Nyheter

David Hargreaves on Metals and Minerals, week 2 2012

Metals and Minerals

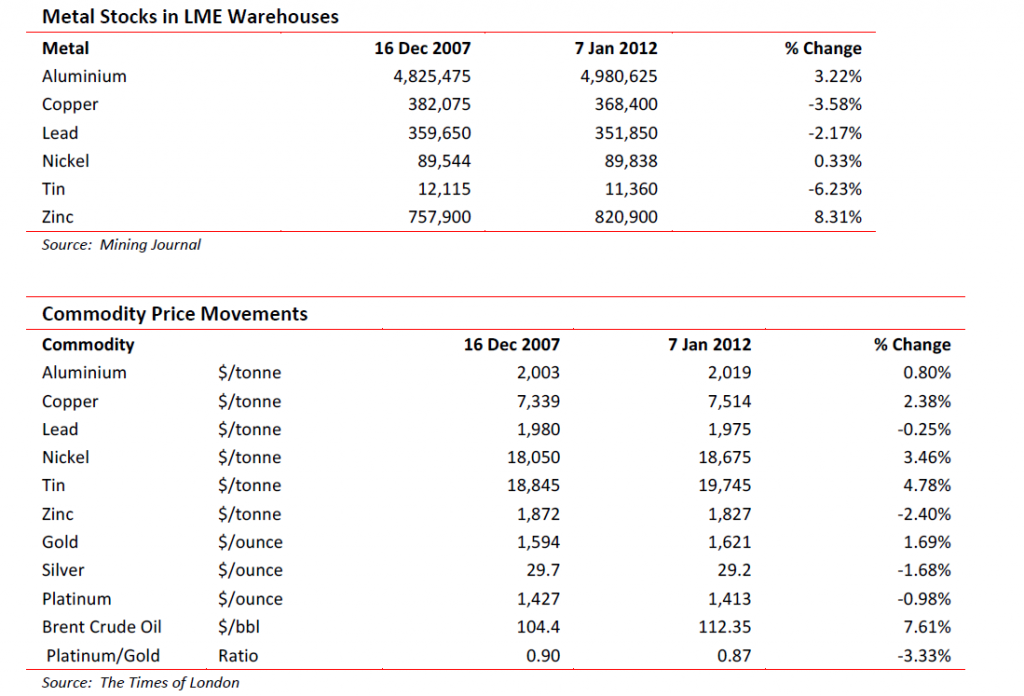

Exchange Traded Metals

It is a proven fact that traded metals do not hold strong religious beliefs. So they exited Christmas and New Year in the same mood that they entered. They mirrored the mood of the economy. It there is to be a recovery – not just this one, any one – the basic steel industry metals kick start it, for roads and building work. Then come the non-ferrous for manufacturing cars and consumer goods, followed by the minors for the clever, high technology end. Last but not least we have the pure indulgences, like diamonds. So it was. Both coal (3%) and iron ore (1%) nudged up last week, the exchanged traded metals hardly moved and the minors were down to neutral. So no runaway recovery posted yet. LME warehouse stocks were indicative. We are conditioning ourselves to aluminium, nickel and zinc being in structural surplus and copper being tight. The stocks concurred. Copper’s fall of almost 4% contrasted with aluminium’s rise of over 3%.

Both were overshadowed by zinc, which rose a full 8%, to over 820,000 tonnes, or 25 days’ world consumption. That is still only a half of the hapless aluminium at 46 days. Tin could be of interest. Stocks at 11,360t are only 11 days’ supply.

The price is level across the 15-month contract spread and could move into a backwardation. It has been a long time since the metals offered these opportunities. Copper could tighten further, although the knowledgeable Simon Hunt, of SH Strategic Services, warns that much of its surplus can be laid at the doorstep of speculators and investors (spot the difference?). On the physical front, Peru, world No 3 miner (8% of total), is still grappling with environmentalists. Then to Indonesia. There Freeport McMoran has settled (or so it thought) a long running violent dispute at its giant Grasberg Mine only to be told the workers are demanding payment for the three months they were on strike. Interesting people, workers. Met one once.

Aluminium’s woes continue. Alcoa, the world’s No 2 refiner with 12% global output, is to cut its smelting capacity by 12% because of low prices. About 25% of all world production runs at a loss below $2500/t. It is presently just over $2000. Will the others, UC Rusal (10%), Rio Tinto (9%) and Chalco (8%) follow suit?

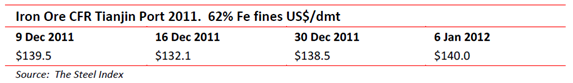

Bulk minerals

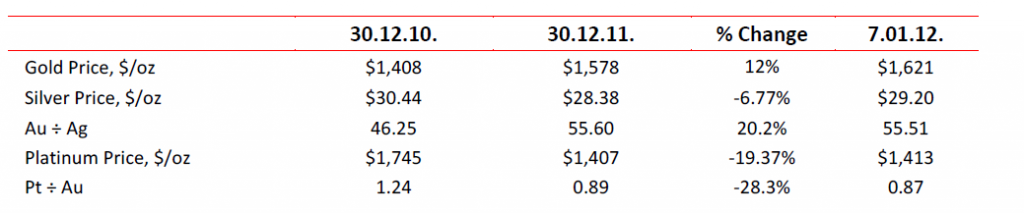

Precious Metals

So a leading analyst tells us silver hit an all time high in 2011. Can’t fault that, but so did gold and platinum. Then which did best and why and will the same factors drive 2013?

Well there are as many forecasts as there are analysts but the gold $5000/oz, silver $200/oz and platinum-in-orbit boys are back behind the barricades. We incline to the downside view of floors around $1400-1450, $20-25 and 1250-1300.

Why? this is much about the Euro and the world will not come to an end whatever the outcome of that sad saga. If the world economy DOES turn down, then silver and platinum will follow it as industrial metals. If it turns up, so will inflation and interest rates. The attractions of gold will diminish. An increasingly ventilated idea is that China will spend some of its $3.2 x 10¹² FOREX reserves buying gold ready for the People’s Republic taking over from the USA. We pointed out some time ago that it is not really do-able. It would buy them about 62,000 tonnes at $1600/oz but would curtail their financial raping and pillaging of Africa. They would need to buy at least 8000 tonnes to overtake what Fort Knox has, then think what it would do to the price. We prefer Plan B, which is allowing their citizens to buy it as a safe haven and take it off them when the need arises. If it worked for the US and Germany, why not China? Annual gold output is c.2600 tonnes, so where would it all come from?

Our friend Adrian Day of Day Asset Management is bullish for gold with caveats. He notes wealth is shifting from West to East (where they have a different take on hoarding and with good reason) and that investors are waiting for a floor. Like a boxer who has gone on too long? He also looks as we do for shares to outperform the metal on the upside. But there has to be an upside. Any more on the down and the shares will fall further.

The Banks Get Coy on gold. Two of Britain’s biggest banks, HSBC and Barclays, have backed off mega upside projections for 2012. HSBC rests at $1825. Barclays comes in at $1875. But J P Morgan Chase, with Morgan Stanley and Société Generale, are for it to be ‘well above’ $2000. Ever thought of taking up darts? It would be uncharitable to suggest the big boys are talking up their own books now, wouldn’t it?

Minor Metals

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Teck Resources kan förse Nordamerika och kanske hela G7 med all germanium som behövs

Kanadensiska gruvbolaget Teck Resources för samtal med både USA och Kanada om att leverera kritiska mineraler till de båda ländernas försvarsindustrier – bara en dag efter att Kina skärpt sina exportregler för sällsynta jordartsmetaller.

Enligt Financial Times diskuterar bolaget möjligheterna att leverera germanium, antimon och gallium, under förutsättning att det kan få garantier för minimipriser och köpvolymer.

Kinas senaste besked innebär en utvidgning och förtydligande av de omfattande exportkontroller som infördes redan i april. De tidigare restriktionerna ledde till stora bristsituationer globalt innan nya avtal med Europa och USA gjorde det möjligt att återuppta leveranser. Den nya regeln klargör dock att exportlicenser sannolikt kommer att nekas till vapenproducenter och vissa halvledarföretag.

Vid FT Metals and Mining Summit uppgav Teck Resources vd att bolaget kan producera tillräckligt med germanium för att täcka hela Nordamerikas behov – och möjligen även G7-ländernas.

Teck Resources och Anglo American går samman

Teck Resources och Anglo American är mitt uppe i en fusion, vilket beskrivs som ett samgående av två jämbördiga parter.

Nyheter

Leading Edge Materials är på rätt plats i rätt tid

Leading Edge Materials har tre olika projekt, men det är ett som är bolagets huvudfokus, Norra Kärr. Den tillgången har tunga sällsynta jordartsmetaller som är viktiga för Sveriges och hela EU:s oberoende när det gäller dessa kritiska råvaror. Kina som kontrollerar större delen av världens sällsynta jordartsmetaller drar hela tiden åt tumskruvarna på resten av världen. Denna vecka införde Kina extremt aggressiva regler som gör att större delen av världens företag som på ett eller annat sätt använder eller producerar metallerna måste ansöka om tillstånd av kinesiska staten för att kunna exportera sina produkter.

Norra Kärr-projektet har i denna kontext blivit strategiskt viktig för hela EU.

Nyheter

Oljepriset faller efter ny handelskonflikt mellan USA och Kina

Priset på amerikansk råolja föll med nära 4 procent på fredagen, efter att president Donald Trump hotat Kina med nya tullar. Uttalandet kom som svar på att Peking infört striktare exportkontroller av sällsynta jordartsmetaller – en åtgärd som återigen väcker oro för en avmattning i den globala ekonomin.

USA:s WTI-olja stängde på 58,90 dollar per fat, en nedgång med 2,61 dollar. Brentoljan föll med 3,8 procent till 62,73 dollar.

”Jag kommer att tvingas att ekonomiskt motverka deras drag,” skrev Trump på sin plattform Truth Social och antydde ”massiva tullhöjningar” på kinesiska varor.

Marknaden reagerade kraftigt på beskedet. ”När marknaden ser dessa vedergällningsåtgärder tolkas det som svagare tillväxt och lägre efterfrågan på olja,” sade Andy Lipow, chef för Lipow Oil Associates, till CNBC.

Samtidigt pressas priserna av ökat utbud från OPEC+ och minskad efterfrågan under pågående underhållsarbete vid raffinaderier. Ett eldupphör mellan Israel och Hamas har dessutom minskat oron för störningar i oljeleveranser från Mellanöstern.

”Marknaden fokuserar nu mer på utbudet än på geopolitiken,” sade Helima Croft, råvaruchef vid RBC Capital Markets.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga