Nyheter

Who’s Afraid of French Socialists

On Sunday 6 May the French people elected Francois Hollande, a Socialist, as President of France. On that same day Greek voters marginalized the previous two largest political parties, giving more votes to two parties that previously were marginalized and sending a signal that they too were disgruntled with recent trends in governance, both in Greece and in Europe more broadly.

On Sunday 6 May the French people elected Francois Hollande, a Socialist, as President of France. On that same day Greek voters marginalized the previous two largest political parties, giving more votes to two parties that previously were marginalized and sending a signal that they too were disgruntled with recent trends in governance, both in Greece and in Europe more broadly.

There were those who saw this as a terrible blow against the austerity programs being imposed across the European Union, and thus as a major obstacle to economic reconstruction on the continent. Indeed it is. It is not, necessarily, a turning against real economic reform. It most likely reflects the strong, multi-generational concept toward a social contract between the governments of Europe and their populations, a contract that in fact has its roots in the centuries of feudal governance and social structure. However, it also may be nothing more than a very rational reaction to premature austerity in the midst of recession, a rejection in Europe of the very policies that turned a deep recession into the Great Depression in Europe and the United States in the early 1930s, which led inevitably to World War Two.

Our economic view has been that Europe needs serious economic reform to address the structural deficits, massive private and public debt, and government programs that are financially unsustainable, but that these policy changes both are long-term in nature and need to be timed to not precipitate a worse economic catastrophe than the one experienced in 2008 and 2009.

Others have a much more orthodox view, suggesting that to reject stringent austerity policies now is to repudiate the concept that serious economic restructuring is necessary. That may be too harsh a judgment on the voters of France and Greece. Time will tell. Others, especially in the United States, shudder at the thought of “Socialists” in charge of France. They seem to see anyone labeled “socialist” as being in essence a Bolshevik communist, with no sense of the subtlety of the spectrum of political and economic opinions and policies.

There were any number of gold market commentators who were convinced that gold prices would soar on Monday because the Socialists had won in France. It did not. In fact, it fell, and continued to fall even more sharply on Tuesday.

There was shock that gold prices would not rise sharply with the ascendancy of Socialists in one of the two keystone states of continental Europe. Perhaps western European socialists just are not as scary as they used to be. Perhaps they never really were that scary.

The gold price fell primarily because the dollar rose sharply against the euro, in reaction to the vote, and because there are any number of people who will sell gold on any dollar strength in a mechanical, thoughtless fashion.

But there was something more tangible and real behind the decline in gold prices after the French and Greek elections:

Investors were signaling that they do not as a group blindly buy into the black-or-white view that the European and global economies are spiraling into a new, worse financial crisis. Not even French Socialists can scare many investors into panicking the way they have been over the past few years. Investors are taking a more thoughtful, more nuanced view toward the economic and financial crises they are facing. They see the problems, but they also see the strengths.

They see financial markets as constrained and likely to be tormented by economic conditions in the future. But they also see that even with such constraints, the global financial system might not collapse, and that economic growth may actually continue. In fact, part of the sell off in gold this week may have reflected the view that economic growth would resume sooner and stronger with a Socialist in charge in France than it would with a right-leaning politician playing Sancho Panza to Angela Merkel’s Don Quixote.

The Shift In Investor Attitudes

All of this discussion leads to the view, espoused in these reports for some time now, that there has been a major directional shift in investor opinions not only toward the world economy but also toward gold and silver markets and prices.

Gold and silver prices have risen to record levels over the past few years, at the most recent end of a bull market that began in 2001 and 2002. CPM Group has been warning since 2010 that gold and silver prices could reach what we have been calling a ‘cyclical peak in a secular bull market’ during or near 2011. Our view is that the long-term increase in investment demand – a secular upward shift in the investment demand curve, in the words of an economist – would remain in place, and keep investors interested in adding more gold and silver to their portfolios for at least the next few years, and possibly even longer.

Within the context of that longer term, secular bull market in investment demand for gold and silver, however, our view was that investment demand could peak around 2011, and back off, at least slightly. This would lead gold and silver prices to peak in or around 2011, and then decline, somewhat. We expected prices would stay high by historical standards:

Above $1,300 most likely for gold, and above $15 for silver, over the next decade. However, we did not see gold going to $2,500, $3,000, or higher, or silver going much beyond $50, at least not until much later in the decade.

As of May 2012, it looks as if the market is following the patterns we had outlined two years ago. Gold prices appear to have peaked around $1,920 in September 2011. It may be higher on an annual average basis in 2012 than the $1,572 average price in 2011, but CPM Group’s projection for 2012 average gold prices is $1,639, not anything close to $2,000 or higher projections banks have made by drawing an accelerating trend line based on the past three years’ price performance.

So, too, with silver, more or less. Silver appears to CPM Group to have peaked at $49 in early May 2011. The annual average price last year was $35.29. That may be the cyclical high. CPM Group is projecting $30 for an average price for 2012. That is incredibly high by historical standards, but it is off sharply from last year, and stands in stark contrast to those price projections based on upward trend lines on price charts, and blind hope that prices will rise forever.

We want to reiterate here that what we have been projecting, which seems to be emerging at present as reality in the markets, is a cyclical peak in a secular, longer term bull market. We expect prices to fall only modestly from their recent record high levels, and to stay high by historical standards. And, we expect prices to rise more in the future, when investors periodically become more concerned about economic and financial stability.

Price Increases Limit Investment Demand

The decline in investment demand, at least marginally, which is leading to this peaking of gold and silver prices was expected to happen for two reasons. Both appear to be occurring. First, gold and silver prices would reach such high levels that investors would reduce their additional purchases. The very increase in gold and silver prices took prices to levels where investment demand declined, at least in volumes of ounces of gold and silver being purchased. Investors may be increasing the amount of money they are converting into gold and silver, but at the sharply higher prices of the past 18 months they are buying less metal with more money.

Also, insofar as some investors target a percentage of their wealth or, as is common in Asia, a certain number of months’ of consumption expenditures, to hold in gold and silver, as the prices of these metals rise, the percentage of investors’ individual wealth held in these metals rises commensurately, reducing the need for individual investors to buy more metal in order to reach their own personal goals as to what percentage of their assets or living expenses they wish to hold in gold and silver.

Over the past decade the percentage of personal wealth held in gold has risen from 0.2% of global private wealth in 2000 to around 0.8% in 2011. Of this enormous increase in the role of gold in global private wealth, two-thirds of the increase reflects the rise in gold prices. While investors have purchased a historically unprecedented amount of gold over the past decade, the actual increase in the number of ounces held by investors has accounted for only one-third of the increase in gold’s share of private wealth holdings. The rest was a function of prices.

In this way, one should realize that a bull market, in any asset, carries with it the seeds of its own ending. Prices ultimately rise to levels that shift supply, demand, and investment demand. This is an immutable economic law, although one which investors repeatedly ignore, whether it is in gold, copper, bank stocks, real estate, internet stocks, or so many other assets.

A Shift In Investor Economic Concerns

The second, and more important, factor behind the peaking of gold and silver prices was our expectation that investors would back away from the unbridled, sometimes irrationally overblown, fear of imminent financial system collapse and economic depression that had been driving them to buy enormous amounts of gold and silver regardless of the price, until September 2011.

We had expected investors to back away from this unbridled fear and move instead to a more nuanced, better informed view that while the global economy faces numerous economic, political, and financial problems of epic proportions, these problems would not lead to a catastrophic financial system collapse. Instead, they would remain problems for years to come, causing economic growth to be lower than one otherwise would expect, inflation to be somewhat higher than it otherwise would be, and leading to periodic recessions and other bouts of heightened economic unrest and uncertainty. In other words, the long-term economic and financial problems built up globally over the past fifty years would take a long time to slowly be addressed and, it is hoped, resolved, by recalcitrant political leaders. In this environment, investors would continue to want to buy and hold gold and silver as protection against these problems.

However, they would become more price sensitive. Instead of chasing metals prices ever higher, they would stop buying when prices rose sharply, and buy when prices dipped lower.

This is exactly the investor buying pattern we have seen over the past eight months, and which we expect to continue for the next few years. Investors have been buying more metal on price dips and pulling back when prices rise. In this environment, we expect gold and silver prices to soften somewhat from the levels achieved in 2011. We do not expect them to drop back to levels seen prior to 2008. We think gold prices actually will remain above $1,400, maybe $1,300, over the next few years. Silver may drop down toward $20 between now and 2014.

Fundamentals

Some market observers say that the fundamentals of the physical gold and silver markets do not apply, since trends in investment demand appear to be the key price determinants. This is wrong on a couple of levels. First, investment demand is a fundamental. Investors are a major part of the physical markets for gold and silver, and they have been a key price-setting fundamental for millennia. Second, while investment demand trends are the most important fundamental, other fundamentals also are important to gold and silver prices.

Gold’s Other Fundamentals

Mine production in gold is rising again. It has been since 2009, and a clear longer term trend of rising global mine production now is established in the gold market. Mine output had more than doubled between 1980 and 1999. By 1999 gold had been in a bear market, with prices below the market clearing floor price of $320 from 1997 through 2002. In this environment, mining companies cut back on exploration, development, and production. Production fell from 1999 through 2008. By 2009 the renewed rise in gold prices, to record levels by then, had stimulated the biggest gold mining exploration and development rush in history, which is now being reflected in rising production.

Global gold mine production should be expected to rise for at least the next decade. Fabrication demand meanwhile has been flat to lower, due to higher prices. Fabrication demand has bottomed out, it seems to CPM Group. If we are correct about the price direction over the next few years, gold use in jewelry and other fabricated products should start rising again. Indeed, fabrication demand did rise slightly in 2010 and again in 2011.

Central banks meanwhile have begun buying gold again. They are purchasing around 10 – 13 million ounces per year, and are projected to continue buying gold around such volumes for many years to come.

Silver’s Other Fundamentals.

Silver mine production actually has been rising for many years, fueled not only by increased output at primary silver mines but also increased production of byproduct silver at copper, lead, zinc, and gold mines. This is likely to continue, given the historically high prices of all of these metals.

Fabrication demand meanwhile seems to have bottomed out, around 2009. Total fabrication demand for silver rose in both 2010 and 2011. Photographic demand is a fraction of what it used to be, having been supplanted by digital imaging. Jewelry and silverware production has declined due to high silver prices and economic stringencies on the part of many consumers. Silver use in electronics, and in solar panels meanwhile has risen sharply. This trend also is expected to continue.

Regulatory Issues Update

Meanwhile, the regulatory environment for commodities markets, including precious metals, continues to grow more worrisome, especially in the United States. Some U.S. regulators are continuing to push toward introducing regulations that could significantly limit liquidity, drive trading into less regulated and more opaque markets, and destroy economic value. Additionally, market participants are reacting to these regulatory efforts the only way left to them: They are seeking court injunctions blocking the implementation of many of these regulations, and are filing legal complaints seeking to block the introduction of improper and destructive regulations.

Much of these stems from the U.S. Dodd Frank legislation pushed through in the aftermath of the financial market debacles of 2007 and 2008. Market participants are questioning the extent of damage to markets that could be wrought by U.S., EU, and UK regulatory and legislative changes. It appears that regulatory changes, especially those proposed in the United States, pose a real threat of reducing liquidity and transparency in commodities markets. They do not seem likely to reverse the so-called financialisation of commodities markets, however. The UK government meanwhile seems most sensitive and sensible in seeking to not damage the commodities markets. The EU is less sensitive to this, and the US government, at least certain employees of it, seem hell-bent to destroy public markets and drive all financial activity into the private equity markets.

While many market observers see the increase in financial trading of commodities as a recent development, in reality commodities always have been financially traded. They were the first financial markets, and never left the stage. It is true that there has been a sharp increase in financial trading in commodities since around 2006, with the securitization of commodities-related derivatives and the sharp increase in the purchase of these securitized debt obligations by institutional investors with less knowledge of and experience in commodities financial instruments than those who have traded commodities related debt instruments throughout the past many decades.

Dodd Frank will slow the growth of these markets, but only slightly. Mostly what it will do is drive liquidity, offerings, and activity into less regulated, more opaque private markets and markets offshore of the United States. The U.S. government’s claims to have jurisdiction over European, UK, and other foreign markets are not based on law, and will not stand. It will, however, be caught up in inter-governmental disputes for as long as the U.S. government persists in saying that it has such jurisdiction, which will have the effect of keeping effective regulations from being put forward, promulgated, and introduced indefinitely. This, obviously, will leave the markets open to all of the problems that have plagued them since the 1990s, at least.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

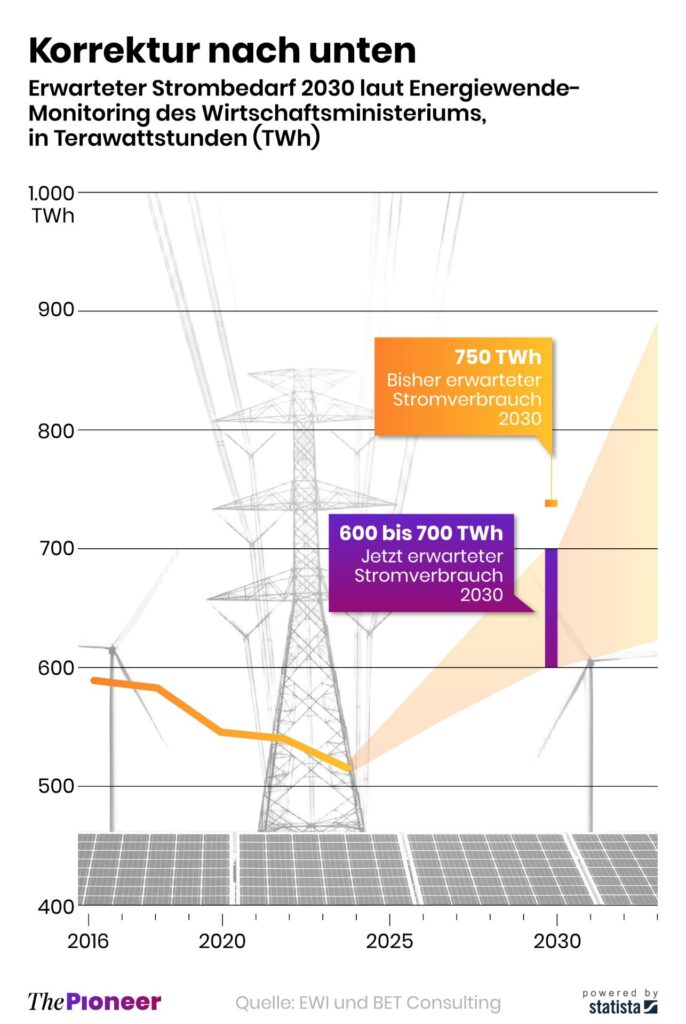

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

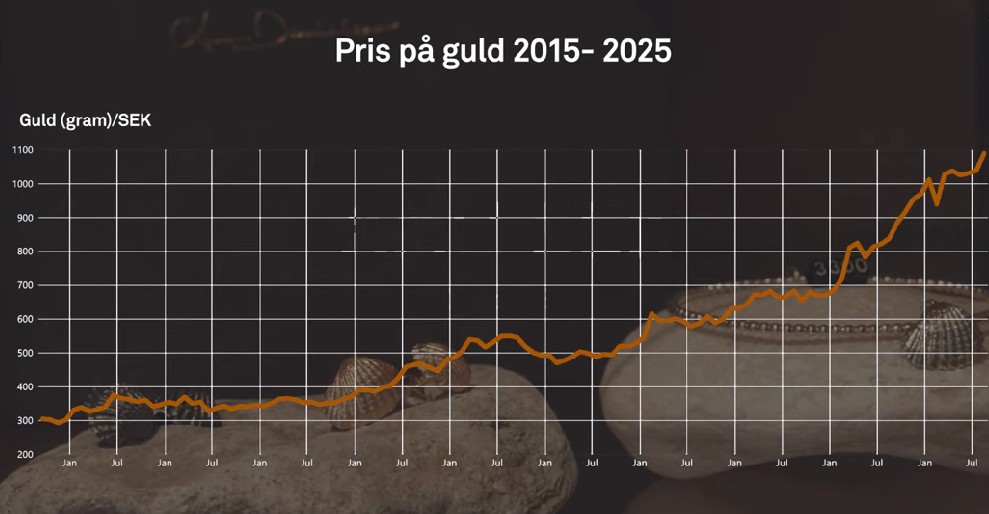

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys4 veckor sedan

Analys4 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC+ in a process of retaking market share