Analys

The value of an EUA spot contract is at least EUR 80/ton

A fight between short-term C-t-G differentials at EUR 40-60/ton and longer term values of EUR 100/ton already in 2026. The value of an EUA today is thus at least EUR 80/ton.

Low emissions, falling nat gas and C-t-G differentials and EUA prices falling along with that is all the range in current market dynamics. But it won’t last as the MSR will quickly remove surpluses and the steep decline in supply of EUAs from 2026 onward will quickly drive the EUA price back up and above C-t-G differentials. The EUA price will then stop relating to power market dynamics as C-t-G switching is maxed out.

The EUA market is currently driven by front-end and front-year Coal-to-Gas dynamics and differentials with the EUA price in the balance between the two. At the very front-end (1-2-3 mths) the C-t-G differentials implies an EUA price close to EUR 40/ton while the front-year 2025 has a C-t-G differential of a little over EUR 60/ton. Thus the front-year is probably a better and stronger guide right now.

But C-t-G differentials holds wide ranges of values and are very sensitive to changes in coal and nat gas prices. So the simple rule of trading approach is probably: ”Sell EUAs if the nat gas price falls”.

The total capacity to switch between coal and gas and thus flex the total amount of emissions is quite limited with a capacity of maybe only 100 mt reduction potential. Thus as the number of allowances declines in the coming years the C-t-G differentials will stop to matter as the switch will max out. Implied by modeling (Blbrg) and also by market pricing of calendar 2026 and 2027 this looks set to happen over the coming 2-3 years. The consequence will be EUA prices which will be above C-t-G differential values and disjoint from power market dynamics.

The EU ETS market probably experienced an emission reduction shock in 2023 where total German emissions are estimated to have fallen by 73 mt YoY to 2023 or some 10%. If we assume that this also is true for the whole EU ETS sector and run Bloomberg’s Carbon Price Model we see that the consequence of this emission reduction shock is washed out by 2026 with the EUA price then back at EUR 100/ton and above. The reason for this is probably due to the Market Stability Reserve dynamics which quickly removes any surplus EUAs in the market and brings the TNAC quickly down below the 833 mt upper trigger level again.

The model runs tells us that no matter what happens to gas prices and EUA prices and emissions in 2023/24, it will all wash out withing three years with the EUA price back at EUR 100/ton in 2026. If we assume a cost of carry of 7% it implies that the value of an EUA today is minimum EUR 80/ton due to bankability (buy today and hold to 2026 and then sell).

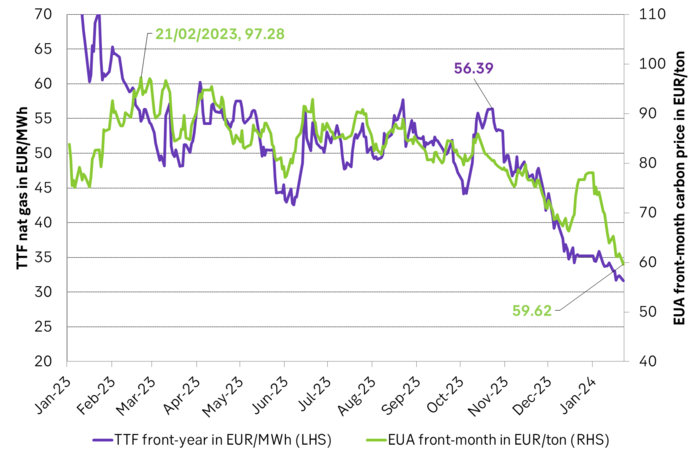

The sell-off in natural gas prices has been the guiding light for the sell-off in EUAs. Accelerated decline in natural gas prices seems to be the guiding light for the EUA price. The decline in the front-year TTF nat gas price accelerated from late October 2023 and continues to trade lower and lower. The front-year 2025 yesterday closed at EUR 32/MWh (-1.1% on the day) while the year 2027 traded down 0.9% to EUR 27.1/MWh. In comparison the average nominal TTF nat gas price from 2010 to 2019 was EUR 20/MWh while the inflation adjusted price was EUR 26/MWh. The 2027 TTF nat gas contract is thus now trading very close to the historical inflation adjusted average.

The falling nat gas price is in part a fundamental driver and in part an associated driver for the EUA price. The fundamental dynamics of the EU ETS market are highly complex because there are so many different participants with different strategies and abatement cost curves. As such it is hard to base trading of EUAs on a complex fundamental bottom up model. The more robust and simple thinking which we think traders may follow is: ”Natural gas is a low CO2 emitting fossil fuel. If the price of nat gas falls then it gets cheaper to switch to a lower emitting fossil fuel. I.e. it gets cheaper to be semi-green.” The trading rule then becomes: ”Sell EUAs if the price of nat gas falls”. With little further in-depth analysis. It’s an associated trading strategy and we think this strategy has been hard at work sine October/November 2023.

The front-year TTF nat gas contract versus the front-month EUA price since Jan 2023. Accelerated selling from Oct/Nov last year.

The good old Coal-to-Gas abatement dynamics is the cornerstone to ”sell EUAs if gas prices fall”. Almost half of emissions in the EU ETS system stems from the power sector running on a mix of coal, gas and other non-emitting sources of power. There is an assumed flex between coal and gas power production and this flex is driven by relative prices in coal, gas and CO2. So if the nat gas price falls, the power sector will burn more gas because it is cheaper, emit less CO2 so the EUA price falls.

If the EU ETS market is massively oversupplied as it was from 2008 to 2019 it hands no constraints at all on the emitters. The result is no dynamical price interaction between the EUA price and Coal-to-Gas differentials. But if the EU ETS market is nicely balanced then C-t-G dynamics kicks in and the EUA price will start to trade on the balance ”Coal+CO2 = Nat gas + CO2” where nat gas of course has a much lower carbon emitting intensity.

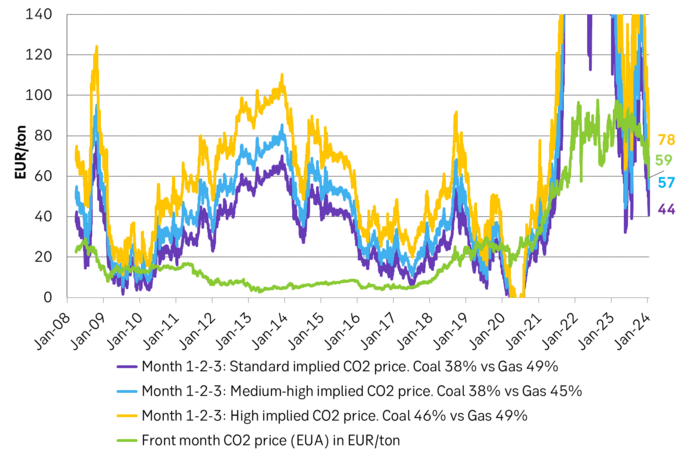

But there is not one switching balance as there are many coal and gas plants with different efficiencies. If we choose three different sets of coal and nat gas power plant efficiency combinations and graph them back in time with focus on front-end power market dynamics we typically get the following.

Coal-to-Gas switching price bands given by front-end power market dynamics are basically saying: ”What should the CO2 price have been for coal and nat gas power plants to be equally competitive.” Here compared with the actual front-month EUA price.

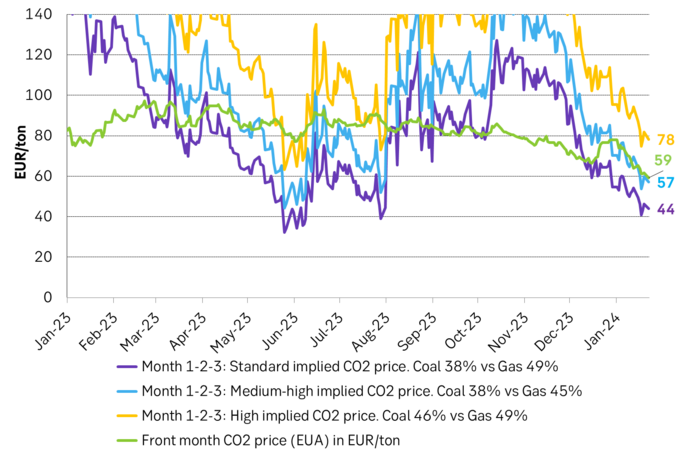

The same graph but starting in 2023. These implied Coal-to-Gas switching bands are highly sensitive to changes in coal and nat gas prices. This probably makes them partially difficult to trade on on a daily basis. Thus trading strategies typically end up with a simpler rule: ”Sell EUAs if the nat gas price falls”.

Coal-to-Gas switching price bands given by front-end power market dynamics are basically saying: ”What should the CO2 price have been for coal and nat gas power plants to be equally competitive.” Here compared with the actual front-month EUA price.

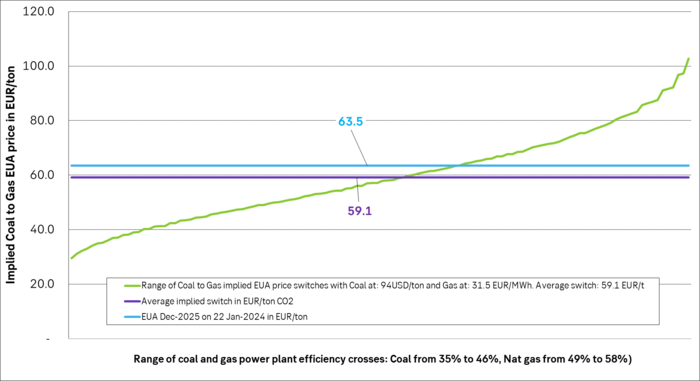

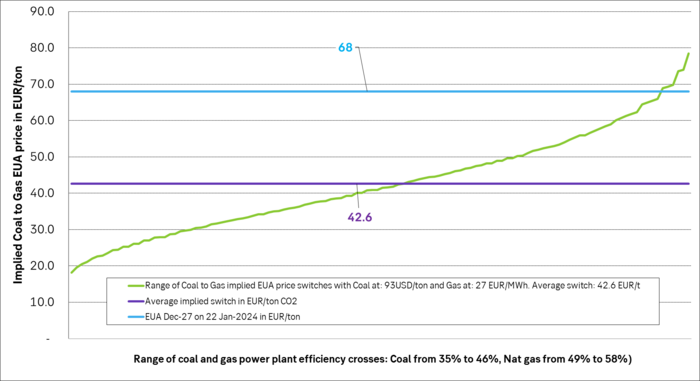

But the possible combination of efficiencies between coal and nat gas is much wider. Coal power plant efficiencies in Europe are assumed to have a range of 35% to 46% while nat gas power plants have an assumed range of 49% to 58%. The following graph has made all the combinatoric crosses in 1% incremental steps. All for the same given set of coal and gas price which here was chosen as the front-year ARA coal price of USD 94/ton versus the front-year (2025) nat gas price of EUR 31.5/MWh. Then all these outcomes are sorted from low to high.

What this distribution shows is that if the ”fair” EUA price stemming from C-t-G differentials can be very wide depending on how loose or tight the EUA market is. If it is quite loose, but just tight enough for C-t-G differentials to matter then the fair EUA price for this given set of coal and gas prices could be as low as EUR 30/ton. Conversely, if the EUA market is so tight that C-t-G differentials are on the verge to not matter any more, then the fair price could be as high as EUR 100/ton.

But the average of all these cross-combinations is EUR 59.1/ton which is quite close to where the front-year EUA is trading today.

Distribution of front-year implied EUA prices given by C-t-G differentials based on front-year coal and nat gas prices

In the following graph we have done the same cross-calculations but for calendar 2027. What we see here is that the current EUA Dec-2027 is trading far up in the distribution of switches to the level where switching is maxed out completely to the point where C-t-G differentials do not matter any more

Distribution of calendar 2027 implied EUA prices given by C-t-G differentials based on Y2027 coal and nat gas prices and compared to the current Dec-27 EUA price. It may be random, but interpretation here is that by 2027, the power market dynamics will start to matter little for the EUA price as the capacity to switch to nat gas has maxed out completely.

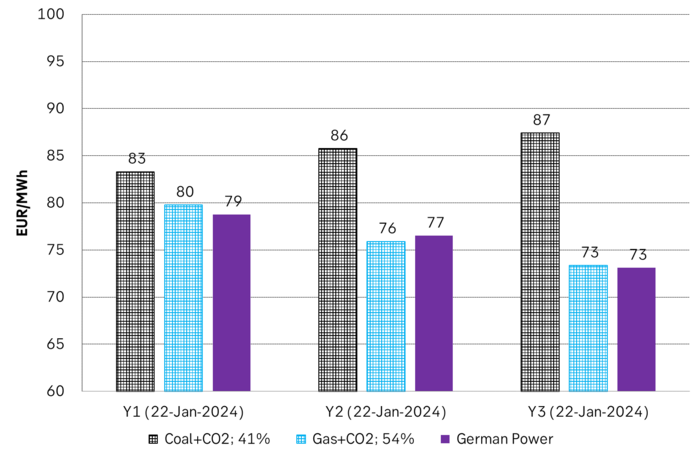

This is also visible when we calculate the cost of coal+CO2 and gas+CO2 for the nearest three years to 2027 and compare them to German power prices for these years. What we see is that coal power plants are completely price out of the stack and are no longer competitive. Unless of course they are located in a place where they cannot be out-competed by nat gas power plants due to grid restrictions. The result is high, local power prices instead.

The market price of German power for 2025/26/27 versus the cost of production by coal and gas with CO2 market prices included.

Sharp reduction in emissions due to the energy crisis has a maximum three year impact before the EUA price is back to EUR 100/ton. Early in January it was reported by Agora Energiewende and then further by Blbrg that German emissions dropped YoY by 73 mt to 70-year low in 2023. That is roughly a 10% YoY reduction in emissions. But it is for the whole economy and not just for the part of German emissions which are compliant under the EU ETS. Further it was stated that only 15% of the 73 mt YoY reduction was of permanent nature while 85% was deemed temporary. I.e. they will kick back over time.

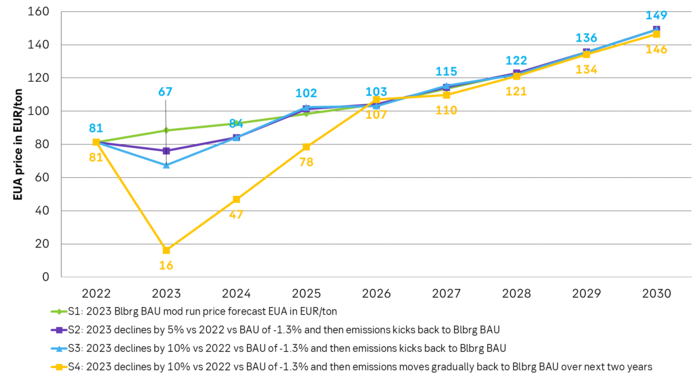

We have used Blbrgs Carbon Price Model to run different scenarios with emission reduction shocks. We have assumed that what happened with emissions in Germany in 2023 is representative for the whole EU ETS to a lesser and larger degree. The model is of course a simplified, stylistic representation of the world so result must be treated with caution.

In the first set of scenarios we assume that the market ”only has 1-year forward vision” and then knows nothing about the future tightening. I.e. it is consistently front-end or front-year spot market balance and dynamics which dictates the prices. What these runs indicates is that the whole emission reduction shock from the recent energy crisis will by wiped away by 2026 with EUA prices then again trading back at EUR 100/ton. One likely reason for this is the MSR dynamic which quickly removes surplus EUAs from the market and brings TNAC (Total Number of Allowances in Circulation) back below the upper trigger level of 833 mt.

Since EUAs are bankable anyone can borrow money today and buy an EUA and carry it on an account for three years for three years to 2026 when the price will be back to EUR 100/b. Depending on what cost of carry you assume the implied value of an EUA today is thus at least EUR 80/ton.

The following model runs have only one year forward vision and as such cannot ”see” future coming tightness. As such the EUA price can crash for a single year as it is constantly the front-end fundamentals which dictates the price dynamics rather than longer-term fundamentals.

Scenarios on Blbrgs Carbon Price Model assuming emission reduction shock in 2023. All price paths are back to EUR 100/ton by 2026. This implies a value of an EUA spot today of at least EUR 80/ton

Analys

Tightening fundamentals – bullish inventories from DOE

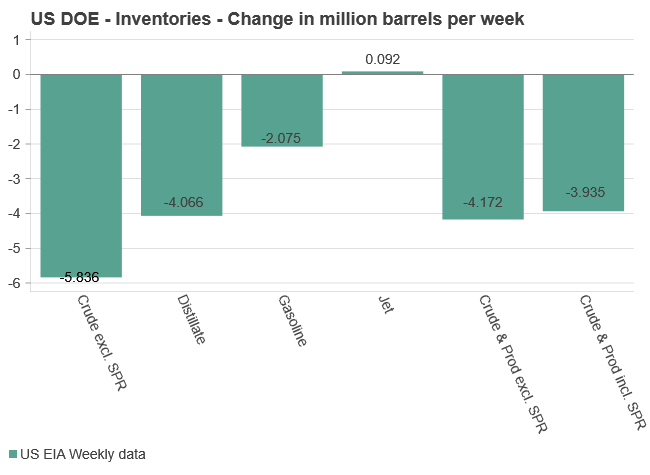

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

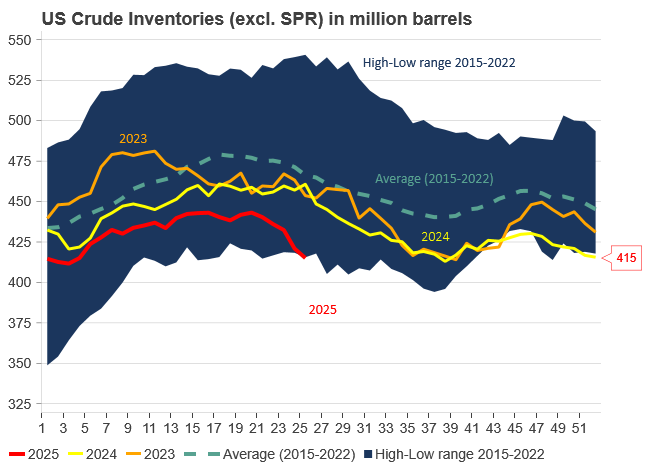

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys2 veckor sedan

Analys2 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMahvie Minerals växlar spår – satsar fullt ut på guld