Nyheter

In Saudi Arabia we trust

Price action – Gasoline prices dives 4% as smoke clears after Henry. No visible market concerns yet for hurricane Irma which is on the way

Price action – Gasoline prices dives 4% as smoke clears after Henry. No visible market concerns yet for hurricane Irma which is on the way

Brent crude oil lost 0.8% ydy with a close of $52.34/b with the rest of the forward curve declining the same as Brent crude Dec 2020 closed at $54.79/b. The front end crude curve backwardation is now all gone even though there is slightly less contango in the very front end of the market. US gasoline prices for October delivery are declining 4% this morning as the smoke clears after Hurricane Henry with refineries signalling restarts in the U.S. Gulf. Brent crude down 0.3% at $52.2/b this morning.

Crude oil comment – In Saudi Arabia we trust

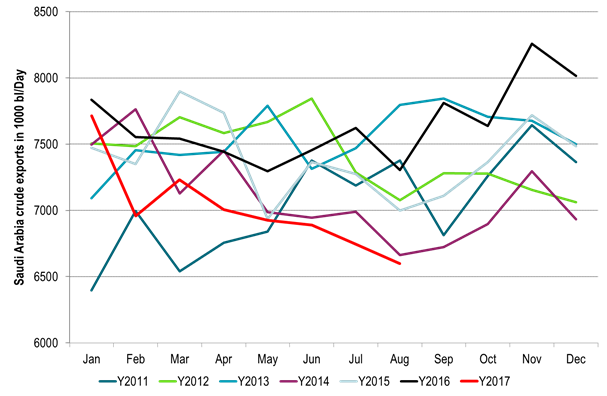

Last week the Saudi Prince Turki Al-Faisal told Bloomberg that the Saudi government is going full ahead with the Aramco IPO sometime in 2018. Yesterday Saudi Arabia lifted their Official Selling Prices (OSPs) for all grades to Asia for October delivery. We also saw that Saudi delivered close to its target of 6.5 mb/d in exports in August where the estimate is that it exported 6.6 mb/d. That is the lowest Saudi August crude export since 2010.

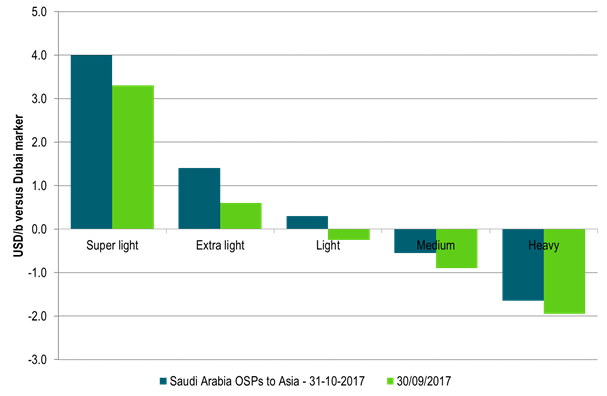

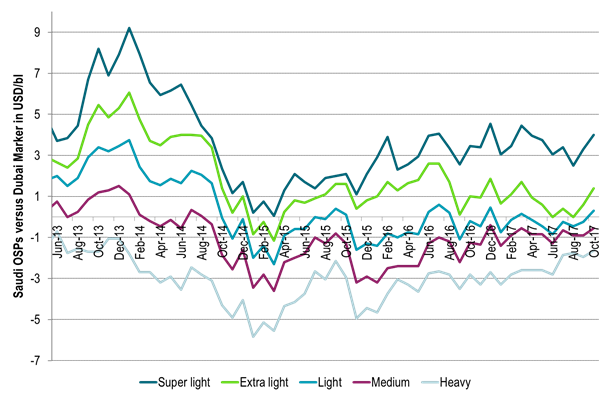

Since production cuts set in at the start of the year Saudi Arabia has held medium to heavy sour crude OSPs steady to stronger while they have softened the light, extra light and super light OSPs. Probably to avoid stimulating light sweet crude oil prices too much. I.e. they have probably tried to keep the light crude market loose, not stimulating shale, while tightening the heavier crude markets. Now we see that they are lifting the extra light and super light OSPs back up for Asia exports for October. The OSPs are the mark-up/discount versus the Dubai marker crude oil price. As they lift their OSPs they make their own crudes less attractive for Asian buyers thus directing buyers towards other suppliers like the North Sea, West Africa or the US.

Long story short. Saudi Arabia stands firmly behind their plan for an Aramco IPO in 2018. I.e. there is no way that they are going to let the oil price head into a bearish tailspin before that is done. They are backing this stand up by reducing exports and lifting OSPs. I.e. before the IPO in 2018 there is little downside risk below $50/b in our view.

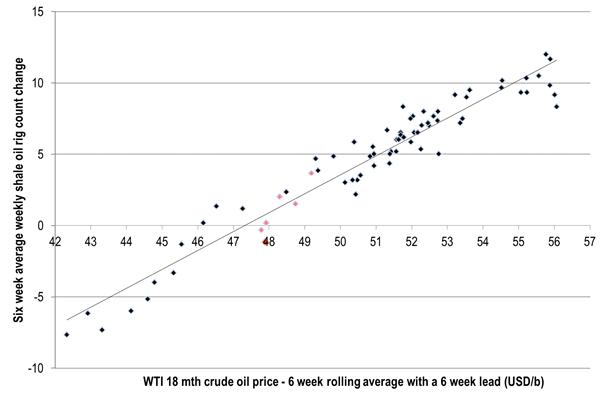

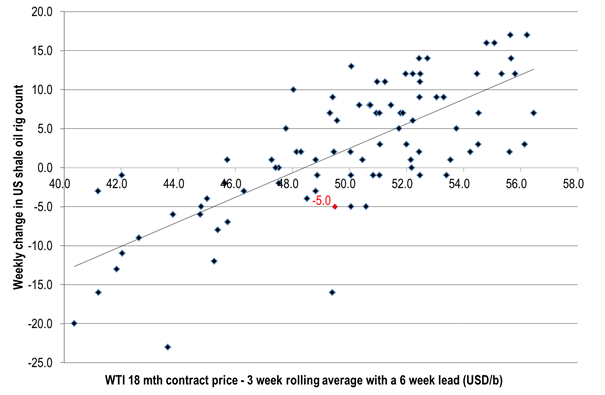

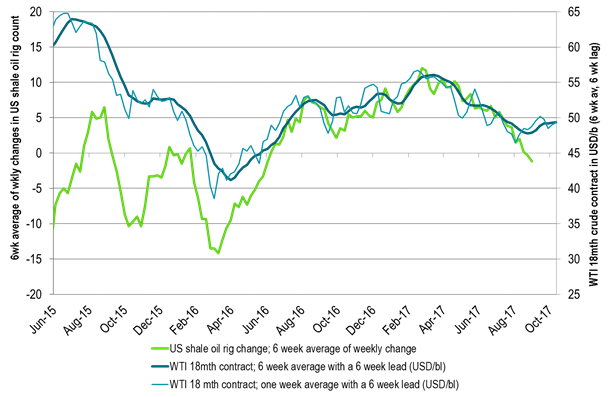

Of other things we saw that implied US shale oil rig count last week declined by 5 rigs. What we see is that the relationship over the last year between forward WTI price levels and the weekly implied shale oil rig count has started to fall apart. We are now losing shale oil rigs even if the WTI 18mth prices holds above $47/b.

Ch1: Saudi Arabia crude oil exports at 6.6 mb/d in August

Ch2: Saudi Arabia lifting all OSPs to Asia for October delivery (quoting strong demand)

Ch3: Saudi OSPs lifting back up for light crudes to levels at the start of the year

Ch4: US shale oil rig count versus WTI 18mth prices starting to come in on the low side – losing rigs

Ch5: US implied shale oil rigs versus WTI 18mth prices – less smoothing

Ch6: US implied shale oil rigs versus WTI 18mth prices – time development – pattern breaking up

Ch7: Hurricane Irma on the way – too early for market reaction as gasoline prices are falling 4.5% this morning taking no notice of this

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Nyheter

Ett samtal om ädelmetaller ur ett längre perspektiv

Det har varit en dramatisk tid för ädelmetaller, guld har gått upp kraftigt och silver har varit bortom alla gränser volatilt. Men vad kan vi lära oss av tidigare snabba rusningar i ädelmetaller? Och vilka faktorer ligger bakom det senaste årets markanta uppgång? Michael Livijn, historieintresserad chefsstrateg på Formue, diskuterar med EFN:s Gabriel Mellqvist den ovanliga utvecklingen och tittar på en krasch från 1980-talet. Han sätter också ett 100-årssperspektiv på realtillgångar.

Nyheter

Under 2025 byggde Kina klart 78 GW ny kolkraft

Kina satsade tidigare på att ersätta fossil energi med sol- och vindkraft. Men när elnäten under 2021 och 2022 började haverera på grund av det så inledde landet en ny storskalig satsning på kolkraft. En enorm infrastruktur för kolkraft började byggas och nu har landet verkligen fått upp farten på att bygga nya kolkraftverk. Över 50 stycken kolkraftverk på 1 GW vardera har under 2025 tagits i bruk med en total kapacitet på 78 GW. Det kan jämföras med att hela EU:s totala installerade kapacitet av kolkraft är 70-100 GW.

78 GW under 2025 är dock bara början. Enbart under 2025 beställde Kina mer kolkraft än det kolälskande landet Indien har gjort under ett helt årtionde. 83 GW kolkraftverk började under 2025 att byggas i Kina.

Den enorma utbyggnaden av kolkraft är väldigt positivt för sol- och vindkraftsbranschen. Ju mer kolkraft som byggs desto mer sol- och vindkraft kan elnätet hantera.

Nyheter

Samtal om den senaste tidens råvarurörelser

Det har varit dramatiska prisrörelser i flera råvaror de senaste dagarna, där bland annat silver som mest tappade 30 procent under fredagen. Spekulationshandlaren Henrik Ekenberg och mineralexperten Anton Löf ger sin syn på händelserna.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset stiger över 100 USD per uns

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset stiger till över 5000 USD per uns

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSamtal om guld och andra råvaror när flera priser rusar i höjden

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanChristian Kopfer om marknadens olika råvaror

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilver utgör nu 30 procent av kostnaden för att producera solcellspaneler

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKall och nederbördsfattig månad driver upp elpriset

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanIndien kommer inte att göra slut med kol

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKylan lyfter elpriset i vinter, minst 40 procent högre än väntat