Analys

Trade war today and oil market balance tomorrow

Brent crude lost 7.2% and closed at $60.5/bl with also the three year contract loosing 4% with a close of $56.02/bl. Neither equities nor oil were satisfied with ”mid-cycle rate adjustment” cut by the Fed earlier in the week and were already on a weak footing. Yesterday’s announcement/tweet by Donald Trump that an additional $300 bn worth of trade with China would get a 10% import levy totally pulled the plug on oil.

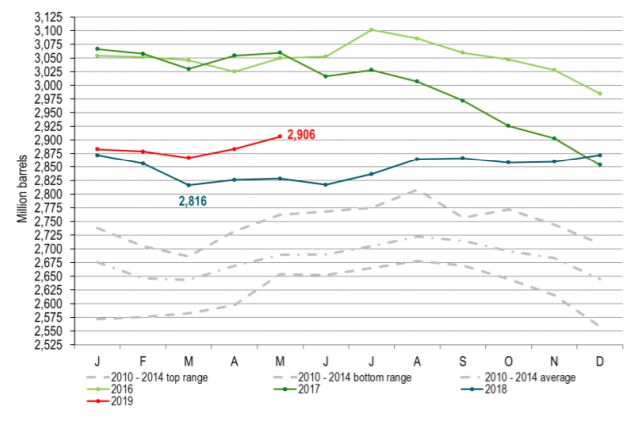

The thing is that the global oil market balance is not too bad right now and so far this year. IEA announced in its July Oil Market Report that OECD oil inventories had been rising during the first part of the year. It is true that the OECD inventories are up 34 m bl in May versus December last year but normally (2010 to 2014 average) they increase 45 m bl during this period. So if inventories are the proof of the pudding then the global oil market was pretty much in balance from Jan to May this year. Since then the US crude oil inventories have fallen sharply and the Brent crude oil forward curve is still in backwardation signalling a market which is on the tight side of the scale.

The sell-off yesterday is thus about concerns for the oil market balance for tomorrow, for next year and not so much for the current balance and the balance in 2H-19.

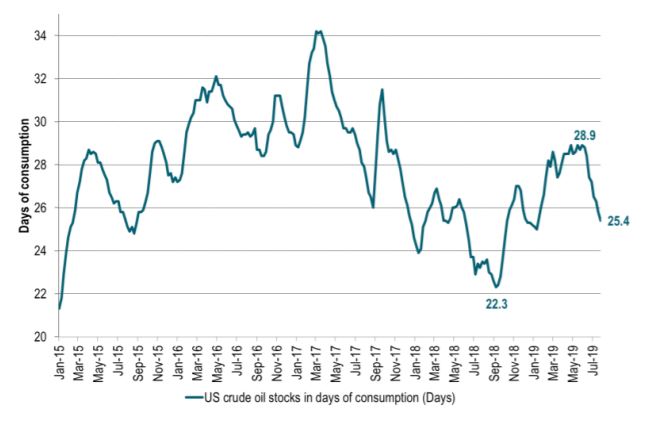

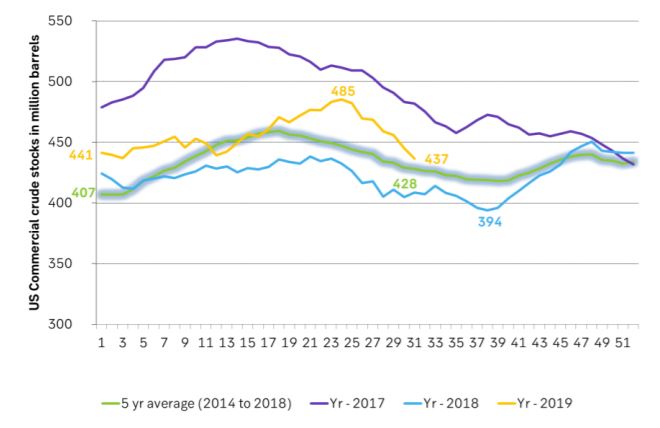

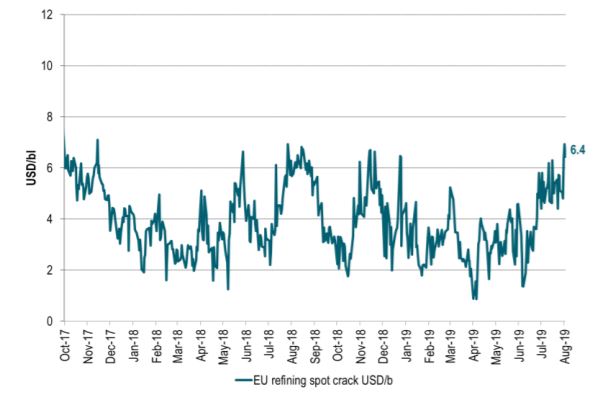

The forward Brent crude oil curve is still in backwardation, US crude inventories have been falling sharply since early June and continue to do so, US shale oil production growth is slowing quite sharply, European overall spot refining margin is close to the highest level over the past 2-3 years, OPEC+ is cutting and supply from Iran and Venezuela is just plunging.

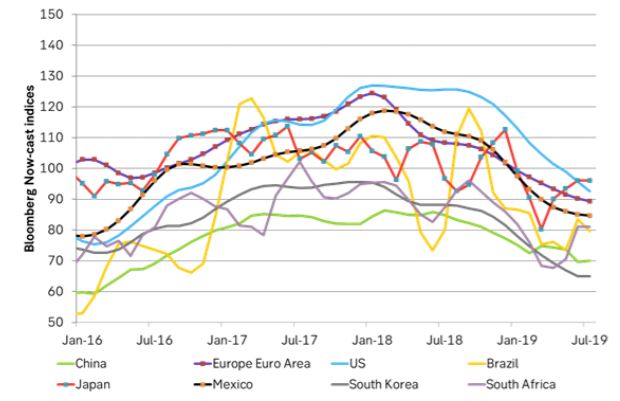

Thus the bearish take on oil is not so much coming from the front end (spot) of the oil market. It is all about slowing global growth, slowing oil demand growth, US-China trade war, too little proactive stimulus from the US Fed and deep concerns for the oil market balance of tomorrow.

If we remember correctly Saudi Arabia commented earlier this summer that it might be difficult to cut yet deeper in 2020 than what they are doing now. So if the oil market is running a surplus in 2020 then the oil price and not OPEC+ will have to do the job of balancing the market.

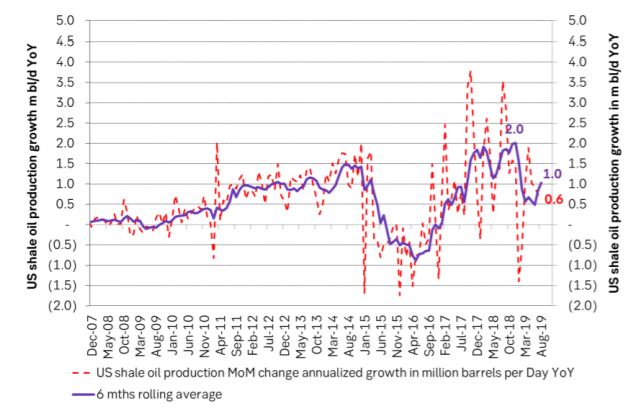

If we look at where oil prices are trading on the forward curve it is very clear that the main job of the oil prices at the moment is about holding US shale oil production growth in check. The three year WTI price yesterday closed at $50.12/bl while the three year Brent crude oil contract closed at $56/bl. Thus the oil price right now is all about controlling US shale oil production growth.

Four new pipelines channelling oil out of the Permian will come on-line in 2H-19 and early 2020 with a total capacity of 2.3 m bl/d. What this mean is that local Permian oil prices will move much closer to US Gulf seaborne oil prices and Brent crude oil prices. Oil will be drained out of the Permian and allow Permian oil producers to ramp up production without crashing the local Permian oil price. The flow of oil from Permian to Cushing Oklahoma on the Sunrise pipeline will slow to a halt. US Cushing stocks will decline much more easily and the WTI Cushing price will also move closer to Brent crude.

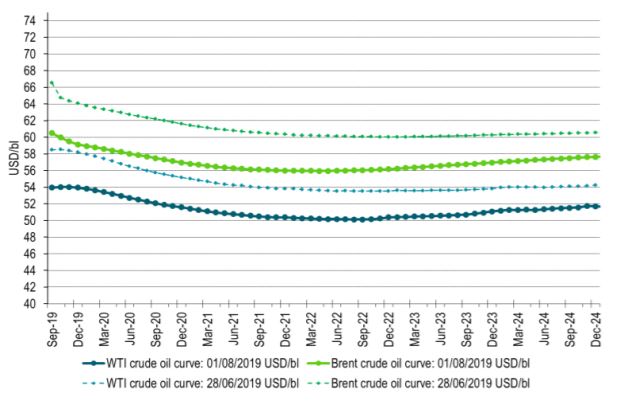

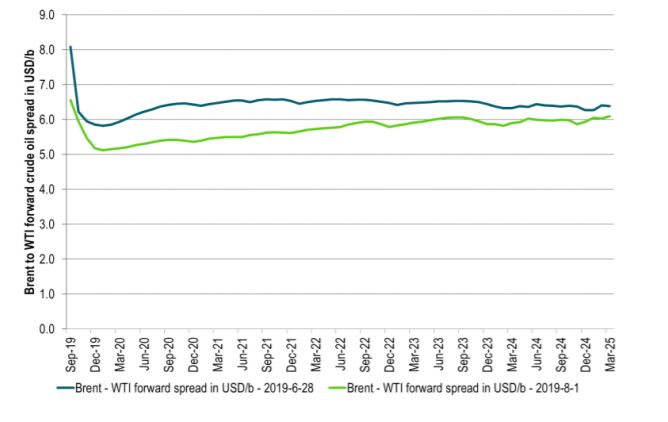

So, again, will WTI move up to Brent or will Brent move down to WTI when the pipelines open up? The 670 Cactus II from Permian to Corpus Christi at the US Gulf opened for service on 1 August. Since one year ago the Brent June 2020 contract has declined by $10.2/bl while the comparable WTI contract has declined by only $7.5/bl and the spread between the two has declined from $8.5 to now $5.8/bl. So over the past year at least we see that it is the Brent contract which has moved down to the WTI price and not the WTI price which has moved up to the Brent price. The interim transportation cost on the Epic II pipeline has been lowered from $5/bl to only $2.5/bl and pipelines from Cushing to US Gulf are lowering tariffs in competition. In a slowing shale oil production growth situation coupled with a large increase in pipeline capacity we should expect to see a further strong convergence between the Brent crude oil price curve and the WTI price curve. In general the Brent prices should move down to the WTI prices but the initial reaction will be declining US crude oil inventories both in general and in Cushing Oklahoma. This will drive WTI prices higher initially and drive the WTI crude curve into full backwardation.

The only reconciliation we can envisage for an oil market where the current situation is tight, refinery margins are strong and IMO 2020 is coming on top coupled with deep rooted market concerns for the oil market balance for 2020 is very weak 2020 forward prices together with spiky and backwardated front end prices. So expect WTI curve into full backwardation (strong spot prices), weak 2020 prices and tighter Brent to WTI spreads with forward Brent prices moving down towards the WTI prices.

Ch1: Rising OECD inventories by IEA. But those rises are very close to normal seasonal trends. From Jan to March inventories usually drop by 32 m bl (2010 to 2014 average seasonal trend). This year they only dropped by 16 m bl. From March to May however they normally increase by 46 m bl while this year they only increased by 39 m bl. In total from Jan to May they normally increase by 14 m bl while this year they increased by 23 m bl. So yes OECD inventories increased by 9 m bl more than the seasonal trend from Jan to May. That is pretty close to noise as it gets. So if OECD inventories are anything to go by we’d say that the OECD-inventory implied supply/demand balance was pretty much in balance from Jan to May

Ch2: US crude stocks have fallen sharply since early June. Here seen in days of consumption where it has fallen from 28.9 days to only 25.4 days in the latest data. We expect US crude inventories to fall further

Ch3: US crude oil stocks in barrels have fallen sharply since early June and now only stands some 9 m bl above the 5 year average. Also if we look at total US crude, middle distillates and gasoline we see that these US inventories in total are only 9 m bl above normal (2014 – 2018).

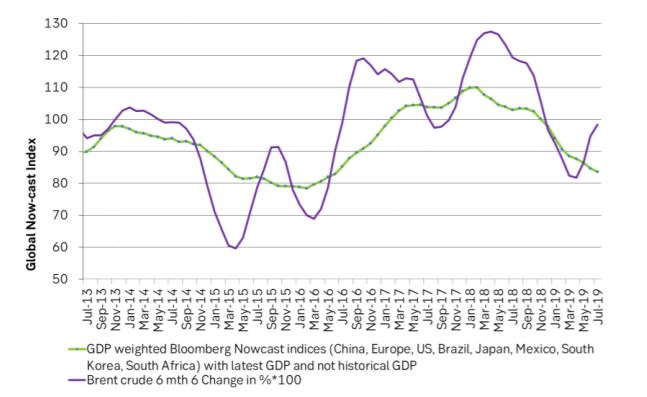

Ch4: What worries the market is this: Global economic growth and thus oil demand growth. Here depicted through the lense of Bloomberg’s calculated now-cast indices. What stands out here is that it is worse in the rest of the world than in the US but maybe more importantly that the US economy now is cooling faster than the rest of the world. Though this is a very qualitatively assesment from the graph. This week’s quarter percent US Fed rate cut is probably far too little to counter this cooling trend.

Ch5: Agregating Bloomberg’s individual country now-cast indices to one “global now-cast” index shows that the global economy is cooling and cooling and will soon be down to the trough in 2015/16. Graphing this global index versus the Brent crude 6m/6m change in prices we see that from a demand/macro view point Brent has moved counter to the cooling macro trend and a deteriorating global demand back-drop. It has risen on the back of OPEC+ supply cuts and Iran issues.

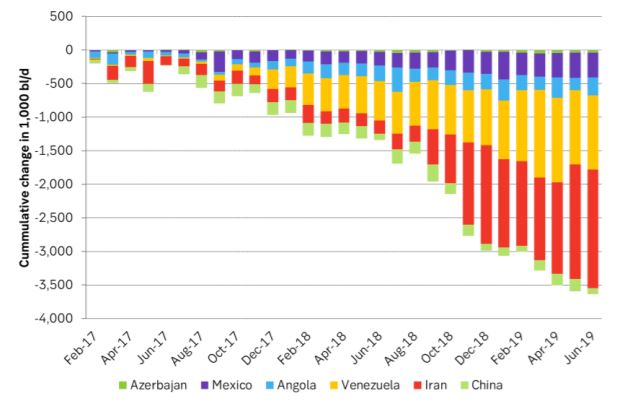

Ch6: Huge loss in supply from key producers since primo 2017 not enough to lift prices

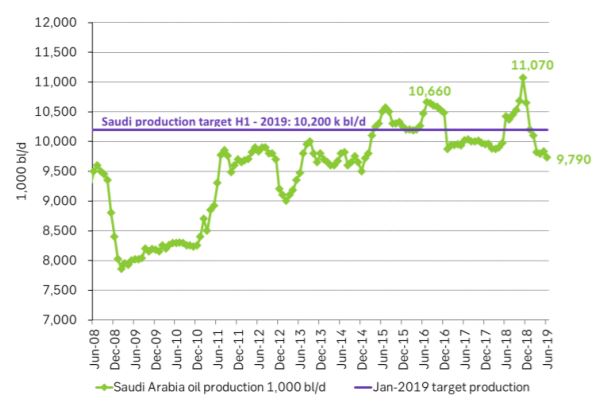

Ch7: Aggressive cuts by Saudi Arabia neither enough to lift prices. It is very hard to lift prices through production cuts amid a deteriorating global growth

Ch8: European spot refining margins are very strong and close to the highest level over the last 2-3 years

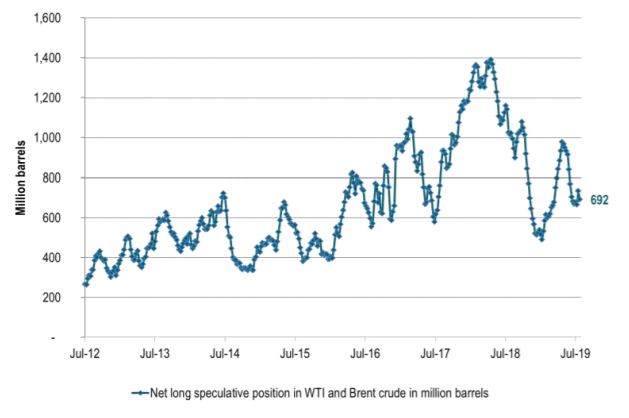

Ch9: Speculators are not feeling very bullish in the face of the deteriorating global macro picture

Ch10: Forward crude oil curves. Ydy close vs end of June. Brent down more than WTI. Brent is moving lower and closer to WTI.

Ch11: Spreads between the forward crude oil curves have moved lower since late June

Ch12: US shale oil production growth has slowed to a growth rate of only 0.6 m bl/d on a marginal, annualized rate. Sharply down from around 1.5 – 2.0 m bl/d in 2017/18 period. Shale oil players are signalling further slowdown during the autumn. The shale oil well completion rate only needs to be lowered by some 100 to 200 wells per month in order to drive US shale oil production growth to close to zero

Analys

Also OPEC+ wants to get compensation for inflation

Brent crude has fallen USD 3/b since the peak of Iran-Israel concerns last week. Still lots of talk about significant Mid-East risk premium in the current oil price. But OPEC+ is in no way anywhere close to loosing control of the oil market. Thus what will really matter is what OPEC+ decides to do in June with respect to production in Q3-24 and the market knows this very well. Saudi Arabia’s social cost-break-even is estimated at USD 100/b today. Also Saudi Arabia’s purse is hurt by 21% US inflation since Jan 2020. Saudi needs more money to make ends meet. Why shouldn’t they get a higher nominal pay as everyone else. Saudi will ask for it

Brent is down USD 3/b vs. last week as the immediate risk for Iran-Israel has faded. But risk is far from over says experts. The Brent crude oil price has fallen 3% to now USD 87.3/b since it became clear that Israel was willing to restrain itself with only a muted counter attack versus Israel while Iran at the same time totally played down the counterattack by Israel. The hope now is of course that that was the end of it. The real fear has now receded for the scenario where Israeli and Iranian exchanges of rockets and drones would escalate to a point where also the US is dragged into it with Mid East oil supply being hurt in the end. Not everyone are as optimistic. Professor Meir Javedanfar who teaches Iranian-Israeli studies in Israel instead judges that ”this is just the beginning” and that they sooner or later will confront each other again according to NYT. While the the tension between Iran and Israel has faded significantly, the pain and anger spiraling out of destruction of Gaza will however close to guarantee that bombs and military strifes will take place left, right and center in the Middle East going forward.

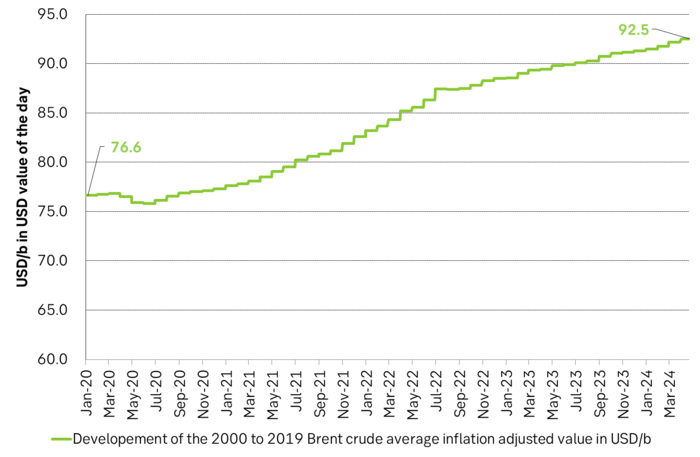

Also OPEC+ wants to get paid. At the start of 2020 the 20 year inflation adjusted average Brent crude price stood at USD 76.6/b. If we keep the averaging period fixed and move forward till today that inflation adjusted average has risen to USD 92.5/b. So when OPEC looks in its purse and income stream it today needs a 21% higher oil price than in January 2020 in order to make ends meet and OPEC(+) is working hard to get it.

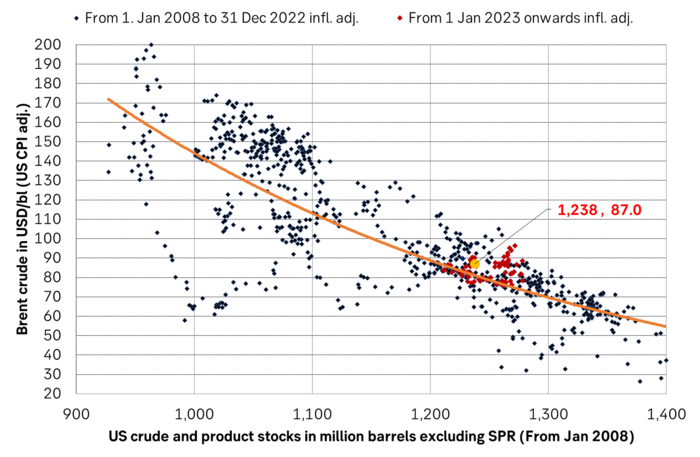

Much talk about Mid-East risk premium of USD 5-10-25/b. But OPEC+ is in control so why does it matter. There is much talk these days that there is a significant risk premium in Brent crude these days and that it could evaporate if the erratic state of the Middle East as well as Ukraine/Russia settles down. With the latest gains in US oil inventories one could maybe argue that there is a USD 5/b risk premium versus total US commercial crude and product inventories in the Brent crude oil price today. But what really matters for the oil price is what OPEC+ decides to do in June with respect to Q3-24 production. We are in no doubt that the group will steer this market to where they want it also in Q3-24. If there is a little bit too much oil in the market versus demand then they will trim supply accordingly.

Also OPEC+ wants to make ends meet. The 20-year real average Brent price from 2000 to 2019 stood at USD 76.6/b in Jan 2020. That same averaging period is today at USD 92.5/b in today’s money value. OPEC+ needs a higher nominal price to make ends meet and they will work hard to get it.

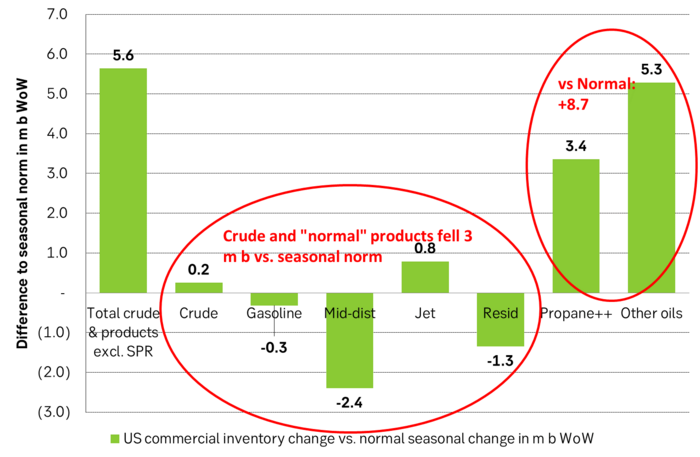

Inflation adjusted Brent crude price versus total US commercial crude and product stocks. A bit above the regression line. Maybe USD 5/b risk premium. But type of inventories matter. Latest big gains were in Propane and Other oils and not so much in crude and products

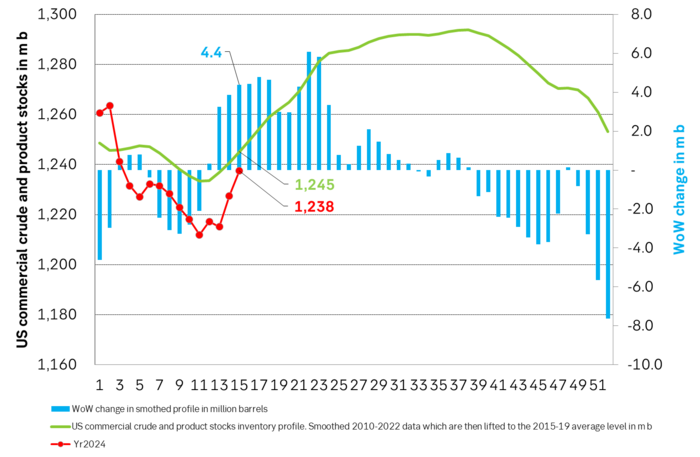

Total US commercial crude and product stocks usually rise by 4-5 m b per week this time of year. Gains have been very strong lately, but mostly in Propane and Other oils

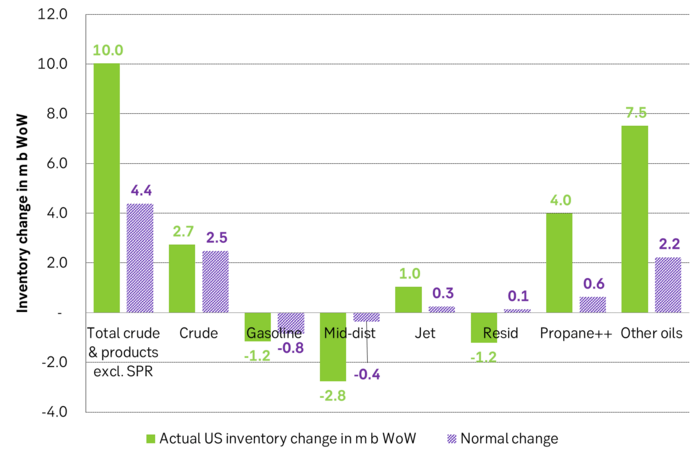

Last week’s US inventory data. Big rise of 10 m b in commercial inventories. What really stands out is the big gains in Propane and Other oils

Take actual changes minus normal seasonal changes we find that US commercial crude and regular products like diesel, gasoline, jet and bunker oil actually fell 3 m b versus normal change.

Analys

Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

Historically positive Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

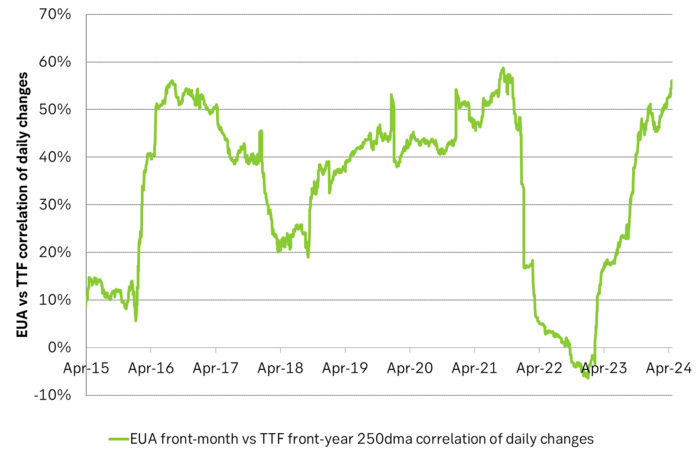

Historically there has been a strong, positive correlation between EUAs and nat gas prices. That correlation is still fully intact and possibly even stronger than ever as traders increasingly takes this correlation as a given with possible amplification through trading action.

The correlation broke down in 2022 as nat gas prices went ballistic but overall the relationship has been very strong for quite a few years.

The correlation between nat gas and EUAs should be positive as long as there is a dynamical mix of coal and gas in EU power sector and the EUA market is neither too tight nor too weak:

Nat gas price UP => ”you go black” by using more coal => higher emissions => EUA price UP

But in the future we’ll go beyond the dynamically capacity to flex between nat gas and coal. As the EUA price moves yet higher along with a tightening carbon market the dynamical coal to gas flex will max out. The EUA price will then trade significantly above where this flex technically will occur. There will still be quite a few coal fired power plants running since they are needed for grid stability and supply amid constrained local grids.

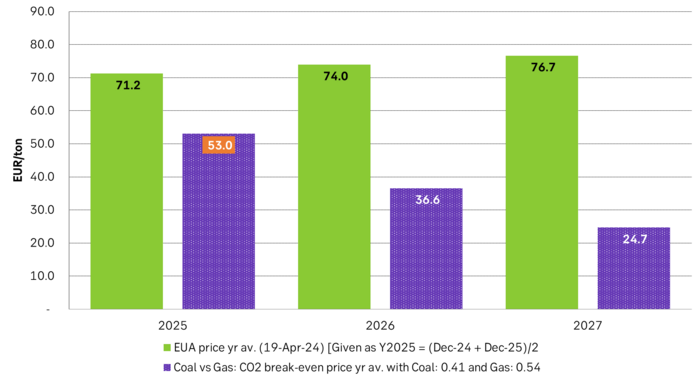

As it looks now we still have such overall coal to gas flex in 2024 and partially in 2025, but come 2026 it could be all maxed out. At least if we look at implied pricing on the forward curves where the forward EUA price for 2026 and 2027 are trading way above technical coal to gas differentials. The current forward pricing implications matches well with what we theoretically expect to see as the EUA market gets tighter and marginal abatement moves from the power sector to the industrial sector. The EUA price should then trade up and way above the technical coal to gas differentials. That is also what we see in current forward prices for 2026 and 2027.

The correlation between nat gas and EUAs should then (2026/27 onward) switch from positive to negative. What is left of coal in the power mix will then no longer be dynamically involved versus nat gas and EUAs. The overall power price will then be ruled by EUA prices, nat gas prices and renewable penetration. There will be pockets with high cost power in the geographical points where there are no other alternatives than coal.

The EUA price is an added cost of energy as long as we consume fossil energy. Thus both today and in future years we’ll have the following as long as we consume fossil energy:

EUA price UP => Pain for consumers of energy => lower energy consumption, faster implementation of energy efficiency and renewable energy => lower emissions

The whole idea with the EUA price is after all that emissions goes down when the EUA price goes up. Either due to reduced energy consumption directly, accelerated energy efficiency measures or faster switch to renewable energy etc.

Let’s say that the coal to gas flex is maxed out with an EUA price way above the technical coal to gas differentials in 2026/27 and later. If the nat gas price then goes up it will no longer be an option to ”go black” and use more coal as the distance to that is too far away price vise due to a tight carbon market and a high EUA price. We’ll then instead have that:

Nat gas higher => higher energy costs with pain for consumers => weaker nat gas / energy demand & stronger drive for energy efficiency implementation & stronger drive for more non-fossil energy => lower emissions => EUA price lower

And if nat gas prices goes down it will give an incentive to consume more nat gas and thus emit more CO2:

Cheaper nat gas => Cheaper energy costs altogether, higher energy and nat gas consumption, less energy efficiency implementations in the broader economy => emissions either goes up or falls slower than before => EUA price UP

Historical and current positive correlation between nat gas and EUA prices should thus not at all be taken for granted for ever and we do expect this correlation to switch to negative some time in 2026/27.

In the UK there is hardly any coal left at all in the power mix. There is thus no option to ”go black” and burn more coal if the nat gas price goes up. A higher nat gas price will instead inflict pain on consumers of energy and lead to lower energy consumption, lower nat gas consumption and lower emissions on the margin. There is still some positive correlation left between nat gas and UKAs but it is very weak and it could relate to correlations between power prices in the UK and the continent as well as some correlations between UKAs and EUAs.

Correlation of daily changes in front month EUA prices and front-year TTF nat gas prices, 250dma correlation.

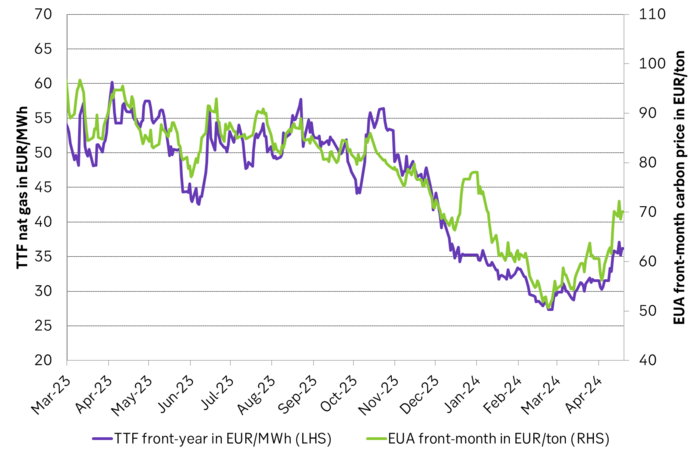

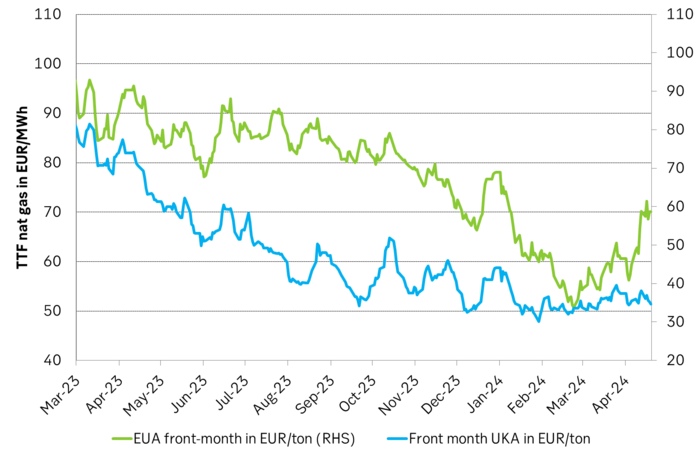

EUA price vs front-year TTF nat gas price since March 2023

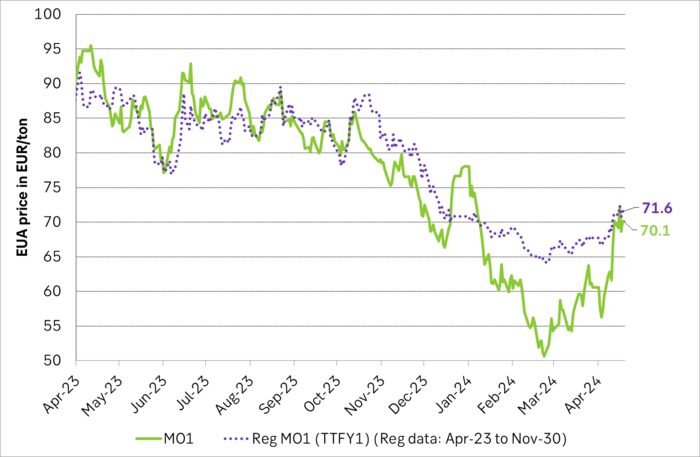

Front-month EUA price vs regression function of EUA price vs. nat gas derived from data from Apr to Nov last year.

The EUA price vs the UKA price. Correlations previously, but not much any more.

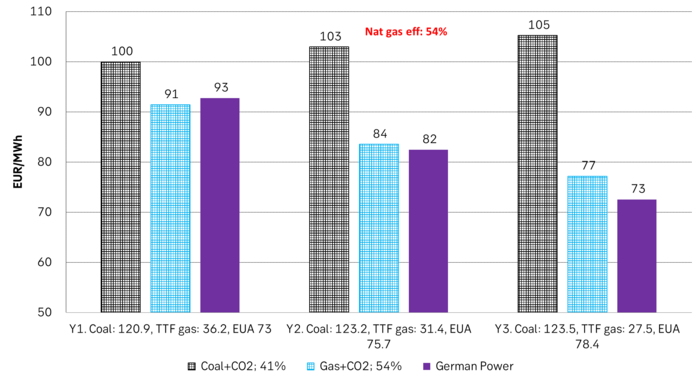

Forward German power prices versus clean cost of coal and clean cost of gas power. Coal is totally priced out vs power and nat gas on a forward 2026/27 basis.

Forward price of EUAs versus technical level where dynamical coal to gas flex typically takes place. EUA price for 2026/27 is at a level where there is no longer any price dynamical interaction or flex between coal and nat gas. The EUA price should/could then start to be negatively correlated to nat gas.

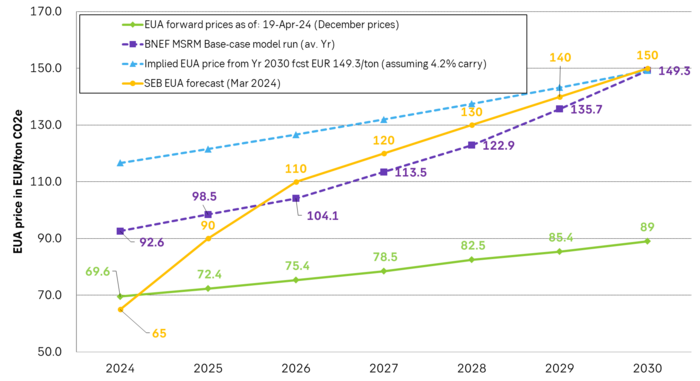

Forward EAU price vs. BNEF base model run (look for new update will come in late April), SEB’s EUA price forecast.

Analys

Fear that retaliations will escalate but hopes that they are fading in magnitude

Brent crude spikes to USD 90.75/b before falling back as Iran plays it down. Brent crude fell sharply on Wednesday following fairly bearish US oil inventory data and yesterday it fell all the way to USD 86.09/b before a close of USD 87.11/b. Quite close to where Brent traded before the 1 April attack. This morning Brent spiked back up to USD 90.75/b (+4%) on news of Israeli retaliatory attack on Iran. Since then it has quickly fallen back to USD 88.2/b, up only 1.3% vs. ydy close.

The fear is that we are on an escalating tit-for-tat retaliatory path. Following explosions in Iran this morning the immediate fear was that we now are on a tit-for-tat escalating retaliatory path which in the could end up in an uncontrollable war where the US unwillingly is pulled into an armed conflict with Iran. Iran has however largely diffused this fear as it has played down the whole thing thus signalling that the risk for yet another leg higher in retaliatory strikes from Iran towards Israel appears low.

The hope is that the retaliatory strikes will be fading in magnitude and then fizzle out. What we can hope for is that the current tit-for-tat retaliatory strikes are fading in magnitude rather than rising in magnitude. Yes, Iran may retaliate to what Israel did this morning, but the hope if it does is that it is of fading magnitude rather than escalating magnitude.

Israel is playing with ”US house money”. What is very clear is that neither the US nor Iran want to end up in an armed conflict with each other. The US concern is that it involuntary is dragged backwards into such a conflict if Israel cannot control itself. As one US official put it: ”Israel is playing with (US) house money”. One can only imagine how US diplomatic phone lines currently are running red-hot with frenetic diplomatic efforts to try to defuse the situation.

It will likely go well as neither the US nor Iran wants to end up in a military conflict with each other. The underlying position is that both the US and Iran seems to detest the though of getting involved in a direct military conflict with each other and that the US is doing its utmost to hold back Israel. This is probably going a long way to convince the market that this situation is not going to fully blow up.

The oil market is nonetheless concerned as there is too much oil supply at stake. The oil market is however still naturally concerned and uncomfortable about the whole situation as there is so much oil supply at stake if the situation actually did blow up. Reports of traders buying far out of the money call options is a witness of that.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset når nytt all time high och bryter igenom 2300 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLundin Mining får köprekommendation av BMO

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVertikal prisuppgång på kakao – priset toppar nu 9000 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCentralbanker fortsatte att köpa guld under februari

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUSAs stigande konsumtion av naturgas

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKakaomarknaden är extrem för tillfället

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHur mår den svenska skogsbraschen? Två favoritaktier

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBoliden på 20 minuter