Nyheter

Bringing old glory to a new shine

A new venture on historically known resources

A new venture on historically known resources- Ground floor opportunity to share in reviving three former gold producers in Zimbabwe

Zimbabwe imminent recovery

The name of the country doesn’t make you think of real good things. But for the more senior among us, the name Rhodesia brings back some better memories. It takes your mind back to waving corn fields, well-fed cattle herds, rich white farmers, the big five, prosperity, tourism. Those were also the days of a flourishing mining industry, reaping the benefits of the country’s vast natural resources and a significant contributor to what was then called the Gross National Product.

I think it would be inappropriate to elaborate in this report on all the intricate developments that took place after Zimbabwe gained its independence in 1980. It should be enough to observe that times were difficult from the beginning.

Years of internal power struggles, followed by a political coup by President Mugabe and his inner circles in 1987, led to the infamous land-reform in 2000, which ’sent’ the whites off and the country into havoc and turmoil, driving the country’s strong engines of agriculture, mining and tourism to a virtual standstill. The redistribution of land was an outright disaster, the leaving of white expertise and capital left the mines deserted, no sensible tourist would decide to travel to and in this beautiful country. A period of economic disarray and an almost unprecedented hyperinflation destroyed the economy during 2000-2008.

A glorious history gone, its flaws remaining and growing more severe……

But with these developments, another very significant other change occured. A revival of the opposition started to develop, starting with the unexpected surprising outcome of the 2000 elections for Morgan Tsvangirai’s MDC (Movement for Democratic Change) party. It was the first time since 1980 that the population had dared to give so much support to an opposition party. Yet, it took until September 2008 when a ’government of national unity’ was formed between Mugabe’s ZANU-PF and the MDC. Although the ’co-operation’ still is a precious and fragile one, the trend for a better future is set.

It is still early stage but after the IMF described the Zimbabwean economy as ”completing its second year of buoyant economic growth”, there are ample signs that recovery has begun. The gold mining industry has been experiencing a revival, in particular since early 2009, when gold producers were allowed to sell their gold directly to the world markets and be paid in US dollars. It is anticipated that the mining industry will be one of the main drivers in a further recovery of the Zimbabwean economy.

Gold mining in the past

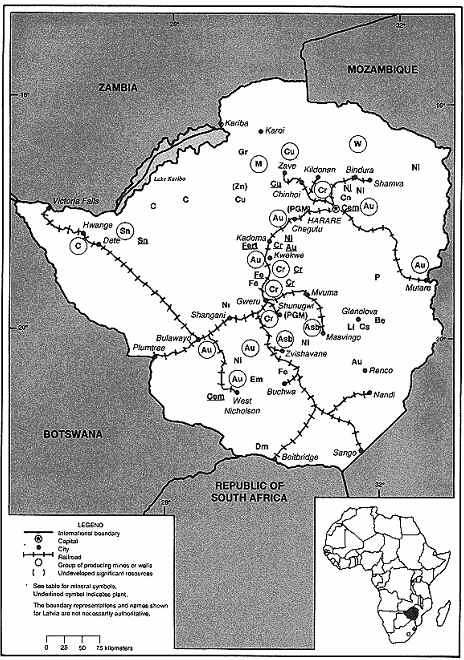

Zimbabwe has a glorious history in mining. Although its natural resources include coal, chromium ore, asbestos, gold, nickel, copper, iron ore, vanadium, lithium, tin, platinum group metals, uranium and diamonds, I will restrict myself to the aspects of gold mining as it is the subject of this report. Some time in the future, it is likely that I also will pay attention to the platinum group metals.

The estimates of former gold producing mines in the country range between 800 and 1,000 mines, clearly indicating how rich Zimbabwe is endowed with our favourite yellow metal. It also reflects the density of mining activities, whereby it should be noted that these counts only include the officially recorded mines and not the obvious artisanal mining activities.

Zimbabwe was once ranked as the 6th largest gold producer in the western world with a production of 18.6 tonnes (598,003 ounces) in 1975. Despite circumstances of civil war, political turmoil and disruptive power shortages, production increased over the years to a record 29.7 tonnes (954,877 ounces) in 1999, good enough to be the 16th largest gold producer of the world.

However, due to the influencing factors described previously, gold mining activities slumped to produce a mere 3.5 tonnes (112,527 ounces) in 2008, to pick up marginally to 4.9 tonnes (157,538 ounces) in 2009 and to 8 tonnes (257,205 ounces) in 2010. Production is expected to have reached 13 tonnes (417,960 ounces) in 2011, reflecting the imminent recovery of the Zimbabwean gold mining industry.

Gold mining at present

The Zimbabwe gold mining industry is definitely in a period of remarkable transition, developing from a depressed and struggling industry into an inventive and enthusiastic new generation of miners. The example of some current gold producers, that have refurbished old mines and resumed production is being followed now, both by some national companies that have been dormant, and by several international companies that have succeeded in, or are in the process of raising the necessary funds to buy and revive formerly producing mines. The dusting off, removing the mothballs, checking old machinery, refurbishing equipment and installing new processing plants are in progress and will come in fuller swing over the next few years.

Production

Looking at a selection of gold producers, the privately-held Metallon Gold is the largest with a contribution of about 50% of Zimbabwe’s total production. The company, having 5 mines on stream, has a lot greater potential, if only the repeating power failures could be solved. Also privately held is Duration Gold which intends to build its 5 core assets into a 350,000 ounce per year producer, based on 5 bankable feasibility studies to be completed by 2014. Details about current progress of the plans to produce 100,000 ounces in 2012 are not available. Another company that has stayed in Zimbabwe all along and kept supporting their former employees financially during the period the mine was idle, is Caledonia Mining Corp. (TSX:CAL, AIM:CMCL) that has been operating its Blanket Mine since 2009. Having produced 35,826 ounces in 2011, production is estimated to be 40,000 ounces in 2012. AIM-listed Mwana Africa (MWA) is operating the Freda Rebecca Gold Mine since acquiring it from Ashanti Gold in 2004 and has produced 27,240 ounces of gold in 2011.

A very good showcase of how mines can be rebuilt is New Dawn Mining Corp. (TSX:ND), a company that I have covered in the past and will update a bit later in the year. The company started with bringing its Turk and Angelus Mines back to production and is now operating a total of 11 mills at 4 gold producing sites in three separate gold camps. It will be expanding its consolidated annualized gold production to a targeted 60,000 ounces by the end of this year and increasing annualized gold production to 100,000 ounces by the end of 2014. As part of its expansion plans, New Dawn acquired 89% of Central African Gold, bringing 4 more mines and nicely expanding New Dawn’s production potential. The company is run by Ian Saunders, born/raised/domiciled in Zimbabwe, who has great expertise and knows the sector in and out. The company’s listing in Toronto should give it an edge in finding support from international investors.

Exploration

As mentioned before, the gold exploration sector is buzzing with activity, brought on by the generally better circumstances, the continuing relative high gold prices, and a definitely improved availability of international investors that have the vision of what is eventually going to happen to mining in Zimbabwe. Existing companies show revived energy and new-to-Zimbabwe companies come to participate. A company that has a history in Zimbabwe and has been around during the difficult years is African Consolidated Resources (AIM:ACR). Since 2004, it has assembled an impressive asset base, including 5 gold projects. Focus is on the Pickstone Gold Project to achieve cash generative, first phase production in mid 2012 and drilling at the Gazema Gold Project that resulted in a resource of 27Mt at 1.2 g/t, containing 1.03 million ounces; target is to define a total resource of 2 million ounces by Q4 2012.

One of the few major mining companies that has joined the renewed elan for mining in Zimbabwe is DRD Gold (NYSE,JSE:DRD) that has taken a 50% interest in a joint-venture with Chizim Investments in 2010 to explore 32 contiguous claims spread over 550 hectares. Knowing DRD as real smart operators, I find it very encouraging that they are part of the game. Also in 2010, the Australian company Cape Range (ASX:CAG) acquired an option to acquire up to 90% in Ox Mining, operating the producing Inez Gold Mine and exploring some other gold projects. In 2011, privately held Bilboes Holdings got a financial injection of $6 million from the new Baker Steel Resources Trust, part of the London-based Baker Steel group of funds. The proceeds will be used at the 4 previously producing oxide mines containing JORC compliant resources totaling 778,000 ounces. Baker Steel feels there is a good opportunity to significantly expand these resources through drilling of the underlying sulphide mineralisation, which is underway. A very recent entry in the Zimbabwe gold scene came just early this month by Australian-based ElDore Mining Corp. (ASX:EDM) with the acquisition of the Lonely Gold Mine for $4.4 million. The mine is situated near Bulawayo in the goldproducing Bubi greenstone belt and was the country’s largest single gold producer until its closure in the mid-1990’s. ElDore plans to determine the potential to restart operations at the mine along with discovering the size and scale of operations and exploration prospects.

Observation

It should be noted that all the new activities in the Zimbabwe gold mining industry are taking place in the presence of the Indigenisation and Empowerment Act, introduced by the Zimbabwe government in 2010 along with a substantial increase of levies on production and license fees. It remains to be seen whether this new regulation will indeed be enforced as introduced and interesting observations have already been made by several mining insiders, including the Chamber of Mines, about its implementation and consequences. It is obvious that the good prospects of an involvement in Zimbabwe’s mining industry outweigh any new regulation. Now, we finally come to the main subject of this report, the new future of Mayfair Mining & Minerals, Inc., and the opportunity it represents to a small privileged group of international investors to take an early-stage interest in Mayfair’s plans to revive 3 formerly producing gold mines and 1 highly promising exploration property, situated in Zimbabwe’s most prospective greenstone gold belt, and further strengthen the company’s property base.

Mayfair Mining & Minerals

Mayfair Mining & Minerals, Inc. is a publicly held, momentarily unlisted mining and exploration company, operated from the U.K. Its experienced management team, headed by Mr. Clive de Larrabeiti, has designed a business plan to build the company into a successful exploration company with the focus on establishing actual gold production in the foreseeable future. To this effect, Mayfair recently acquired assets in Zimbabwe, formerly held by Conquest Resources (TSXV:CQR), consisting of three former gold producing mines, the Babs Gold Mine, the Beehive Gold Mine, the Piper Moss Mine and the Eva exploration property. The consideration for the acquisition was $2.0 million, payable by 20 million fully paid common shares, thus giving Conquest an approximate interest of 36.4% in the capital of Mayfair.

The Project

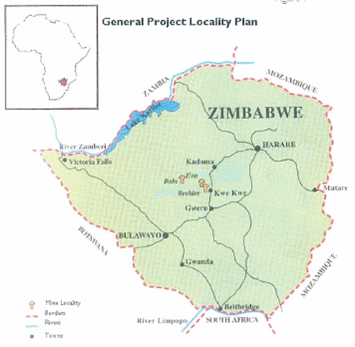

The three acquired mines are situated north and northeast of Kwe Kwe within the Midlands Greenstone Belt on the highly prospective Taba Mali Deformation Zone. This major structural feature exceeds 100 km in length and 20 km in width and hosts some of the significant gold producing operations in Zimbabwe.

The Beehive and Babs mines were developed between 1997 and 1998 at a cost of approximately $4.5 million and operated for 9 months before being placed on care and maintenance in early 1999, due to falling gold prices and increasing costs in Zimbabwean currency. In 1998, a 300 tpd processing plant was installed at the Beehive mine site, equipped with a crushing circuit, two parallel ball mills, C.I.P. tanks for leaching and subsequent carbon recovery. Unfortunately, the machinery attracted the attention of thieves and was stolen in the idle and bad years.

The Beehive and Babs mines were developed between 1997 and 1998 at a cost of approximately $4.5 million and operated for 9 months before being placed on care and maintenance in early 1999, due to falling gold prices and increasing costs in Zimbabwean currency. In 1998, a 300 tpd processing plant was installed at the Beehive mine site, equipped with a crushing circuit, two parallel ball mills, C.I.P. tanks for leaching and subsequent carbon recovery. Unfortunately, the machinery attracted the attention of thieves and was stolen in the idle and bad years.

The Beehive mine is reported to have produced 15,000 ounces whilst the Babs produced 20,000 ounces. The average grade of the ores from which this production was derived were 6.8g/t and 9.6g/t. The Eva prospect, located 4 km north of the Beehive, has produced minor amounts of gold in the past. The inferred mineral resources for the Beehive Mine are in excess of 145,000 tonnes at an average grade of 6.8g/t gold, whilst the Babs Mine may initially host 214,650 tonnes at 5g/t gold. The Eva prospect may host 360,000 tonnes grading 2-3g/t.

The Piper Moss Mine has an extensive history going back to the original claim staking in 1912. Old production records show that 163,190 ounces of gold were produced from 518,376 tons of ore. The mine is situated 3km north of the Globe and Phoenix Mine which has produced over 3.2 million ounces of gold from 3.6 million tons, which made it one of the richest gold mines in the then British Commonwealth.

Prospects

The most recent availabe documentation on the acquired properties are summary geological reports that date from respectively October 2000 on the Beehive, Babs and Eva properties and October 1996 on the Piper Moss property. According to these reports, the following observations can be made:

- all properties are situated in regions where various finds of mineralization are known to be present,

- all properties are fully documented and should be read and studied with the general mining and exploration knowledge of today;

- none of the properties have been subjected to modern exploration techniques;

- the known reserves seem small but a great potential for further resources has been recognized;

- the Eva prospect has the potential to become a significant low grade open pit mining operation;

- all mining localities can be brought into production relatively quickly;

- it is believed that the Beehive, Eva and Babs mines have the potential to become significant medium-sized gold producing operations whereas the Piper Moss mine has the additional feature of the Moss vein that offers great potential, provided comprehensive and meaningful exploration and development programs are carried out;

- on all four properties, there are substantial quantities of tailings readily available which should be sampled and investigated for possibilities of early and economically feasible recovery of the gold by vat and/or heap leaching;

- all properties are easily accessible via main paved roads and short distances on gravel roads and close to railroads and large hydroelectric power lines;

- within the territories of the company’s licensed areas, there are several indications of mineral occurrences that should be investigated.

First financing

Mayfair Mining & Minerals is seeking an initial financing by Private Placement of Units to a total amount of C$500,000. The price of each Unit offered is C$0.10 and each Unit shall consist of one share of the Company’s restricted Common Stock, par value US$0.001 per share and one warrant to purchase an additional common share for a period of two years from the date of the issue at a subscription price of C$0.15 per Unit. The proceeds of the issue will be used to enable the company to

- design the first working program to inspect, organize and evaluate the properties, including a program for pre-exploration, initial sampling and testing, and starting up the refurbishing of the processing plant;

- preparing and initiating a listing of the company’s shares on a generally recognized stock exchange or automated quotation system in Canada. Management has already commenced having discussions with some of the suitable choices for listing;

- preparing and initiating negotiations to conduct a first major financing in a range of US$5.0 million plus to enable the company to start its first mature exploration and refurbishing program on the acquired properties in Zimbabwe.

The challenge: An opportunity

Management of Mayfair Mining & Minerals is determined to build a future in Zimbabwe, where it has recognized good opportunities to participate in its emerging gold industry. The completed acquisition of the four above described mineral properties should be a sound and prospective base for accomplishing that. The company is also in further advanced discussions on additional mining project acquisitions or joint ventures in other highly prospective gold regions of Zimbabwe.

Zimbabwe may not be the easiest operating environment in the world but considering its history and the process of change that is underway, Zimbabwe is widely and increasingly becoming regarded as one of the more promising mining destinations of Africa. The rich greenstone belts that were the host of hundreds of smaller gold mines were not left because they were depleted, the mines stopped working due to adverse political and economic circumstances.

Over the last few months, it has become apparent that several good parties are coming to join the new interest in Zimbabwe gold mining. It is too early to speak of a gold rush but I am sure that we will see a lot more of the same happening in the forthcoming future. On a longer term, it is likely to change the nature of the mining industry as we know it from the past. It will be a time that larger entities will come in and will be created. Consolidation should be the name of the new game, as may be applying a new way of approaching exploration and mining. The richness of Zimbabwe may not only to be found in deep underground mining, there may be enough gold to be found closer to surface. New techniques should be used, unconventional thinking should be given room. The resources are there, in ample quantities and qualities.

Mayfair Mining & Minerals has entered the Zimbabwe gold search at an early stage, reflecting management’s vision of what is likely to develop in the Zimbabwean gold mining scene over the next few years. To make it happen and get the activities off to a good start, the company is seeking a small group of sophisticated and smart investors that are willing to share and support that vision. As I described it on the first page of this report, I feel that Mayfair represents ”A NEW VENTURE ON HISTORICALLY KNOWN RESOURCES”, offering a ”GROUND-FLOOR OPPORTUNITY” that you don’t see coming by every day.

Henk J. Krasenberg

European Gold Centre

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Eurobattery Minerals förvärvar majoritet i spansk volframgruva

Eurobattery Minerals har tagit ett stort steg i sin utveckling genom att underteckna ett avtal om att förvärva en majoritetsandel i volframgruvan San Juan i Galicien, Spanien. Genom en investering på totalt 1,5 miljoner euro i det spanska bolaget Tungsten San Juan S.L. (TSJ), säkrar Eurobattery Minerals en ägarandel på 51 procent – och kontroll över projektet redan efter första delbetalningen.

Investeringen syftar till att bygga en pilotanläggning för mineralbearbetning och starta gruvdriften, som redan har alla nödvändiga licenser och ett preliminärt leveransavtal med Wolfram Bergbau und Hütten AG – en ledande volframproducent inom Sandvik-koncernen. Första leveranserna till Europa väntas ske under andra halvåret 2026, då även positivt kassaflöde förväntas genereras.

”Detta är en game-changer för oss. För första gången går vi från ett prospekteringsbolag till ett bolag med faktiskt intäktspotential inom en snar framtid,” säger VD Roberto García Martínez.

San Juan-projektet har bekräftade malmreserver på cirka 60 000 ton med en volframoxidhalt på 1,3 %. Volfram är en kritisk råvara med ökande strategisk betydelse för industri och försvar, och priset har stigit med över 40 % under 2025.

Med detta förvärv stärker Eurobattery Minerals både sin finansiella ställning och sin position som en europeisk leverantör av kritiska råmaterial – ett viktigt steg mot en hållbar och självförsörjande batterivärdekedja i Europa.

Nyheter

USA ska införa 50 procent tull på koppar

USA:s president Donald Trump har precis meddelat att landet ska införa en tull på 50 procent på basmetallen koppar. Priset på råvarubörsen i USA stiger omgående med 10 procent.

USA har viss inhemsk produktion av koppar, men den inhemska efterfrågan överstiger produktionen. Därför måste landet importera koppar för att täcka behovet, särskilt för användning inom elnät, elektronik, byggindustri och fordonssektorn. De största exportörerna till USA är Chile, Kanada, Mexiko och Peru.

När tullar av denna typ införs uppstår prisskillnader i världen. Handlar man koppar på börsen är det därför viktigt att veta vilken börs man handlar på eller om man använder certifikat så är det viktigt att veta vilka underliggande värdepapper de följer.

Sedan är det som alltid med Trump, begreppet är som bekant TACO, Trump Always Chickens Out. Man ska alltså inte ta några definitiva stora beslut baserat på vad han säger. Saker och ting kan ändra sig från dag till dag.

Nyheter

Ryska staten siktar på att konfiskera en av landets största guldproducenter

En våg av panik sprider sig bland Moskvas elit sedan Vladimir Putins regim inlett en dramatisk offensiv för att beslagta tillgångarna hos Konstantin Strukov – en av Rysslands rikaste affärsmän och ägare till landets största guldgruvföretag, Yuzhuralzoloto. Åtgärden ses som ett tydligt tecken på hur långt Kreml är villigt att gå för att säkra ekonomiska resurser i takt med att kostnaderna för kriget i Ukraina stiger.

Strukovs förmögenhet, som uppskattas till över 3,5 miljarder dollar, byggdes upp under decennier i nära relation med maktens centrum i Ryssland. Men den 5 juli stoppades hans privatjet från att lyfta mot Turkiet. Enligt flera ryska medier deltog den federala säkerhetstjänsten FSB i ingripandet, och Strukovs pass beslagtogs. Händelsen ska vara kopplad till en omfattande rättsprocess där åklagare kräver att hela hans företagsimperium förverkas – med hänvisning till påstådd korruption och användning av skalbolag och familjemedlemmar för att dölja tillgångar.

Företaget själva förnekar att något inträffat och kallar rapporteringen för desinformation. De hävdar att Strukov befann sig i Moskva hela tiden. Trots det bekräftar rättsdokument att både han och hans familj förbjudits att lämna landet, och att myndigheterna snabbt verkställt beslutet.

Det som nu sker är en del av ett större mönster i ett Ryssland präglat av krigsekonomi: staten tar tillbaka kontrollen över strategiska sektorer som guld, olja och försvarsindustri – industrier som nu allt mer mobiliseras för att finansiera och stödja krigsinsatsen. Intressant nog handlar det inte om att Strukov ska ha varit illojal mot regimen – tvärtom har han varit en lojal allierad, med politiska uppdrag knutna till Putins parti. Men lojalitet räcker inte längre som skydd.

Medan tidigare utrensningar ofta riktade sig mot krigskritiker eller de som flydde landet, drivs dagens tillgångsövertaganden av något mer fundamentalt: ekonomisk nöd. De växande sanktionerna har nästan helt strypt inflödet av utländskt kapital. Statens oljeintäkter minskar och budgetunderskotten växer. Putins lösning är att vända sig inåt – till de oligarker han själv lyfte fram – för att fylla statskassan.

Det här är inte ett enskilt fall. På senare tid har flera framstående affärspersoner hamnat i plötsliga rättsliga tvister, omkommit under mystiska omständigheter eller sett sina bolag tas över av staten. Den oskrivna överenskommelsen som länge gällde i Putins Ryssland – rikedom i utbyte mot lojalitet – håller på att kollapsa.

Den 8 juli väntar en rättsförhandling som kan avgöra framtiden för Strukovs affärsimperium. Men budskapet till Rysslands näringslivselit är redan tydligt: ingen är för rik, för lojal eller för nära den politiska makten för att gå säker. I ett Ryssland där kriget kräver allt större uppoffringar riskerar oligarker att snabbt förvandlas till måltavlor.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering