Analys

SEB – Jordbruksprodukter, vecka 6 2012

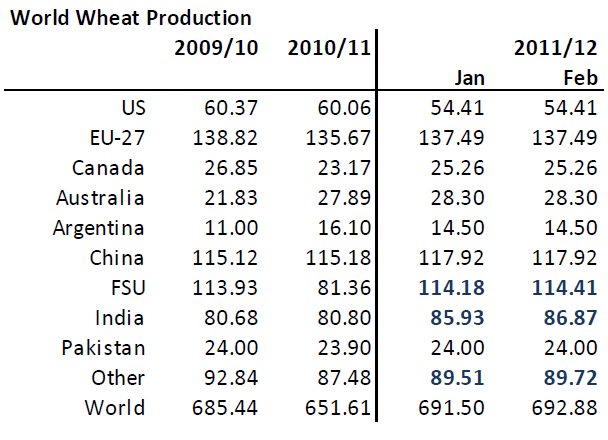

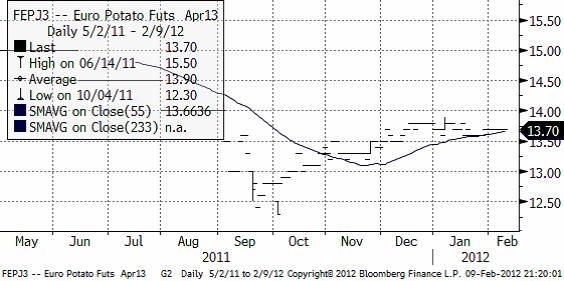

Vi har hållit på skrivandet och utskicket av det här veckobrevet för att få med intrycken av WASDE-rapporten som släpptes av USDA klockan 14:30 igår torsdag. Rapporten, vars siffror nog förefaller vara övermåttan försiktigt justerade med anledning av torkan i Argentina, togs emot med något av en axelryckning av marknaden, men med tydliga prisnedgångar för alla grödor, mest för vete, där utgående lager justerades upp.

Vi har hållit på skrivandet och utskicket av det här veckobrevet för att få med intrycken av WASDE-rapporten som släpptes av USDA klockan 14:30 igår torsdag. Rapporten, vars siffror nog förefaller vara övermåttan försiktigt justerade med anledning av torkan i Argentina, togs emot med något av en axelryckning av marknaden, men med tydliga prisnedgångar för alla grödor, mest för vete, där utgående lager justerades upp.

NOAA rapporterar i sin senaste synopsis att La Niña torde övergå till ”neutrala” ENSO-förållanden under perioden mars till maj 2012. Detta skulle betyda att hotet mot torka för norra halvklotets skörd kraftigt har minskat. Detta är klart negativ information för marknaderna för majs, vete, sojabönor och raps.

Vete

Terminspriset på Matif-vete (november) föll kraftigt till 193.50 euro / ton efter WASDE-rapporten

Marknadens oro över ett ryskt exportförbud har kvarstått under veckan och de blandade budskap som kommit från Rysslands regering har orsakat en viss förvirring.

Rysslands premiärminister Viktor Zubkov sa att med tanke på att spannmålsskörden reviderats till 93,9 miljoner ton så har prognosen för spannmålsexporten 2011/12 höjts till 27 miljoner ton och att det därmed inte skulle finnas något behov av att införa restriktioner, vilket hade diskuterats till följd av den höga exporttakt som har rått.

Det uttalandet kom strax efter att regeringskällor sa att Zubkov inte skulle meddela något beslut under fredagen och det i sin tur kom efter att vice premiärministern inte kunde uttala sig i frågan under torsdagen som tidigare angivits. De dubbla budskapen började dock redan på tisdagen då den biträdande jordbruksministern sade att ett beslut om export restriktioner skulle tas i mitten på februari, för att sedan skifta till att Zubkov skulle meddela beslutet under torsdagen.

Det uttalandet kom strax efter att regeringskällor sa att Zubkov inte skulle meddela något beslut under fredagen och det i sin tur kom efter att vice premiärministern inte kunde uttala sig i frågan under torsdagen som tidigare angivits. De dubbla budskapen började dock redan på tisdagen då den biträdande jordbruksministern sade att ett beslut om export restriktioner skulle tas i mitten på februari, för att sedan skifta till att Zubkov skulle meddela beslutet under torsdagen.

Den snabba exporttakten av Rysslands spannmål har varit regerings främsta orosmoln genom att den skulle kunna driva upp de inhemska priserna kraftigt med en ökad matinflation och högre kostnader för animalie producenter som följd. Men eftersom spannmålen för export från gårdar och silos i närheten av hamnarna vid Svarta havet börjar sina så tvingas handlarna att se sig om efter spannmål längre in i landet vilket innebär långväga transporter på landets järnvägsnät som också bidrar till högre kostnader.

Det kalla vädret har också varit en bidragande faktor till oro. I Ryssland verkar dock snötäcket skydda de flesta grödor medan det kalla vädret i Svarta havsområdet kan komma att orsaka skador på framförallt korn och raps. Trots det kalla vädret i Europa så är påverkan av rapsgrödorna i Tyskland och Frankrike dock mindre oroande. I Ukraina är problemen desto större med effekten av kylan på de grödor som redan har drabbats av en oerhört torr höst och där vissa delar av landet har fått mycket snö, på sina ställen upp till 50 cm, medan andra delar av landet helt saknar snötäcke grödorna därmed exponeras för den extrema kylan. Med en mild höst och en ”varm vinter” kan det hända att grödorna blir något mindre vinterhärdiga än förväntat men det verkar dock som att de flesta europeiska länder har fått ett skyddande snötäcke mot kylan, även om det på vissa ställen vore önskvärt med ett större snödjup. Ännu är det dock för tidigt att sia om eventuella konsekvenser. Nedan ser vi WASDE-rapportens estimat för global veteproduktion.

Indien, Kazakstan och Marocko har justerat upp sina produktionsestimat, vilket slår igenom i en högre global produktion.

På konsumtionssidan är det främst Indien, som beräknas konsumera 1.6 mt mindre än i januari. Konsumtionen i EU och resten av världen är oförändrad, trots ett mycket högre pris än förra månaden. Men summa summarum – vi har trots allt ett högre utgående lager av vete än förra månaden.

Vi vet sedan tidigare att USDA har en tendens att fortsätta med justeringar ”åt samma håll”. Vi kan alltså förvänta oss högre uppjusteringarna av utgående lager att fortsätta, månad för månad, i WASDE-rapporterna och detta bör understödja en trend av sjunkande priser på vete. Nedan ser vi kursdiagrammet på decemberkontraktet på CBOT.

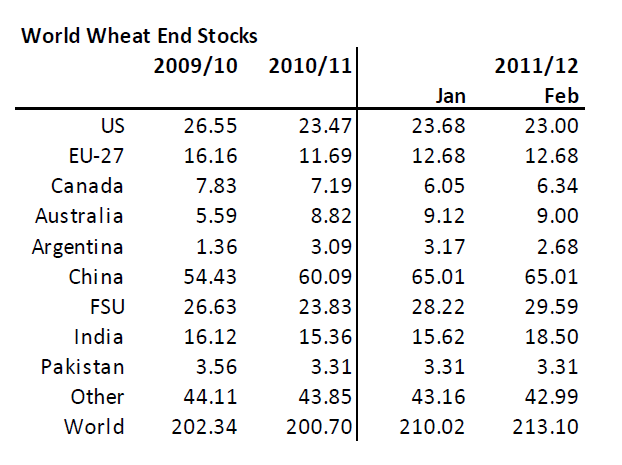

Maltkorn

Maltkornsmarknaden har behållit sin styrka relativt andra spannmål med novemberleverans på Matif på 250 euro per ton.

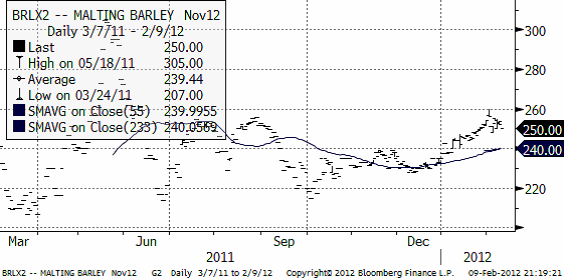

Potatis

Nedan ser vi kursdiagrammet på europeisk potatis, som handlas på Eurex; terminen avser leverans april 2013.

Majs

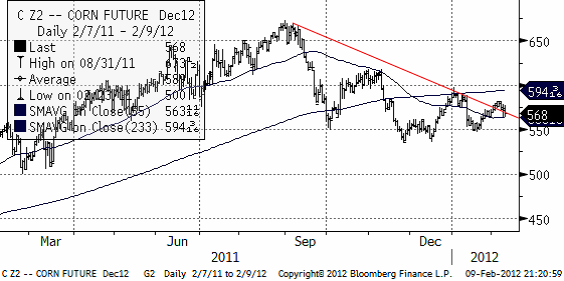

Majspriset föll något lite när börsen öppnade efter USDA-rapporten, som vi ser i kursdiagrammet för decemberkontraktet nedan:

WASDE-rapporten visade dock på lägre produktion och lägre – rekordlåga utgående lager.

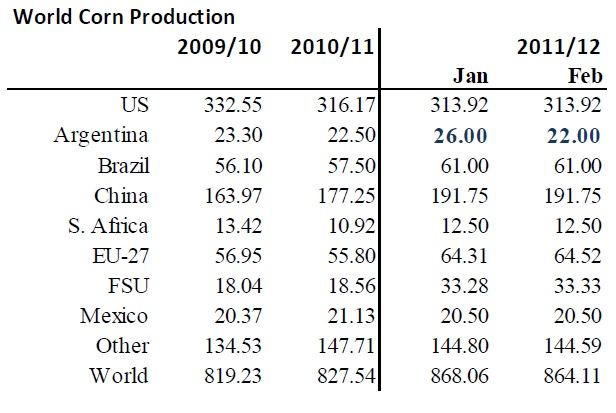

USDA justerade ner skörden i Argentina i spåren av torkan, från 26 mt till 22 mt. 22 mt ligger på den högsta nivån som vi sett inhemska Argentinska prognosmakare förutspå, som ligger i intervallet 18 – 22 mt. Produktionen skulle alltså ha kunnat minska med 8 mt istället för de 4 mt som USDA förutspår nu i sin februarirapport. USDA gör ingen justering för Brasiliens skörd, vilket stämmer någorlunda bra med vädret där.

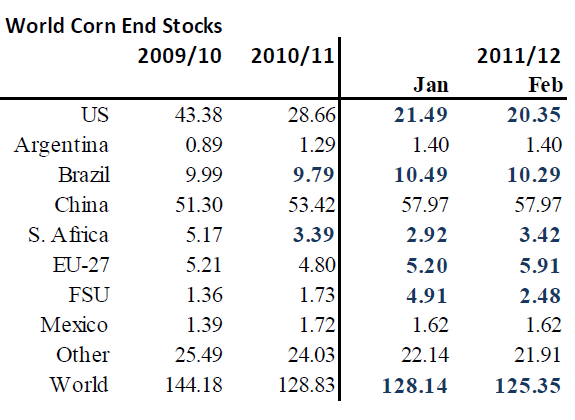

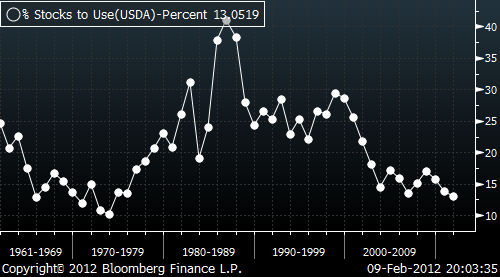

USA:s utgående lager som anges i WASDE:n ligger på den lägsta nivån sedan 1975/76 och utgående lager på global basis i förhållande till konsumtion ligger på 1973 års nivå, som vi ser i nedanstående diagram.

Med ett förmodligen större bortfall från produktion och export från Argentina, måste detta kompenseras med lägre lager i USA. Det kan alltså bli ett riktigt lågt utgående lager i USA – och på global basis.

Å andra sidan väntas amerikanska bönder välja att så majs på bekostnad av sojabönor i vår. Ett högre pris på majs skulle öka denna tendens.

Sojabönor

Priset på sojabönor föll efter WASDE-rapporten i linje med de andra grödorna. Tekniskt är situationen intressant. Det finns de, bland annat SEB:s tekniska analytiker, som pekar på att det sedan september bildats en omvänd ”head-and-shoulders” formation, där ”nacklinjen” (grön linje) bröts i månadsskiftet januari – februari. Den skulle signalera en förestående potentiell prisuppgång till 1400 cent / bushel. Prisuppgången har dock stoppats av motståndet som utgörs av toppen som noterades i slutet av oktober. Skulle vi få en uppgång över 1267 får vi anse att vi har en teknisk köpsignal.

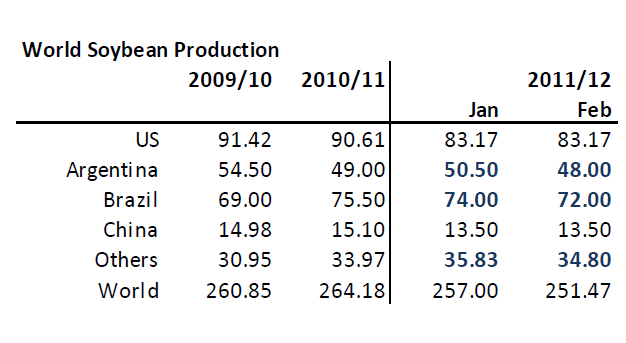

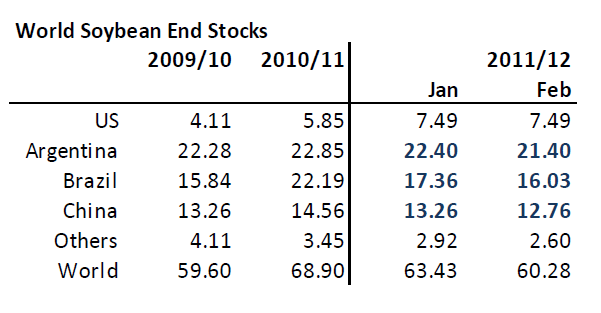

Nedan ser vi USDA:s produktionsestimat från WASDE-rapporten igår.

Argentinas och Brasiliens skörd sänks med 2.5 mt respektive 2 mt i spåren av torkan. Bland ”Others” hittar vi Paraguay och Uruguay och de justeras ner 1 mt också.

Utgående lager sänks 3 mt. Argentinas skörd ligger i det övre intervallet av inhemska skördeestimat. Det känns som om man tagit i lite i underkant i justeringen och det är vanligt att USDA gör så. Vi kan alltså vänta oss att det ligger ytterligare en nedjustering sparad till nästa månad.

Vi är negativa ur tekniskt perspektiv de närmaste tre månaderna.

Raps

Priset på raps har gått starkt och hejdats på 430, uppenbarligen ett motstånd. Prisuppgången dit är ungefär lika lång från 410 – botten på rekylen i uppgången från 390. Det är 20 euro i båda rusningarna uppåt. Det är vanligt att man ser den typen av rörelser, där det är lika långt från ”halvvägskonsolideringen” uppåt som nedåt. Detta skulle indikera att den kortsiktiga uppgången är över. Vid 440 finns ett större motstånd, där priset vände ner i maj-juni förra året. Detta är alltså ett högt pris i ett historiskt perspektiv och säljvärt, tror vi.

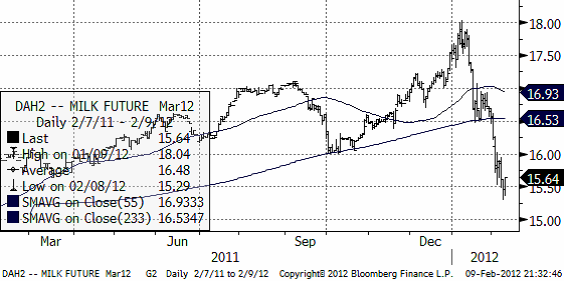

Mjölk

Nedan ser vi priset på marskontraktet på flytande mjölk (kontakt avräknat mot USDA:s prisindex). Priset har som vi ser fallit kraftigt i februari. Marknaden är ”översåld” och ”borde” få en kortsiktig rekyl uppåt den närmaste veckan.

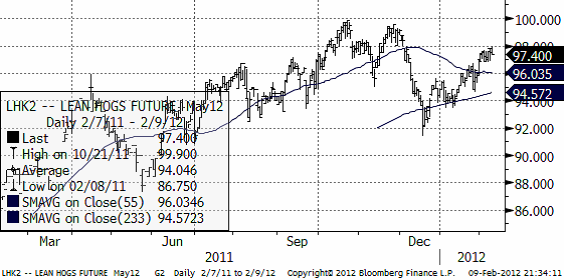

Gris

Priset på lean hogs har segat sig uppåt och befinner sig nu återigen i sälj-området. Nedan ser vi terminspriset för leverans i maj.

Valutor

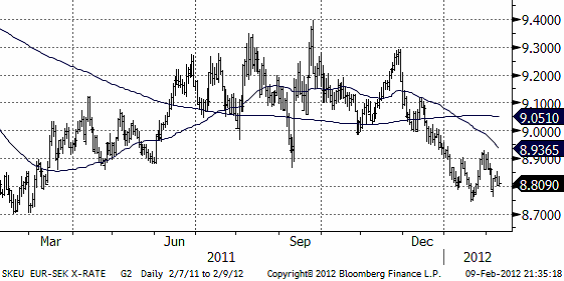

EURSEK som fanns stöd på 8.80 kr och steg till 8.90 har vänt ner igen och ska sannolikt testa 8.80 igen.

EURUSD har vänt upp och har precis lämnat en konsolidering – kanske halvvägs på väg upp mot 1.35 dollar.

USDSEK har fallit av och tycks vara på väg nedåt.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

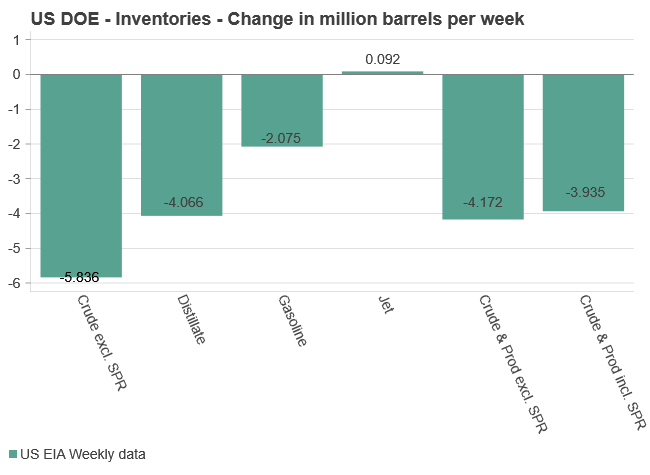

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

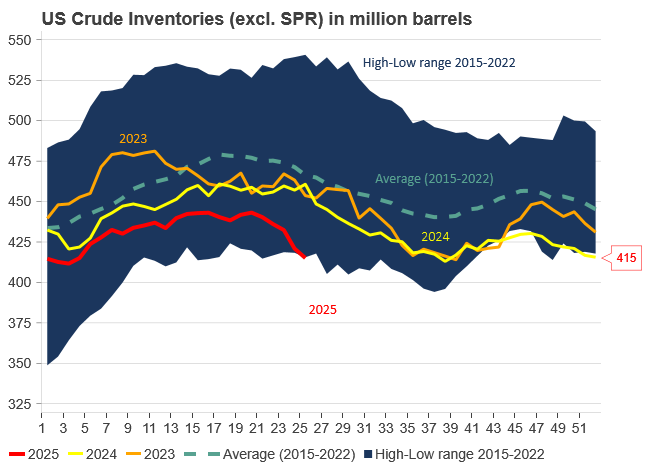

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras