Analys

Unlikely that Saudi switches from ”price” to ”volume” any time soon

Small gains with low conviction this morning. But we don’t think Brent can resist the upside. Brent crude rebounded 0.9% ydy with a close at USD 77.99/b following the sharp selloff last week on signals that a ceasefire in Gaza could be in the cards. This morning Brent crude is inching higher by 0.2% to USD 78.1/b without great conviction early in the morning it seems. Shanghai and Hong Kong equities are however up 3-4% this morning and industrial metals follows suites with some positive backdrop. The Chinese equity gains this morning may be more due to Chinese government technical measures to stem the equity market route than from real growth fundamentals. The general view of SEB’s Chief Asia Strategist, Eugenia Victorino, is however that the Chinese government these days has shifted fully to growth focus. Positive surprises from China are in the cards for 2024 in her view. While oil seems a little bewildered on where to go this morning, we think it won’t be able to resist the upside. The selloff last week on the possible ceasefire in Gaza followed by hopeful qualm in the Red Sea, Houthis, Hezbollah, Hamas, Iran, the lot seems way premature in our view.

No Chance that Saudi/OPEC+ will fold their cards now that we see emerging signs of global revival. The great concern now for a long time has been that the incredible rise in interest rates (US+++) would lead to a recession which would kill oil demand cyclically and possible force Saudi/OPEC+ to fold their cards, increase production, let the oil price fall and thus reduce US shale oil production to a more suitable level.

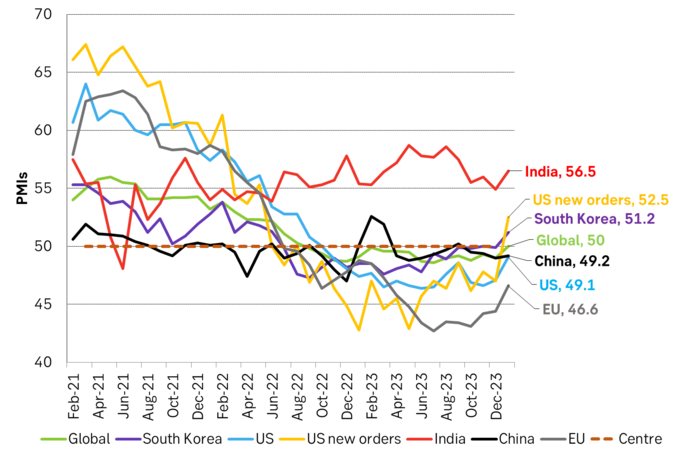

The latest manufacturing PMIs are however very interesting reading. India is of course full steam ahead at 56.5. But suddenly South Korea has moved up above the 50-line to 51.2. SEB’s prior economist in Norway, Stein Bruun, used to say that South Korea manufacturing PMI is the ”Canary in the coal mine” as the whole world needs manufactured sub-components from the country. So when the world starts to accelerate it will be visible in South Korea to start with. US ”new orders” has jumped to 52.5, the global PMI has lifted to 50.0 and the EU is ticking higher (still below 50) month by month as the cost of natural gas now has come down just an inch from the real average price from 2010-2019.

These emerging signs of improvements is essentially what Saudi/OPEC+ has been hoping for and dreaming about: Global economic acceleration. It almost seems too good to be true amid high interest rates, geopolitical turmoil, EU energy crisis and Chinese property market problems. Still, that is what the PMIs seems to indicate.

There is no chance in h*** that Saudi/OPEC+ will cave in and switch from ”price over volume” to ”volume over price” with emerging signs on the horizon of a global revival. It implies a stronger demand impulse down the road. And if you look upon the world economy with the eyes of an optimist your take would probably be: Chinese policy has shifted focus to growth, Biden is stimulating the h*** out of the US economy with his infrastructure stimulus package (to be re-elected), the EU is crawling out of the woods as nat gas prices have come down towards the real, 2010-2019 average level, India marches on, inflation globally is fading and interest rate cuts are coming.

I.e. the risk for a sudden drop in the oil price as a consequence of a possible shift from price to volume by Saudi/OPEC+ seems highly unlikely at present.

Global manufacturing PMIs

Speculators tend to build long positions when global manufacturing accelerates and reduce when it contracts. Net long specs will likely be in for an upturn if global manufacturing starts to expand again.

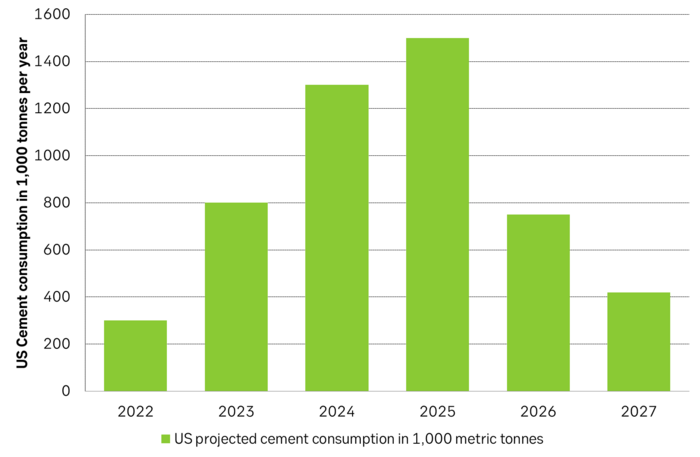

Is Biden stimulating his way to re-election? Projection for US cement consumption to 2027 gives a great reflection of the incredible magnitude of Biden’s infrastructure package.

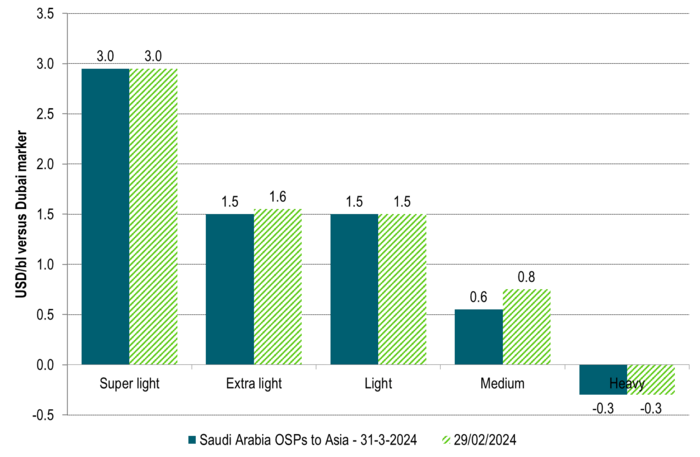

Saudi Arabia Official Selling prices. Only marginal changes for March.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

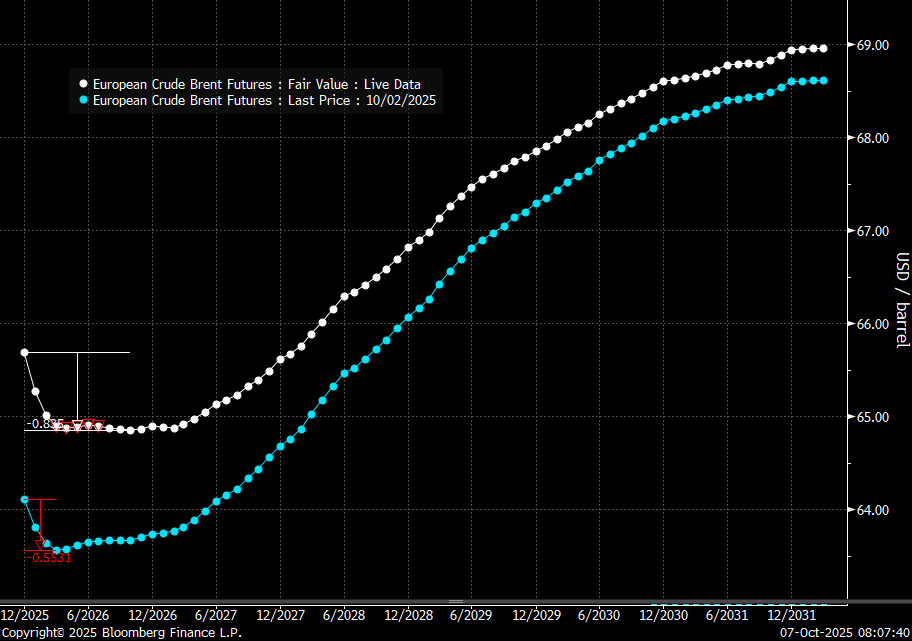

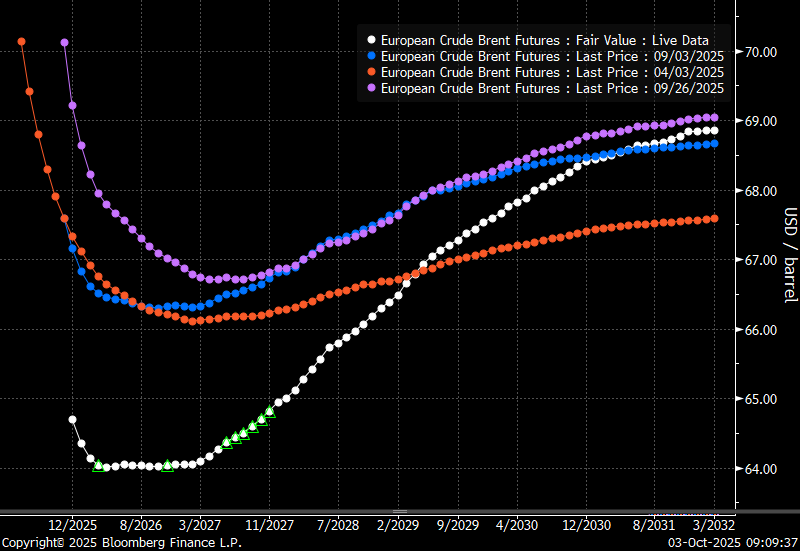

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

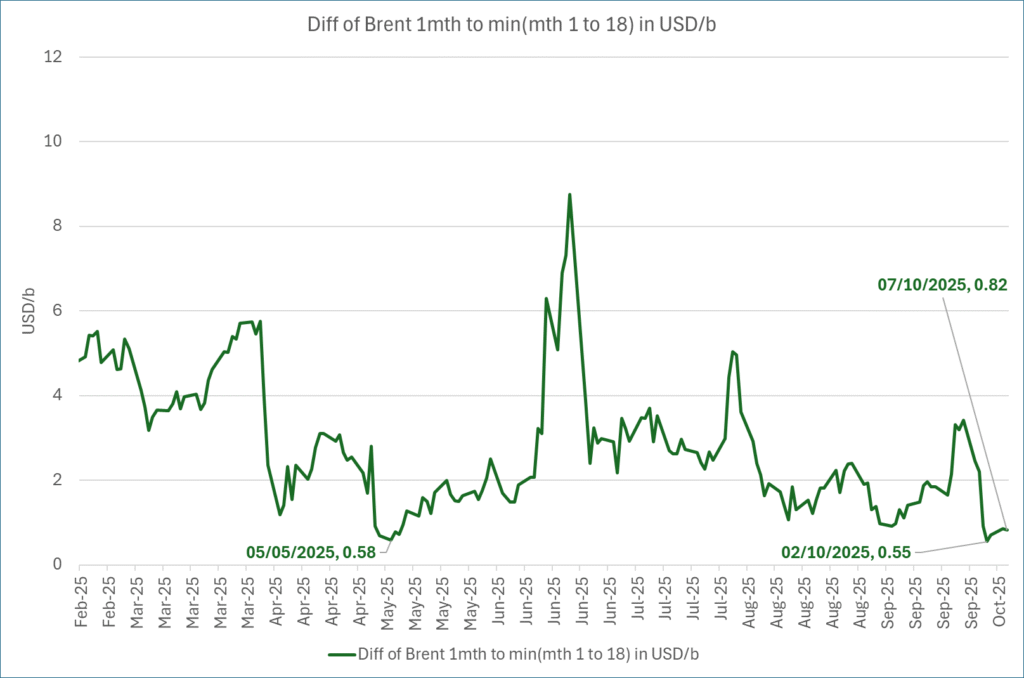

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

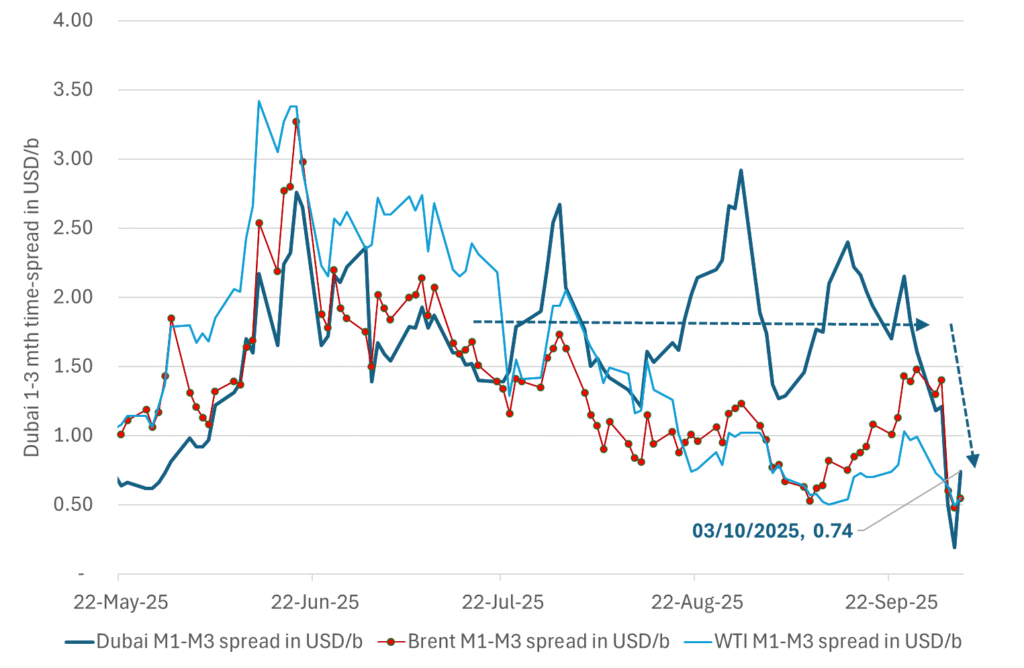

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

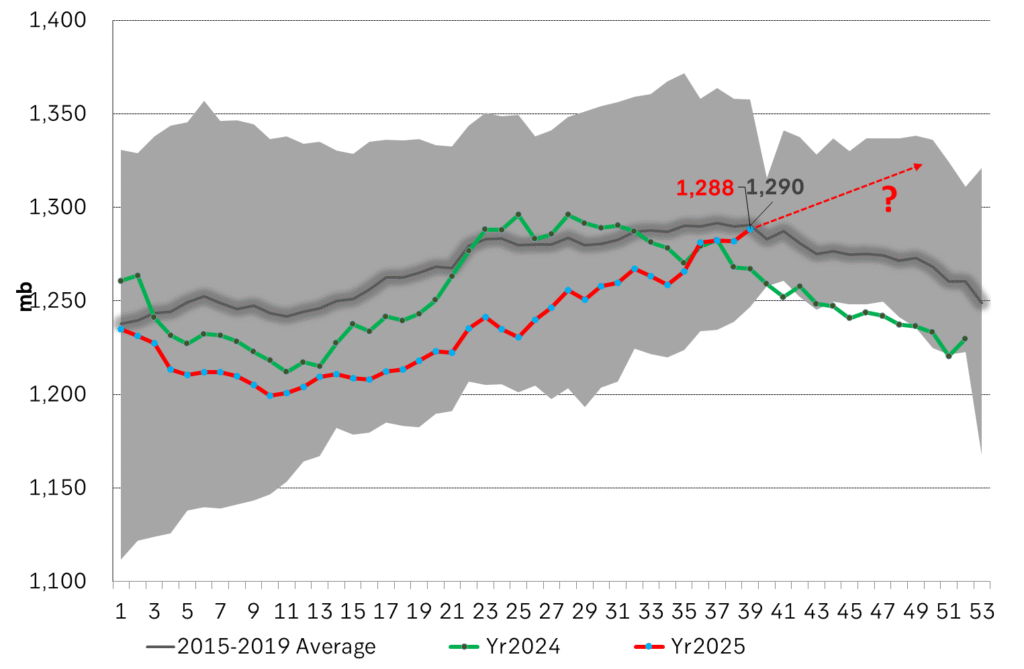

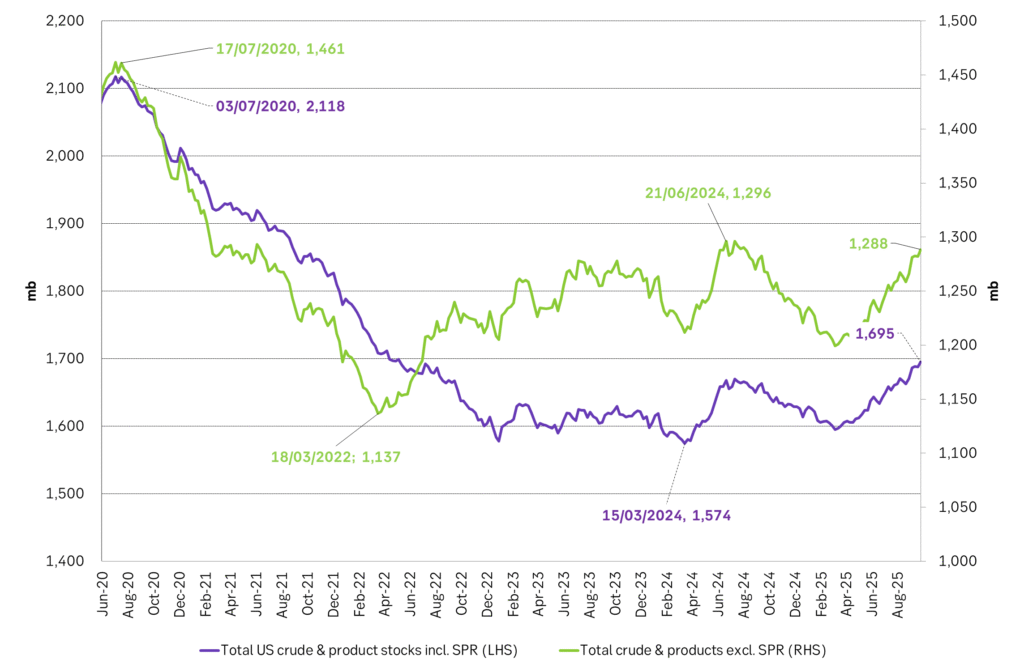

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

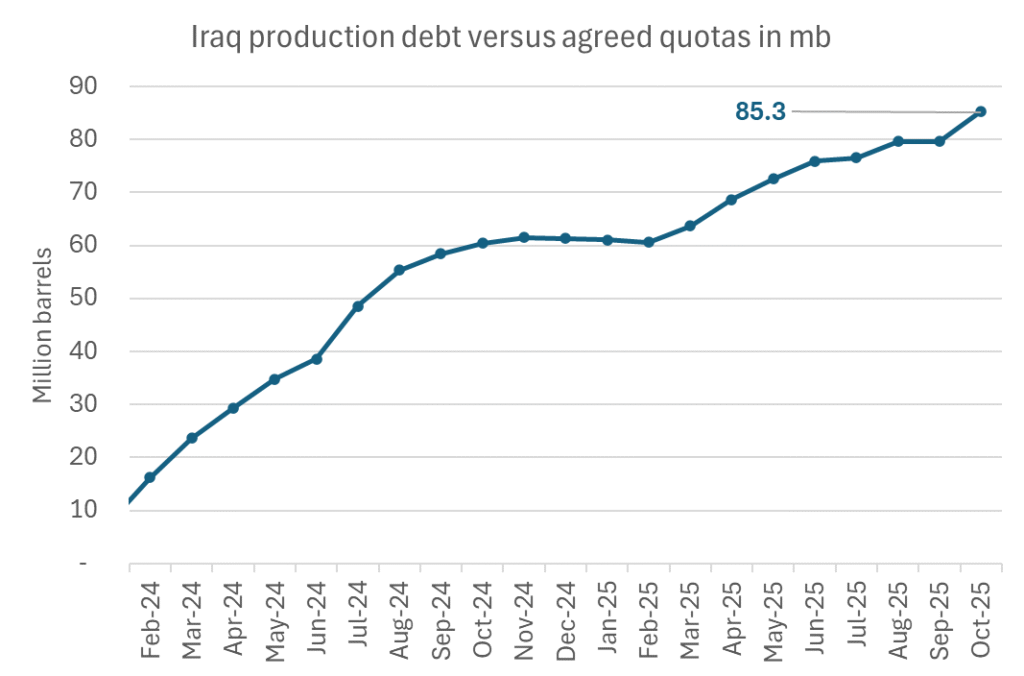

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

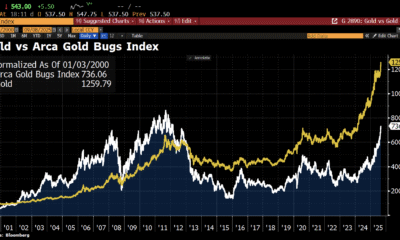

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft