Analys

EU sanctions on Russian alu will likely drive EU premiums higher

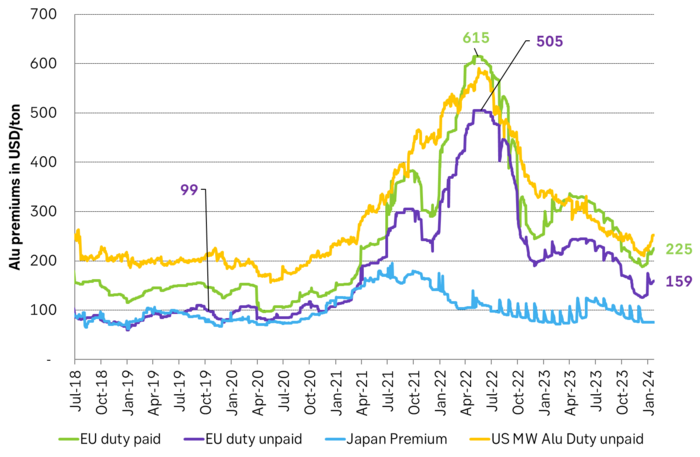

The LME 3mth alu price has bounced 4.5% past two days but its a far cry from 2022 impacts. The 3mth aluminum price has bounced 4.5% (+96 USD/ton) to USD 2256.5/ton on news that the EU is considering an embargo on Russian aluminum. It’s a notable gain amid an otherwise lukewarm and bearish energy complex where natural gas and coal prices have been trending steadily lower since October last year. But it is nothing compared to what happened in 2022 when Russia attacked Ukraine. The 3mth aluminum price then rallied to USD 3849/ton and the EU aluminum premium rallied to USD 505/ton versus a more normal USD 100/ton. Thus so far the the price action in aluminum is nothing like what we experienced in 2022.

It looks likely to us that the EU will indeed impose sanctions on Russian aluminium. We don’t know yet if the EU actually will implement sanctions on Russian aluminum. Personally I think its likely that they will do it as it is kind of a moral stand and the last large piece of the Russian energy complex which is possible to place under sanctions. But the actual effects both on the EU and Russia will likely be limited. Russia will not stop producing and exporting aluminium. Rather it will export it and send it elsewhere in the world. That is what happened to Russian crude and product exports. They weren’t lost in terms of global supply, but rerouted elsewhere.

New sanctions will have limited effect on Russia and dissipate over time. It’s a moral stand. Previously it was possible to enforce effective sanctions on one specific country. Those were the days when the US ruled the world and China chose to side with the US. For example with sanctions on Iran. These sanctions have not at all been lifted yet. But Iranian oil exports have rebounded from 1.9 m b/d at the low in 2019 to now 3.2 m b/d as China now is accepting to import Iranian crude oil and is placing less emphasis on the US.

The effect of sanctions have a tendency to deteriorate over time. Even when the US ruled the world and China played along. But sanctions today will leak massively if China isn’t playing along with what the EU and the US wants. And China isn’t playing along.

The goal is to hurt Russia’s income from aluminum exports. But the effect will be limited. The aim with the sanctions towards Russian oil, and now possibly also aluminum, isn’t to bar the supply from the global market. Rather the opposite. Neither the US nor the EU wants to put a stop to Russian raw materials exports as it could drive up the price of these globally which would hurt consumers and generate inflation. The aim is to keep exports flowing but to try to hurt Russian earnings from the exports. The same will likely be the case for the potentially upcoming EU sanctions on aluminum.

But even the ”hurt the income” strategy with a cap on the price of Russian crude and products has deteriorated over time. Russian Urals crude had a discount to Brent crude in 2022 of as much as USD 36/b and today it is only USD 12/b below Brent.

Russia has probably made contingency plans a long time ago. Russia has also probably made contingency plans for its aluminum exports as the risk has been there all along since 2022. Thus new EU sanctions towards Russian aluminium exports will likely be less of a shock today versus when all hell broke lose in 2022.

Europe has also already reduced its Russian imports of primary aluminium, to about 10% of its primary needs. A large proportion of imports are now increasingly coming from middle eastern producers.

EU alu premiums already rising along with Mid-East issues (Red Sea). Will rise further with sanctions. Issues in the region has pushed up freight costs, insurance costs and added transit delays and length of journey to Europe. A combination of these issues have already lifted the European premium. New sanctions on Russia will likely lift the regional premiums further.

The dirty details. How deeply is EU’s industrial supply chains embedded in Russian alu semies? The actual effects of new EU sanctions on Russian aluminum will be down to the dirty details. An important question is how deeply Russian semies, and prefabricated aluminum parts (which also looks to be sanctioned) are embedded and integrated in the European industrial system (supply chains). If the EU is deeply dependent of pre-fabricated aluminum parts from Russia, then it could be painful for EU to disentangle from these imports.

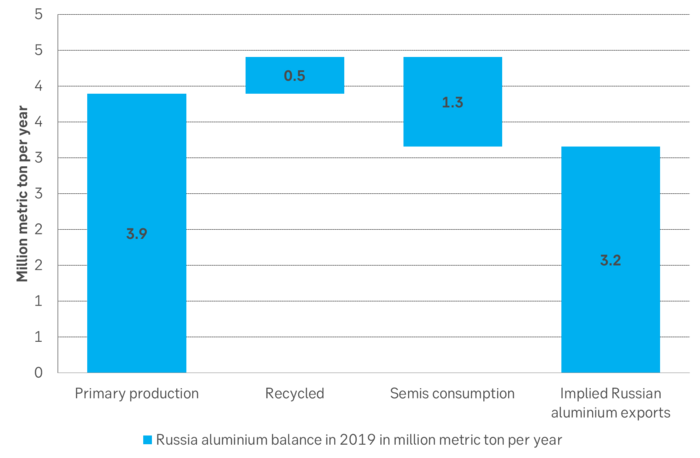

Sanctions = additional costs and frictions as global aluminum flows are rerouted. New sanctions will naturally lead to frictions and some added price due to that. Aluminum can of course be transported across the world. It is cheaper to transport it from Russia to Europe and that is why it historically has landed in the EU. But, if need be, due to possible EU sanctions towards Russia on aluminum, then Russia can and will send its aluminum to other global regions, maybe and possibly predominantly, to China. Then the EU can and must import more aluminum from other places instead. Probably the middle east and maybe from China

The Global LME 3mth price will likely rise only marginally as no supply is actually lost. Just rerouted. The price of aluminum across the world may increase a little bit due to such sanction-frictions but probably not all that much since there will not be any loss of supply and only added transportation frictions and costs.

EU aluminum premiums will naturally rise in order to attract non-Russian supply from further away. EU Alu-premiums should naturally increase in order to attract aluminum from further away. China will probably be able to import Russian aluminum on the cheap. So Russia will lose some income on its aluminum exports as it potentially has to cover transportation costs all the way to China and possibly an additional discount in order for China to take it. China may only import a lot of Russian aluminium if it can get it on the cheap. China can then export more as its country balance will improve and possibly export all the way back to Europe.

A weak macro-backdrop in Europe makes sanctions easier. The backdrop to all of this is very weak aluminum demand in Europe amid a bleak macro-picture. Disruption of Russian supply to the EU should thus be less painful than it otherwise would have been.

What to do with Russian alu stocks already in EU LME storage? Consume it or export it? A tricky question is what to do about all the Russian aluminum which currently is sitting at EU LME storage sites where it is constituting some 90% of aluminum stocks. If it has to leave EU LME storage sites due to sanctions then it may have to be sold at a discount in order to get it to flow elsewhere. Maybe it will create deep front-end contango is one speculation. A natural solution however would be that sanctions allows consumption of Russian aluminum currently in stock in the EU but bans new and further stocking of Russian aluminum. Then these Russian stocks would gradually be consumed and dissipate and instead gradually be replaced by non-Russian aluminum.

”Futures market can tighten quickly and spreads could rally.” The following is a comment from one of SEB’s metals traders: ”The futures market could get very tight very quickly following EU sanctions on Russian aluminum. Spreads could tighten aggressively until market reaches a new balance.”

The LME 3mth aluminum price rallied to USD 3,849/ton when Russia attacked Ukraine. Price has now gained a little (+4.5%) to USD 2,254/ton on possible EU sanctions.

Aluminum premiums across the world. EU premiums rallied to USD 505/ton and USD 615/ton (duty unpaid and paid resp.) in 2022 vs normal USD 100-150/ton. Now gained a little on Mid-East troubles and rerouting. Could rise much more on EU sanctions.

Russia probably has a normal, net export of alu semies and primary alu of around 3 m mtpa. This would normally be destined to Europe.

Analys

’wait and see’ mode

So far this week, Brent Crude prices have strengthened by USD 1.3 per barrel since Monday’s opening. While macroeconomic concerns persist, they have somewhat abated, resulting in muted price reactions. Fundamentals predominantly influence global oil price developments at present. This week, we’ve observed highs of USD 89 per barrel yesterday morning and lows of USD 85.7 per barrel on Monday morning. Currently, Brent Crude is trading at a stable USD 88.3 per barrel, maintaining this level for the past 24 hours.

Additionally, there has been no significant price reaction to Crude following yesterday’s US inventory report (see page 11 attached):

- US commercial crude inventories (excluding SPR) decreased by 6.4 million barrels from the previous week, standing at 453.6 million barrels, roughly 3% below the five-year average for this time of year.

- Total motor gasoline inventories decreased by 0.6 million barrels, approximately 4% below the five-year average.

- Distillate (diesel) inventories increased by 1.6 million barrels but remain weak historically, about 7% below the five-year average.

- Total commercial petroleum inventories (crude + products) decreased by 3.8 million barrels last week.

Regarding petroleum products, the overall build/withdrawal aligns with seasonal patterns, theoretically exerting limited effect on prices. However, the significant draw in commercial crude inventories counters the seasonality, surpassing market expectations and API figures released on Tuesday, indicating a draw of 3.2 million barrels (compared to Bloomberg consensus of +1.3 million). API numbers for products were more in line with the US DOE.

Against this backdrop, yesterday’s inventory report is bullish, theoretically exerting upward pressure on crude prices.

Yet, the current stability in prices may be attributed to reduced geopolitical risks, balanced against demand concerns. Markets are adopting a wait-and-see approach ahead of Q1 US GDP (today at 14:30) and the Fed’s preferred inflation measure, “core PCE prices” (tomorrow at 14:30). A stronger print could potentially dampen crude prices as market participants worry over the demand outlook.

Geopolitical “risk premiums” have decreased from last week, although concerns persist, highlighted by Ukraine’s strikes on two Russian oil depots in western Russia and Houthis’ claims of targeting shipping off the Yemeni coast yesterday.

With a relatively calmer geopolitical landscape, the market carefully evaluates data and fundamentals. While the supply picture appears clear, demand remains the predominant uncertainty that the market attempts to decode.

Analys

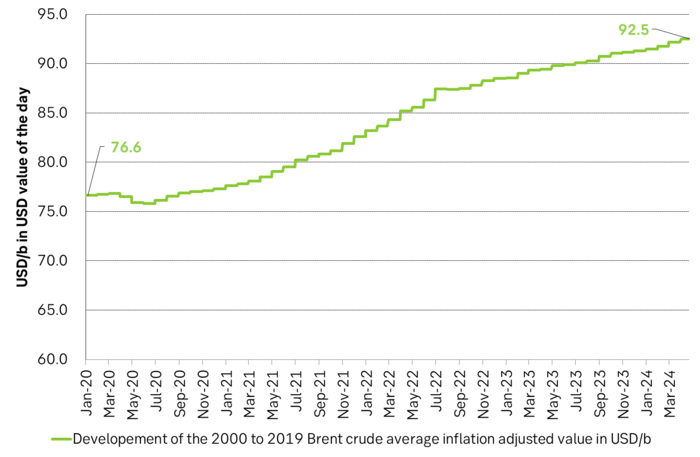

Also OPEC+ wants to get compensation for inflation

Brent crude has fallen USD 3/b since the peak of Iran-Israel concerns last week. Still lots of talk about significant Mid-East risk premium in the current oil price. But OPEC+ is in no way anywhere close to loosing control of the oil market. Thus what will really matter is what OPEC+ decides to do in June with respect to production in Q3-24 and the market knows this very well. Saudi Arabia’s social cost-break-even is estimated at USD 100/b today. Also Saudi Arabia’s purse is hurt by 21% US inflation since Jan 2020. Saudi needs more money to make ends meet. Why shouldn’t they get a higher nominal pay as everyone else. Saudi will ask for it

Brent is down USD 3/b vs. last week as the immediate risk for Iran-Israel has faded. But risk is far from over says experts. The Brent crude oil price has fallen 3% to now USD 87.3/b since it became clear that Israel was willing to restrain itself with only a muted counter attack versus Israel while Iran at the same time totally played down the counterattack by Israel. The hope now is of course that that was the end of it. The real fear has now receded for the scenario where Israeli and Iranian exchanges of rockets and drones would escalate to a point where also the US is dragged into it with Mid East oil supply being hurt in the end. Not everyone are as optimistic. Professor Meir Javedanfar who teaches Iranian-Israeli studies in Israel instead judges that ”this is just the beginning” and that they sooner or later will confront each other again according to NYT. While the the tension between Iran and Israel has faded significantly, the pain and anger spiraling out of destruction of Gaza will however close to guarantee that bombs and military strifes will take place left, right and center in the Middle East going forward.

Also OPEC+ wants to get paid. At the start of 2020 the 20 year inflation adjusted average Brent crude price stood at USD 76.6/b. If we keep the averaging period fixed and move forward till today that inflation adjusted average has risen to USD 92.5/b. So when OPEC looks in its purse and income stream it today needs a 21% higher oil price than in January 2020 in order to make ends meet and OPEC(+) is working hard to get it.

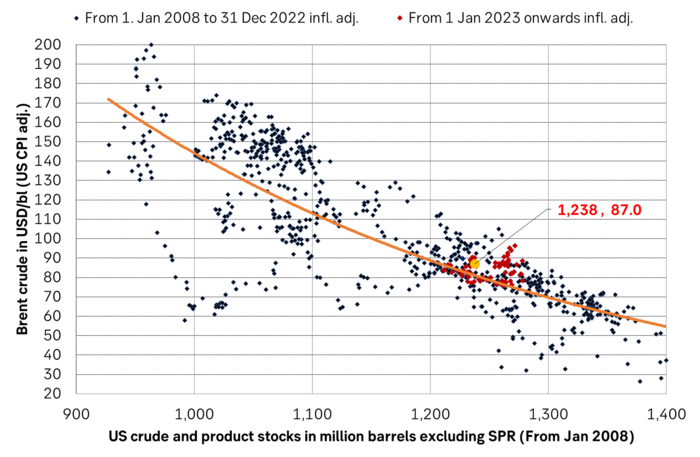

Much talk about Mid-East risk premium of USD 5-10-25/b. But OPEC+ is in control so why does it matter. There is much talk these days that there is a significant risk premium in Brent crude these days and that it could evaporate if the erratic state of the Middle East as well as Ukraine/Russia settles down. With the latest gains in US oil inventories one could maybe argue that there is a USD 5/b risk premium versus total US commercial crude and product inventories in the Brent crude oil price today. But what really matters for the oil price is what OPEC+ decides to do in June with respect to Q3-24 production. We are in no doubt that the group will steer this market to where they want it also in Q3-24. If there is a little bit too much oil in the market versus demand then they will trim supply accordingly.

Also OPEC+ wants to make ends meet. The 20-year real average Brent price from 2000 to 2019 stood at USD 76.6/b in Jan 2020. That same averaging period is today at USD 92.5/b in today’s money value. OPEC+ needs a higher nominal price to make ends meet and they will work hard to get it.

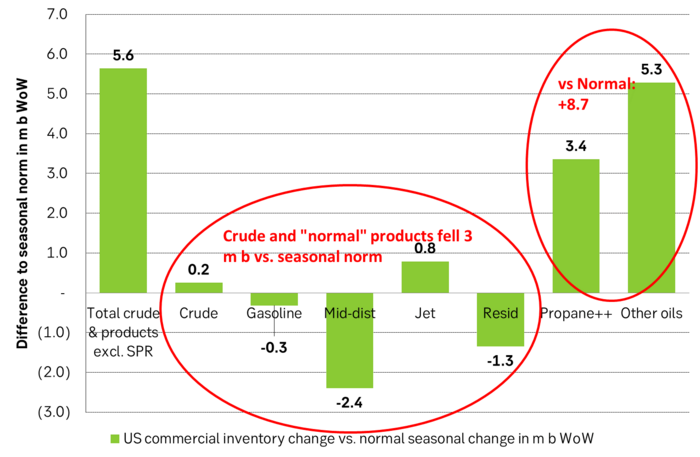

Inflation adjusted Brent crude price versus total US commercial crude and product stocks. A bit above the regression line. Maybe USD 5/b risk premium. But type of inventories matter. Latest big gains were in Propane and Other oils and not so much in crude and products

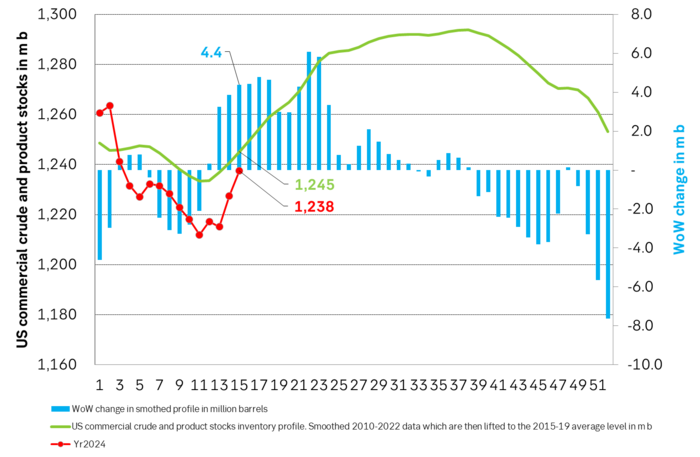

Total US commercial crude and product stocks usually rise by 4-5 m b per week this time of year. Gains have been very strong lately, but mostly in Propane and Other oils

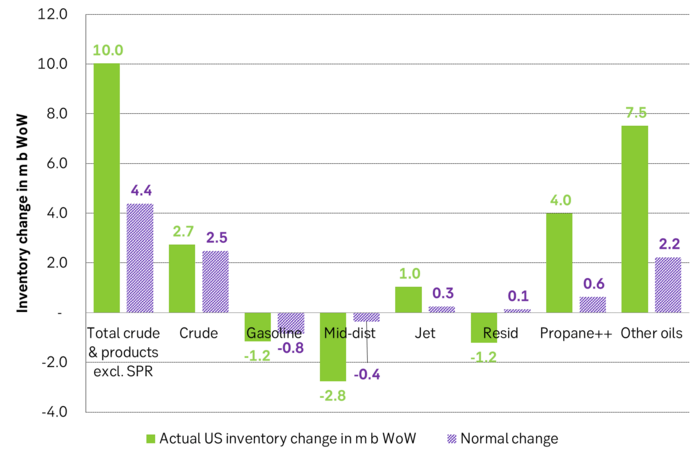

Last week’s US inventory data. Big rise of 10 m b in commercial inventories. What really stands out is the big gains in Propane and Other oils

Take actual changes minus normal seasonal changes we find that US commercial crude and regular products like diesel, gasoline, jet and bunker oil actually fell 3 m b versus normal change.

Analys

Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

Historically positive Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

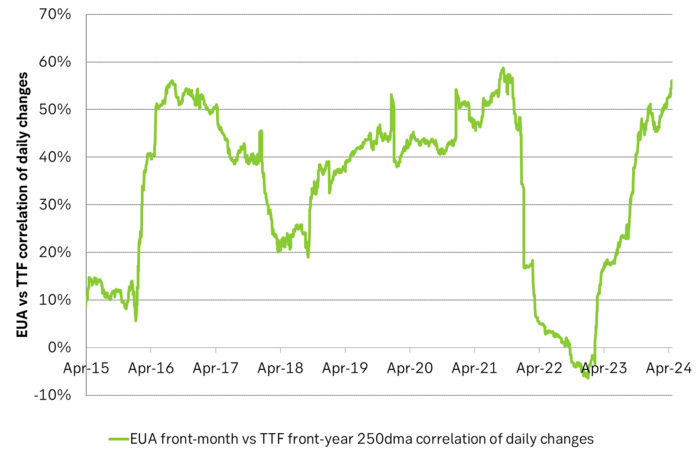

Historically there has been a strong, positive correlation between EUAs and nat gas prices. That correlation is still fully intact and possibly even stronger than ever as traders increasingly takes this correlation as a given with possible amplification through trading action.

The correlation broke down in 2022 as nat gas prices went ballistic but overall the relationship has been very strong for quite a few years.

The correlation between nat gas and EUAs should be positive as long as there is a dynamical mix of coal and gas in EU power sector and the EUA market is neither too tight nor too weak:

Nat gas price UP => ”you go black” by using more coal => higher emissions => EUA price UP

But in the future we’ll go beyond the dynamically capacity to flex between nat gas and coal. As the EUA price moves yet higher along with a tightening carbon market the dynamical coal to gas flex will max out. The EUA price will then trade significantly above where this flex technically will occur. There will still be quite a few coal fired power plants running since they are needed for grid stability and supply amid constrained local grids.

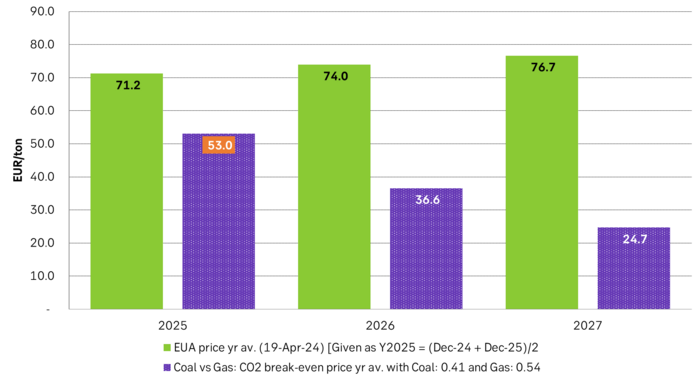

As it looks now we still have such overall coal to gas flex in 2024 and partially in 2025, but come 2026 it could be all maxed out. At least if we look at implied pricing on the forward curves where the forward EUA price for 2026 and 2027 are trading way above technical coal to gas differentials. The current forward pricing implications matches well with what we theoretically expect to see as the EUA market gets tighter and marginal abatement moves from the power sector to the industrial sector. The EUA price should then trade up and way above the technical coal to gas differentials. That is also what we see in current forward prices for 2026 and 2027.

The correlation between nat gas and EUAs should then (2026/27 onward) switch from positive to negative. What is left of coal in the power mix will then no longer be dynamically involved versus nat gas and EUAs. The overall power price will then be ruled by EUA prices, nat gas prices and renewable penetration. There will be pockets with high cost power in the geographical points where there are no other alternatives than coal.

The EUA price is an added cost of energy as long as we consume fossil energy. Thus both today and in future years we’ll have the following as long as we consume fossil energy:

EUA price UP => Pain for consumers of energy => lower energy consumption, faster implementation of energy efficiency and renewable energy => lower emissions

The whole idea with the EUA price is after all that emissions goes down when the EUA price goes up. Either due to reduced energy consumption directly, accelerated energy efficiency measures or faster switch to renewable energy etc.

Let’s say that the coal to gas flex is maxed out with an EUA price way above the technical coal to gas differentials in 2026/27 and later. If the nat gas price then goes up it will no longer be an option to ”go black” and use more coal as the distance to that is too far away price vise due to a tight carbon market and a high EUA price. We’ll then instead have that:

Nat gas higher => higher energy costs with pain for consumers => weaker nat gas / energy demand & stronger drive for energy efficiency implementation & stronger drive for more non-fossil energy => lower emissions => EUA price lower

And if nat gas prices goes down it will give an incentive to consume more nat gas and thus emit more CO2:

Cheaper nat gas => Cheaper energy costs altogether, higher energy and nat gas consumption, less energy efficiency implementations in the broader economy => emissions either goes up or falls slower than before => EUA price UP

Historical and current positive correlation between nat gas and EUA prices should thus not at all be taken for granted for ever and we do expect this correlation to switch to negative some time in 2026/27.

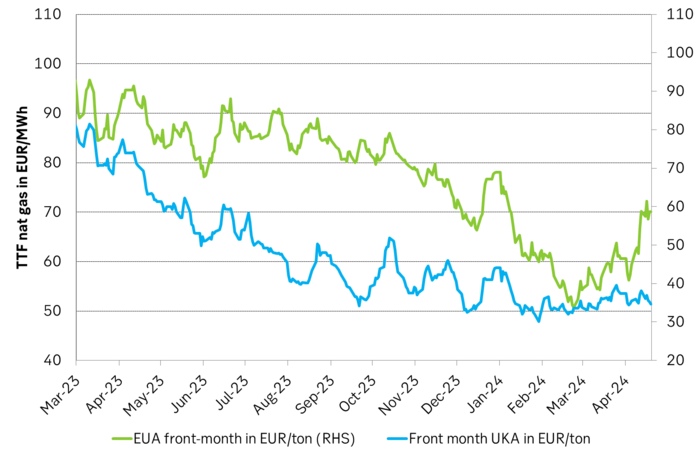

In the UK there is hardly any coal left at all in the power mix. There is thus no option to ”go black” and burn more coal if the nat gas price goes up. A higher nat gas price will instead inflict pain on consumers of energy and lead to lower energy consumption, lower nat gas consumption and lower emissions on the margin. There is still some positive correlation left between nat gas and UKAs but it is very weak and it could relate to correlations between power prices in the UK and the continent as well as some correlations between UKAs and EUAs.

Correlation of daily changes in front month EUA prices and front-year TTF nat gas prices, 250dma correlation.

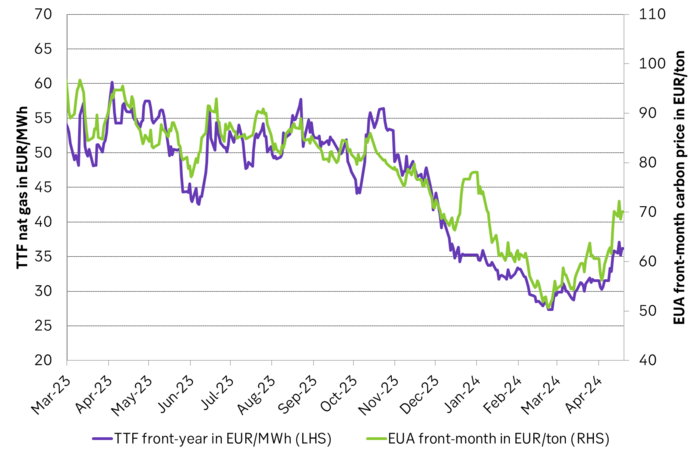

EUA price vs front-year TTF nat gas price since March 2023

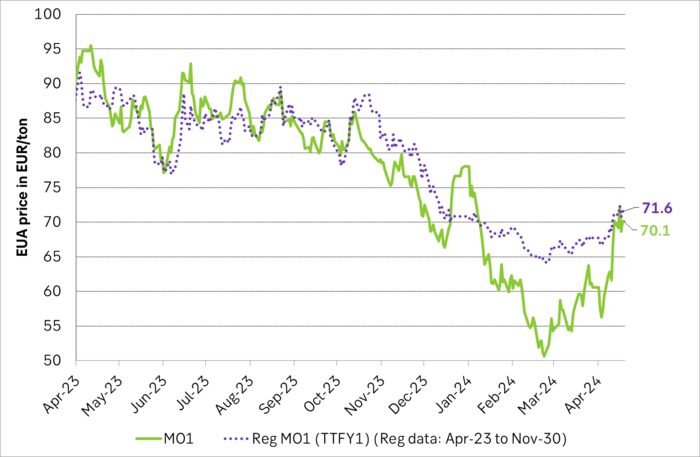

Front-month EUA price vs regression function of EUA price vs. nat gas derived from data from Apr to Nov last year.

The EUA price vs the UKA price. Correlations previously, but not much any more.

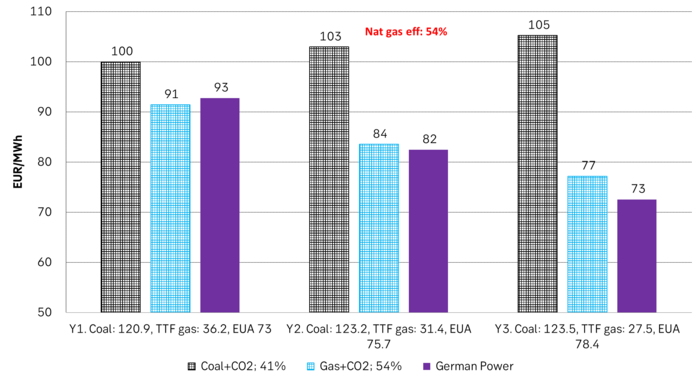

Forward German power prices versus clean cost of coal and clean cost of gas power. Coal is totally priced out vs power and nat gas on a forward 2026/27 basis.

Forward price of EUAs versus technical level where dynamical coal to gas flex typically takes place. EUA price for 2026/27 is at a level where there is no longer any price dynamical interaction or flex between coal and nat gas. The EUA price should/could then start to be negatively correlated to nat gas.

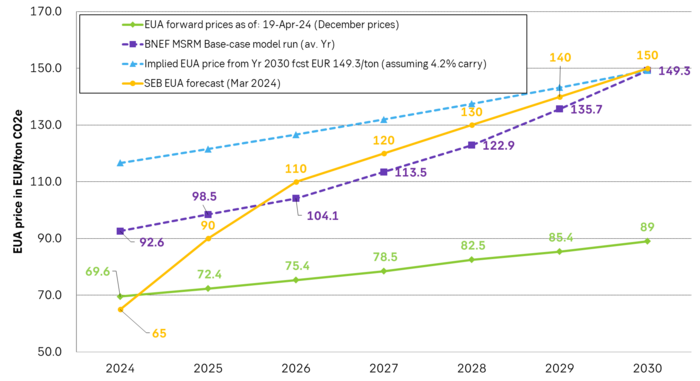

Forward EAU price vs. BNEF base model run (look for new update will come in late April), SEB’s EUA price forecast.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset når nytt all time high och bryter igenom 2300 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSAs stigande konsumtion av naturgas

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCentralbanker fortsatte att köpa guld under februari

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKakaomarknaden är extrem för tillfället

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHur mår den svenska skogsbraschen? Två favoritaktier

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBoliden på 20 minuter

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBetydande underskott i utbudet av olja kan få priset att blossa upp

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMyten om guld – Den magiska metallen född från stjärnstoft