Analys

SEB Jordbruksprodukter, 22 april 2013

Efter två år av avvaktande lugn på råvarumarknaden, vaknade den till liv, om man får säga så när det handlar om prisfall, i veckan som gick. BNP-tillväxten under första kvartalet i Kina kom in på +7.7%, betydligt svagare än de 8% som marknaden väntat sig. IMF reviderade ner sin prognos för global BNP-tillväxt till +3.3%. Det är den svagaste tillväxten sedan åtminstone 1980, bortsett från katastrofåret 2008. Den svaga tillväxten i världen, som nu även märks i tillväxtländer, ledde till stora prisfall på råvarumarknaden i veckan som gick.

Efter två år av avvaktande lugn på råvarumarknaden, vaknade den till liv, om man får säga så när det handlar om prisfall, i veckan som gick. BNP-tillväxten under första kvartalet i Kina kom in på +7.7%, betydligt svagare än de 8% som marknaden väntat sig. IMF reviderade ner sin prognos för global BNP-tillväxt till +3.3%. Det är den svagaste tillväxten sedan åtminstone 1980, bortsett från katastrofåret 2008. Den svaga tillväxten i världen, som nu även märks i tillväxtländer, ledde till stora prisfall på råvarumarknaden i veckan som gick.

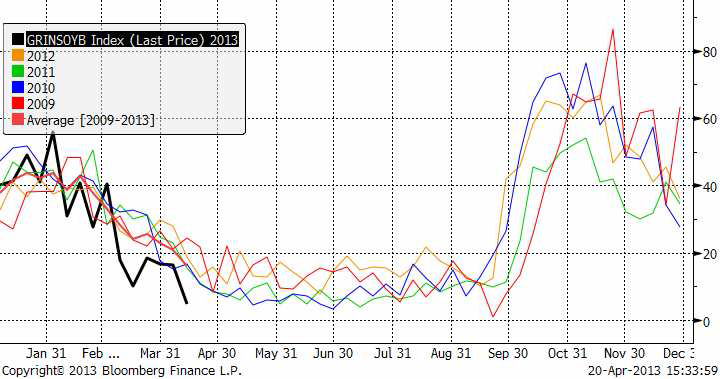

Vädret i USA har fördröjt majssådden, vilket fått majspriset att hålla sig stabilt, men i gengäld påverkat sojabönorna negativt, eftersom denna gröda då tenderar att vinna areal. Kinas svagare ekonomi tyngde också sojabönorna. Handeln är annars mest väderstyrd nu och vi går igenom detta lite djupare än vanligt.

Vädret i USA har fördröjt majssådden, vilket fått majspriset att hålla sig stabilt, men i gengäld påverkat sojabönorna negativt, eftersom denna gröda då tenderar att vinna areal. Kinas svagare ekonomi tyngde också sojabönorna. Handeln är annars mest väderstyrd nu och vi går igenom detta lite djupare än vanligt.

Odlingsväder

USA och Kanada är kallt, vått och snörikt. Australiens odlingsområden är torra och norr om Svarta-havet byggs ett högtryck upp. Norra Kina är torrt, där man odlar vete. I lördags (förrgår) föll temperaturen i Oklahoma ner till minus 4 grader och i New Mexico till minus fem grader. Samtidigt har över hälften av vetet börjat gå i ax, vilket gör plantan känslig för frost. Mer om detta nedan.

Vete

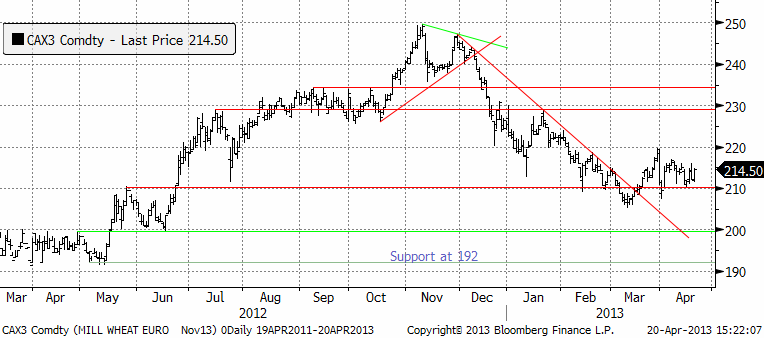

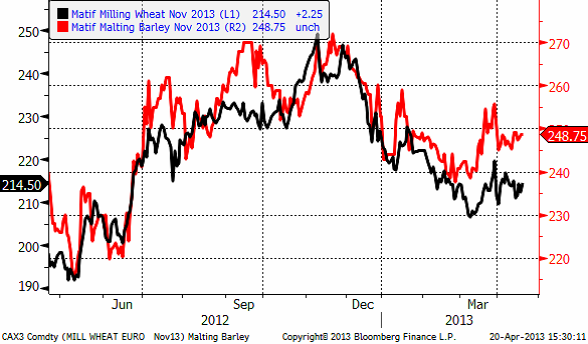

Priset på november (2013) har hållit sig över 210 euro, som nu återigen fungerar som ett tekniskt stöd. Frågan är om priset ska bryta uppåt och testa 230.

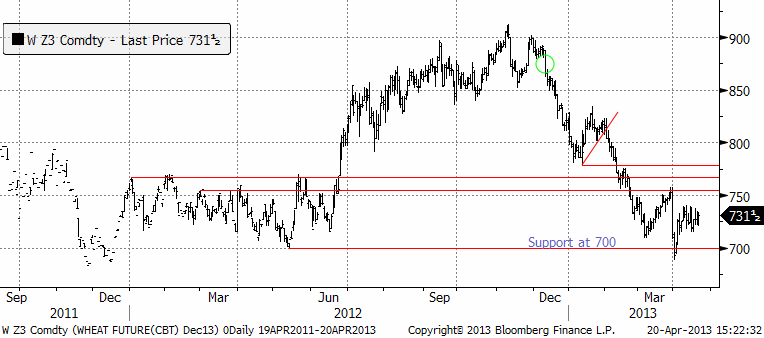

Decemberkontraktet på CBOT ser mindre ”bullish” ut än grafen för Matif-vetet. Så som Chicagovetet handlats förefaller ett test av 700 cent på nedsidan vara troligare.

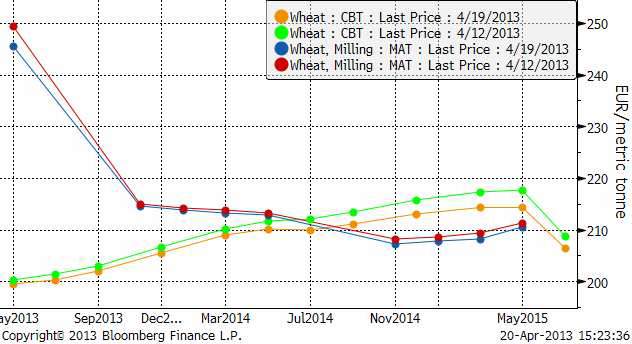

Ser vi på den senaste veckan förändring av terminskurvorna, ser vi att framförallt gammal skörd på Matif handlats ner. Det kan bero på att Tunisien faktiskt köpt ryskt vete i veckan. Det verkar alltså som om Ryssland kommit ut på exportmarknaden igen, efter att ha varit borta i nästan sex månader. I USA föll framförallt de tidsmässigt mest avlägsna leveransdatumen.

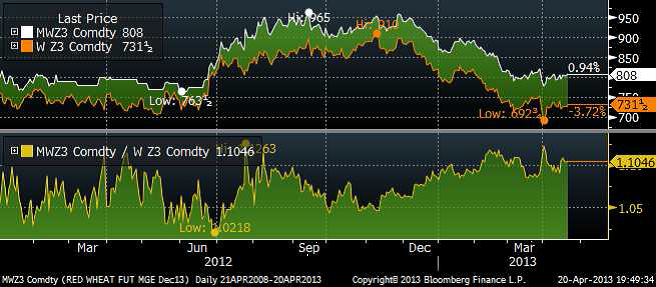

Den kalla och sena våren i USA har gjort att vårvetet på Minneapolis Grain Exchange handlats upp. I diagrammet nedan ser vi kvoten mellan priset på vårvete och chicagovete. Premien för kvalitet ökade som vi ser redan under vintern, och har legat högt – och kommer kanske att gå högre på helgens köldknäpp.

Vi ser ju faktiskt något av samma sak vad gäller maltkornet på Matif, som drar ifrån höstvetet. Strategie Grains fortsätter att justera ned sitt estimat för EU:s veteproduktion 2013/14 med ca 500 000 ton till 130 mt, vilket är den fjärde nedjusteringen i rad. Revideringen beror främst på en minskning av produktionen i Storbritannien med 330 000 ton efter förra årets katastrofala höstsådd samt lägre areal i Danmark och Spanien som resulterar i en minskning med 200 000 ton. Det blöta och kalla vädret i år har dessutom försenat höstgrödornas utveckling samtidigt som det har hämmat sådden av vårgrödor.

Estimatet för EU:s produktion plus Kroatiens, som ansluter sig och blir EU:s 28:e medlem i juli, uppgår till 131.1 mt, vilket är en nedjustering från 131.6 mt förra månaden. Men temperaturen i norra Europa, med centrum i Tyskland, har den senaste veckan legat över det normala.

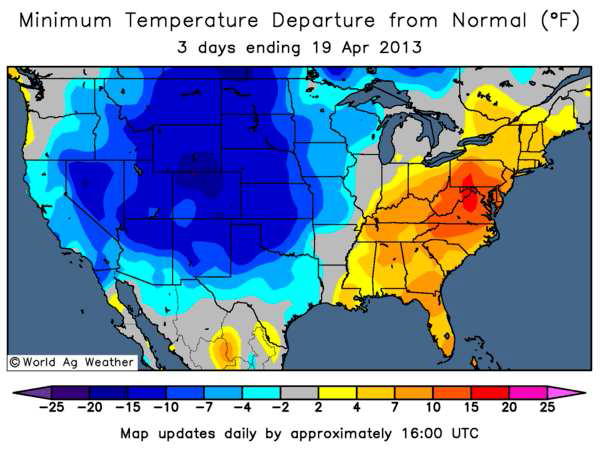

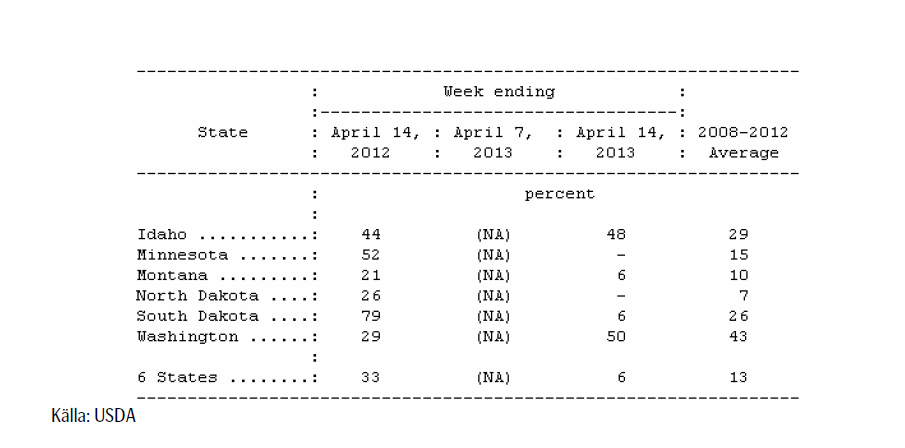

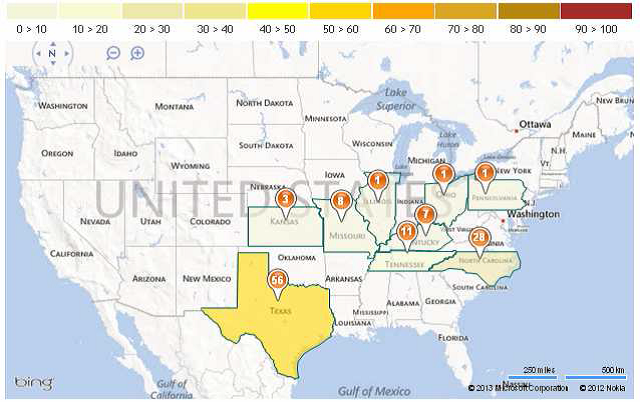

Prognosen för de närmaste två veckorna visar att värmen håller i sig. Nederbörden har också varit god och väntas vara fortsatt god. I USA har det däremot varit alarm. I Kansas, den delstat som producerar mest vete, föll temperaturen i lördags till minus 4 grader. I Texas föll temperaturen till minus 5 grader. Även Oklahoma och New Mexico berördes av frosten. Kansas, Oklahoma och Texas star för 28% av den amerikanska veteproduktionen. 68% av Oklahomas vete och 49% av Texas vete hade satt ax den 14 april enligt USDA-data. I Kansas var det bara 17% som gått i ax. Nedan ser vi de tre senaste dagarnas temperaturavvikelse från det normala. Nedan ser vi de tre senaste dagarnas temperaturavvikelse för USA.

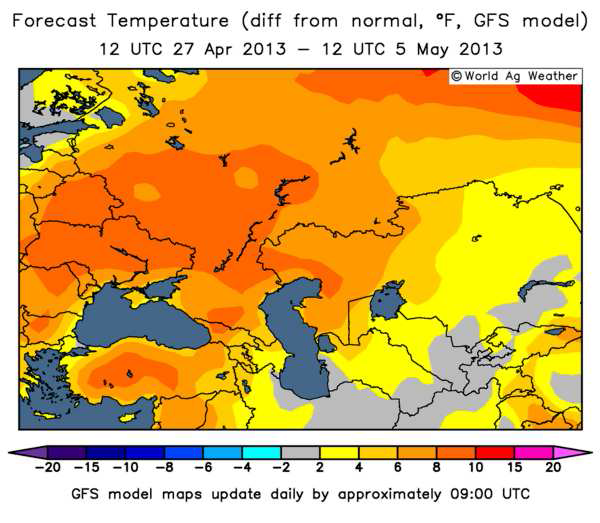

Under tiden håller ett ordentligt högtryck på att stärkas över Svartahavsområdet (Ryssland och Ukraina) med temperaturer upp till 8 grader över det normal. Det är redan ovanligt torrt i området nord – till nordost om Svarta havet.

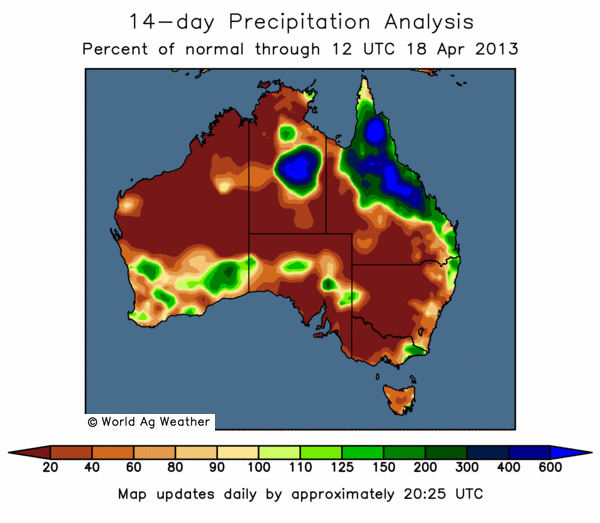

På andra sidan klotet, där vårbruket snart ska starta, är det ovanligt torrt, som vi ser av nederbördskartan nedan.

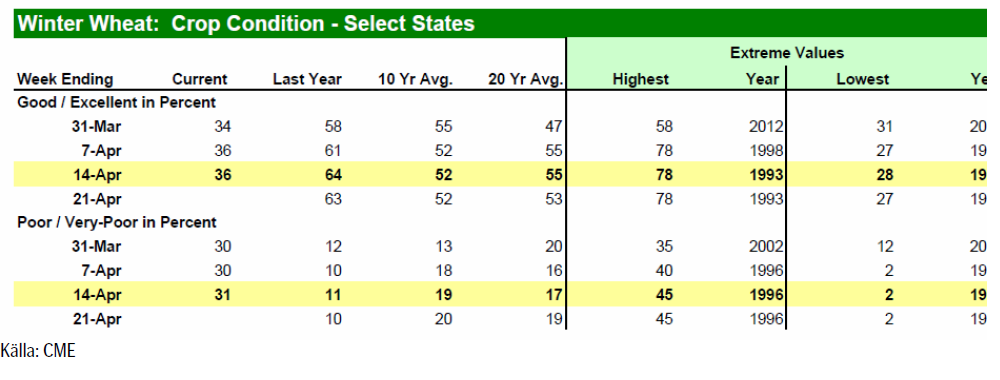

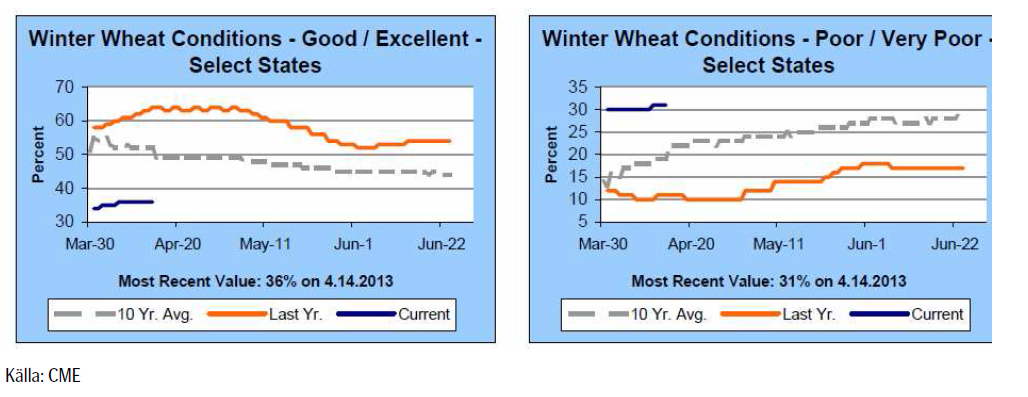

Crop progress för en vecka sedan visade oförändrat 36% i good/excellent condition.

USDA bekräftar att frost har skadat somliga höstgrödor som har kommit ur vintervilan, och som då är mer utsatta för kyla. Bl.a i Kansas, oroar sig lantbrukarna över de låga temperaturernas påverkan på grödorna, men det är fortfarande för tidigt att avgöra skadornas omfattning. I måndagens Crop Progress rapport från USDA så klassas dock fortfarande 36% av det amerikanska höstvetet som ”good/excellent” vilket är oförändrat från förra veckan, men givetvis mycket lägre än förra årets 64% vid samma tid, men samtidigt bättre än vad marknaden hade förväntat sig. Andelen grödor klassade som ”poor/very poor” har dock ökat med 1% till 31%.

Crop Progress-rapporten visar också att sådden av vårvete i USA har fått en långsam start. 6% är i marken, vilket är att jämföra med det femåriga genomsnittet på 13% och 33% förra året, som en följd av snöfall i de norra staterna som producerar vårvete. Snön, som inte bara försenar sådden, leder också till en viss oro för översvämningar vid en snabb snösmältning framöver.

Vi fortsätter tro på sidledes prisrörelse tills vidare. Vi har sett de högsta priserna för året – om det inte blir en rejäl torka i år igen. Allt annat lika bör man passa på att sälja på uppgångar tycker jag.

Maltkorn

Priset på maltkorn med leverans i november har fortsatt att visa mer styrka än höstvetet / kvarnvetet på Matif.

Majs

Majspriset (december 2013) har trotsat prisfallen på resten av råvarumarknaden och ligger på toppnivåer för månaden. I fredags stängde handeln i decemberkontraktet på 547 cent per bushel. Det är den låga takten i sådden som ligger bakom. I veckan var endast 2% av arealen sådd i USA, pga kallt och ogynnsamt väder. Från Argentina rapporterar BAGE att 32% är skördat.

Råoljepriset har fortsatt falla, men etanolpriset har stigit i veckan, vilket gett stöd för majspriset. I veckans energistatistik var etanollagren mindre, men så var även produktionen.

Strategie Grains höjer sitt estimat för EU:s majsproduktion 2013/14 med 500 000 ton till 64.6 mt som en följd av ett skifte i areal från vårkorn till majs i Frankrike, Polen och Tyskland. Estimatet för EU:s produktion plus Kroatiens uppgår till 66.5 mt, vilket är en ökning från förra månadens 66 mt. Kroatien ansluter sig till EU:s framgångsrika union och blir dess 28:e medlem från och med juli månad. Kroatien är ett land som är har ”credit rating” ”B”, har en frisk banksektor, statskulden är 60% av BNP, och livnär sig huvudsakligen på varvsindustri och säsongsturism.

Det kalla och blöta vädret i USA har också lett till att sådden av majs har fått en riktigt långsam start. USDA:s Crop Progress-rapport från den 14 april visar att amerikanska lantbrukare endast hade sått 2%, vilket är 5% lägre än det femåriga genomsnittet på 7%.

Det är också en enorm kontrast jämfört med förra året då det varma och torra vädret gjorde att 15% av sådden var avklarad vid denna tidpunkt på året.

Framförallt har vädret varit en bidragande faktor till begränsat fältarbete i Iowa och Illinois, de största producenterna av majs. I Illinois uppgick sådden till 1%, att jämföra med det femåriga genomsnittet på 12%, medan sådden i Iowa ännu inte har påbörjats.

Prisfallet har stannat av därför att sådden går långsamt. Det är vädret som styr. Om vädret förbättras och takten i sådden ökar, kan ett test av 530 cent bli aktuellt i veckan. Minns den stora arealen från prospective plantings-rapporten för ett par veckor sedan. Marknaden väntar bara på varmare och torrare väder i ”Corn belt” i USA för att sälja terminer.

Sojabönor

Sojabönorna (november 2013) har tagit nästa trappsteg nedåt och studsade på 1200 cent, med 1225 som övre motstånd. Chansen är stor att 1200 bryts i veckan som kommer. Det rapporterades bland annat i veckan att efterfrågan på griskött i USA utvecklas svagt och fågelinfluensan i Kina kan påverka importbehovet av sojabönor i Kina något sämre, allt annat lika. Det kalla och ogynnsamma vädret för sådden av majs i USA, där endast 2% var i backen i förra måndagens statistik, gör att mer areal kan flyttas över till soja istället. Soja sås senare än majs. På samma sätt som det amerikanska vädret ger stöd för majspriset, verkar det alltså negativt på sojapriset.

Det kommer naturligtvis vanlig veckostatistik också. Nedan ser vi export inspections enligt USDA.

BAGE rapporterade att skörden var klar till 39% och behöll skördeestimatet på 48.5 mt. USDA låg förra veckan på 51.5 mt. Brasiliens skörd är till 82% färdig. Det är lite snabbare än vanligt. Abiove sänkte skördeestimatet till 82.1 mt.

USDA låg i april månadads WASDE-rapport på 83.5 mt. Conab ligger högre. Vi tror att priset kommer att fortsätta falla och rekommenderar en såld position i sojabönor.

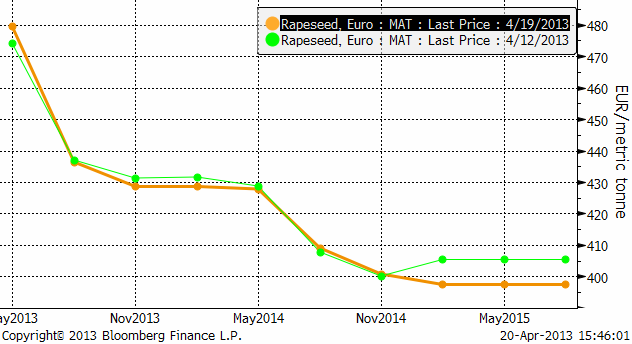

Raps

Rapspriset (november 2013) ligger kvar på någorlunda hög nivå. En anledning är att skörden i Europa väntas bli ca 1 månad senare än normalt.

Vi ser förhållandevis små förändringar i terminskurvan från förra veckan (fredag till fredag).

Om vi däremot tänker att skörden blir senare än normalt, kan det påverka utbudet för augustikontraktet på Matif. Leveranser på det kontraktet kan ske hela augusti och det är normalt sett inga problem att leverera ny skörd på det. Men i år ligger skörden kanske en månad senare än normalt. I diagrammet nedan ser vi priset på novemberkontraktet dividerat med priset på augustikontraktet. Vi ser att marknaden har börjat prisa in en försening av skörden (och utbudet). Med väsentligt bättre väder i Europa i prognosen för de kommande 14 dagarna tror vi att det kan vara värt att sälja augusti och köpa november.

Generellt sett alltså, tror vi att en såld position i raps är bra. Vi tror också att augusti är mer säljvärd än november. Att sälja augusti och köpa november är en affär som direkt spelar på att vädret förbättras fram till skörd.

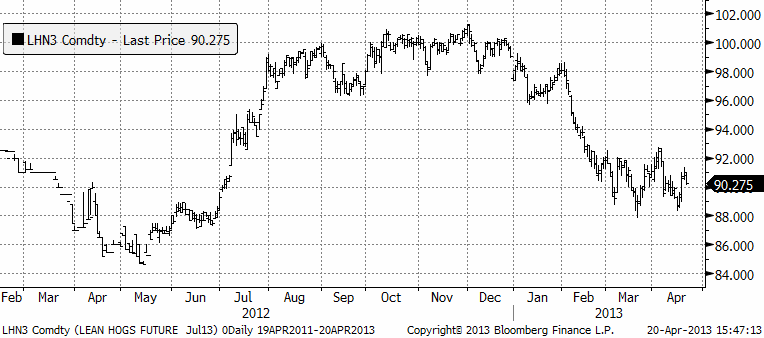

Gris

Grispriset (September 13) som har fortsatt att röra sig sidledes. Det rapporterades i veckan att efterfrågan på griskött i USA utvecklar sig svagare än väntat, vilket fick priset att falla tillbaka mot slutet av förra veckan.

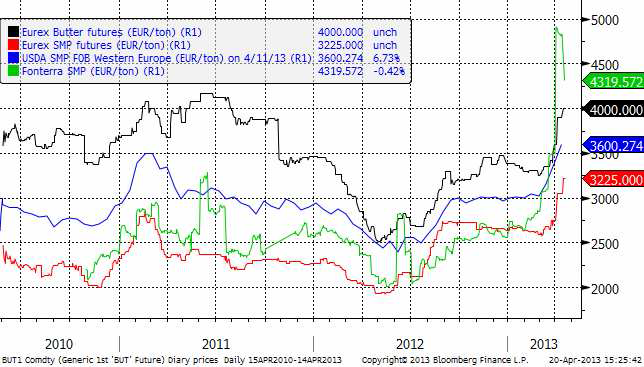

Mjölk

Fonterras pris på SMP tvärvände ner i veckan. Priset ligger fortfarande högt. Ser vi till tidigare tillfällen när Fonterra-priset rusat, ser vi att då har nedgången varit lika kraftig som uppgången och hela den abnorma uppgången tagits ut av nedgången.

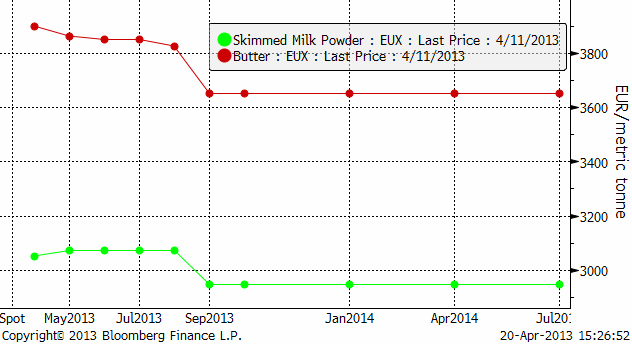

I kursdiagrammet nedan ser vi priserna på Fonterras SMP, USDA:s prisnotering på SMP i Europa och Eurex-börsens pris, samt Eurex pris på smör. Alla priser är angivna i euro per ton.

Priserna på smör och skummjölkspulver har fortsatt att stiga på Eurex. Sedan förra veckan har det implicita priset på mjölk, som man får genom att ta rätt andelar smör och SMP, stigit med 10% för leverans i maj och med 9% för leverans i juni. För leverans längre fram i tiden har det varit betydligt mindre prisrörelser.

Nedan ser vi terminskurvorna för smör och skummjölkspulver på Eurex.

SEB Commodities erbjuder ett litet ”prova-på” kontrakt som består av 0.5 ton Eurex-smör och 0.9 ton Eurex SMP. Ett paket som motsvarar 10 ton flytande mjölkråvara. Just nu är det underliggande värdet på ett sådant kontrakt drygt 33 000 kronor. Vi garanterar börspris eller bättre.

Den som vill följa priset på SMP på Eurex gör det via länken:

www.eurexchange.com/exchange-en/products/com/agr/14016/

Vi tycker att den här haussen på världsmarknaden skapar ett bra tillfälle att säkra via terminer.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

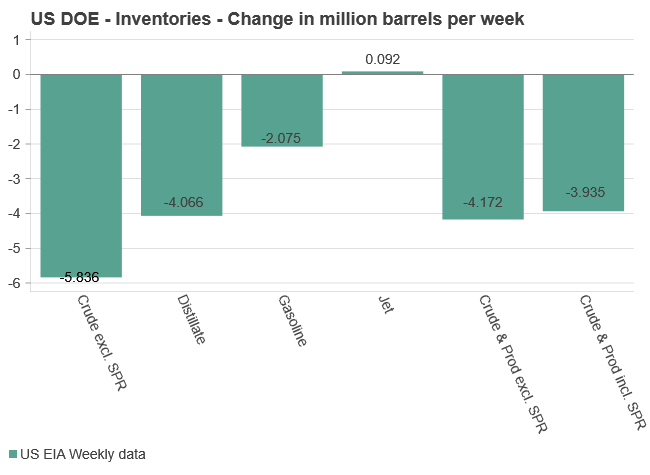

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

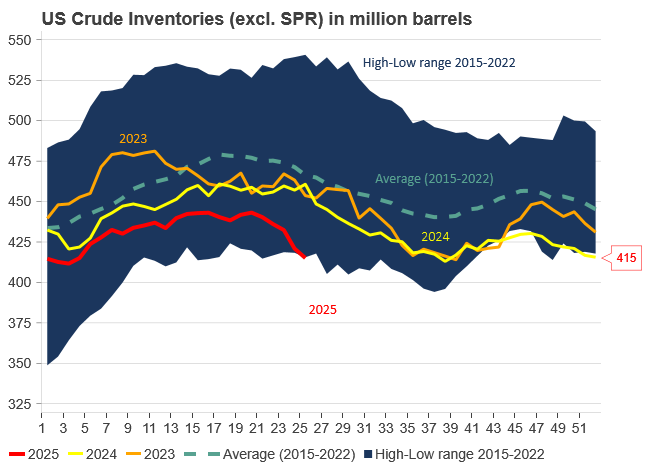

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen