Analys

SEB – Råvarukommentarer vecka 12 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: +0,67 %

Brett råvaruindex: +0,67 %

UBS Bloomberg CMCI TR Index- Energi: +0,36 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -3,57 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +0,13 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: +2,66 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadssyn:

- Guld: Köp

- Olja: Neutral/köp

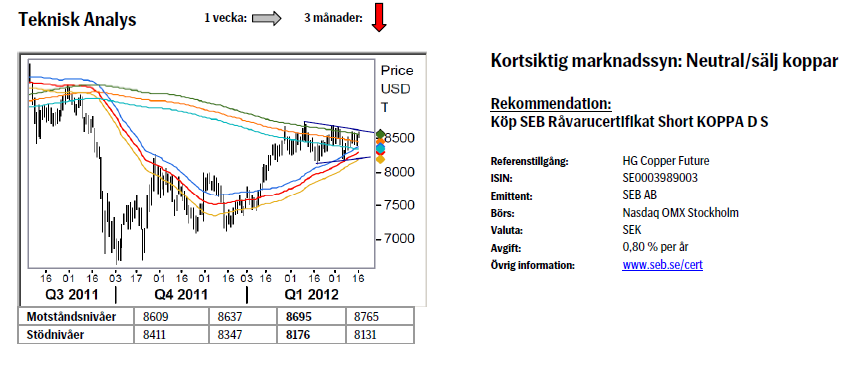

- Koppar: Sälj

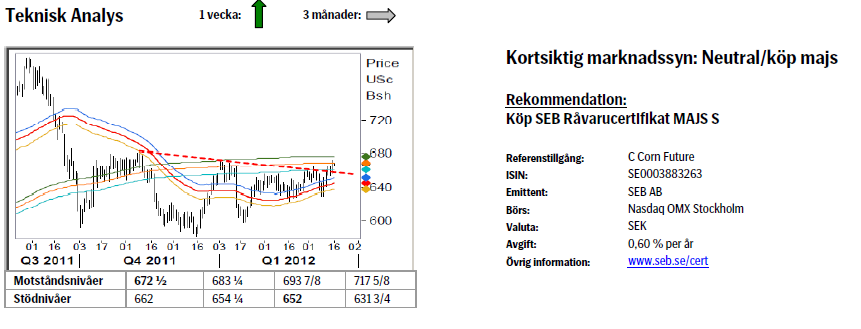

- Majs: Neutral/köp

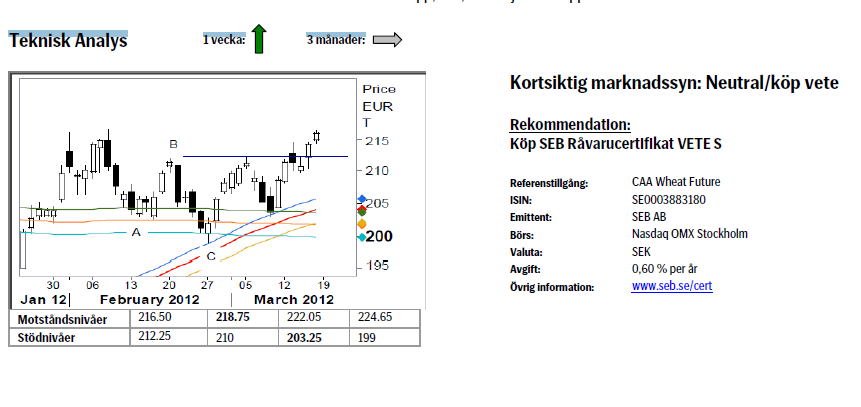

- Vete: Neutral/köp

Guld

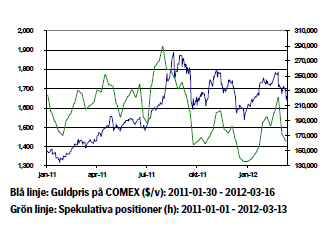

- Guldpriset föll kraftigt efter Feds möte onsdagen förra veckan där Bernanke inte nämnde något om ytterligare stimulanser. Fed lyfte istället fram förbättringar i arbetsmarknaden. Dollarn stärktes på beskedet och guldpriset föll till 1663 dollar per troy ounce, den lägsta nivån sedan slutet av januari. På torsdagen föll guldpriset ytterligare till 1635 dollar och bröt därmed igenom viktiga stödnivåer.

- Enligt Financial Times har BIS ”the Bank for International Settlement ” köpt cirka fem ton guld i OTC-marknaden förra veckan.

- Enligt US Mint har redan 23 500 American Eagle guldmynt sålts under mars månad vilket är mer än vad som såldes under hela februari. Fysiska guld ETF: er uppgår enligt Bloomberg till 2 409,5 ton, en ny rekordnivå.

- Vi ser det kraftiga prisfallet som varit som en möjlighet att bygga upp positioner.

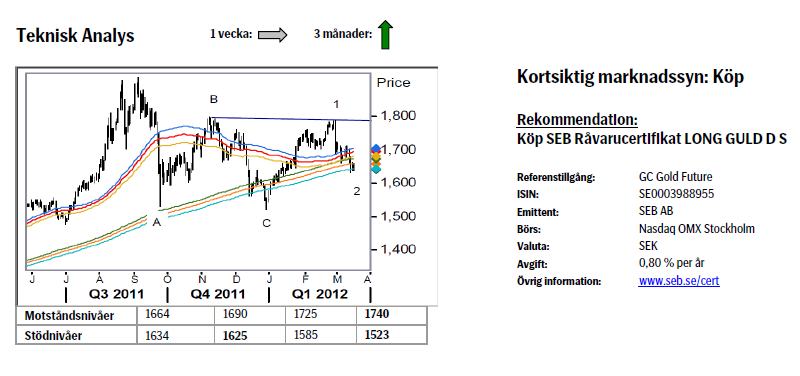

- Teknisk Analys: Vår bedömning är att marknaden befinner sig i slutfasen av innevarande nedgång och precis som vid tidigare korrektioner bör en förnyad uppgångsfas ta sin början från framför allt 233-dagarsbandet eller strax därunder. Ett brott tillbaka över 55-dagars medelvärdesband bekräftar därefter vändningen uppåt. Över 1725/40 kan vi med stor säkerhet peka på ett nytt mål runt 2070.

Olja

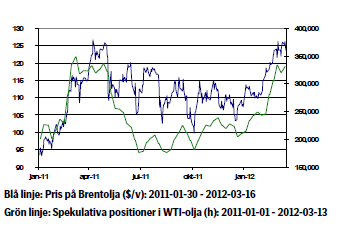

- Brent priset steg 0,80 procent förra veckan. Geopolitisk risk och spänningar kring Iran fortsätter att oroa marknaden. Saudiarabien har låtit meddela att man kommer att kompensera för utebliven oljeexport från Iran samtidigt som det är osäkert hur stor reservkapacitet landet egentligen har.

- Priset på Brentolja återhämtade sig på fredagen efter torsdagen då priset föll kraftigt efter nyheten att Storbritannien och USA skulle ha en överenskommelse om att släppa lös sina strategiska oljelager för att på så sätt stävja att höga bränslepriser hämmar den ekonomiska tillväxten. Nyheten har dock dementerats av USA.

- Amerikanska energidepartementet DOE presenterade statistik som visade att lagren av råolja steg mer än förväntat. Enligt IEA bör OPEC producera 30,1 fat olja per dag 2012 vilket faktiskt är mindre än de 31,4 miljoner fat som OPEC idag producerar per dag.

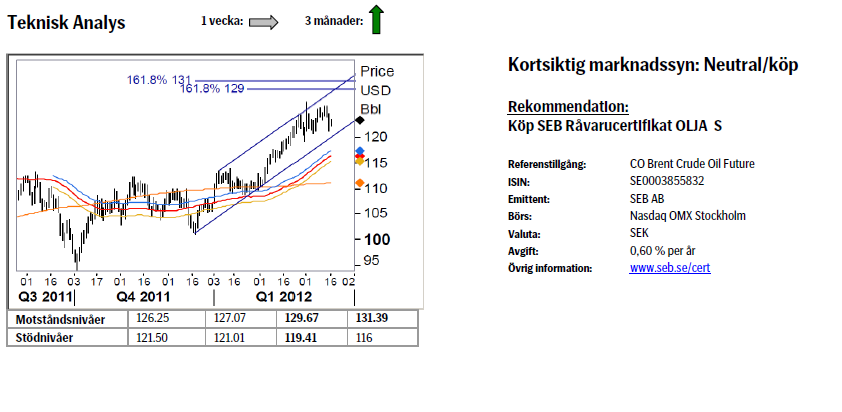

- Teknisk Analys: Förra veckans fråga huruvida vi hade en topp på plats får nog för närvarande besvaras nekande. Det ser mer ut som om vi konsoliderar snarare än korrigerar, varför det sannolikt finns en topp kvar i området 129/131. Under 121 börjar nedsidan vinna förtroende, men bara under 119 pekar på en avslutad uppgångsfas.

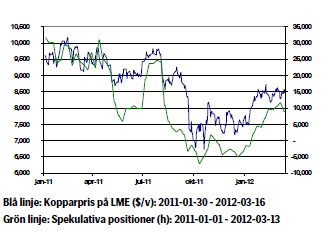

Koppar

- LME lager fortsätter att sjunka och är snart på de låga nivåer vi såg i slutet av 2008.

- Oro för utvecklingen i Kina präglar kopparmarknaden igen. I Kina gick premiärminister Wen Jiabao ut med budskapet att fastighetssektorn är övervärderad, framförallt i landets storstäder och att man därför kommer att föra en politik som dämpar marknaden vilket kan innebära mindre ekonomiska stimulanser. Kina och USA är världens två största kopparkonsumenter.

- Dollarn stärktes efter Fed räntebesked där räntan lämnades oförändrad och förväntas ligga kvar på dessa låga nivåer en längre tid. Trots att statistik från USA visar på en försiktig återhämtning och att den akuta krisen i Europa för tillfället dämpats genom stödlån till Grekland så dominerar för tillfället oron över den kinesiska ekonomin kopparmarknaden.

- Teknisk Analys: För tredje gången testar vi nu det fallande 233-dagarsbandet (efter ånyo en bortstötning från 55-dagarsbandet). Frågan som måste ställas är om vi är i slutfasen av att skapa en triangel. En triangel skulle definitivt försena det negativa utfall vi målat in under 2012 då trianglar faller i kategorin fortsättningsmönster. Eftersom vi gått in i triangeln underifrån så skall den följaktligen bryta uppåt (över 8695 bekräftar 9250-ish).

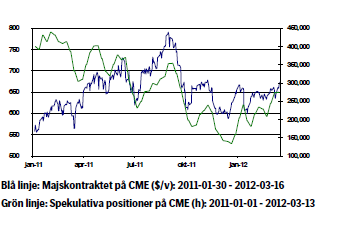

Majs

- Vår kortsiktiga vy om en fortsatt svag uppgång visade sig stämma väl under föregående vecka. En del spekulanter hade inför WASDE-rapporten den 9/3 positionerat sig mot en högre än förväntad utbudsprognos och när detta inte besannades var dessa aktörer tvungna att ta stänga korta kontrakt, vilket hjälpte priset att stiga under förra veckan. Totalt sett kunde vi se en uppgång med 4,35 procent.

- Det stora samtalsämnet är dock fortsatt huruvida Kina har börjat köpa på sig stora volymer majs från USA. Detta har fått en del spekulanter att gå in i marknaden igen, vilket bedöms vara den primära drivkraften bakom förra veckans prisuppgång.

- Konferensen Global Grain Asia 2012 gick av stapeln i Singapore under förra veckan. Enligt en representant från kinesiska myndigheter bedömer de inte att importbehovet bör öka i någon större omfattning de närmaste åren. Detta bör inte påverka marknaden den kommande veckan, men det är ändå intressant att se hur åsikterna går isär avseende landets behov, där flera stora spannmålsorganisationer istället ser ett kraftigt ökat behov från Kina.

- Enligt CME tror många analytiker att vi kortsiktigt bör kunna se bibehållna eller något högre priser, detta baserat på en generell tro att USDA överskattar den amerikanska skörden.

- Vi väljer att bibehålla vår kortsiktigt något positiva syn på majspriset. Detta bland annat baserat på det faktum att de inhemska kinesiska majspriserna fortsätter att stiga.

- Teknisk Analys: Andra försöket att bryta trendlinjen lyckades betydligt bättre än det första som ju ”spikade” ovanför linjen. Brottet har satt igång en rörelse som borde kunna ta oss upp över 233-dagarsbandet. Givet brottet av trendlinjen har vi också antagit en mer positiv vy gentemot majsmarknaden.

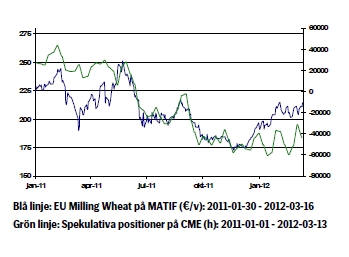

Vete

- I samband med att USDA:s jordbruksrapport kom ut förra fredagen blev nog många förvånade när de justerade ned sin prognos på de globala vetelagren för 2012. Detta tryckte förra veckan upp vetepriset i både Chicago och Paris, där det europeiska priset ökade med nästan 2,5 procent.

- Den franska analysfirman Tallage justerade i sin Stratégie grains-rapport från i torsdags ned sin förväntansbild på den europeiska veteskörden för skördeåret 2012-2013. Nu spekuleras det allt mer kring hur hårt köldknäppen i Europa under februari faktiskt kommer att slå mot den kommande skörden.

- Många oroar sig i nuläget för att stora delar av det amerikanska vintervete som börjar skördas i vår kan påverkas av snabba temperaturförändringar. Under de senaste veckorna har det varit ovanligt varmt väder i flera av de veteproducerande staterna, vilket har påskyndat utvecklingen för vetet i marken och gjort det extra känsligt för kyla. Klarar områdena under de kommande veckorna sig från för låga temperaturer bör dock skörden av vintervete i USA kunna bli omfattande detta år.

- Precis som för majspriset förhåller vi oss kortsiktigt fortsatt svagt positiva till vetepriset. Huruvida skördarna blir bättre eller sämre än förväntat får vi bättre klarhet i inom några veckor. Osäkerheten är i nuläget stor.

- Teknisk Analys: I och med brottet över B-vågens topp har vi bekräftat att nya toppar är på väg. Ett teoretiskt mål torde återfinnas runt €245. Nuvarande stopp, 199, kan nu justeras upp till 203.25.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Crude inventories builds, diesel remain low

U.S. commercial crude inventories posted a 3-million-barrel build last week, according to the DOE, bringing total stocks to 426.7 million barrels – now 6% below the five-year seasonal average. The official figure came in above Tuesday’s API estimate of a 1.5-million-barrel increase.

Gasoline inventories fell by 0.8 million barrels, bringing levels roughly in line with the five-year norm. The composition was mixed, with finished gasoline stocks rising, while blending components declined.

Diesel inventories rose by 0.7 million barrels, broadly in line with the API’s earlier reading of a 0.3-million-barrel increase. Despite the weekly build, distillate stocks remain 15% below the five-year average, highlighting continued tightness in diesel supply.

Total commercial petroleum inventories (crude and products combined, excluding SPR) rose by 7.5 million barrels on the week, bringing total stocks to 1,267 million barrels. While inventories are improving, they remain below historical norms – especially in distillates, where the market remains structurally tight.

Analys

OPEC+ will have to make cuts before year end to stay credible

Falling 8 out of the last 10 days with some rebound this morning. Brent crude fell 0.7% yesterday to USD 65.63/b and traded in an intraday range of USD 65.01 – 66.33/b. Brent has now declined eight out of the last ten days. It is now trading on par with USD 65/b where it on average traded from early April (after ’Liberation day’) to early June (before Israel-Iran hostilities). This morning it is rebounding a little to USD 66/b.

Russia lifting production a bit slower, but still faster than it should. News that Russia will not hike production by more than 85 kb/d per month from July to November in order to pay back its ’production debt’ due to previous production breaches is helping to stem the decline in Brent crude a little. While this kind of restraint from Russia (and also Iraq) has been widely expected, it carries more weight when Russia states it explicitly. It still amounts to a total Russian increase of 425 kb/d which would bring Russian production from 9.1 mb/d in June to 9.5 mb/d in November. To pay back its production debt it shouldn’t increase its production at all before January next year. So some kind of in-between path which probably won’t please Saudi Arabia fully. It could stir some discontent in Saudi Arabia leading it to stay the course on elevated production through the autumn with acceptance for lower prices with ’Russia getting what it is asking for’ for not properly paying down its production debt.

OPEC(+) will have to make cuts before year end to stay credible if IEA’s massive surplus unfolds. In its latest oil market report the IEA estimated a need for oil from OPEC of 27 mb/d in Q3-25, falling to 25.7 mb/d in Q4-25 and averaging 25.7 mb/d in 2026. OPEC produced 28.3 mb/d in July. With its ongoing quota unwind it will likely hit 29 mb/d later this autumn. Staying on that level would imply a running surplus of 3 mb/d or more. A massive surplus which would crush the oil price totally. Saudi Arabia has repeatedly stated that OPEC+ it may cut production again. That this is not a one way street of higher production. If IEA’s projected surplus starts to unfold, then OPEC+ in general and Saudi Arabia specifically must make cuts in order to stay credible versus what it has now repeatedly stated. Credibility is the core currency of Saudi Arabia and OPEC(+). Without credibility it can no longer properly control the oil market as it whishes.

Reactive or proactive cuts? An important question is whether OPEC(+) will be reactive or proactive with respect to likely coming production cuts. If reactive, then the oil price will crash first and then the cuts will be announced.

H2 has a historical tendency for oil price weakness. Worth remembering is that the oil price has a historical tendency of weakening in the second half of the year with OPEC(+) announcing fresh cuts towards the end of the year in order to prevent too much surplus in the first quarter.

Analys

What OPEC+ is doing, what it is saying and what we are hearing

Down 4.4% last week with more from OPEC+, a possible truce in Ukraine and weak US data. Brent crude fell 4.4% last week with a close of the week of USD 66.59/b and a range of USD 65.53-69.98/b. Three bearish drivers were at work. One was the decision by OPEC+ V8 to lift its quotas by 547 kb/d in September and thus a full unwind of the 2.2 mb/d of voluntary cuts. The second was the announcement that Trump and Putin will meet on Friday 15 August to discuss the potential for cease fire in Ukraine (without Ukraine). I.e. no immediate new sanctions towards Russia and no secondary sanctions on buyers of Russian oil to any degree that matters for the oil price. The third was the latest disappointing US macro data which indicates that Trump’s tariffs are starting to bite. Brent is down another 1% this morning trading close to USD 66/b. Hopes for a truce on the horizon in Ukraine as Putin meets with Trump in Alaska in Friday 15, is inching oil lower this morning.

Trump – Putin meets in Alaska. The potential start of a process. No disruption of Russian oil in sight. Trump has invited Putin to Alaska on 15 August to discuss Ukraine. The first such invitation since 2007. Ukraine not being present is bad news for Ukraine. Trump has already suggested ”swapping of territory”. This is not a deal which will be closed on Friday. But rather a start of a process. But Trump is very, very unlikely to slap sanctions on Russian oil while this process is ongoing. I.e. no disruption of Russian oil in sight.

What OPEC+ is doing, what it is saying and what we are hearing. OPEC+ V8 is done unwinding its 2.2 mb/d in September. It doesn’t mean production will increase equally much. Since it started the unwind and up to July (to when we have production data), the increase in quotas has gone up by 1.4 mb/d, while actual production has gone up by less than 0.7 mb/d. Some in the V8 group are unable to increase while others, like Russia and Iraq are paying down previous excess production debt. Russia and Iraq shouldn’t increase production before Jan and Mar next year respectively.

We know that OPEC+ has spare capacity which it will deploy back into the market at some point in time. And with the accelerated time-line for the redeployment of the 2.2 mb/d voluntary cuts it looks like it is happening fast. Faster than we had expected and faster than OPEC+ V8 previously announced.

As bystanders and watchers of the oil market we naturally combine our knowledge of their surplus spare capacity with their accelerated quota unwind and the combination of that is naturally bearish. Amid this we are not really able to hear or believe OPEC+ when they say that they are ready to cut again if needed. Instead we are kind of drowning our selves out in a combo of ”surplus spare capacity” and ”rapid unwind” to conclude that we are now on a highway to a bear market where OPEC+ closes its eyes to price and blindly takes back market share whatever it costs. But that is not what the group is saying. Maybe we should listen a little.

That doesn’t mean we are bullish for oil in 2026. But we may not be on a ”highway to bear market” either where OPEC+ is blind to the price.

Saudi OSPs to Asia in September at third highest since Feb 2024. Saudi Arabia lifted its official selling prices to Asia for September to the third highest since February 2024. That is not a sign that Saudi Arabia is pushing oil out the door at any cost.

Saudi Arabia OSPs to Asia in September at third highest since Feb 2024

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanStargate Norway, AI-datacenter på upp till 520 MW etableras i Narvik

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKina har ökat sin produktion av naturgas enormt, men konsumtionen har ökat ännu mer