svag under 2012. Det land som kommer att ha störst bortfall är Ukraina, där skörden väntas minska med över 40 procent jämfört med föregående skördeår. Den köldknäpp som drabbade Europa under början av 2012 har fått omfattande konsekvenser och priset på MATIF-vete har sedan årsskiftet gått upp med 1,5 procent. Under samma period har vetepriset i Chicago minskat med nästan 14 procent.

- De senaste veckornas positiva skördeutveckling i USA verkar hålla i sig och det amerikanska jordbruksdepartementet prognostiserar en produktionsökning med 13 procent för landets vintervetesskörd 2012.

- Nu bedömer vi att de största bortfallen avseende den europeiska produktionen är inprisade och ser det som mer troligt att priset kommer att gå ned de kommande veckorna.

- Teknisk Analys: Fallande top Fallande toppar indikerar ett något höjt säljtryck. Skulle stödet just under €200-nivån (& nedsidan på 55-dagars bandet) sluta att attrahera köpare så väntas snabb rörelse tillbaka ner mot stödet vid 233- dagars bandet (som är i fallande) och som börjar vid €193. Över €206 skulle åter minska risken för brott lägre och i stället tas som efterfrågan vid nivåer som tidigare ansågs säljvärda.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

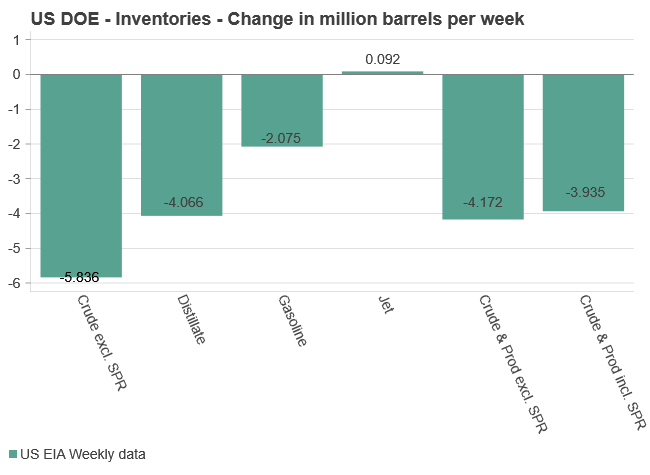

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

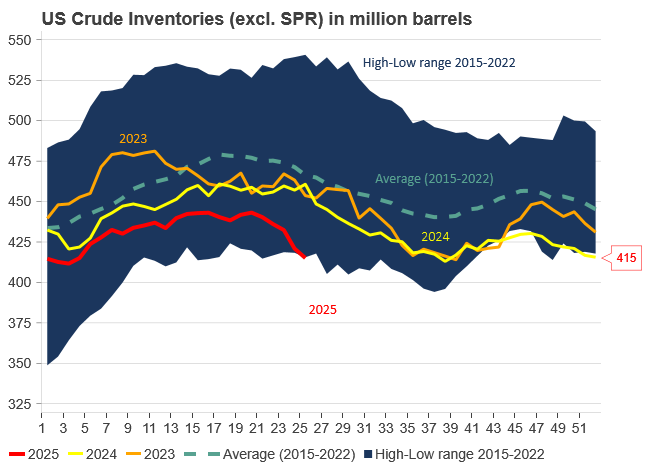

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys4 veckor sedan

Analys4 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering

-

Analys3 veckor sedan

Analys3 veckor sedanTightening fundamentals – bullish inventories from DOE

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanRyska staten siktar på att konfiskera en av landets största guldproducenter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSommarvädret styr elpriset i Sverige