Analys

SEB – Jordbruksprodukter, vecka 50

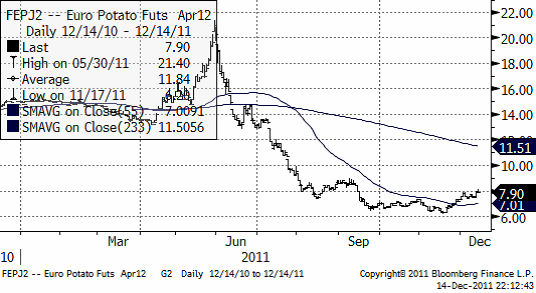

I detta det sista veckobrevet för 2011 om marknaderna för jordbruksprodukter kan vi summera året. Det senaste året har priset på kvarnvete sjunkit med 23%, rapsfrö med 12%. Mjölkpriset har stigit med 35% och urea med 52%. Tack vare gynnsamt väder har priset på potatis fallit med 71% på Eurexbörsen i Frankfurt. Dollarn är upp med 3% mot svenska kronor och euron är oförändrad, faktiskt.

I detta det sista veckobrevet för 2011 om marknaderna för jordbruksprodukter kan vi summera året. Det senaste året har priset på kvarnvete sjunkit med 23%, rapsfrö med 12%. Mjölkpriset har stigit med 35% och urea med 52%. Tack vare gynnsamt väder har priset på potatis fallit med 71% på Eurexbörsen i Frankfurt. Dollarn är upp med 3% mot svenska kronor och euron är oförändrad, faktiskt.

Konjunkturoron och med den oron för svagare efterfrågan på mat tynger marknaderna just nu. Precis som väntat åstadkom EU-ledarna ingenting, vilket gick upp för marknaden på måndagen när stora kursfall noterades på råvaru-, kapital- och kreditmarknader i hela världen. Det hela sjönk in ordentligt på onsdagen, när panikförsäljning startade i guldmarknaden och sedan spred sig till oljemarknaden och slutligen till hela råvarumarknaden. OPEC kom under onsdagens möte i Wien fram till att öka produktionen av olja (höja produktionstaket). Det hjälpte inte upp situationen på marknaden.

Den ledande kinesiska websidan för fastighetsbranschen sade i måndags att antalet fastighetsaffärer har fallit mer än 50% i 13 av de 35 största städerna och sjunkit i 27 av dem. Kinas ekonomi bromsar in och Shanghaibörsens aktieindex noterade ett kursfall i onsdags till den lägsta nivån på mer än 2 år.

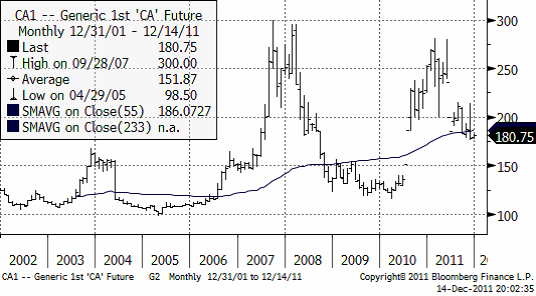

Nedan ser vi vetepriset på Matif de senaste tio åren. Priset är faktiskt ganska högt ännu i ett historiskt perspektiv och det är fortfarande attraktiva priser att säkra framtida försäljning till genom att sälja terminskontrakt.

Vete

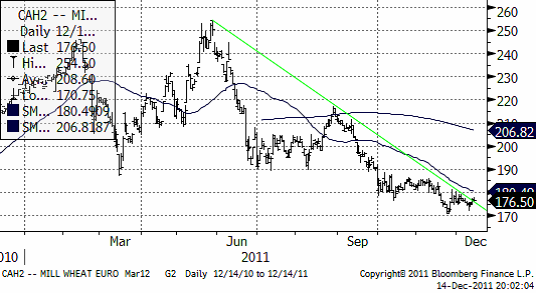

Terminspriset på Matif-vete (mars) ligger i en stadig trend nedåt.

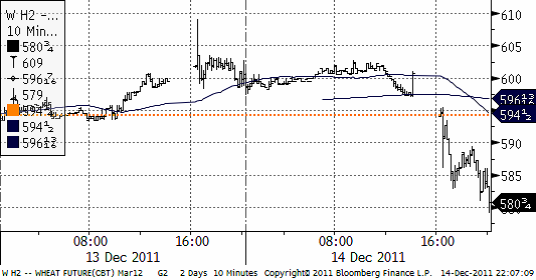

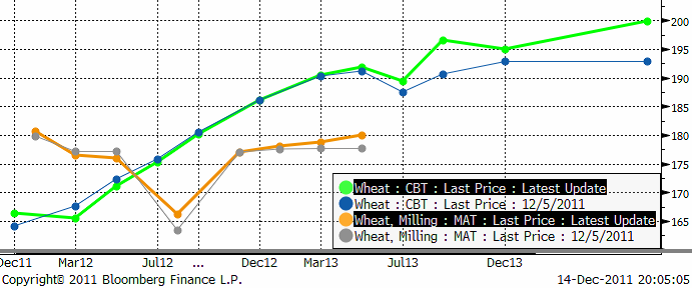

När handeln öppnade på CBOT i onsdags eftermiddag satta kursfallet fart. Priset för mars-leverans föll från 600 cent / bushel ner till 580 cent, som vi ser i diagrammet nedan.

Fredagens WASDE rapport bjöd inte på några större överraskningar då marknaden förväntade sig en höjning av estimaten för produktion samt utgående lager. Några dagar innan hade dessutom FAO kommit med sin decemberrapport där man justerade upp den globala vete produktionen till rekordhöga 694.8 mt, vilket är en ökning med 6.5% jämfört med 2010 och 10 mt mer än den tidigare högsta nivån från 2009.

Den globala vete produktionen justerades upp 5.7 mt till en all-time-high på 688.97 mt, där USDA höjer sina estimat för Argentina, Australien, Kanada och Kina medan estimaten för Nordafrika sänks något.

Den globala vete produktionen justerades upp 5.7 mt till en all-time-high på 688.97 mt, där USDA höjer sina estimat för Argentina, Australien, Kanada och Kina medan estimaten för Nordafrika sänks något.

Produktionen för EU-27 noterades oförändrad (137.49 mt) från föregående rapport. Även produktionen i Ryssland och Kazakhstan var oförändrad (56 mt resp 21 mt) medan FAO tidigare i veckan estimerade produktionen till 58 mt resp 24 mt för dessa länder.

Utgående lager (world wheat ending stocks) för 2011/12 justeras upp till 208.52 mt jämfört med 202.60 mt för en månad sedan. Detta gör att vi nu börjar närma oss historiska rekordnivåer. Intressant var också utgående lager för USA. Innan rapporten förväntade sig marknaden en snittsiffra på ca 830 miljoner bushels, en liten förändring från novembers 828 miljoner bushels, men när rapporten kom hade USDA justerat upp siffran med 50 miljoner och landade på 878 miljoner till följd av en nedjustering på 50 miljoner bushels för estimerad export.

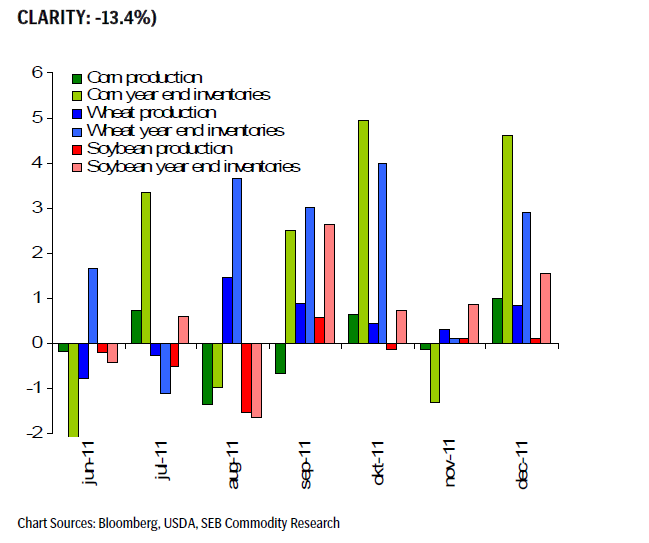

Terminspriserna sjönk som en första reaktion på WASDE-rapporten för att sedan återhämtade sig trots att rapporten var starkt ”bearish” för vetet med rekordskördar, höga lagernivåer och minskad export. Vi ser i grafen nedan (procentuell förändring) att detta är femte månaden i följd som USDA har reviderat upp produktionen och utgående lager för vete!

PRODUCTION AND INVENTORY ESTIMATE

REVISIONS

(WASDE, MONTHLY DATA, %, JUNE CORN INV. EST. CUT FOR

Men redan nu börjar marknaden att blicka fram emot januaris WASDE-rapport. Det är den rapportsom brukar ge de största prisrörelserna när den kommer ut:

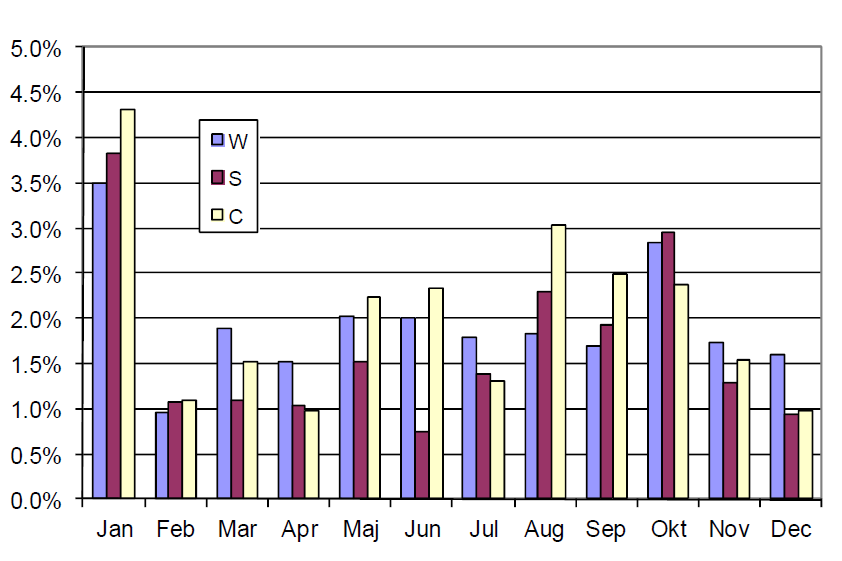

Genomsnittlig prisrörelse på WASDE-rapporteringsdagar sedan 2002 (10 år):

I fredags publicerade också FranceAgriMer sina arealprognoser för nästa säsong där man räknar med följande ökningar av arealen; vete (+1,61%), durumvete (2,79%), korn (0,91%) och raps (+1,75%). Frankrike är EU:s största producent och exportör av vete.

Enligt Coceral kommer den europeiska (EU-27) vete produktionen att uppgå till 129.64 mt i år, vilket är en justering från 128.39 mt från förra månaden.

Egyptens GASC köpte 180,000 ton vete i tisdags med jämn fördelning mellan Ryssland, Argentina och… Frankrike! Priset på det franska vetet som vann budgivningen kom in på 240.50 usd / ton, vilket var ca 3.50 usd / ton billigare än det ryska vetet på 243.98 usd / ton (FOB). Ryssland har dock ett övertag mot Frankrike vad gäller frakt (kostnad) till Egypten. Argentina erbjuder fortfarande det billigaste vetet (226.19 usd / ton) men har dyrare fraktkostnad emot sig.

Nämnvärt är också att US White Wheat fanns med i denna budgivning, men exkluderades då leveransen inte avsåg 60,000 ton. Vi ser dock att gapet i prisskillnaderna nu minskar och att både det franska och amerikanska vetet börjar bli konkurrenskraftigt mot FSU länderna.

Även det kraftiga fallet i euron ger stöd åt jordbruksprodukterna på Matif och gör att Europa åter kan konkurrera på den internationella marknaden.

Nedan ser vi terminskurvan för Chicagovete och Matif nu och för en vecka sedan. De ”feta” kurvorna är de aktuella. De ”smala” är förra veckans. Matif är nästan inte förändrat alls, medan priserna liksom förra veckan gått upp i Chicago – för längre löptider. Bakom ligger oro för kommande skörd pga La Niña kanske och förmodligen också för att räntorna (som man kan låna till) är högre.

Allt talar för att Matif-vete faller ner i första hand till 150 – 160 – euro-nivån.

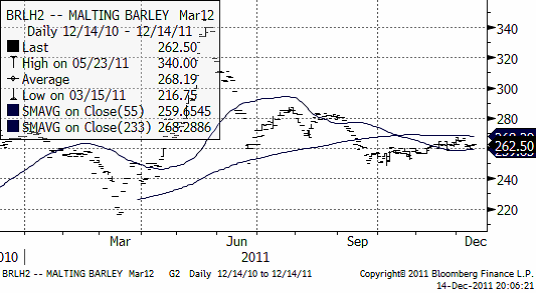

Maltkorn

Maltkornsmarknaden har behållit sin styrka relativt andra spannmål med marsleverans på Matif på 262 euro per ton.

I Ryssland försöker regeringen att stödja produktionen av maltkorn genom subventioner av inköp av utsäde och bekämpningsmedel. Även om Ryssland producerar 17 MMT foderkorn så importeras det 400 000 ton maltkorn varje år sedan 2007 för att möta de behov som finns.

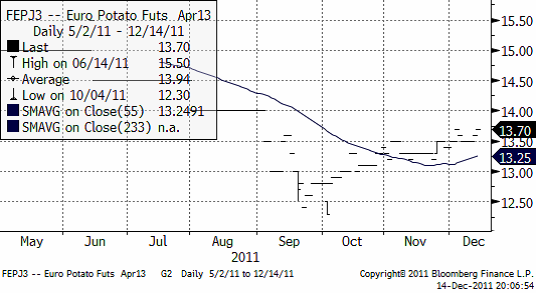

Potatis

Priset på potatis av årets skörd fortsatte stiga i veckan, ännu en vecka. Rapporten kom från Jordbruksverket tidigare i veckan om en betydligt högre skörd av matpotatis i Sverige, men informationen nådde alltså marknaden redan på försommaren, när priserna började falla. Nedan ser vi kursdiagrammet på europeisk potatis, som handlas på Eurex; terminen avser leverans april 2012.

Priset för leverans i april 2013 ligger betydligt högre på 13.37 euro per deciton och har också stigit ännu mer den senaste tiden.

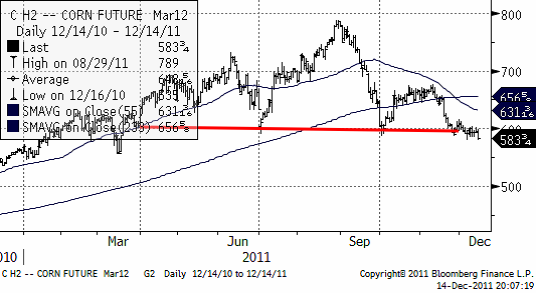

Majs

Majspriset föll liksom det mesta andra kraftigt när börserna öppnade på onsdagseftermiddagen. Den 12 december rapporterade Martell Crop Projections att tork-stressen ökat i Argentina och södra Brasiliens majsfält. De skriver

”Growing conditions have become increasingly stressful in southern South America the past 2-3 weeks with intense drying. The crop area affected by emerging drought includes Argentina’s eastern grain belt in Buenos Aires, Entre Rios and Santa Fe. La Nina is the suspected culprit. Uruguay and Rio Grande do Sul in Brazil also are very dry.”

Kopplingen till etanol och oron kring Irans kärnvapenprogram och dess potentiellt explosiva effekt på oljepriset gör majshandlare oroliga att sälja, fast mycket annat tyder på att priset borde vara lägre.

Nedan ser vi marskontraktet på CBOT, där priset just fallit ner från 600-cent-nivån.

Tekniskt ser det ut som om priset skulle kunna falla ner mot 500 cent.

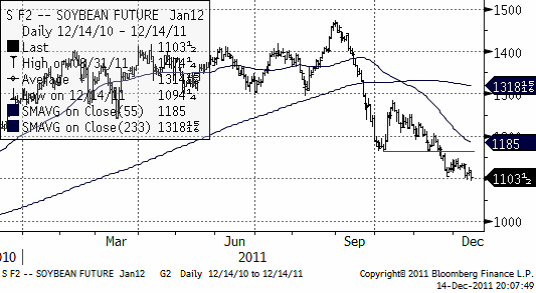

Sojabönor

Priset på sojabönor befinner sig i en sjunkande trend. Vi sade i förra veckan att den lilla rekylen uppåt var ett säljtillfälle och det visade sig rätt. Priset ligger just nu på 1100 cent, som har utgjort ett stöd. Troligtvis bryter trenden nedåt igenom nivån och då blir nästa nivå som kan utgöra ett stöd, den jämna siffran 1000 cent.

Vi är negativa ur tekniskt perspektiv de närmaste tre månaderna.

Raps

Priset på raps har gått upp och håller sig starkt med stöd från den svaga euron.

Uppgifter om att Hormuz-sundet skulle stängas på grund av militärövning (vilket förnekades av Irans utrikesdepartement) och nyheten om en attack mot en oljeledning i Irak fick råoljepriset att stiga under tisdagen och drog med sig priset på raps. Priset har också påverkats av oro över de extremt torra väderförhållanden som kan komma att påverka ny skörd.

Oljepriset föll under onsdagskvällen mycket kraftigt, med mer än 4% för Brent och mer än 5% för West Texas Intermediate. Detta bör påverka rapsfröet på Matif under torsdag och fredag. Nedan ser vi priset på februariterminen på Matif.

Matifraps var förra veckan 13% dyrare än kanadensisk canola och ligger kvar på samma nivå den är veckan. Raps är ovanligt dyrt.

Vi har en negativ vy på Matif raps.

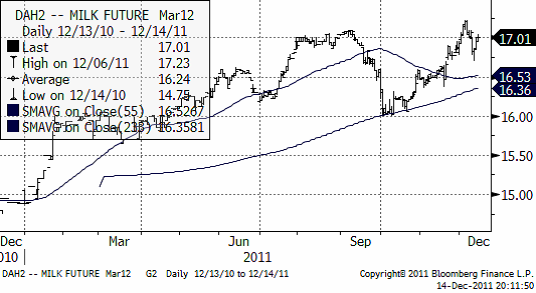

Mjölk

Nedan ser vi priset på marskontraktet på flytande mjölk (kontakt avräknat mot USDA:s prisindex). Priset har varit väldigt rörligt den senaste tiden. Trenden är uppåtriktad, men är vid den nivå som priset toppade vid under sensommaren. Det kan utgöra ett motstånd för ytterligare prisuppgång.

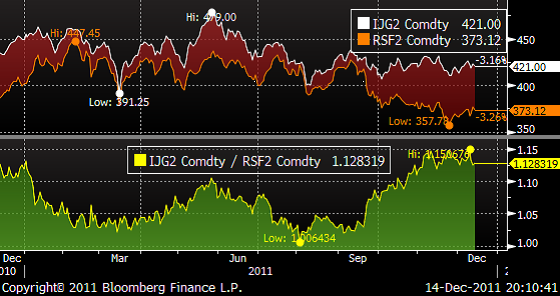

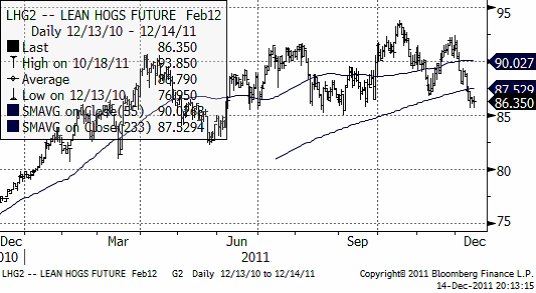

Gris

Priset på lean hogs har fallit stadigt den senaste veckan, men priset ligger ännu inom det breda prisintervall som etablerades under senvåren. 85 cent torde utgöra ett stöd, såsom botten på prisintervallet.

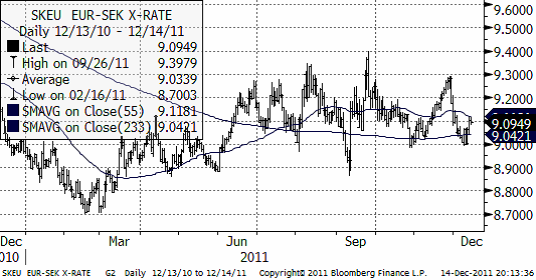

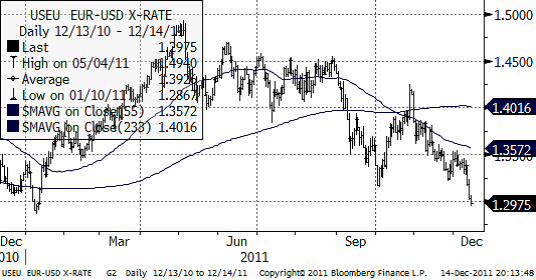

Valutor

EURSEK har märkligt nog stigit upp från 9 kr. Kanske tycker marknaden att det finns anledning att tveka även om den svenska kronans värde.

EURUSD är i en tydlig negativ trend.

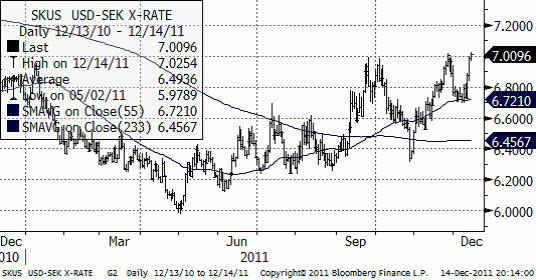

USDSEK har en stigande trend och har nått upp till heltalet 7 kr per dollar. Växelkursen har vänt ner därifrån två gånger tidigare och frågan är nu om kursen ska orka ta sig igenom den här gången.

Gödsel

Kväve

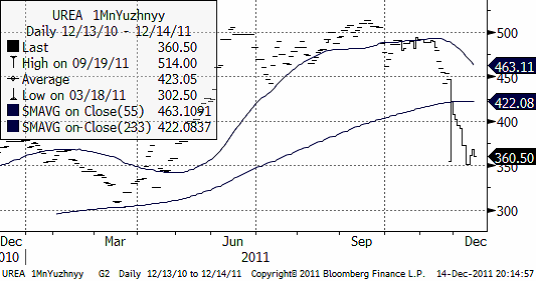

Nedan ser vi 1 månads terminspris på Urea fob Uyzhnyy. Priset har fallit kraftigt under hösten.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

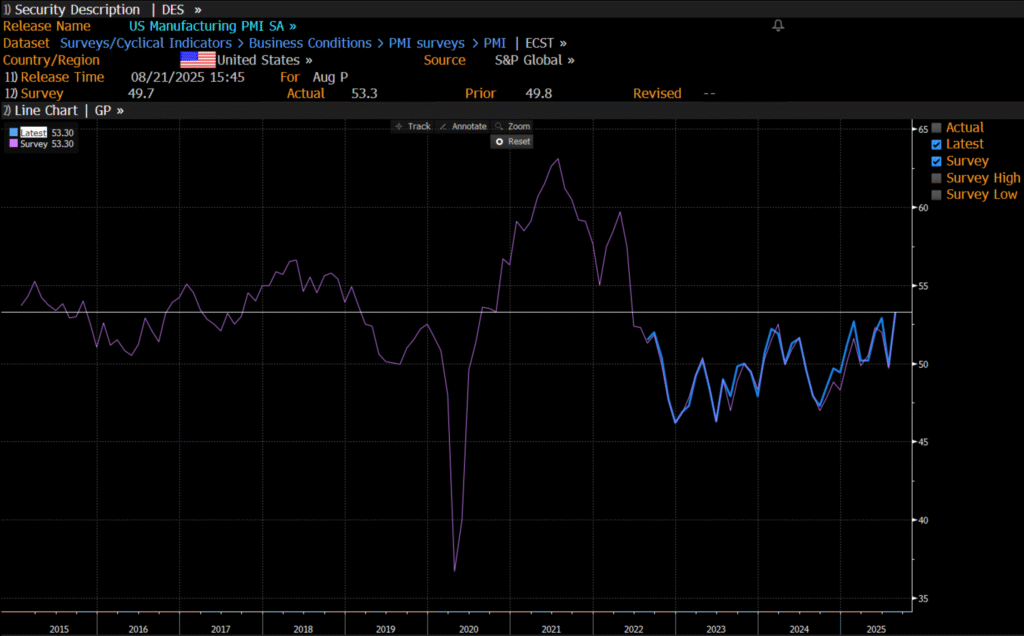

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

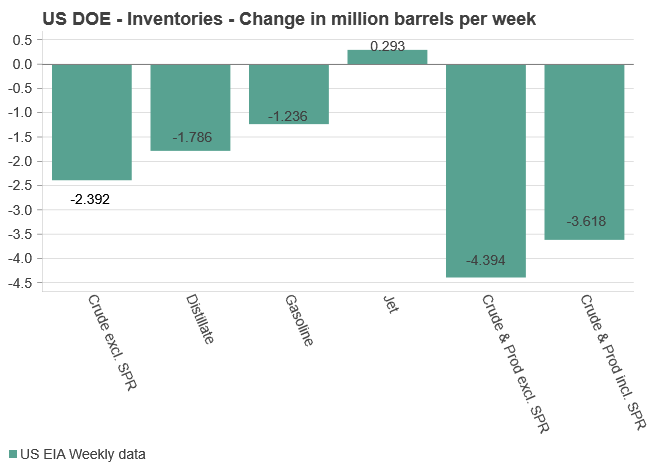

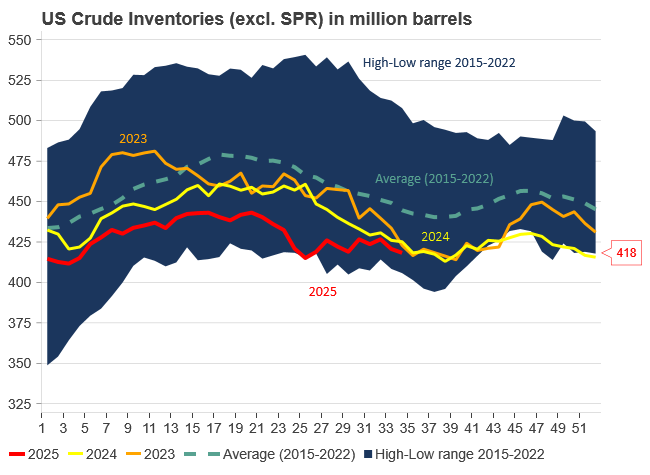

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland