Analys

Trade war today and oil market balance tomorrow

Brent crude lost 7.2% and closed at $60.5/bl with also the three year contract loosing 4% with a close of $56.02/bl. Neither equities nor oil were satisfied with ”mid-cycle rate adjustment” cut by the Fed earlier in the week and were already on a weak footing. Yesterday’s announcement/tweet by Donald Trump that an additional $300 bn worth of trade with China would get a 10% import levy totally pulled the plug on oil.

The thing is that the global oil market balance is not too bad right now and so far this year. IEA announced in its July Oil Market Report that OECD oil inventories had been rising during the first part of the year. It is true that the OECD inventories are up 34 m bl in May versus December last year but normally (2010 to 2014 average) they increase 45 m bl during this period. So if inventories are the proof of the pudding then the global oil market was pretty much in balance from Jan to May this year. Since then the US crude oil inventories have fallen sharply and the Brent crude oil forward curve is still in backwardation signalling a market which is on the tight side of the scale.

The sell-off yesterday is thus about concerns for the oil market balance for tomorrow, for next year and not so much for the current balance and the balance in 2H-19.

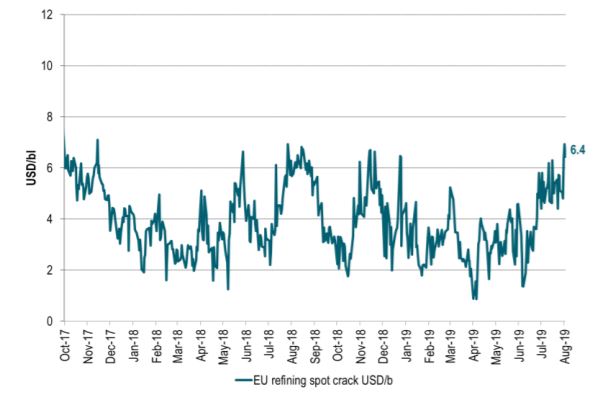

The forward Brent crude oil curve is still in backwardation, US crude inventories have been falling sharply since early June and continue to do so, US shale oil production growth is slowing quite sharply, European overall spot refining margin is close to the highest level over the past 2-3 years, OPEC+ is cutting and supply from Iran and Venezuela is just plunging.

Thus the bearish take on oil is not so much coming from the front end (spot) of the oil market. It is all about slowing global growth, slowing oil demand growth, US-China trade war, too little proactive stimulus from the US Fed and deep concerns for the oil market balance of tomorrow.

If we remember correctly Saudi Arabia commented earlier this summer that it might be difficult to cut yet deeper in 2020 than what they are doing now. So if the oil market is running a surplus in 2020 then the oil price and not OPEC+ will have to do the job of balancing the market.

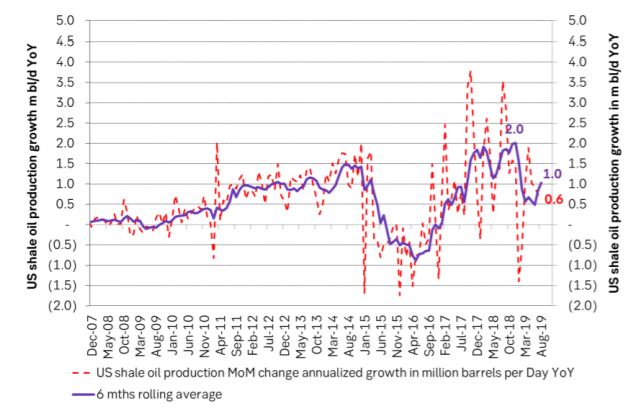

If we look at where oil prices are trading on the forward curve it is very clear that the main job of the oil prices at the moment is about holding US shale oil production growth in check. The three year WTI price yesterday closed at $50.12/bl while the three year Brent crude oil contract closed at $56/bl. Thus the oil price right now is all about controlling US shale oil production growth.

Four new pipelines channelling oil out of the Permian will come on-line in 2H-19 and early 2020 with a total capacity of 2.3 m bl/d. What this mean is that local Permian oil prices will move much closer to US Gulf seaborne oil prices and Brent crude oil prices. Oil will be drained out of the Permian and allow Permian oil producers to ramp up production without crashing the local Permian oil price. The flow of oil from Permian to Cushing Oklahoma on the Sunrise pipeline will slow to a halt. US Cushing stocks will decline much more easily and the WTI Cushing price will also move closer to Brent crude.

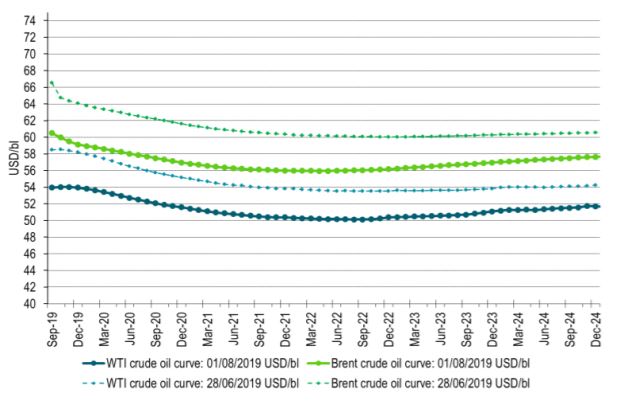

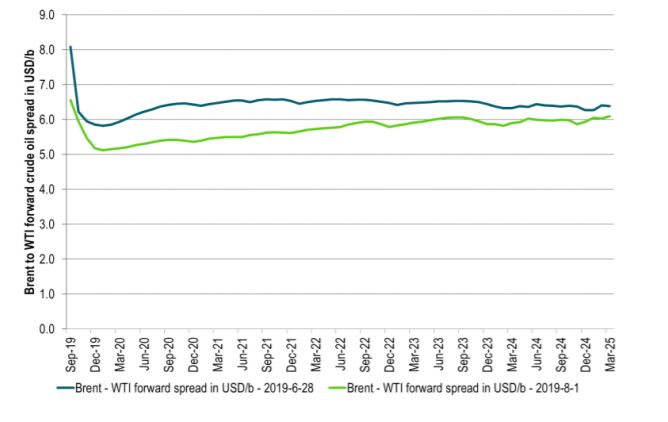

So, again, will WTI move up to Brent or will Brent move down to WTI when the pipelines open up? The 670 Cactus II from Permian to Corpus Christi at the US Gulf opened for service on 1 August. Since one year ago the Brent June 2020 contract has declined by $10.2/bl while the comparable WTI contract has declined by only $7.5/bl and the spread between the two has declined from $8.5 to now $5.8/bl. So over the past year at least we see that it is the Brent contract which has moved down to the WTI price and not the WTI price which has moved up to the Brent price. The interim transportation cost on the Epic II pipeline has been lowered from $5/bl to only $2.5/bl and pipelines from Cushing to US Gulf are lowering tariffs in competition. In a slowing shale oil production growth situation coupled with a large increase in pipeline capacity we should expect to see a further strong convergence between the Brent crude oil price curve and the WTI price curve. In general the Brent prices should move down to the WTI prices but the initial reaction will be declining US crude oil inventories both in general and in Cushing Oklahoma. This will drive WTI prices higher initially and drive the WTI crude curve into full backwardation.

The only reconciliation we can envisage for an oil market where the current situation is tight, refinery margins are strong and IMO 2020 is coming on top coupled with deep rooted market concerns for the oil market balance for 2020 is very weak 2020 forward prices together with spiky and backwardated front end prices. So expect WTI curve into full backwardation (strong spot prices), weak 2020 prices and tighter Brent to WTI spreads with forward Brent prices moving down towards the WTI prices.

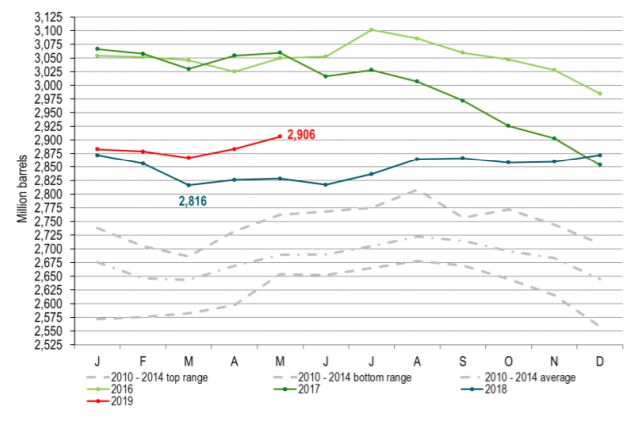

Ch1: Rising OECD inventories by IEA. But those rises are very close to normal seasonal trends. From Jan to March inventories usually drop by 32 m bl (2010 to 2014 average seasonal trend). This year they only dropped by 16 m bl. From March to May however they normally increase by 46 m bl while this year they only increased by 39 m bl. In total from Jan to May they normally increase by 14 m bl while this year they increased by 23 m bl. So yes OECD inventories increased by 9 m bl more than the seasonal trend from Jan to May. That is pretty close to noise as it gets. So if OECD inventories are anything to go by we’d say that the OECD-inventory implied supply/demand balance was pretty much in balance from Jan to May

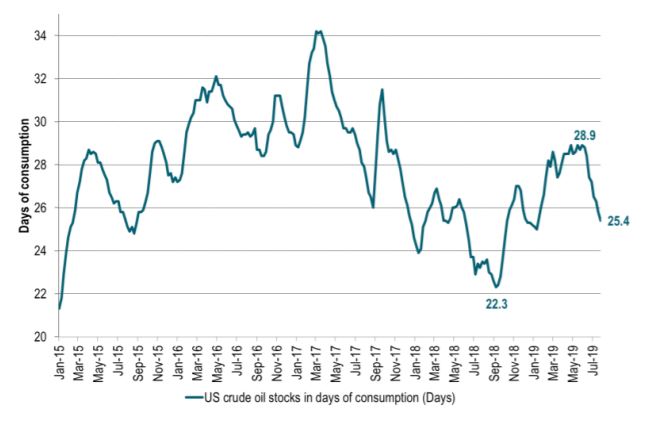

Ch2: US crude stocks have fallen sharply since early June. Here seen in days of consumption where it has fallen from 28.9 days to only 25.4 days in the latest data. We expect US crude inventories to fall further

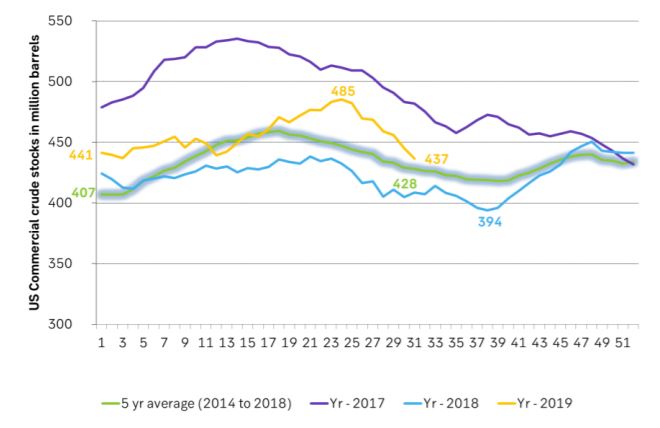

Ch3: US crude oil stocks in barrels have fallen sharply since early June and now only stands some 9 m bl above the 5 year average. Also if we look at total US crude, middle distillates and gasoline we see that these US inventories in total are only 9 m bl above normal (2014 – 2018).

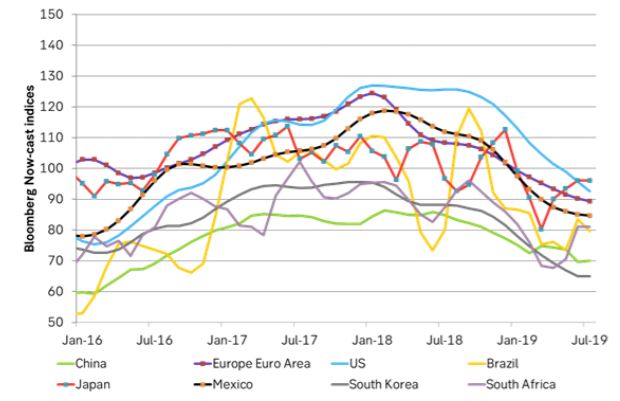

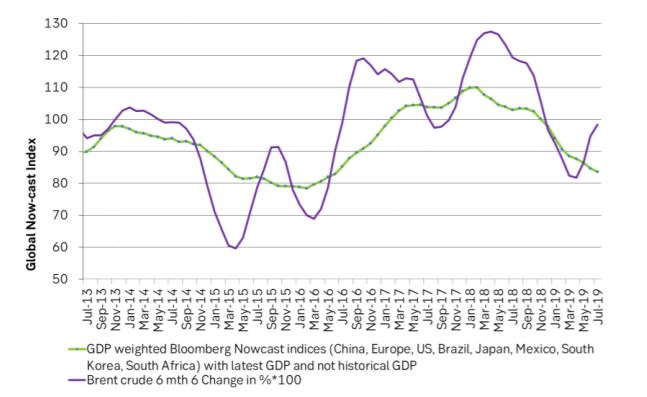

Ch4: What worries the market is this: Global economic growth and thus oil demand growth. Here depicted through the lense of Bloomberg’s calculated now-cast indices. What stands out here is that it is worse in the rest of the world than in the US but maybe more importantly that the US economy now is cooling faster than the rest of the world. Though this is a very qualitatively assesment from the graph. This week’s quarter percent US Fed rate cut is probably far too little to counter this cooling trend.

Ch5: Agregating Bloomberg’s individual country now-cast indices to one “global now-cast” index shows that the global economy is cooling and cooling and will soon be down to the trough in 2015/16. Graphing this global index versus the Brent crude 6m/6m change in prices we see that from a demand/macro view point Brent has moved counter to the cooling macro trend and a deteriorating global demand back-drop. It has risen on the back of OPEC+ supply cuts and Iran issues.

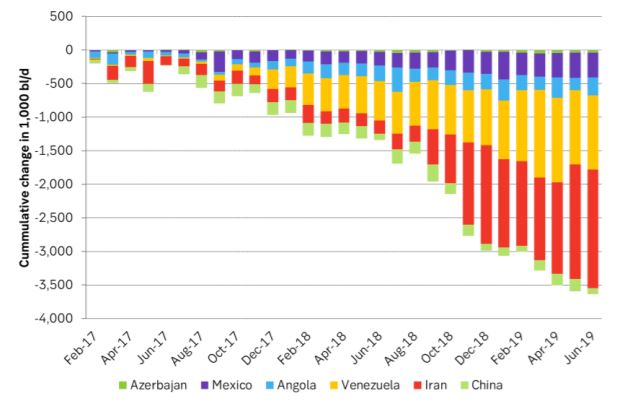

Ch6: Huge loss in supply from key producers since primo 2017 not enough to lift prices

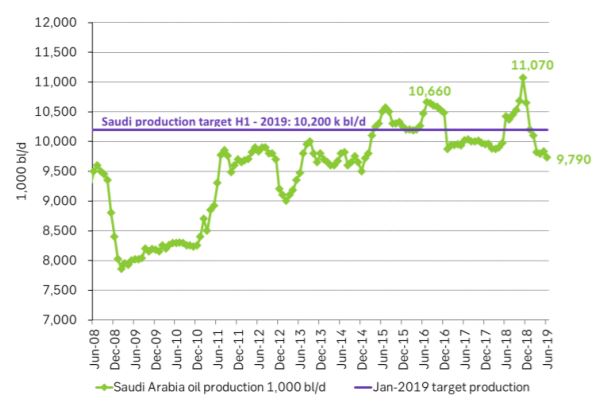

Ch7: Aggressive cuts by Saudi Arabia neither enough to lift prices. It is very hard to lift prices through production cuts amid a deteriorating global growth

Ch8: European spot refining margins are very strong and close to the highest level over the last 2-3 years

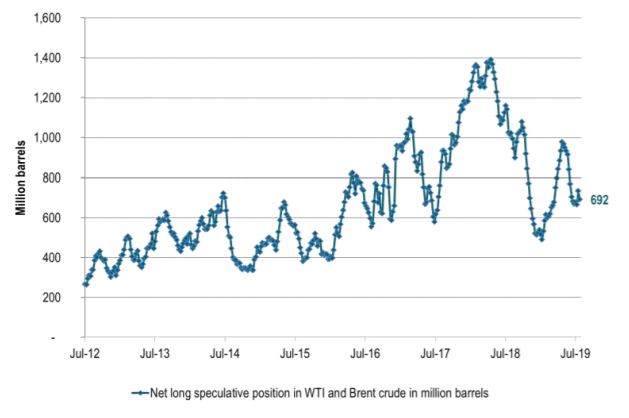

Ch9: Speculators are not feeling very bullish in the face of the deteriorating global macro picture

Ch10: Forward crude oil curves. Ydy close vs end of June. Brent down more than WTI. Brent is moving lower and closer to WTI.

Ch11: Spreads between the forward crude oil curves have moved lower since late June

Ch12: US shale oil production growth has slowed to a growth rate of only 0.6 m bl/d on a marginal, annualized rate. Sharply down from around 1.5 – 2.0 m bl/d in 2017/18 period. Shale oil players are signalling further slowdown during the autumn. The shale oil well completion rate only needs to be lowered by some 100 to 200 wells per month in order to drive US shale oil production growth to close to zero

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

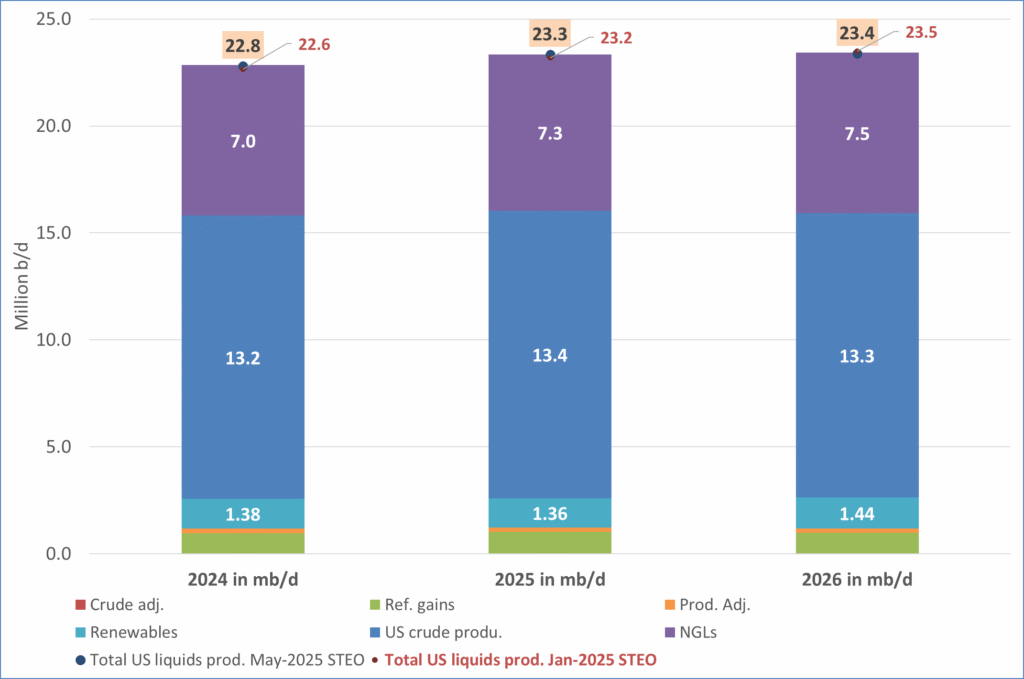

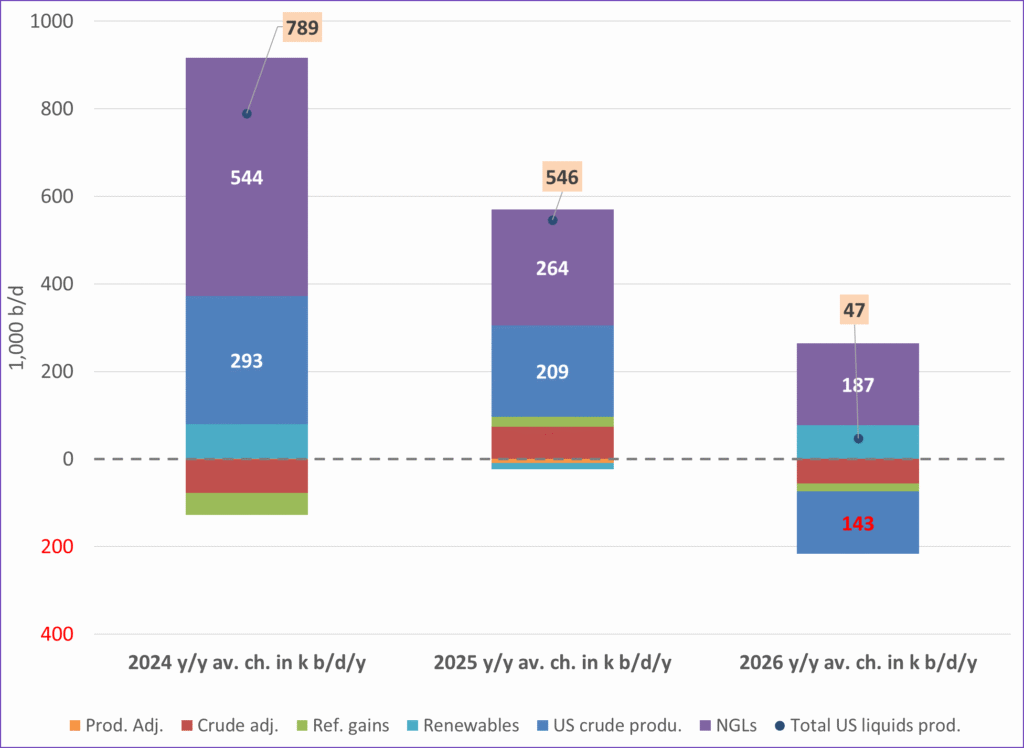

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

Analys

Brent crude sticks around $66 as OPEC+ begins the ’slow return’

Brent crude touched a low of USD 65.07 per barrel on Friday evening before rebounding sharply by USD 2 to USD 67.04 by mid-day Monday. The rally came despite confirmation from OPEC+ of a measured production increase starting next month. Prices have since eased slightly, down USD 0.6 to around USD 66.50 this morning, as the market evaluates the group’s policy, evolving demand signals, and rising geopolitical tension.

On Sunday, OPEC+ approved a 137,000 barrels-per-day increase in collective output beginning in October – a cautious first step in unwinding the final tranche of 1.66 million barrels per day in voluntary cuts, originally set to remain off the market through end-2026. Further adjustments will depend on ”evolving market conditions.” While the pace is modest – especially relative to prior monthly hikes – the signal is clear: OPEC+ is methodically re-entering the market with a strategic intent to reclaim lost market share, rather than defend high prices.

This shift in tone comes as Saudi Aramco also trimmed its official selling prices for Asian buyers, further reinforcing the group’s tilt toward a volume-over-price strategy. We see this as a clear message: OPEC+ intends to expand market share through steady production increases, and a lower price point – potentially below USD 65/b – may be necessary to stimulate demand and crowd out higher-cost competitors, particularly U.S. shale, where average break-evens remain around WTI USD 50/b.

Despite the policy shift, oil prices have held firm. Brent is still hovering near USD 66.50/b, supported by low U.S. and OECD inventories, where crude and product stocks remain well below seasonal norms, keeping front-month backwardation intact. Also, the low inventory levels at key pricing hubs in Europe and continued stockpiling by Chinese refiners are also lending resilience to prices. Tightness in refined product markets, especially diesel, has further underpinned this.

Geopolitical developments are also injecting a slight risk premium. Over the weekend, Russia launched its most intense air assault on Kyiv since the war began, damaging central government infrastructure. This escalation comes as the EU weighs fresh sanctions on Russian oil trade and financial institutions. Several European leaders are expected in Washington this week to coordinate on Ukraine strategy – and the prospect of tighter restrictions on Russian crude could re-emerge as a price stabilizer.

In Asia, China’s crude oil imports rose to 49.5 million tons in August, up 0.8% YoY. The rise coincides with increased Chinese interest in Russian Urals, offered at a discount during falling Indian demand. Chinese refiners appear to be capitalizing on this arbitrage while avoiding direct exposure to U.S. trade penalties.

Going forward, our attention turns to the data calendar. The EIA’s STEO is due today (Tuesday), followed by the IEA and OPEC monthly oil market reports on Thursday. With a pending supply surplus projected during the fourth quarter and into 2026, markets will dissect these updates for any changes in demand assumptions and non-OPEC supply growth. Stay tuned!

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September