Analys

SEB – Råvarukommentarer vecka 17 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: +0,33 %

Brett råvaruindex: +0,33 %

UBS Bloomberg CMCI TR Index- Energi: +0,37 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -0,15 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +1,75 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: +0,14 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral

- Olja: Sälj

- Koppar: Sälj

- Majs: Neutral/sälj

- Vete: Neutral

Guld

- Guldpriset föll 0,4 procent förra veckan. Under veckan låg fokus på spanska obligationsemissioner, spansk 10-års ränta steg igen över 6 procent.

- Utvecklingen i Spanien är problematisk. Landet tyngs av stigande räntor, problem att få ner det offentliga underskottet och eventuella ytterligare behov att stötta banker.

- Det krävs besparingar vilka riskerar en ännu sämre ekonomisk utveckling som följd.

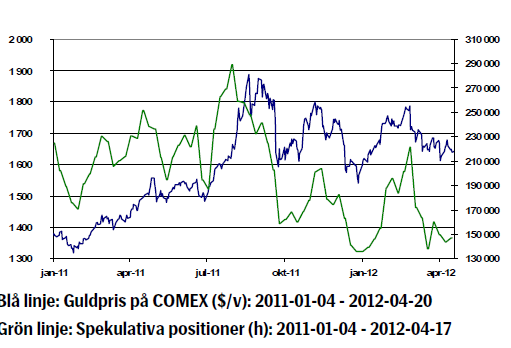

- Öppna positioner i terminskontrakt på Comex föll veckan som gick vilket grafen till vänster visar men fysiska guld ETF: er såg inga större in eller utflöden och världens största guld ETF SPDR har inte haft utflöden under veckan.

- Efterfrågan på guld i Indien kommer sannolikt att öka i samband med veckans festival ”Akshaya Tritya”.

- På onsdag riktas blickarna mot USA och räntebesked från FOMC. Indikationer på ytterligare QE3 kommer att ha stor betydelse för guldprisets utveckling.

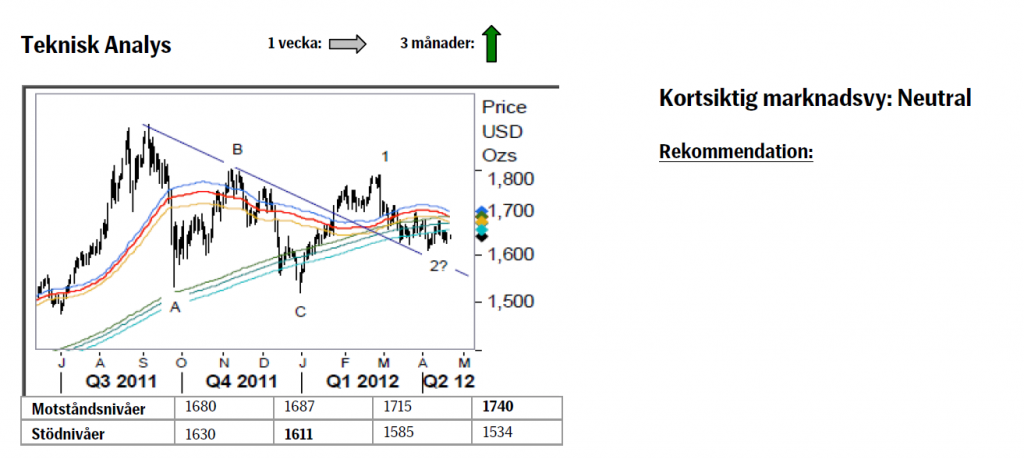

- Teknisk Analys: Efter ett försök upp i medelvärdesbanden har vi under inne-varande vecka åter drivit ned under dessa. Detta är dock ännu ingen fara på taket och vi vidhåller att en potentiell lågpunkt har passerats så länge vi inte faller under 1611. En uppgång och framför allt en stängning över 1680 skulle vara klart positivt för vår positiva vy,

Olja

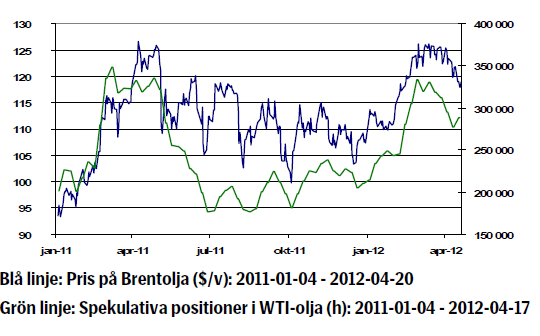

- Oljepriset steg åter på fredagen och det prisfall vi sett i början av veckan återhämtades och priset stängde oförändrat jämfört med föregående vecka.

- Oron kring Iran och landets atomenergiprogram har minskat efter förra helgen då västländer mötte Iran för samtal som beskrevs ha varit ”konstruktiva”.

- Irans oljeminister uttalade emellertid förra veckan att Iran kommer att sluta exportera till Europa om inte nästa möte i Bagdad, den 23 maj, blir ”positivt”.

- Europa har redan beslutat om ett totalförbud mot import av iransk olja från den först juli och många oljebolag har förberett sig på förbudet genom att leta substitut från bland annat Saudiarabien och Förenade Arabemiraten.

- Tisdagens APIs oljestatistik visare att råoljelagersteg steg med 3,4 miljoner fat. DOE data på onsdagen visade att råoljelager steg med 3,9 miljoner fat.

- Enligt Bloomberg News räknar 17 av 30 analytiker med sjunkande oljepriser

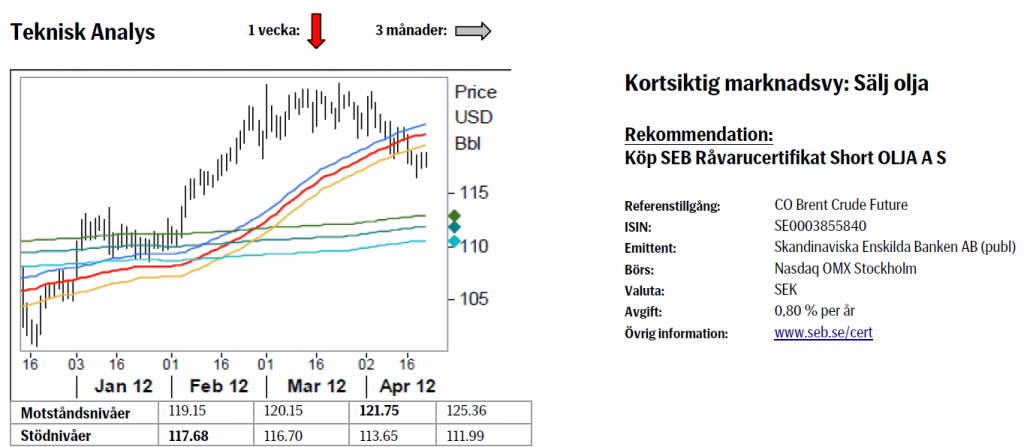

- Teknisk Analys: I och med nedgången under 55dagars bandet har vi övergivit vår medelsiktigt positiva vy och anser att sannolikheten för att få se den sista (?) uppgången till 129- 131 nu måste betraktas som låg. Ett återtest av 55dagars bandet för att prova validiteten i brottet ligger i korten för nästkommande vecka. Vi tror att man ska sälja en sådan reaktion till 120/122.

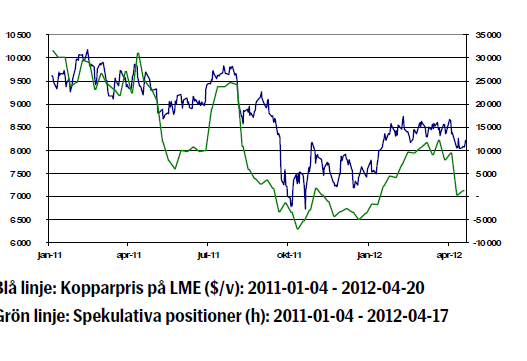

Koppar

- Kopparpriset steg 2,7 procent förra veckan.

- HSBC:s inköpschefsindex för Kina visade 49.1 för april. Det var en ökning från förra månadens siffra, 48.3, men det är samtidigt den sjätte månaden i rad som indexet hamnar under 50-nivån (som innebär att fler ser försämring än förbättring).

- Man har sett att fastighetspriser i 37 av 70 städer i Kina föll nio procent på årlig basis i mars vilket kan tyda på en viss nedkylning i landets ekonomi. Kinesiska myndigheter har uttryckt en önskan att se lägre fastighetspriser.

- Kinas import av koppar har varit stadig en längre tid. Mycket tyder på att importen har hamnat i lager och många analytiker anser att kinesiska kopparlager ligger på rekordhöga nivåer.

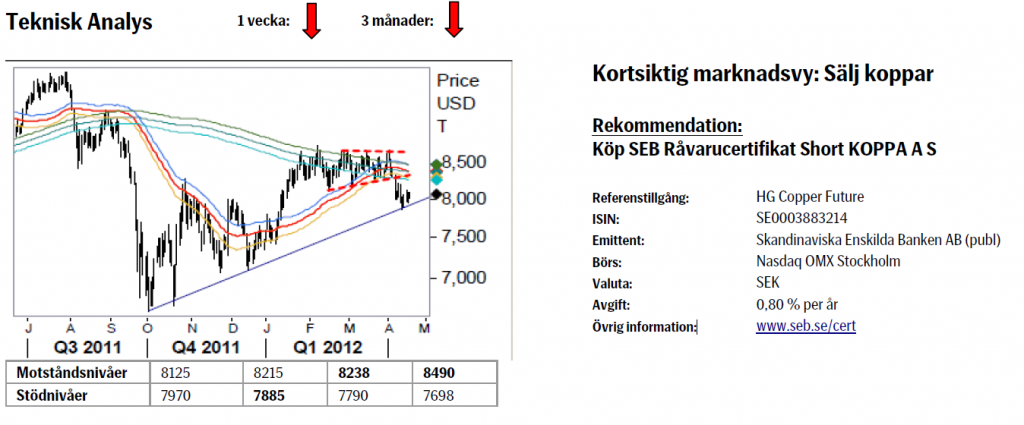

- Kortsiktigt fortsätter vi att tro på ett lägre kopparpris.

- Teknisk Analys: Brottet ned ur topp formationen bör inom kort fortsätta pressa priserna lägre. Den lilla reaktion vi nu sett ifrån den medellånga stödlinjen ser väldigt svag ut och bör därför snart reverseras och en ny nedgångsfas ta vid.

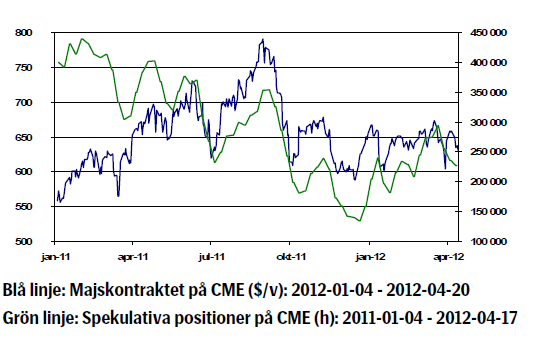

Majs

- Vår kortsiktigt negativa syn på majsen har visat sig stämma förhållandevis väl den senaste tiden. Under förra veckan gick priset på majkontraktet i Chicago ned med 2,66 procent. Då den amerikanska dollarn försvagades under samma period var den motsvarande rörelsen i svenska kronor en nedgång med över 4 procent.

- En stark drivkraft bakom förra veckans negativa prisutveckling var planteringen av majs i USA, där det amerikanska jordbruksdepartementet (USDA) i sin rap-port från den 17/4 meddelade att 17 procent av landets skörd nu har planterats. För ett år sedan hade 5 procent planterats och snittet de senaste fem åren ligger även det på 5 procent. Varmt väder under mars och god nederbörd under första halvan av april innebär mycket goda förutsättningar för planteringen av majs.

- I Chicago fortsätter andelen spekulativa majsköpare att minska. Odlingsprocessen i USA samt positiva väderprognoser minskar incitamentet att ha majs i portföljen. Man bör dock vara medveten om att det från kinesiskt håll har uttryckts intresse för att köpa majs om priserna fortsätter falla, vilket innebär att det bör finnas ett golv för majsen. För att priset ska nå detta golv bör det nog falla runt 10 procent från nuvarande nivå.

- Det som möjligen skulle kunna tala för majsen den närmaste tiden är fortsatta försämringar av utbudet från Argentina och Brasilien, detta efter ovanligt torra väderförhållanden de senaste månaderna.

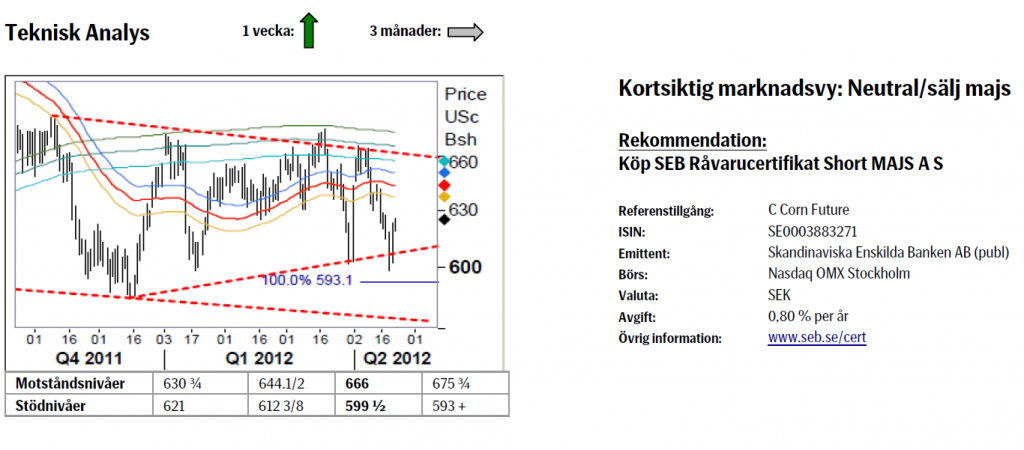

- Fundamentalt förhåller vi oss svagt negativa till majspriset.

- Teknisk Analys: Det misslyckade brottet under 624 ½ tillsammans med relativt aggressivt köpande efter det falska brottet gör att vi ser en viss ytterligare uppåtpotential för nästkommande vecka. Om historien ska fortsätta upprepa sig borde vi inom ett par veckor igen testa den övre delen av årets intervall.

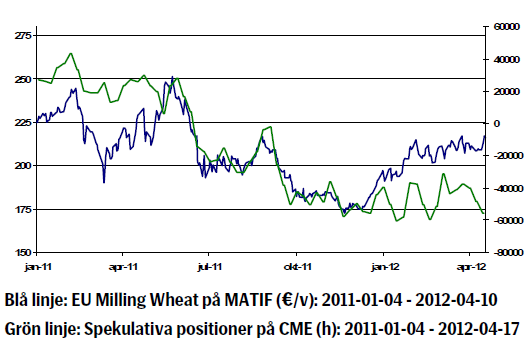

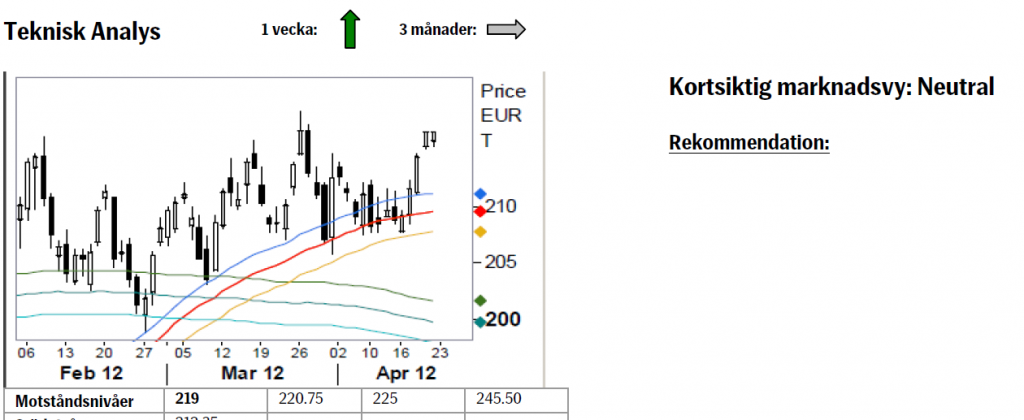

Vete

- Till skillnad från vetet i Chicago kunde vi under förra veckan se en uppgång hos kvarnvetet i Paris. Bakgrunden till detta är att samtidigt som utsikterna för den amerikanska skörden ser goda ut är de desto sämre i Europa. En del analytiker bedömer att den franska veteskörden kommer att bli något sämre än tidigare, detta efter den kalla vintern.

- Ett Europeiskt land som har stora problem med spannmålsproduktionen är Spanien, där det spanska jordbruksdepartementet i sin senaste prognos be-dömer att landets veteproduktion kommer att falla med 22 procent jämfört med förra året. Trots att den ryska skörden som en konsekvens av den kalla vin-tern väntas bli något lägre än föregående skördeår verkar landets export bli omfattande. Den stora flaskhalsen är dock logistiken, där dåliga vägar och svaga järnvägsförbindelser begränsar flödet från de centrala delarna av landet ut till hamnarna.

- På investeringssidan fortsätter förvaltarna att dra ned sin exponering mot vete, en utveckling som varit rådande sedan slutet av mars.

- Det är intressant att följa efterfrågerelationen mellan vete i USA och i Europa. Fortsätter priset att stiga i Europa och minska i USA bör reaktionen bli en minskad efterfrågan på MATIF-vete.

- Fundamentalt är vi försiktiga säljare av vete, detta särskilt då majspriset fortsätter att falla. De tekniska signalerna visar istället på en fortsatt uppgång som mest trolig och därför är vi denna vecka neutrala när det gäller vetepriset.

- Teknisk Analys: Så där jag, efter flera veckor av kontinuerligt köpande i 55dagars bandet har marknaden innevarande vecka dragit iväg norrut. Ett nytt årshögsta ligger i korten och ett lyckat brott över 219 sätter fokus på 2011 års topp, 254. Följaktligen rekommenderar vi att även framgent ligga lång. Möjligtvis kommer en viss vinsthemtagning att ske vid 221/22.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

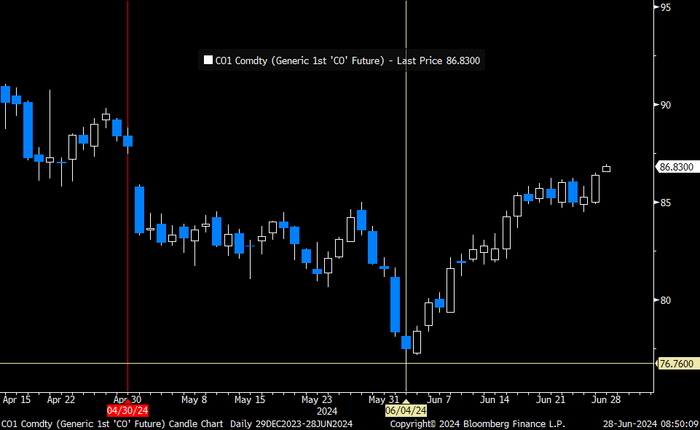

Brent crude inching higher on optimism that US inflationary pressures are fading

Brent crude price inching higher on optimistic that US inflationary pressures are fading. Brent crude closed up 1.1 USD/b ydy to a close of USD 86.39/b which was the highest close since the end of April. This morning it is trading up another half percent to USD 86.9/b along with comparable gains in industrial metals and Asian equities. At 14:30 CET the US will publish its preferred inflation gauge, the PCE figure. Recent data showed softer US personal spending in Q1. Expectations are now high that the PCE inflation number for May will show fading inflationary pressures in the US economy thus lifting the probability for rate cuts later this year which of course is positive for the economy and markets in general and thus positive for oil demand and oil prices. Hopes are high for sure.

Brent crude is trading at the highest since the end of April

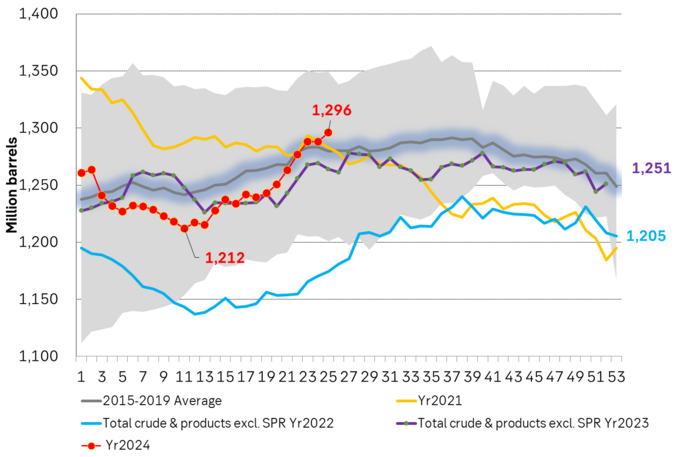

The rally in Brent crude since early June is counter to rising US oil inventories and as such a bit puzzling to the market.

US commercial crude and oil product stocks excluding SPR.

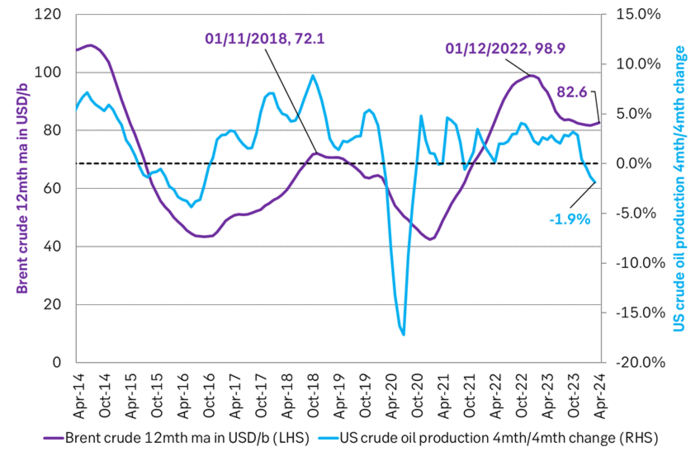

Actual US crude oil production data for April will be published later today. Zero growth in April is likely. Later today the US EIA will publish actual production data for US crude and liquids production for April. Estimates based on US DPR and DUC data indicates that there will indeed be zero growth in US crude oil production MoM in April. This will likely driving home the message that there is no growth in US crude oil production despite a Brent crude oil price of USD 83/b over the past 12 mths. The extension of this is of course rising expectations that there will be no growth in US crude oil production for the coming 12 months either as long as Brent crude hoovers around USD 85/b.

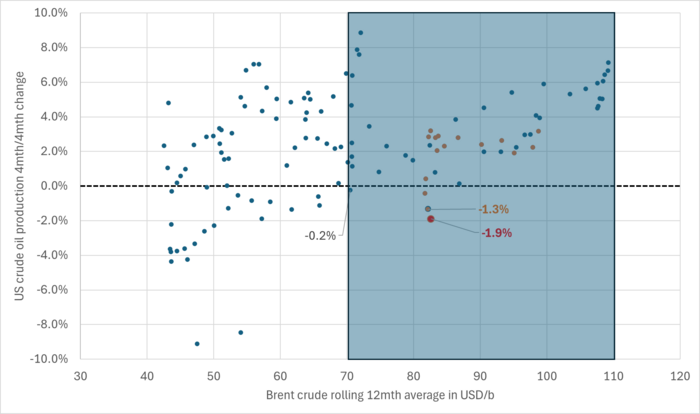

US production breaking a pattern since Jan 2014. No growth at USD 83/b. What stands out when graphing crude oil prices versus growth/decline in US crude oil production is that since January 2014 we have not seen a single month that US crude oil production is steady state or declining when the Brent crude oil price has been averaging USD 70.5/b or higher.

US Senate looking into the possibility that US shale oil producers are now colluding by holding back on investments, thus helping to keep prices leveled around USD 85/b.

Brent crude 12mth rolling average price vs 4mth/4mth change in US crude oil production. Scatter plot of data starting Jan 2014. Large red dot is if there is no change in US crude oil production from March to April. Orange dots are data since Jan 2023. The dot with ”-1.3%” is the March data point.

Brent crude 12mth rolling average price vs 4mth/4mth change in US crude oil production. Data starting Jan 2014. The last data point is if there is no change in US crude oil production from March to April.

Analys

Price forecast update: Weaker green forces in the EU Parliament implies softer EUA prices

We reduce our forecast for EUA prices to 2030 by 10% to reflect the weakened green political agenda in the EU Parliament following the election for the Parliament on 6-9 June. The upcoming election in France on 7 July is an additional risk to the political stability of EU and thus in part also to the solidity of the blocks green agenda. Environmental targets for 2035 and 2040 are most at risk of being weakened on the margin. EUA prices for the coming years to 2030 relate to post-2030 EUA prices through the bankability mechanism. Lower post-2030 climate ambitions and lower post-2030 EUA prices thus have a bearish impact on EUA prices running up to 2030. Actual softening of post-2030 climate ambitions by the EU Parliament have yet to materialize. But when/if they do, a more specific analysis for the consequences for prices can be carried out.

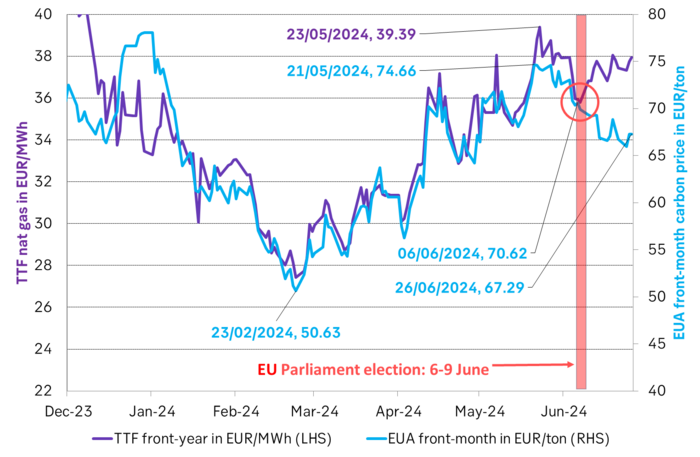

EUA prices broke with its relationship with nat gas prices following the EU Parliament election. The EUA price has dutifully followed the TTF nat gas price higher since they both bottomed out on 23 Feb this year. The EUA front-month price bottomed out with a closing price of EUR 50.63/ton on 23 Feb. It then reached a recent peak of EUR 74.66/ton on 21 May as nat gas prices spiked. Strong relationship between EUA prices and nat gas prices all the way. Then came the EU Parliament election on 6-9 June. Since then the EUA price and TTF nat gas prices have started to depart. Bullish nat gas prices are no longer a simple predictor for bullish EUA prices.

The front-month EUA price vs the front-year TTF nat gas price. Hand in hand until the latest EU Parliament election. Then departing.

The EU Parliament election on 6-9 June was a big backlash for the Greens. The Greens experienced an euphoric victory in the 2019 election when they moved from 52 seats to 74 seats in the Parliament. Since then we have had an energy crisis with astronomic power and nat gas prices, rampant inflation and angry consumers being hurt by it all. In the recent election the Greens in the EU Parliament fell back to 53 seats. Close to where they were before 2019.

While green politics and CO2 prices may have gotten a lot of blame for the pain from energy prices over the latest 2-3 years, the explosion in nat gas prices are largely to blame. But German green policies to replace gas and oil heaters with heat pumps and new environmental regulations for EU farmers are also to blame for the recent pullback in green seats in the Parliament.

Green deal is still alive, but it may not be fully kicking any more. Existing Green laws may be hard to undo, but targets for 2035 and 2040 will be decided upon over the coming five years and will likely be weakened.

At heart the EU ETS system is a political system. As such the EUA price is a politically set price. It rests on the political consensus for environmental priorities on aggregate in EU.

The changes to the EU Parliament will likely weaken post-2030 environmental targets. The changes to the EU Parliament may not change the supply/demand balance for EUAs from now to 2030. But it will likely weaken post-2030 environmental targets and and thus projected EU ETS balances and EUA prices post-2030. And through the bankability mechanism this will necessarily impact EUA prices for the years from now to 2030.

Weaker post-2030 ambitions, targets and prices implies weaker EUA prices to 2030. EUA prices are ”bankable”. You can buy them today and hold on to them and sell them in 2030 or 2035. The value of an EUA today fundamentally rests on expected EUA prices for 2030/35. These again depends on EU green policies for the post 2030 period. Much of these policies will be ironed out and decided over the coming five years.

Weakening of post-2030 targets have yet to materialize. But just talking about it is a cold shower for EUAs. These likely coming weakenings in post-2030 environmental targets and how they will impact EUA prices post 2030 and thus EUA prices from now to 2030 are hard to quantify. But what is clear to say is that when politicians shift their priorities away from the environment and reduce their ambitions for environmental targets post-2030 it’s like a cold shower for EUA prices already today.

On top of this we now also have snap elections in the UK on 4 July and in France on 7 July with the latter having the potential to ”trigger the next euro crisis” according to Gideon Rachman in a recent article in FT.

What’s to be considered a fair outlook for EUA prices for the coming five years in this new political landscape with fundamentally changed political priorities remains to be settled. But that EUA price outlooks will be lowered versus previous forecasts is almost certain.

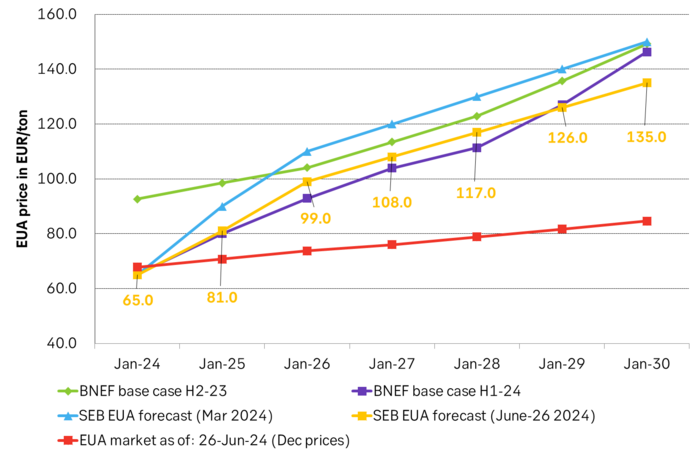

We reduce our EUA price forecast to 2030 by 10% to reflect the new political realities. To start with we reduce our EUA price outlook by 10% from 2025 to 2030 to reflect the weakened Green agenda in the EU parliament.

SEB’s EUA price forecast, BNEF price forecasts and current market prices in EUR/MWh

Analys

The most important data point in the global oil market will be published on Friday 28 June

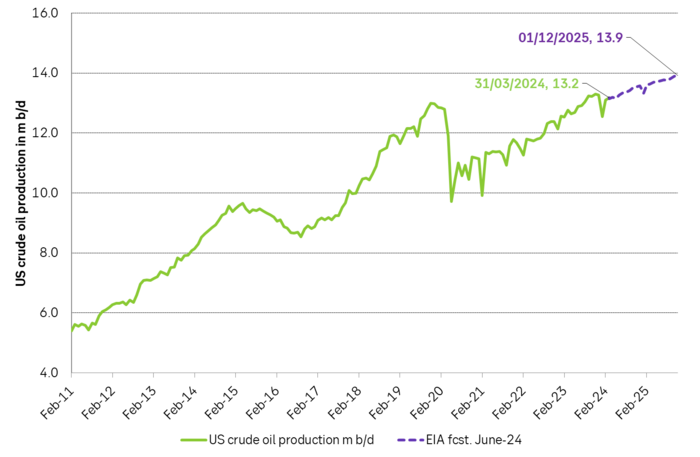

US crude oil production has been booming for more than a decade. Interrupted by two setbacks in response to sharp price declines. The US boom has created large waves in the global oil market and made life very difficult for OPEC(+). Brent crude has not traded below USD 70/b since Dec-2021 and over the past year, it has averaged USD 84/b. US shale oil production would typically boom with such a price level historically. However, there has been zero growth in US crude oil production from Sep-2023 to Mar-2024. This may be partially due to a cold US winter, but something fundamentally seems to have changed. We recently visited a range of US E&P and oil services companies in Houston. The general view was that there would be zero growth in US crude oil production YoY to May 2025. If so and if it also is a general shift to sideways US crude oil production beyond that point, it will be a tremendous shift for the global oil market. It will massively improve the position of OPEC+. It will also sharply change our perception of the forever booming US shale oil supply. But ”the proof is in the pudding” and that is data. More specifically the US monthly, controlled oil production data is to be published on Friday 28 June.

The most important data point in the global oil market will be published on Friday 28 June. The US EIA will then publish its monthly revised and controlled oil production data for April. Following years of booming growth, the US crude oil production has now gone sideways from September 2023 to March 2024. Is this a temporary blip in the growth curve due to a hard and cold US winter or is it the early signs of a huge, fundamental shift where US crude oil production moves from a decade of booming growth to flat-lining horizontal production?

We recently visited a range of E&P and oil services companies in Houston. The general view there was that US crude oil production will be no higher in May 2025 than it is in May 2024. I.e. zero growth.

It may sound undramatic, but if it plays out it is a huge change for the global oil market. It will significantly strengthen the position of OPEC+ and its ability to steer the oil price to a suitable level of its choosing.

The data point on Friday will tell us more about whether the companies we met are correct in their assessment of non-growth in the coming 12 months or whether production growth will accelerate yet again following a slowdown during winter.

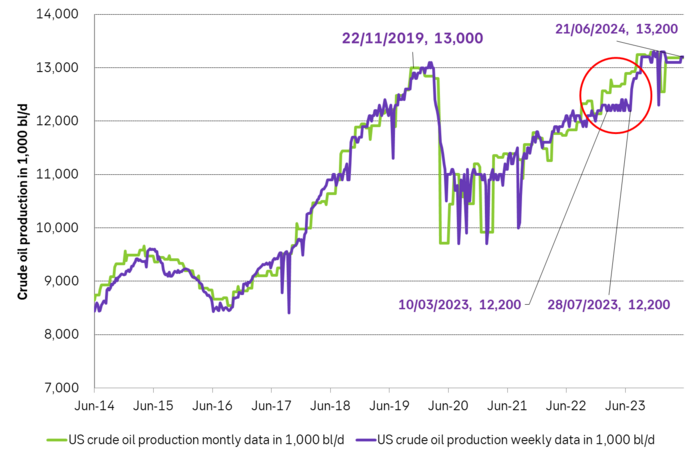

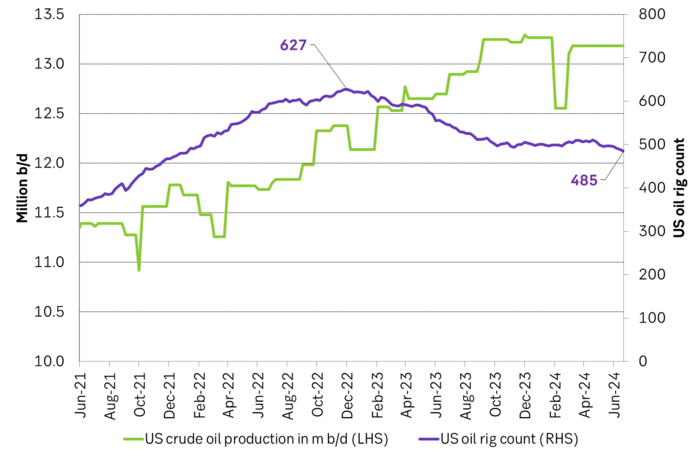

The US releases weekly estimates for its crude oil production but these are rough, temporary estimates. The market was fooled by these weekly numbers last year when the weekly numbers pointed to a steady production of around 12.2 m b/d from March to July while actual monthly data, with a substantial lag in publishing, showed that production was rising strongly.

The real data are the monthly, controlled data. These data will be the ”proof of the pudding” of whether US shale oil production now is about to shift from a decade of booming growth to instead flat-line sideways or whether it will drift gradually higher as projected by the US EIA in its latest Short-Term Energy Outlook.

US crude oil production given by weekly data and monthly data. Note that the monthly, controlled data comes with a significant lag. The market was thus navigating along the weekly data which showed ”sideways at 12.2 m b/d” for a significant period last year until actual data showed otherwise with a time-lag.

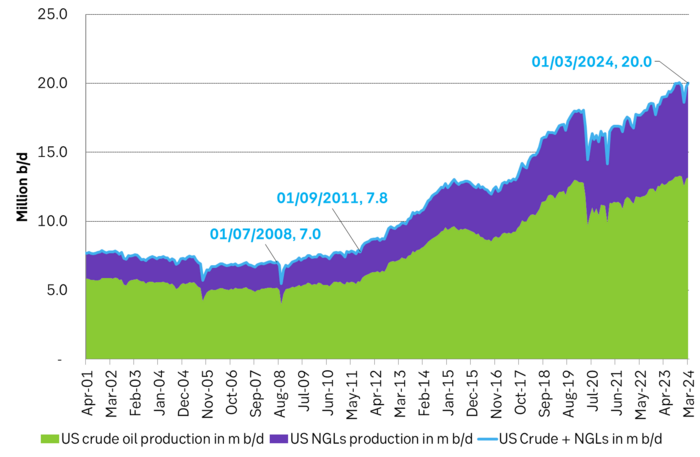

If we add in Natural Gas Liquids and zoom out to include history back to 2001 we see an almost uninterrupted boom in supply since Sep 2011 with a few setbacks. At first glance, this graph gives little support to a belief that US crude oil production now suddenly will go sideways. Simple extrapolation of the graph indicates growth, growth, growth.

US crude and liquids production has boomed since September 2011

However. The latest actual data point for US crude oil production is for March with a reading of 13.18 m b/d. What stands out is that production then was still below the September level of 13.25 m b/d.

The world has gotten used to forever growing US crude oil production due to the US shale oil revolution, with shorter periods of sharp production declines as a result of sharp price declines.

But the Brent crude oil price hasn’t collapsed. Instead, it is trading solidly in the range of USD 70-80-90/b. The front-month Brent crude oil contract hasn’t closed below USD 70/b since December 2021.

Experiences from the last 15 years would imply wild production growth and activity in US shale oil production at current crude oil prices. But US crude oil production has now basically gone sideways to lower from September to March.

The big, big question is thus: Are we now witnessing the early innings of a big change in US shale oil production where we shift from booming growth to flat-lining of production?

If we zoom in we can see that US liquids production has flat-lined since September 2023. Is the flat-lining from Sep to Mar due to the cold winter so that we’ll see a revival into spring and summer or are we witnessing the early signs of a huge change in the global oil market where US crude oil production goes from booming growth to flat-line production.

The message from Houston was that there will be no growth in US crude oil production until May 2025. SEB recently visited oil and gas producers and services providers in Houston to take the pulse of the oil and gas business. Especially so the US shale oil and shale gas business. What we found was an unusually homogeneous view among the companies we met concerning both the state of the situation and the outlook. The sentiment was kind of peculiar. Everybody was making money and was kind of happy about that, but there was no enthusiasm as the growth and boom years were gone. The unanimous view was that US crude oil production would be no higher one year from now than it is today. I.e. flat-lining from here.

The arguments for flat-lining of US crude oil production here onward were many.

1) The shale oil business has ”grown up” and matured with a focus on profits rather than growth for the sake of growth.

2) Bankruptcies and M&As have consolidated the shale oil companies into larger, fewer public companies now accounting for up to 75% of total production. Investors in these companies have little interest/appetite for growth after having burned their fingers during a decade and a half of capital destruction. These investors may also be skeptical of the longevity of the US shale oil business. Better to fully utilize the current shale oil infrastructure steadily over the coming years and return profits to shareholders than to invest in yet more infrastructure capacity and growth.

3) The remaining 25% of shale oil producers which are in private hands have limited scope for growth as they lack pipeline capacity for bringing more crude oil from field to market. Associated nat gas production is also a problem/bottleneck as flaring is forbidden in many places and pipes to transport nat gas from field to market are limited.

4) The low-hanging fruits of volume productivity have been harvested. Drilling and fracking are now mostly running 24/7 and most new wells today are all ”long wells” of around 3 miles. So hard to shave off yet another day in terms of ”drilling yet faster” and the length of the wells has increasingly reached their natural optimal length.

5) The average ”rock quality” of wells drilled in the US in 2024 will be of slightly lower quality than in 2023 and 2025 will be slightly lower quality than 2024. That is not to say that the US, or more specifically the Permian basin, is quickly running out of shale oil resources. But this will be a slight headwind. There is also an increasing insight into the fact that US shale oil resources are indeed finite and that it is now time to harvest values over the coming 5-10 years. One company we met in Houston argued that US shale oil production would now move sideways for 6-7 years and then overall production decline would set in.

The US shale oil revolution can be divided into three main phases. Each phase is probably equally revolutionary as the other in terms of impact on the global oil market.

1) The boom phase. It started after 2008 but didn’t accelerate in force before the ”Arab Spring” erupted and drove the oil price to USD 110/b from 2011 to 2014. It was talked down time and time again, but it continued to boom and re-boom to the point that today it is almost impossible to envision that it won’t just continue to boom or at least grow forever.

2) The plateau phase. The low-hanging fruits of productivity growth have been harvested. The highest quality resources have been utilized. The halfway point of resources has been extracted. Consolidation, normalization, and maturity of the business has been reached. Production goes sideways.

3) The decline phase. Eventually, the resources will have been extracted to the point that production unavoidably starts to decline.

Moving from phase one to phase two may be almost as shocking for the oil market as the experience of phase 1. The discussions we had with oil producers and services companies in Houston may indicate that we may now be moving from phase one to phase two. That there will be zero shale oil production growth YoY in 2025 and that production then may go sideways for 6-7 years before phase three sets in.

US EIA June STEO report with EIA’s projection for US crude oil production to Dec-2025. Softer growth, but still growth.

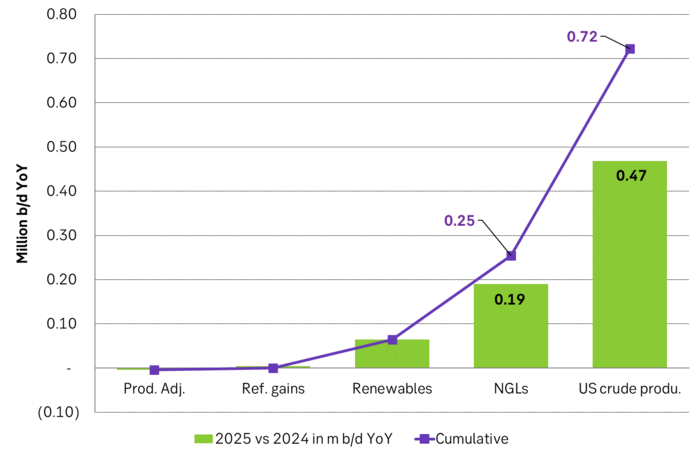

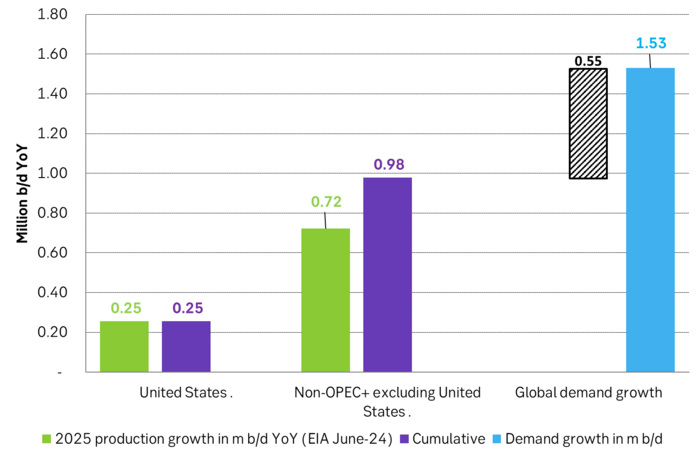

US EIA June STEO report with YoY outlook growth for 2025. Projects that US crude production will grow by 0.47 m b/d YoY in 2025 and that total liquids will grow by 720 k b/d YoY.

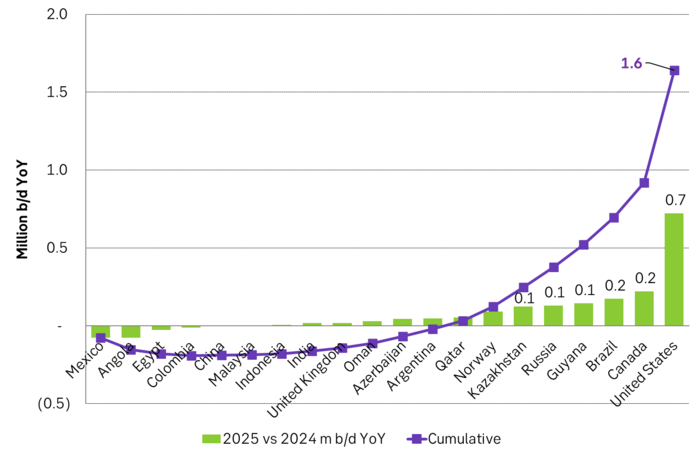

US EIA June STEO report with outlook for production growth by country in 2025. This shows how big the US production growth of 0.7 m b/d YoY really is compared to other producers around the world

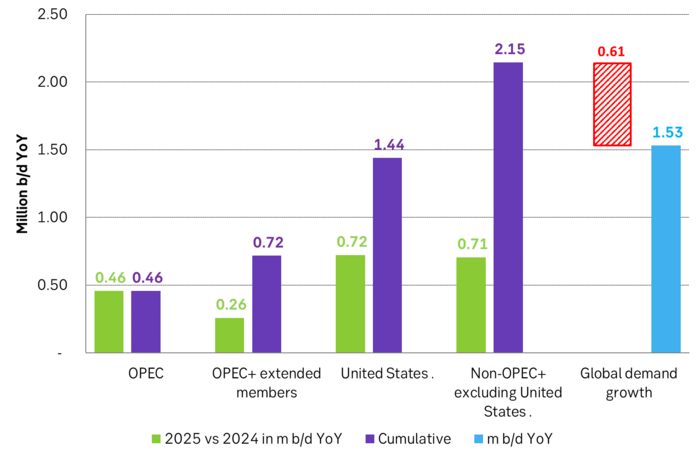

US EIA June STEO report with projected global growth in supply and demand YoY in 2025. Solid demand growth, but even strong supply growth with little room for OPEC+ to expand. Production growth by non-OPEC+ will basically cover global oil demand growth.

But if there instead is zero growth in US crude oil production in 2025 and the US liquids production only grows by 0.25 m b/d YoY due to NGLs and biofuels, then suddenly there is room for OPEC+ to put some of its current production cuts back into the market. Thus growth/no-growth in US shale oil production will be of huge importance for OPEC+ in 2025. If there is no growth in US shale oil then OPEC+ will have a much better position to control the oil price to where it wants it.

US crude oil production and drilling rig count

-

Nyheter7 dagar sedan

Nyheter7 dagar sedanDe tre bästa råvaruvaruaktierna just nu

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Mining vill köpa Filo Corp tillsammans med BHP

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAfrica Oil är bra att köpa anser Stifel som inleder analysbevakning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor risk att Africa Energy inte överlever det kommande året

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFirst Nordic Metals har fyra prospekteringsprojekt i Sverige

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude inching higher on optimism that US inflationary pressures are fading

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUniper satsar på att göra elektrobränsle av sin elektricitet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTre bra aktier inom olja och oljeservice i Kanada