Analys

SEB – Råvarukommentarer vecka 19 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: -2,79 %

Brett råvaruindex: -2,79 %

UBS Bloomberg CMCI TR Index- Energi: -4,31 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -1,59%

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: -2,42 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: -2,01 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral/köp

- Olja: Sälj

- Koppar: Sälj

- Majs: Sälj

- Vete: Sälj

Guld

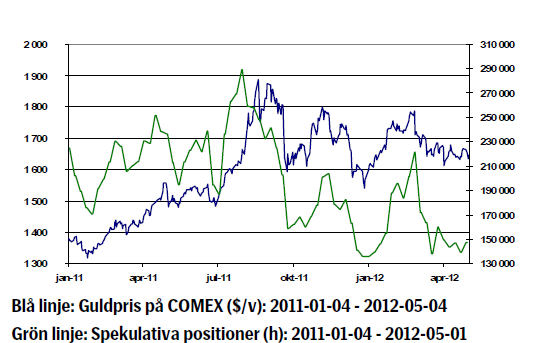

- Guldet föll 1,14 procent förra veckan och vi såg att guldtillgångar i börshandlade ETP: er sjönk till 2 381 ton, den lägsta nivån sedan 1 februari i år. Guldet handlade i ett intervall och lyckas inte bryta på uppsidan. Bristen på av politiker bekräftade penningpolitiska lättnader och en starkare dollar höll tillbaka guldet.

- Den amerikanska jobbrapporten NFP som publiceras i fredags kom ut sämre än förväntat, 115 000 nya jobb mot förväntade 160 000 nya jobb skapades. NFP siffran ökade marknadens förhoppningar om nya kvantitativa lättnader vilket gav stöd åt guldet som steg en halv procent samtidigt dollarn försvagades marginellt.

- Råvaror faller brett idag på morgonen efter valseger för Hollande i Frankrike. Segern skapar politisk oro eftersom överenskommelser med Tyskland nu kan komma att rivas upp. Helgens val i Grekland gav en klar seger för små partier som visat missnöje med de överenskommelser landets största partier gjort med EU och IMF. Osäkerheten i Europa ökar och euron tappade kraftigt mot dollarn efter valresultaten.

- I Europa är osäkerheten kring Spanien stor där ekonomin åter är i recession, dvs. ekonomin krymper för andra kvartalet i rad. En fråga som oroar marknaden är om Spanien kommet att behöva resurser från EU:s nödlånefaciliteter. Negativa nyheter kan snabbt skapa turbulens i marknaden. Den oro man ser i Europa har emellertid inte ökat intresset för guld som säker hamn. Guldet har snarare korrelerat positivt med övriga risktillgångar.

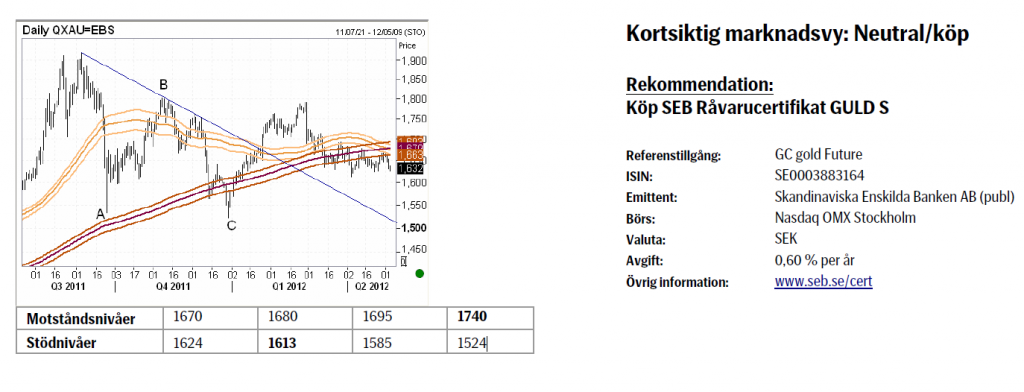

- Teknisk Analys: Fortsatt endast marginella rörelser noterade inom ett redan ganska väl utstakat intervall där under $1620 verkar ”för lågt” och over $1690 ”för högt”. Priset håller sig under ett rullande 55-dagars genomsinittsband. Bandet är svagt i fallande och är på marginalen ett uttryck för visst nedåttryck, men marknaden svarar samtidigt bra på nedställ och i en större positiv bild ser eventuell svaghet ut at vara temporär. Över $1670 & $1695 skulle påvisa efterfrågan och ses som positivt.

Olja

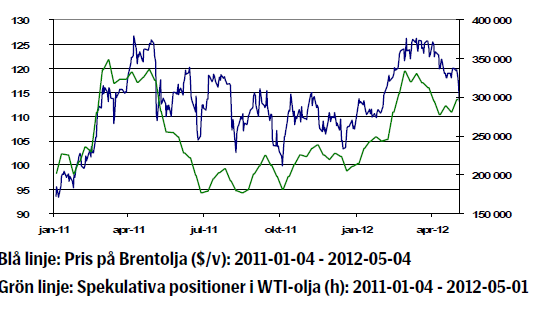

- Oljepriset föll 5,3 procent förra veckan. Statistik från USA:s energidepartement, DOE, visade att de amerikanska lagren av råolja steg med 2,8 miljoner fat under förra veckan till den högsta nivån på 21 år.

- Den viktiga amerikanska jobbrapporten NFP som publiceras på fredagen kom ut sämre än förväntat, 115 000 nya jobb mot förväntade 160 000 nya jobb skapades.

- Arbetslösheten minskade med 0,1 % och föll till 8,1 procent (samtidigt bör noteras att antalet registrerade arbetslösa minskade, de försvinner alltså ur systemet vilket i sig förbättrar siffran).

- Den inofficiell amerikanska jobbstatistiken, ADP-rapporten, som mäter utvecklingen i den privata sysselsättningen, visade på en ökning om 119 000 personer vilket också var långt under väntade 170 000.)

- Opec:s generalsekreterare är “inte nöjd” över nuvarande oljepris och kartellen arbetar för att få ned priserna. Enligt Opec som idag producerar 3,2 miljoner fat per dag över de uppsatta kvoterna, är ett oljepris kring 100 dollar att föredra. Enligt Opec finns det gott om olja och utbudssituationen är inte ett problem trots Irankrisen. Exporten från Iran har minskat mindre än förväntat. Detta, tillsammans med Europas kris, gör att vi kortsiktigt inte tror på en uppgång i oljepriset.

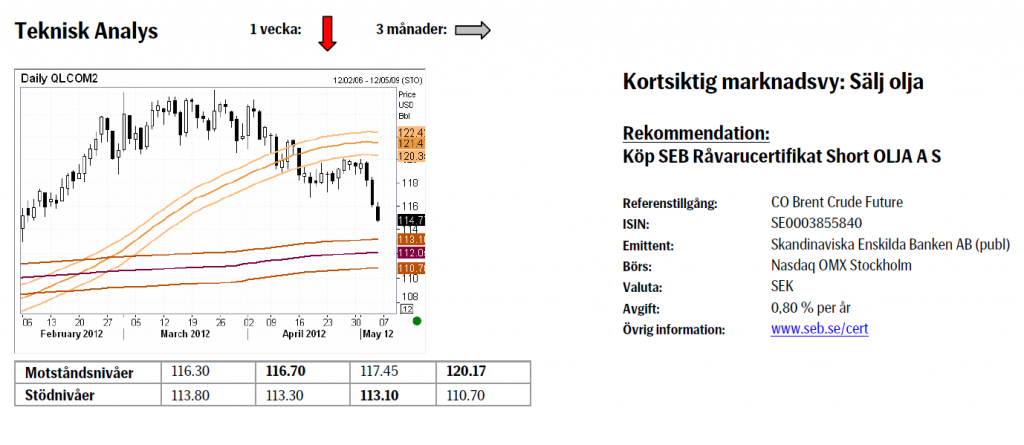

- Teknisk Analys: Undersidan av 55-dagars bandet (som efter kraftigt nedställ denna vecka är satt i fallande) agerar som dynamisk motstånd (borde inte återtestas under de kommande veckorna). Rörelsen ner är som sagt hård och ska väntas fortsätta för att testa 233-dagars bandet som just nu börjar vid $113.

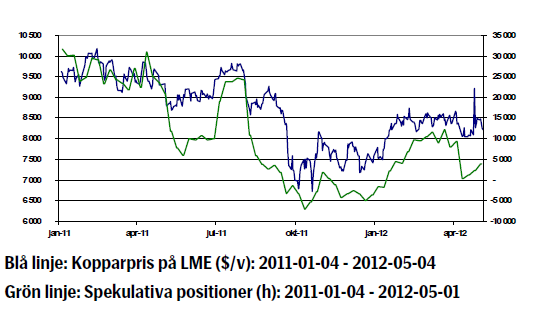

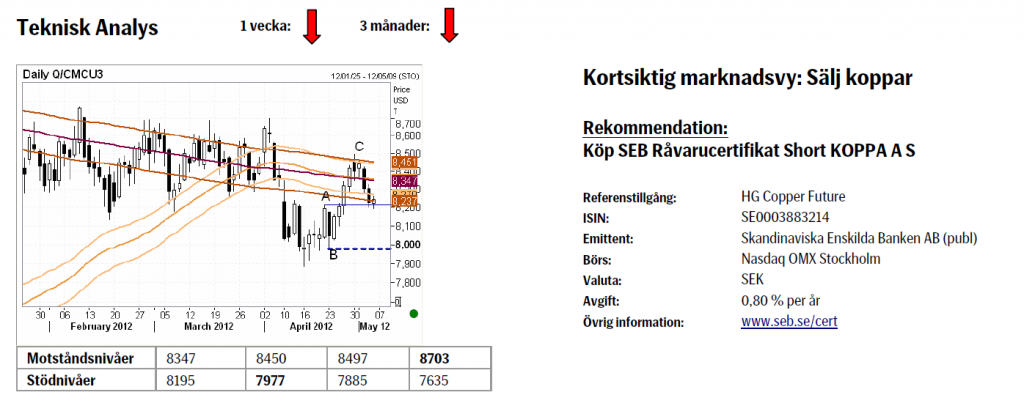

Koppar

- Kopparlagren på LME (London Metal Exchange) föll förra veckan till den lägsta nivån sedan november 2008.

- HSBC inköpschefsindex för tillverkningsindustrin kom in under 50-nivån vilket är den nivå som indikerar att ekonomin är i kontraktion. Fastighetspriser i Kina faller och föll i april till 14-månaders lägsta. Husbyggande står för ungefär 40 procent av inhemsk efterfrågan på koppar enligt Copper Development Association.

- ECB lämnade som förväntat räntan oförändrad på en procent. Störst fokus var emellertid på ECB chefen Draghis efterföljande presskonferens i samband med räntebeskedet där Draghi uttryckte kritik mot euro-ländernas politiker vilka inte har förbättrat tillväxtpotentialen med förbättrade strukturreformer. Framtiden ser osäker ut enligt Draghi som inte heller utlovade ytterligare stimulanser vilket marknaden reagerade negativt på och råvaror fortsatte att falla brett på fredagen i samklang med aktiemarknaden.

- Stämningsläget hos europeiska inköpschefer bekräftade det kärva läge som europeisk tillväxt befinner sig i. Arbetsmarknadsstatistiken är dyster och den europeiska arbetslösheten har stigit till 15-årshögsta. Obligationsräntorna har rört sig nedåt eller ligger kvar på mycket låga nivåer t.o.m. i ekonomier som bedöms som säkra att låna ut till.

- Teknisk Analys: Rörelsen högre gick något längre än vad som tidigare var trott, men uppsidan av 55-, & 233-dagars ”banden” höll köpare över $8500 nivån borta. Den nuvarande överlappningen under 20 april toppen vid $8218 har ökat sannolikheten att apr/maj rörelsen verkligen är den korrektion vi antagit att den är. Under $$7977 skulle helt bekräfta detta och starkt argumentera för fortsatt rörelse under apr botten vid 7885.

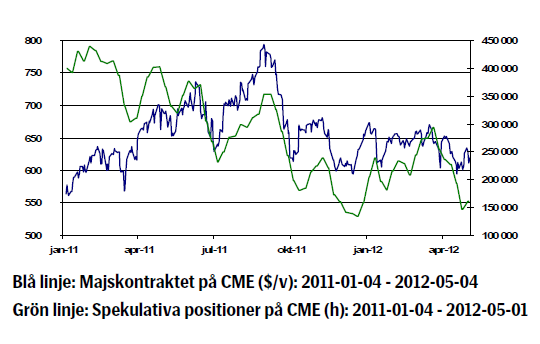

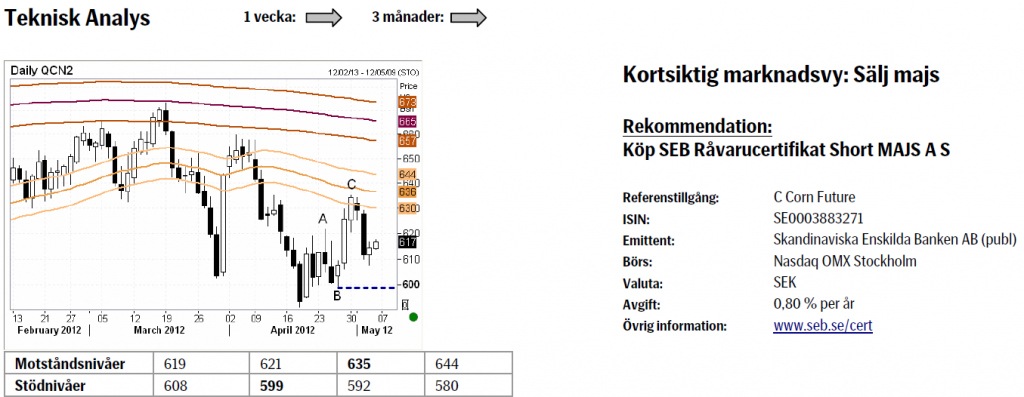

Majs

- Denna vecka byter vi referenskontrakt för majs. Från att den senaste tiden ha använt majkontraktet byter vi nu istället till julikontraktet.

- Förra veckan kunde vi se en nedgång med knappt en procent, detta till följd av framförallt den fortsatt goda utvecklingen för den amerikanska majsskörden, där mer än 50 procent av planteringen nu är avslutad.

- Prognoserna för den sydamerikanska majsskörden ser fortsatt blandade ut, där Brasilien som kontinentens största producent justerat upp sin prognos samtidigt som Argentina fått dra ned sina estimat något.

- Den senaste tiden har det spekulerats mycket kring Kinas ökade import av majs och huruvida denna kommer att fortlöpa under 2012. Enligt en mängd analytiker verkar det i nuläget som att importen kommer att öka något, vilket borde utgöra ett starkt fundamentalt motstånd för majspriset.

- Fundamentalt förhåller vi oss fortsatt negativa till majspriset, där fredagens amerikanska arbetsmarknadsdata, tillsammans med den generella riskaversionen i kapitalmarknaden, bör agera sänke även på spannmålspriserna denna vecka.

- Teknisk Analys: Rörelsen upp från apr botten har kommit av sig och börjat se ut som en korrektiv ”3-vågs” rörelse där A-, & C-vågorna nu är symmetriska i storlek och hastighet. Tillbaka under 599 skulle till fullo bekräfta detta och den lätt negativa lutningen på 55-dagars bandet och då argumentera för rörelse under 592, möjligtvis ner mot 580-området.

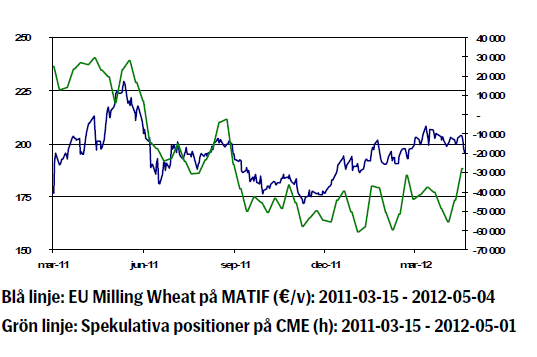

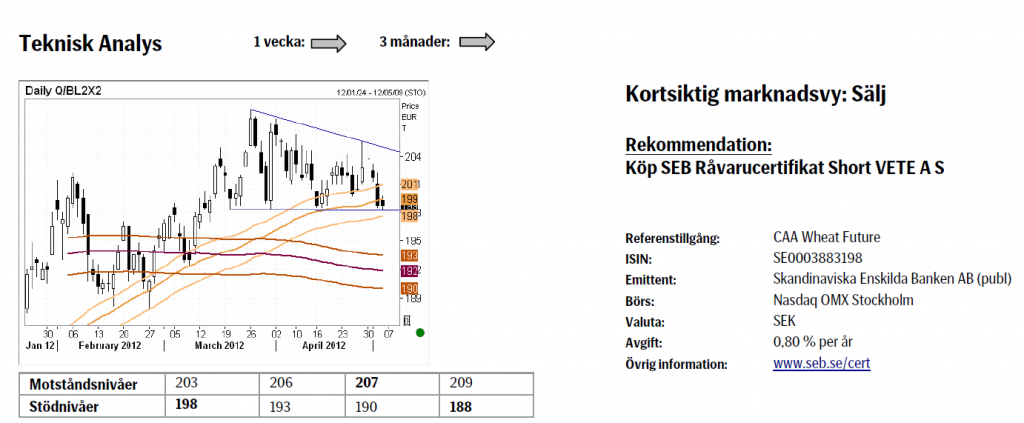

Vete

- Efter att den senaste månaden ha använt majkontraktet som referenskontrakt för europeiskt vete byter vi nu över till novemberkontraktet.

- Förra veckan föll priset på vete med nästan 3,5 procent, vilket till stor del kan förklaras av den amerikanska skördeutvecklingen, där 64 procent av vintervetet är av hög eller mycket hög kvalitet. Den gängse normen på marknaden är att en siffra över 60 procent i regel leder till hög avkastning på skörden.

- I Europa är det fortsatt blandat, där exempelvis skörden i Ukraina och Spanien i år ser ut att bli väsentligen sämre jämfört med föregående skördeår. I länder som Ryssland och Frankrike ser det däremot förhållandevis ljust ut, där det blöta vädret under april och maj skapat förutsättningar för en god avkastning.

- Som en konsekvens av rådande riskaversion samt de goda utsikterna för den amerikanska skörden är vi denna vecka säljare av vete. Det krävs en svag WASDE-rapport på torsdag för att vi ska revidera denna kortsiktiga vy.

- Teknisk Analys: Fallande toppar indikerar ett något höjt säljtryck. Skulle stödet just under €200-nivån (& nedsidan på 55-dagars bandet) sluta att attrahera köpare så väntas snabb rörelse tillbaka ner mot stödet vid 233-dagars bandet (som är i fallande) och som börjar vid €193. Över €206 skulle åter minska risken för brott lägre och i stället tas som efterfrågan vid nivåer som tidigare.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

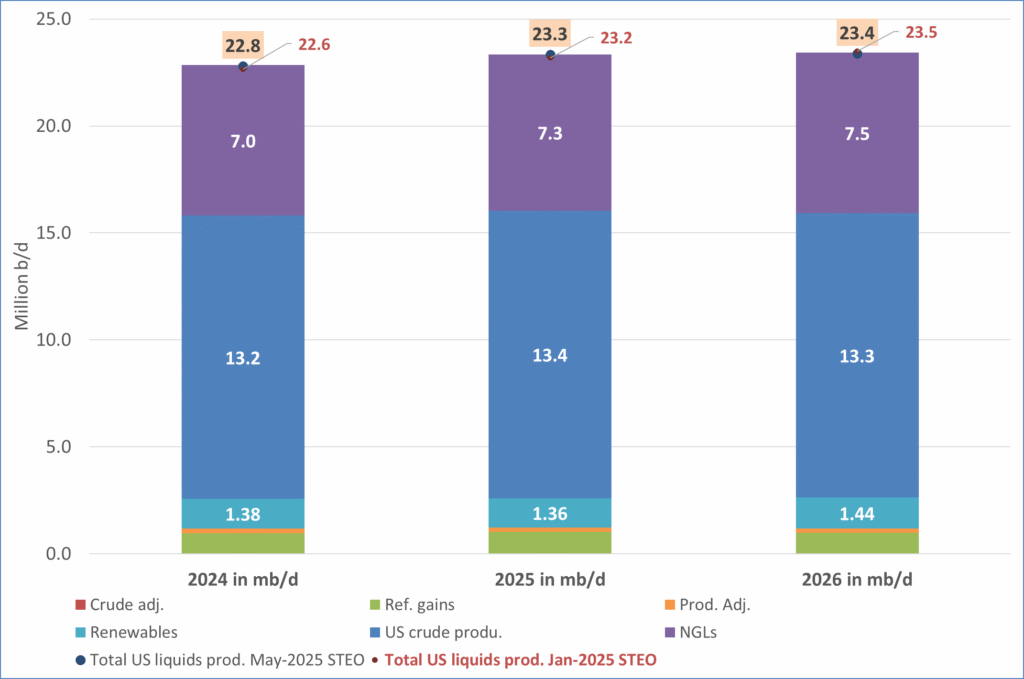

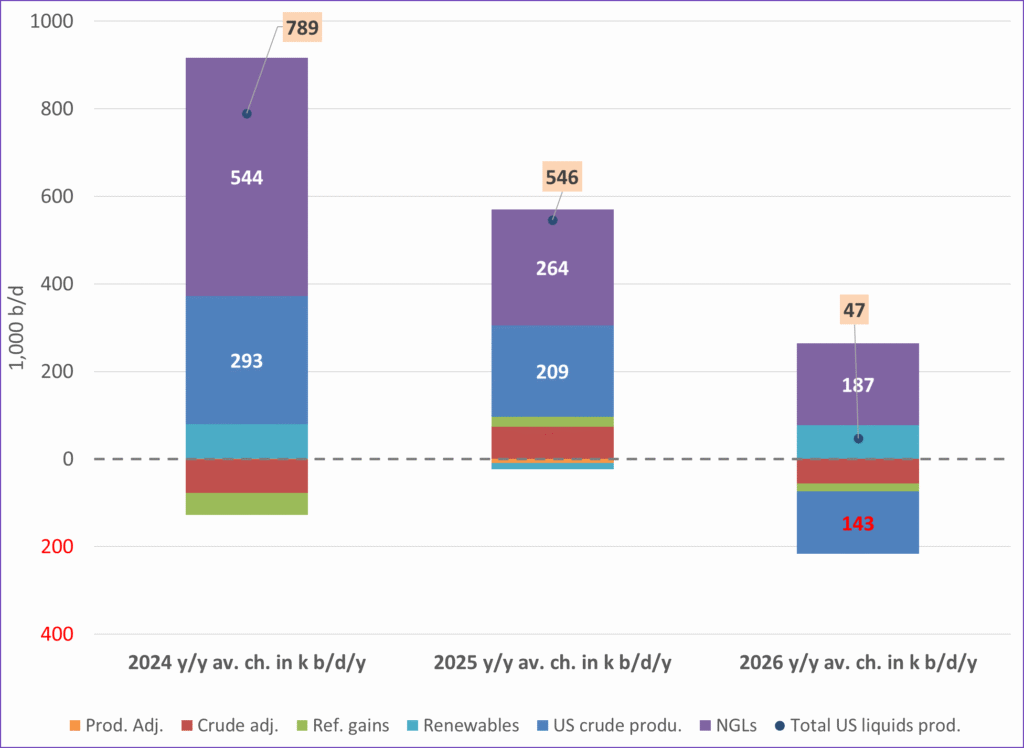

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC+ in a process of retaking market share

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD