Nyheter

David Hargreaves on Precious Metals, week 13 2014

So down below $1300 clipped the gold fix whilst platinum stayed stubbornly at a 1.08 premium. It would, wouldn’t it, given the state of the industry in RSA. Perhaps, if Vladimir stays upright in the saddle, we can now treat the precious metals on their merits. If, as our leader suggests, the fear factor abates, then we can look at our $1200 downside as a marker. Barclays goes for perhaps $1050. Now the focus is on supply and demand. The latest offering from the WGC reads a bit like a student thesis. It pitches into the role fo the metal in managing emerging market risks (EM). Then it explores gold replacing bonds in balancing equity risk. Finally, it wraps up with its perspective to a hedge in an expanding financial system. Meanwhile, back to reality, here is what happened on the week.

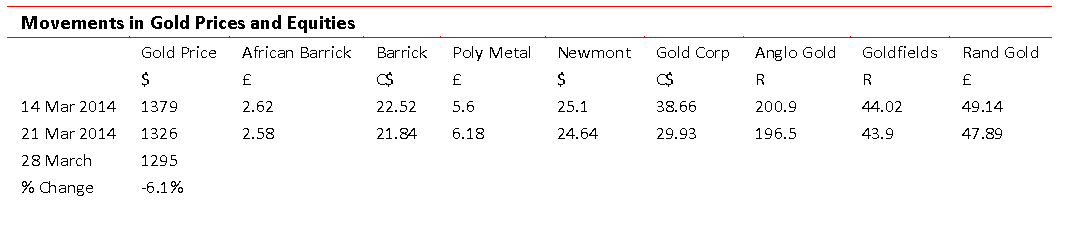

The metals and the equities subside but in honesty, we have no clue what next week might bring. The US has shown its hand by ruling out force – presumably even if VP goes for the rest of the Ukraine. The Chinese are sitting on their hands an like the Japanese, South Koreans and Indians, desperately need a continuity of oil and gas supplies. So we saw:

The Gold Investor, Volume 5, is a hefty 38-page tome which explores the use of the metal in:

Hedging emerging market risks

Replacing bonds

Gold as a hedge in an expanding financial system.

Even reading it is not for the faint-hearted. Frankly, we found it pedantic, academic and difficult to swallow. The facts it did give us included: Gold Demand in the 5 years ending 2013 showed 73% absorbed by emerging markets, principally India and China with only 27% by Europe, North America and others. The case for holding gold versus government bonds, rests primarily with the metal price rising, since bonds always offer a return whilst holding bullion does not. In conclusion, WGC says you should hold ‘some gold’ in your portfolio as a risk spreader.

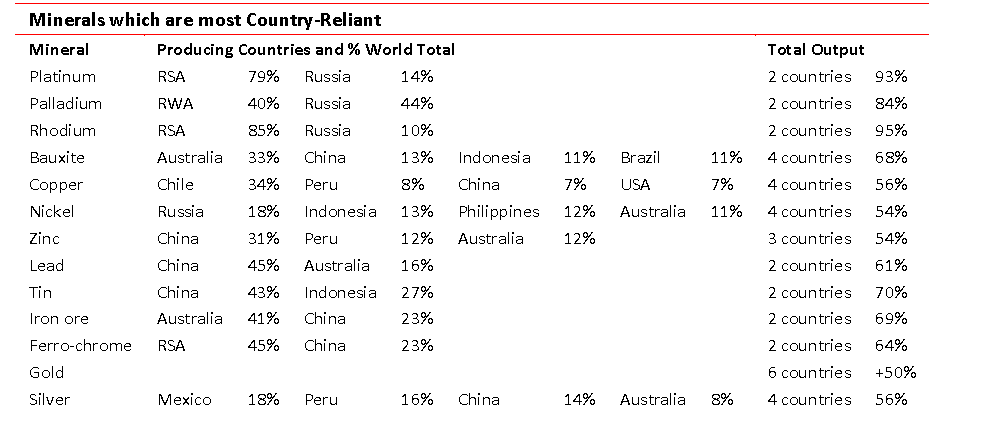

WIM says: It was ever thus, but you can buy and sell gold on a whim. It is increasingly driven by political risk, only marginally by economics. Why not go for platinum, iron ore or copper, where you can have exposure to both? Just for reference:

So if you must choose physical, the choice is wide open and the trading mechanisms are available. As for the WGC report: If you are marooned on a desert island, recovering from a major operation or have been medically advised to avoid excitement, this is the read for you.

The Platinum Strike. The RSA mine strike, prompted by upstart union AMCU, is now in its 9th week. It is causing misery to the workers and major concern to the involved companies, Anglo Plat, Impala and Lonmin.

The union is demanding a doubling of wages and will not get it. The companies sell most of their output on long term contract, although at market-related prices and Anglo Plat, the largest, says it will buy on the open market to satisfy its customers for ‘some time to come’. We note that the price premium to gold has widened to 1.09 at $1413/oz vs $1295/oz. The country’s largest labour grouping COSATU, is calling on the government to intervene. That would legitimise similar wage increase calls countrywide even as elections approach. Uneasy lies the head that wears the crown, eh Jacob?

China and Gold. An increasing amount of the metal goes into China, but very little seems to come out. At least the Indians re-export as jewellery. So how much goes in and what happens to it? The bulk flows in via Hong Kong.

Newly-mined gold worldwide amounts to about 3,000tpa. China and India are now vying as the major importers at up to 1000t each. Additionally, China is now the leading producer at over 400t. Its imports are rising rapidly. In January- February 2014, it pulled 192.8t through Hong Kong. That annualises at almost 1200t. Its February draw alone was up 30% on January and 79% up year-on-year. Now that is normally a quiet month because of lunar new year, so what gives? Official Central Bank holdings are stuck at 1035t so where is it going?

Iraq has bought 36t of gold (c. $1.5bn), its largest purchase in 3 years. Our figures show that in February 2014, the country held 29.8t, 1.6% of its foreign exchange reserves. This will bump it to c.665, to rank No 40-42 in the world.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Ett samtal om guld, silver, olja och skog

Ett samtal om råvarorna guld, silver, olja och skog. Experter som ger sin syn i programmet är Daniel Karlgren, investeringschef på Captor, Rhona O’Connell, chef för marknadsanalys på Stone X och Ole Hansen råvarustrategichef på Saxo Bank.

Rhona O’Connell beskriver silver som en “askungenmetall”, en metall som ibland behandlas som industriråvara och ibland som ädelmetall. Panelen håller med om att volatiliteten är extrem och att prisrörelser ofta drivs av spekulation snarare än fundamenta. Likviditeten gör att silver snabbt stiger och lika snabbt faller.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys4 veckor sedan

Analys4 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNeptune Energy bekräftar enorma litiumfyndigheter i Tyskland