Nyheter

World´s largest silver producer and a lot more than that

Enormous exploration potential secures future growth

Enormous exploration potential secures future growth

According to the Silver Institute, Mexico maintained it long-time position as the world’s largest silver producer with a production of 128.6 millions of ounces in 2010. But as said, it is a lot more than that. It ranks 11th in the list of the world’s largest gold producers, 9th in the list of the world’s largest copper producers, 6th in the list of the world’s largest zinc producers, 5th in the list of the world’s largest lead producers and 16th in the list of the world’s largest iron ore producers. Historically, mining and exploration has been a significant activity in many parts of the country and often a main source for families to make a living. The industry was very fragmented, also due to the old mining laws that were in force. In a report that I wrote a few years ago, I illustrated the silver mining industry by mentioning that there were many, many silver producers but that 75% of the total production was coming from the top-3 mines. That situation has been changing in the last few years. A new mining law was adopted which gave much more flexibility to mining companies to build their property portfolios with larger entities. Many foreign, mostly Canadian companies finally could develop their plans so that today, the mining industry is a much more modern industry than ever before. Moreover, as described above, the production of other metals has become increasingly important. I have followed the developments in Mexico for many years and I believe that its mining and exploration industry is facing a long term and very prospective future in view of fundamental economic factors relating to the international use of metals and minerals, I am confident that Mexico will retain and even enhance its prominent position in the world of metals and mining. That is why I decided to initiate this new MINING IN MEXICO publication.

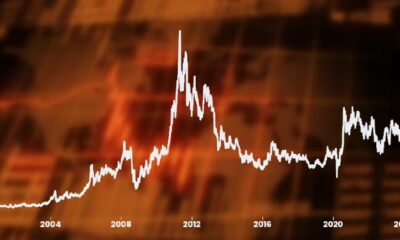

After about the 10 years of indulgence, frustration, cost-consciousness, scraping finances, lacklustre share prices, in short: surviving, that characterized the world of mining and metals in the 1990’s, the current period of recovery started in 2002. Almost everywhere in the world, mining and exploration activities stepped up considerably as a result of the new hunger for metals. If there is one country in the world where exploration activities have come to a frenzy again, it is Mexico. From a country that had been in a severe economic turmoil, triggered by the devaluation of the peso in late 1994, which threw the country in its worst recession in over half a century, Mexico turned into a country of reorganization and remarkable revival. The mining industry played a significant role in that. Not surprisingly, because there were, and still are, several obvious factors present that made and make the choice for Mexico a very logic one:

- Mexico has a mining history of almost 500 years. But already in the ancient times, thousands of years ago, the Mayans and Aztecs built complex civilizations using gold and silver. It was also ’plata’ that made the Spanish rulers stay there from 1521 to 1821 when independence came. This all has built a deep-rooted tradition of extensive mining expertise;

- the political situation is considered to be a most stable one, although the outbursts of violence between the drug lords and their gangs have become a factor of concern over the last few years. President Felipe Calderon has made combating this organised crime a priority and has been quite successful in removing some top leaders;

- the government has been and is very friendly towards mining and exploration activities and welcomes foreign corporate entities and capital to be applied to the benefit of the country and its people;

- the legal and regulatory circumstances for mining and exploration have significantly improved by implementation of the National Mining Development Plan, released in 2002 and updated in 2007 and the 2005 amendment of the Mexican Mining Law;

- foreign companies can own 100% of Mexican companies, freely import and export capital and new land ownership regulations have made an end to the historical highly fragmented ownership of mining claim areas;

- there are no taxes or levies imposed specifically on the mining industry. Companies pay the standard corporate income tax rates;

- the country has an excellent infrastructure of air, road and rail transport facilities. There are approximately 365,000 km of paved roads and 27,000 km of railroads, several major maritime ports and numerous international airlines serving the country;

- due to Mexico’s a long time record of mining and exploration activities, experienced labour forces are readily available;

- currency risks have been diminished since the Mexican peso is pegged to the US$;

- and most importantly, the ready availability of known under-explored mineral properties and projects with available records of past exploration.

Mexico is generally considered to be one of the most attractive and easiest accessible destinations for mining and exploration companies in the world. In several studies, Mexico has been ranked among the most desirable countries for applying exploration capital. In a study of the Metals Economics Group, Mexico came right behind the top three, Canada, Australia and the United States. Therefore, it is not surprising that now over 250 foreign mining companies are active in this industry: around 75% are Canadian, 14% hail from the United States, the balance is made up by England, Australia, Japan, China and Korea. Mining and exploration are spread over practically all over Mexico. In several regions, it looks as if the mining operations are almost next door to each other. From the north-west, three rich gold and silver belts run adjacently downwards through about 70% over half of the country’s territory, on both sides of the Sierra Madre Occidental mountain chains. The map on the page 5 of this report gives a good impression of the density of mining in the country. Looking at the production companies, the leader of the pack is the established Mexican Fresnillo (LSE, MSE: FRES), the world’s largest primary silver producer and the second largest gold producer of Mexico. The company is determined to maintain that position and strives to produce 65 million ounces of silver and over 400,000 ounces of gold by 2018.

[quote]Mexico has been the largest silver producing country in the world since long with production having increased from 91.7 million ounces of silver produced in 2002 to 128.6 million ounces in 2010[/quote]

During the last 10 years, several younger companies have joined the ranks of producers, either through extensive exploration programs on their projects or by taking over and refurbishing former producers. In the silver sector, companies like Pan American Silver* (TSX: PAAS) Coeur d’Alene (NYSE:CDE, TSX:CDM), Endeavour Silver (NYSE:EXK), TSX:EDR), Great Panther Silver** (TSX:GPR, NYSE:GPL), First Majestic (TSX:FR, NYSE:AG), Excellon* (TSX:EXN) and Aurcana (TSXV: AUN) have made great progress by developing their companies from one of the many exploration companies to the more prominent ranks of silver producers.

[quote]Mexico has been emerging as a significant gold producer, having almost tripled its production from 685.000 ounces in 2002 to over 1.750,000 ounces in 2010[/quote]

However, as said in the heading of this report, Mexico should not only be seen as a leading silver producer. In the last decade, Mexico has also emerged as a significant gold producer. Having almost tripled its gold production, it is very likely that Mexico will continue to move up in the ranks of world gold producers and enter the top-10 list of producers in the next few years. In the gold sector, the largest production company is Goldcorp (NYSE:GG, TSX:G), which brought its Peñaquito mine to production in 2010, to be Mexico’s largest open pit mine, containing gold, silver, lead and zinc. Together with the producing

Los Filos and El Sauzal mines, total production is expected to further increase considerably. Of course, also here Fresnillo has to be mentioned. As stated above, it is the second largest gold producer in the country. Other emerging gold producers are Alamos Gold (TSX:AGI), Agnico-Eagle (NYSE, TSX:AEM), AuRico Gold (TSX, NYSE:AUQ) -the former Gammon Gold-, Minefinders* which made the headlines last week with the announcement that it will be acquired by Pan American and thus become a part of a very powerful gold and silver producing combination, Newgold* (TSX:NGD), Timmins Gold** (NYSE:TGD, TSX:TMM) and the newest kid on the gold production block, Argonaut Gold (TSX:AR).

To take a quick peek into the near future, there are three companies that are currently moving rapidly towards their initial production stage. First of all, the never to be ignored, newly formed McEwen Mining (NYSE, TSX:MUX) -originating from the U.S. Gold and Minera Andes combination- that will be joining the producers group this year when its El Gallo mine will be completed and commissioned, then NWM Mining (TSXV:NWM) that is commissioning its completed mine and Vista Gold* (NYSE, TSX:VGZ) which is now in the permitting stage.

This review of the companies that are currently producing silver and gold does not pretend to be complete but gives, in my opinion, a good view of what is happening today in Mexico in this fascinating sector. I do hope it shows you that the launch of this new publication is a sensible thing to do. And of course that you will find it worthwhile to give it your attention. On the next page you will find a map of Mexico which shows the most important locations of production projects. I think it is warranted to say that there is hardly another country to be found in the world, where there is this kind of density of resource activities. Certainly giving me enough to talk and write about in the forthcoming issues.

In the next issue of MINING IN MEXICO I will give you a review of the most interesting exploration companies and projects. That report will also include an overview of The Centre’s Having looked closely at what is going on in Mexico and in line with my firm belief that the overall mining and exploration industry is facing very prospective longterm future in view of fundamental economic factors relating to the international use of metals and minerals, I am confident that Mexico will not only retain but significantly enhance its leading position in the world’s mining and exploration scene. International investors have been paying attention and should continue to do so.

* these companies were signalled in their early stage of developments in previous reporting and coverage of The Centre

** these companies are current Supporting Companies of The Centre and will be described extensively in Corporate Reports, to be published in the near future, and updated later this year.

Henk J. Krasenberg

European Gold Centre

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

Nyheter

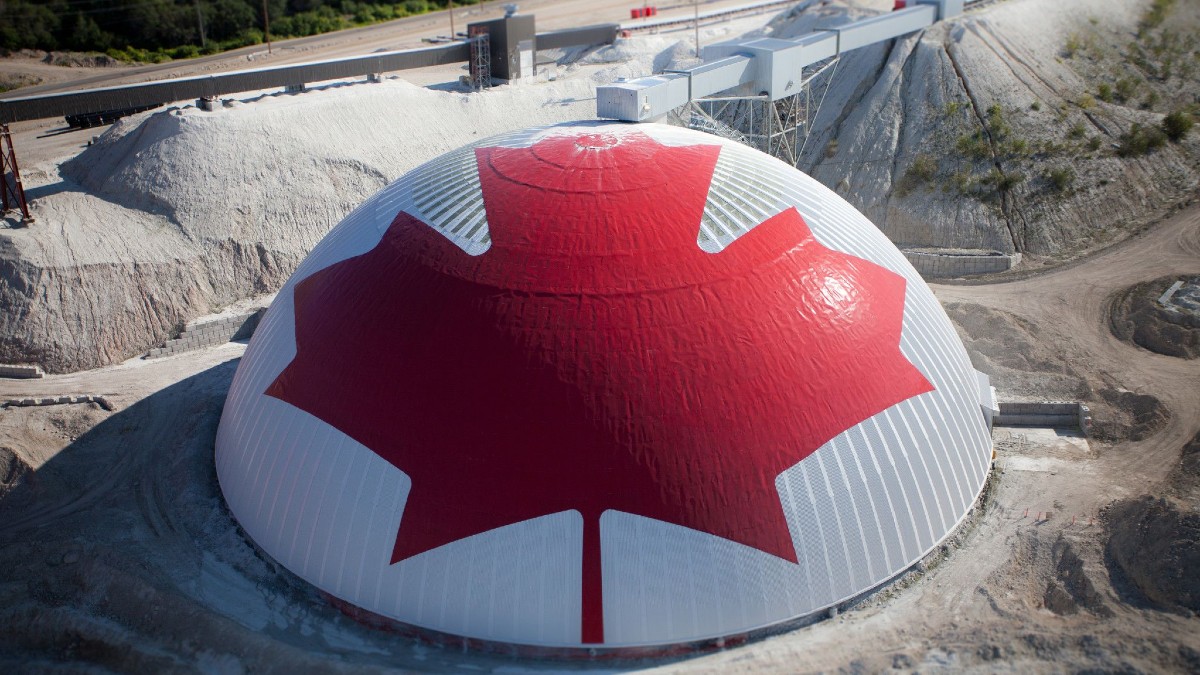

Teck Resources kan förse Nordamerika och kanske hela G7 med all germanium som behövs

Kanadensiska gruvbolaget Teck Resources för samtal med både USA och Kanada om att leverera kritiska mineraler till de båda ländernas försvarsindustrier – bara en dag efter att Kina skärpt sina exportregler för sällsynta jordartsmetaller.

Enligt Financial Times diskuterar bolaget möjligheterna att leverera germanium, antimon och gallium, under förutsättning att det kan få garantier för minimipriser och köpvolymer.

Kinas senaste besked innebär en utvidgning och förtydligande av de omfattande exportkontroller som infördes redan i april. De tidigare restriktionerna ledde till stora bristsituationer globalt innan nya avtal med Europa och USA gjorde det möjligt att återuppta leveranser. Den nya regeln klargör dock att exportlicenser sannolikt kommer att nekas till vapenproducenter och vissa halvledarföretag.

Vid FT Metals and Mining Summit uppgav Teck Resources vd att bolaget kan producera tillräckligt med germanium för att täcka hela Nordamerikas behov – och möjligen även G7-ländernas.

Teck Resources och Anglo American går samman

Teck Resources och Anglo American är mitt uppe i en fusion, vilket beskrivs som ett samgående av två jämbördiga parter.

Nyheter

Leading Edge Materials är på rätt plats i rätt tid

Leading Edge Materials har tre olika projekt, men det är ett som är bolagets huvudfokus, Norra Kärr. Den tillgången har tunga sällsynta jordartsmetaller som är viktiga för Sveriges och hela EU:s oberoende när det gäller dessa kritiska råvaror. Kina som kontrollerar större delen av världens sällsynta jordartsmetaller drar hela tiden åt tumskruvarna på resten av världen. Denna vecka införde Kina extremt aggressiva regler som gör att större delen av världens företag som på ett eller annat sätt använder eller producerar metallerna måste ansöka om tillstånd av kinesiska staten för att kunna exportera sina produkter.

Norra Kärr-projektet har i denna kontext blivit strategiskt viktig för hela EU.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga