Analys

Venezuela is bullish but S&P 500 still looks like the driver

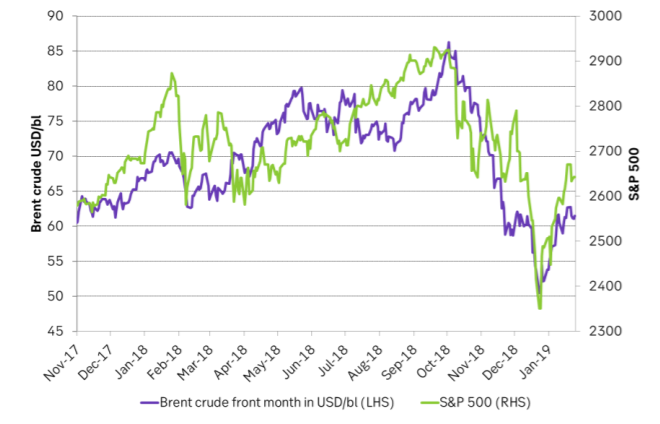

Brent crude has gained 21% since Christmas eve following a comparable 12.4% recovery in the S&P 500 index. So just as the sell-off in Brent crude went more or less hand in hand with the equity sell-off this autumn the Brent crude recovery has gone hand in hand with the recovery of the S&P 500 so far this year. There is of course a fundamental story for the oil rebound as well with cuts by OPEC+, US shale oil rig count decline and declining production in Venezuela and Iran (and others). But what the equity-oil relationship through the autumn up to now is telling us is that if the current equity rebound falters with a renewed sell-off in the S&P 500 then the Brent crude oil price is likely to falter as well.

Brent crude has gained 21% since Christmas eve following a comparable 12.4% recovery in the S&P 500 index. So just as the sell-off in Brent crude went more or less hand in hand with the equity sell-off this autumn the Brent crude recovery has gone hand in hand with the recovery of the S&P 500 so far this year. There is of course a fundamental story for the oil rebound as well with cuts by OPEC+, US shale oil rig count decline and declining production in Venezuela and Iran (and others). But what the equity-oil relationship through the autumn up to now is telling us is that if the current equity rebound falters with a renewed sell-off in the S&P 500 then the Brent crude oil price is likely to falter as well.

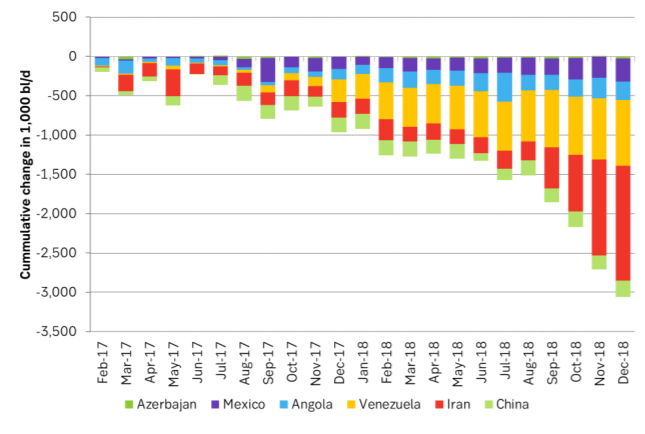

Donald Trump’s call for a regime shift in Venezuela with his outright support for opposition politician Juan Guaidó has led to a gain in the value of government bonds in Venezuela and thus seen as a positive development by bond investors on a general basis. Impacts on Venezuela’s oil production in the short to medium term is however another matter. To us it looks like more chaos and further decline in crude production.

A ban on oil imports from Venezuela to the US would likely only hurt US refineries which needs the heavy oil from Venezuela to blend with ultralight shale oil. Venezuela’s crude would probably just travel to other parts of the world instead of to the US. So an import ban to the US would probably not tighten the oil market as such. Tighter sanctions towards the Venezuelan economy with the goal of toppling the current Maduro regime would however most likely lead to a further rapid deterioration in Venezuela’s oil production which of course is directly bullish for the oil market. Eventually moving to the other side of chaos with an eventual Juan Guaidó regime holding hands with the US would then of course turn things around again as it would lay the foundation for a revival in crude production in Venezuela again but that seems to be way down the road from here.

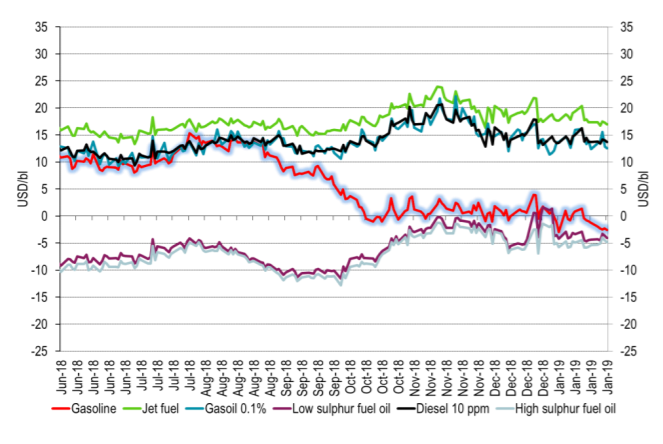

As far as we understand it is not at all impossible for the US refineries to process ultralight US shale oil as it is today without blending it with heavy crude from Mexico or Venezuela. It is more that it is not optimal. Many of the US refineries were built for medium sour crude from the Middle East. In such complex refineries there are a lot of expensive post processing units following the division of the oil molecules in the atmospheric and vacuum distillation stage. All these post processing units have specific volume capacities calibrated to the molecule distribution in medium sour crude. So if US refineries process outright ultralight US shale oil in the distillation stage then many of the post processing units will run at sub-par volumes. Even the distillation stage may not be able to run at optimal capacity. I.e. it is technically and economically sub-optimal for these refineries to run shale oil outright but not necessarily difficult. It is mostly about economics. So a lower shale oil crude price versus product prices should facilitate this. The gasoline crack to Brent crude has however crashed to below zero and made it much more difficult. Or said in another way: A yet lower shale oil crude price is needed.

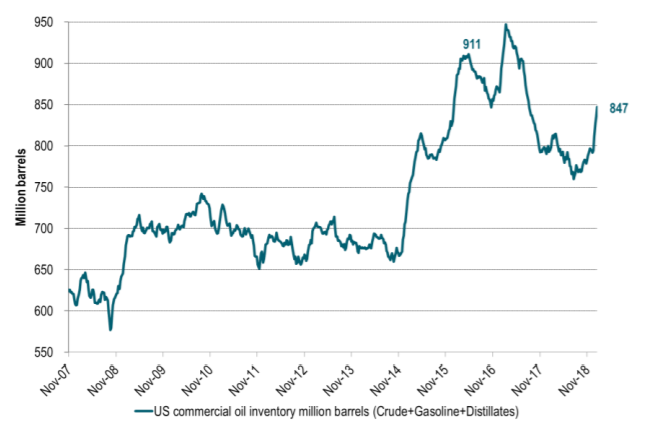

US crude and product inventories have sky-rocketed adding close to 90 m bl since late July last year of which 60 m bl have been added since late December. At the moment the market does not care too much about this since OPEC+ is cutting and production in Iran is falling (with further falls in Venezuela to be expected) while US well completions and rig count has started to decline. So the remedy for the booming inventories is on the way. If however the US S&P 500 recovery sours before the remedy shows signs of working (declining inventories) then crude oil prices would most likely follow the S&P 500 index lower.

A price-path dependent oil market. In our crude oil projection for 2019 we have projected Brent crude to average $55/bl in Q1-19 and we are well above that level now. It is important to note the strong price path dependence of today’s crude oil market. If we get a higher oil price now we’ll have more drilling more well completions and a higher oil production in the following quarters. It may feel good with Brent at $61/bl right now for global oil producers, but it may not be so good for the oil market in H2-19 as it will lead to a higher US crude oil production then.

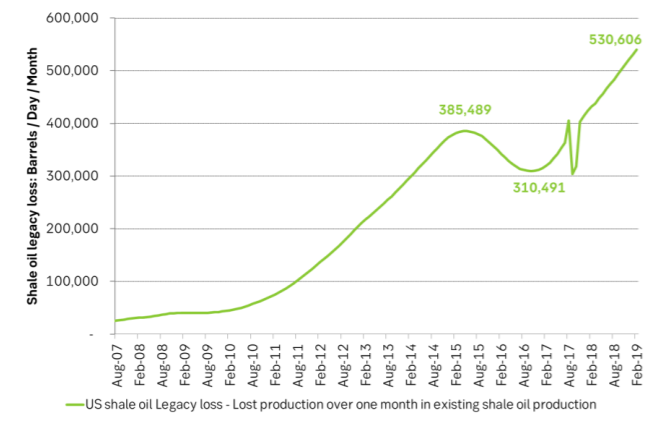

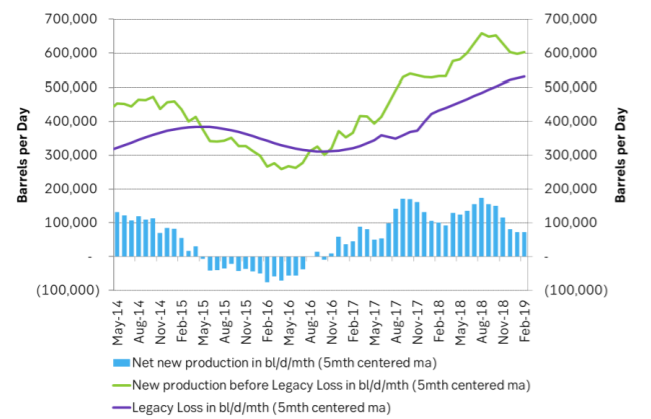

US shale oil production slows. In this week’s US EIA drilling productivity report we see that well completions have come down thus reacting to the decline in crude oil prices in H2-18. Losses in existing production rose to a new high of 530 k bl/d/mth while new production before losses rose to 602 k bl/d/mth for February. Marginal, annualized production growth thus fell to only 0.86 m bl/d/yr as new production growth slowed and moved closer to the rising legacy loss in the existing production.

Ch1: Crude prices and the S&P 500 continue hand in hand.

Ch2: US crude and product stocks have rallied. Up close to 90 m bl since late July of which close to 60 m bl since late December. But remedy is on the way with cuts by OPEC+ so the market has not cared too much about this since late December

Ch3: Refining margins have been murdered by the crash in the gasoline crack (to Brent). Now gasoil and diesel cracks are also ticking lower as we moves towards the later part of the Nordic hemisphere winter.

Ch4: Not so difficult to be booming shale oil as long as some 3 m bl/d is removed from supply from other suppliers. Booming US shale oil supply in the US is bad for Iran. The higher it goes the more room it gives Donald Trump to tighten Iran sanctions yet tighter.

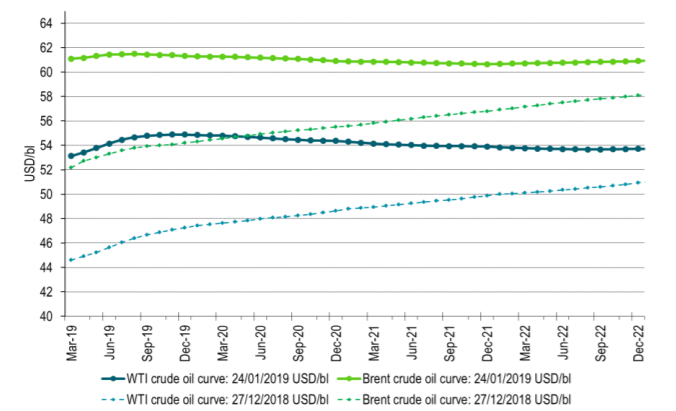

Ch5: Brent crude curve has flattened significantly since the low of 24 December

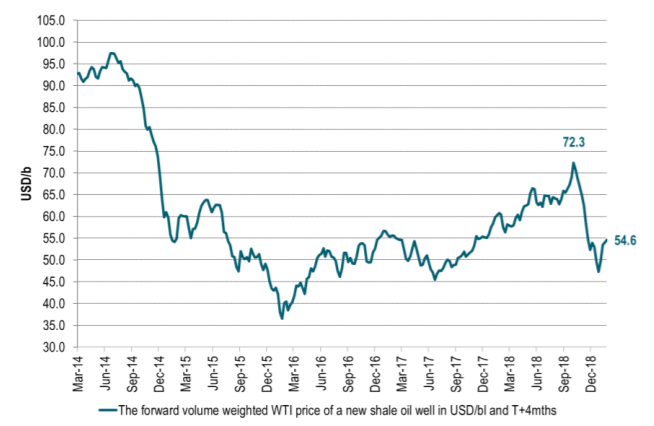

Ch6: The shale oil volume weighted WTI crude price has come down from $72.3/bl. But it has rebounded back to close to $55/bl which would imply “medium shale oil heat” if it stays at that price level. Access to capital is probably just as important as the oil price.

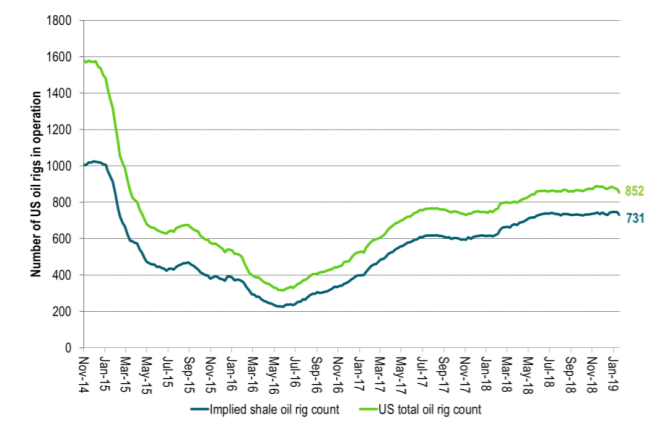

Ch7: US oil rig count has ticked lower but not all that much yet

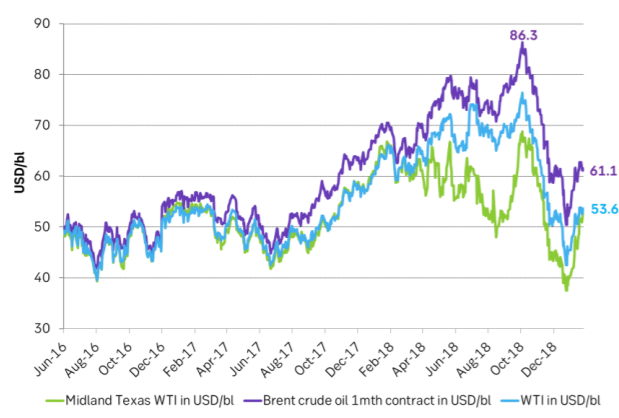

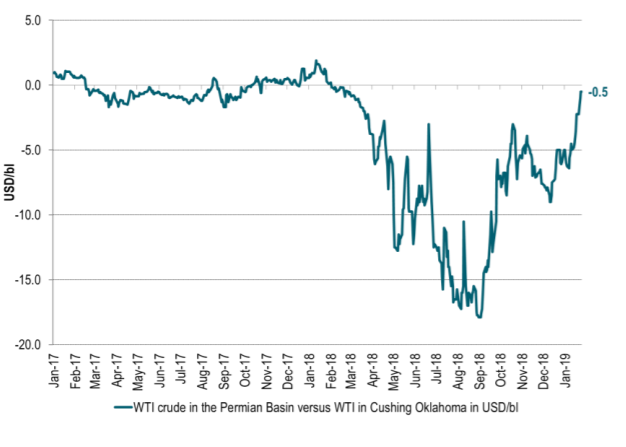

Ch8: The local Permian crude oil price traded at a huge discount versus Brent and WTI at times in 2018 as lack of pipelines out of Permian basin led to land-locked oil in the Permian

Ch9: Permian is obviously no longer very land-locked with respect to getting its oil to Cushing Oklahoma WTI and Permian prices are now almost equal again.

Ch10: Losses in existing US shale oil production will be 530 k bl/d/mth in February according to the US EIA. The most ever. I.e. more and more new wells need to be completed in order to counter this rising loss.

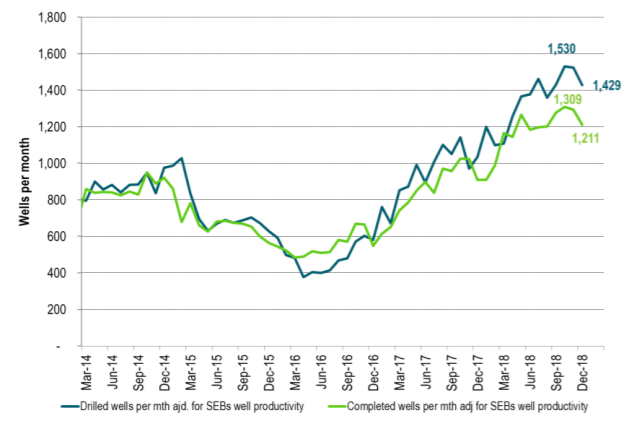

Ch11: Number of completed shale oil wells moved sideways in Oct and Nov and then down in December.

Ch12: A lower level of well completions led to a lower level of “new production”. Losses in existing production continued to increase. The gap between new production and losses thus narrowed so net production growth slowed to lowest growth rate since mid-2017.

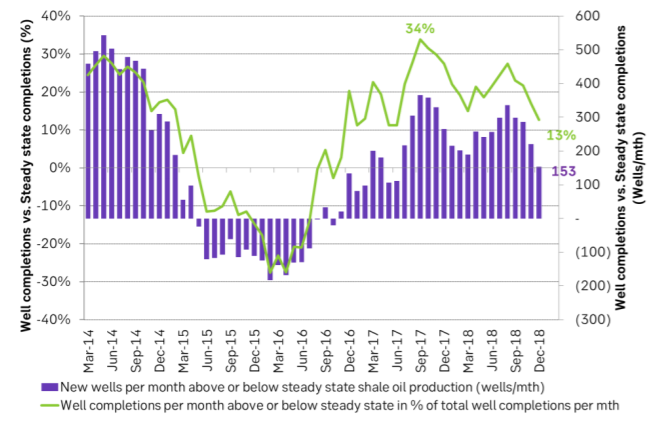

Ch13: Well completions per month now only running at 153 (13%) wells above steady state (when US shale oil production growth = 0). That is the lowest since mid-2017. Due to strongly rising legacy loss the well completions only need to decline by another 153 wells per month to drive US shale oil production growth to a halt.

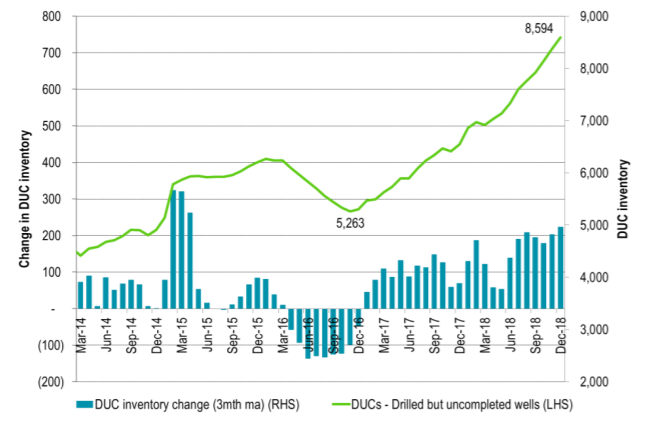

Ch14: Shale players are however still drilling way more than they are able or willing to complete. There is thus probably a significant inventory of DUCs which they can complete without drilling. So there is room for drilling rigs to decline significantly without a comparably significant decline in well completions.

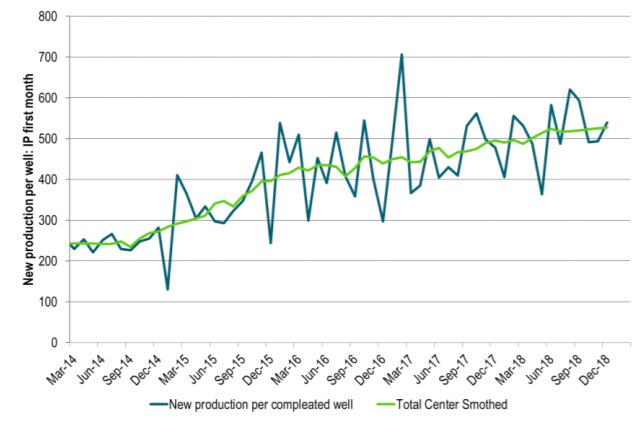

Ch15: Well productivity ticks higher at a pace of about 5-10% per year. But number of completed wells/mth is more important

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

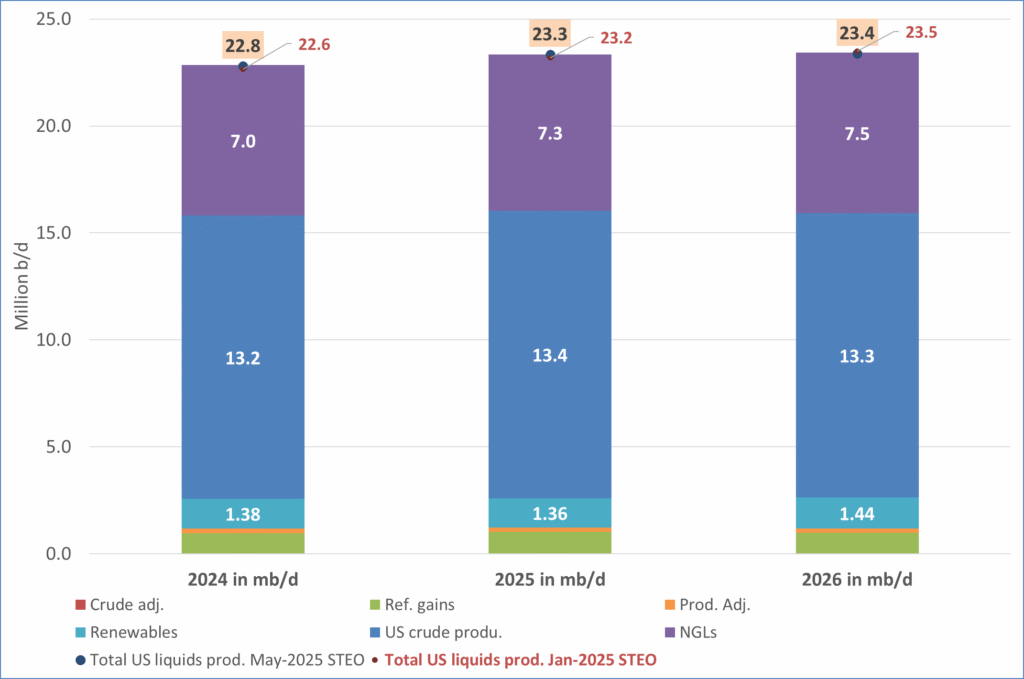

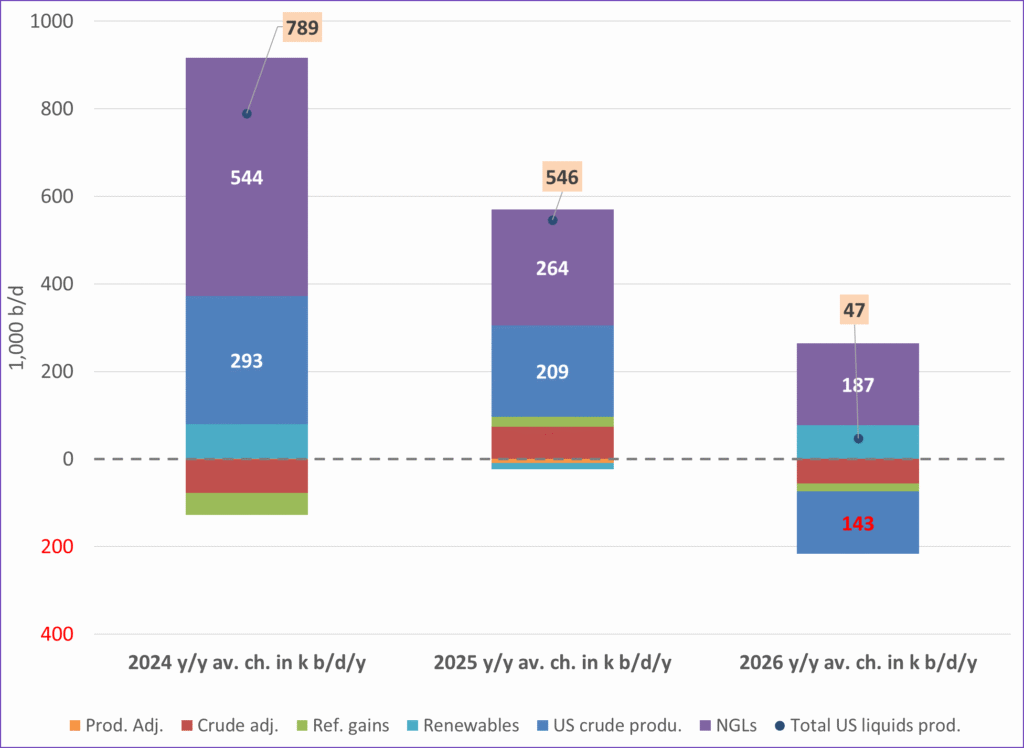

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September