Analys

Peak oil-teorin har peakat – men har priset gjort det?

International Petroleum Week London

International Petroleum Week London

“Peak oil theory has peaked – but has the price peaked too?”

Under veckan besökte vi den årliga internationella petroleum konferensen i London. Vårt första intryck var lika starkt som tydligt; för sex år sedan pratade alla ”peak oil”, i år pratar alla ”shale revolution”. Nedan sammanfattar vi de fundamentala förutsättningarna på oljemarknaden inför konferensen samt de diskussioner som fördes såväl på podiet som i annexen över kaffe, snacks och drinkar.

Oljemarknadens hörnpelare skakar

Vi reste till London med bilden av en oljemarknad som på pappret ser ut att möta svåra prövningar under 2014. Brent, den nya globala standarden, har snittat 110 USD under de tre senaste åren, ett väldigt högt pris med historisk blick. Under 25 år fram till 2011 snittade brent 33 USD. På kort tid har konsensus långsiktiga syn med ett brentpris över 100 USD växt sig så starkt att man kan tro att vi alla föds med den vyn. Bloombergs konsensus-undersökning visar just nu 105 USD för december 14. Goda nyheter för oljeproducenter – mindre goda för oljeimporterande länder, speciellt de lidande i Europa som med en svag euro betalar mer för sin oljenota under eurokrisen än under prisspiken på 147 USD 2008. ”That´s the Europeans´ problem isn´t it?”, som en amerikansk producent kommenterade den saken.

Emerging Markets

Första och största utmaningen för året är Kina och de övriga snabbväxande icke OECDländerna. Detta kluster ska skapa väldens ökade oljekonsumtion under året genom att kompensera för fallande konsumtion i OECD orsakad av energieffektiviseringar. Kina står för 25 % av gruppens oljekonsumtion men landets ekonomi skakar. Sista kvartalet 2013 växte drakens revir med 7,7 %, den lägsta nivån på 14 år och vår prognos är att inbromsningen fortsätter till 7,5 % under 2014. Zoomar vi in på drakens aptit för olja har den mättats oroväckande fort. Under 2013 växte den bara med 1,6 % klart under IEA:s förväntning på 3,8%. Det gjorde faktiskt att USA blev världens snabbast växande oljekonsument i fat räknat 2013. Det gör också att Kina inte längre kan axla rollen som hörnpelaren på efterfrågesidan i ekvationen som ger ett oljepris över 100 USD.

Big Ben

Det slutar inte med Kina, icke OECD blocket har problem även utöver drakens matvanor. Västvärldens maniska stimulanser efter finanskrisen har gett EM ett lyft när investerare sökt bättre avkastning utanför sina hemmamarknader och på så vis gett EM-länderna tillgång till billig finansiering. Denna rörelse har triggat ett starkt behov av råvaror – däribland olja – till EM. När nu västvärldens fanbärare, Fed har vänt på klacken och börjat strypa tillgången på ”hot money” till EM så har det skakat om EM ordentligt, både i år när tapering började och i maj 2013 när tapering påkallades av Ben Bernanke.

Geopolitiken och OPEC

Den tredje skakande hörnpelaren är den geopolitiska oron. Oron kring Iran, oljetjuvar i Nigeria, sönderfallet i Irak och inbördeskriget i Libyen har alla eldat på oljepriset under de tre senaste åren. Omkring 3 millioner fat per dag i export ligger idag nere i dessa länder. Denna förlust kompenseras ganska precist av USA:s stigande produktion vilket skapat ett status quo för oljepriset trots den dramatiska omfördelningen i produktion de senaste åren. Nu börjar emellertid dessa problem att lätta. Irak har redan ökat exporten från de södra delarna med 0,3 Mbpd och landet säger sig kunna addera 1 Mbpd under året totalt.

Förhandlingarna med Iran har däremot klappat ihop och motsvarar inte längre förväntansbilden. Lättnader i sanktionerna innefattar ännu inte olja men om de fortsätter borde oljesanktionerna släppas i mitten av året och Irans oljeexport kan då påbörja en långsam återhämtning. Om det överhuvudtaget händer.

Libyen ser däremot hoppfullt ut. Exporten är uppdämd av strejker och hot från östra delarna av landet om att sälja olja oberoende av Tripoli. Det vore osannolikt att 2014 slutar utan en lösning och möjlighet för Libyen att säkra väl behövda exportinkomster från olja. Av de tre oroshärdarna är Libyen den som snabbast kan åstadkomma en prispåverkande export och därför den främste att hålla ögonen på.

OPEC:s situation kommer därmed försämras radikalt. De icke drabbade medlemmarna i kartellen har kunnat åtnjuta hög produktion till högt pris då tre av medlemmarnas export ofrivilligt legat nere. Återvänder Libyen, Iran och Irak till export återstår det att se hur intresserade Saudi är av att skära ner på produktionen för att lämna över inkomsterna till Irak (som ännu officiellt står utanför OPEC:s gemensamma produktionskvot) och Iran?

Vad tyckte folk på IP Week?

Enklast kan man dela upp diskussionspunkterna i vad som deltagarna generellt tycktes vara

väl överrens om:

- Brent som benchmark fungerar dåligt. Den underliggande produktionen är nu under 1 Mbpd och 60-70 % av den går till Asien. Ska Brent som benchmark överleva när Nordsjöns produktion faller måste kvalitéer från Afrika eller Ryssland inkluderas.

- Energiefterfrågan kommer att öka med icke OECD-ländernas framväxt.

- Elproduktion kommer ta en allt större del av oljekonsumtionen när EM får utökad tillgång till el.

- Energikonsumtionen är mättad i OECD och kommer minska i takt med energieffektiviseringar.

- Kina kommer öka energikonsumtionen fram till 2020 och sedan plana ut.

- Konceptet med ”peak oil” är utdött, var är Aleklett nu?

- Fossila bränslen kommer att dominera under en horisont fram till 2040

- Naturgas har växt fram som den mest prisvärda energiråvaran i kontexten av ett pris på CO2 utsläpp.

…och de områden där åsikterna starkt gick isär:

- Kommer kolanvändningen öka eller minska (beror på Kinas vägval för att lösa luftproblemen)

- Hur kommer efterfrågan på energi att påverkas av OECD:s allt effektivare energianvändande? (potentialen är enorm, energiförlusten innan den slutar som användbar värme eller kyla, ljus eller rörelse är förvånansvärt stor) .

- Kommer gas ersätta oljan i transportsektorn?

- Kommer el och/eller vätgasbilar ta betydelsefulla marknadsandelar från olja i transportsektorn?

Man kan konstatera att transportsektorns ökade andel av oljekonsumtionen förde sektorn högt på agendan. Utvecklingspotentialen i sektorn skapade diskussioner. Så gjorde även de nu inte lika aktuella klimatmålen. Osäkerheten kring hur mycket koldioxid som krävs för en grad uppvärmning divergerar mer än någonsin och gör diskussionerna hypotetiska. 2 gradsmålet verkar energiindustrin inte längre ta på allvar.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

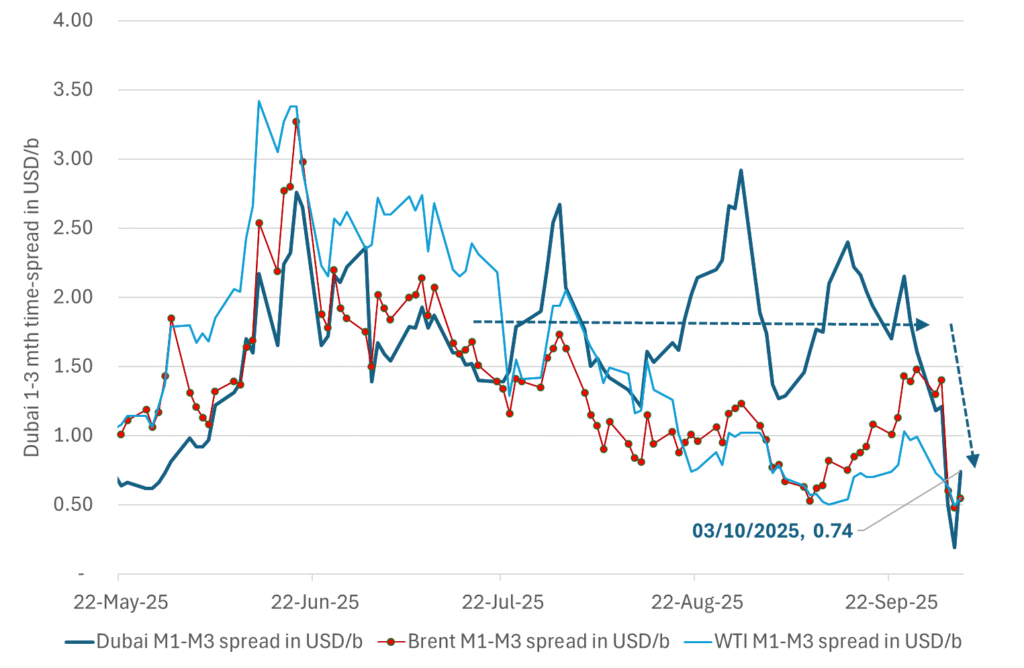

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

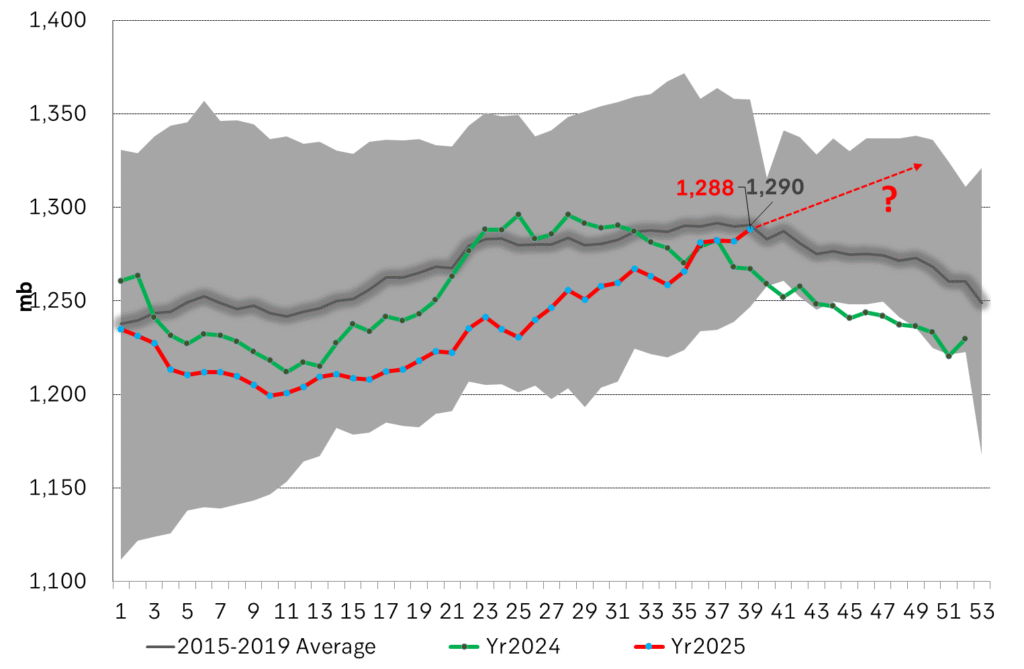

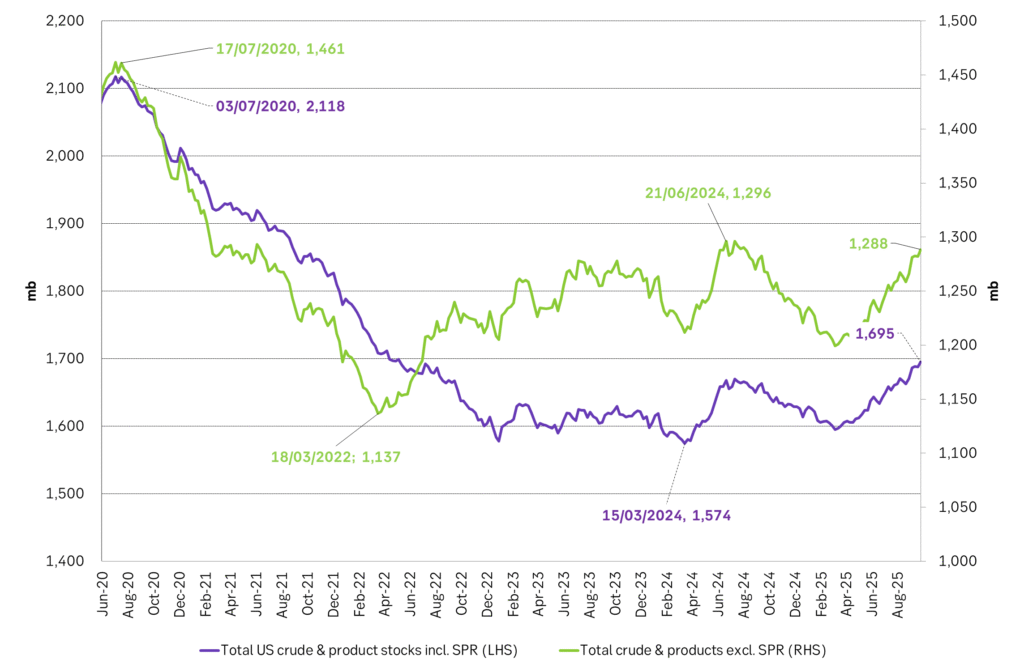

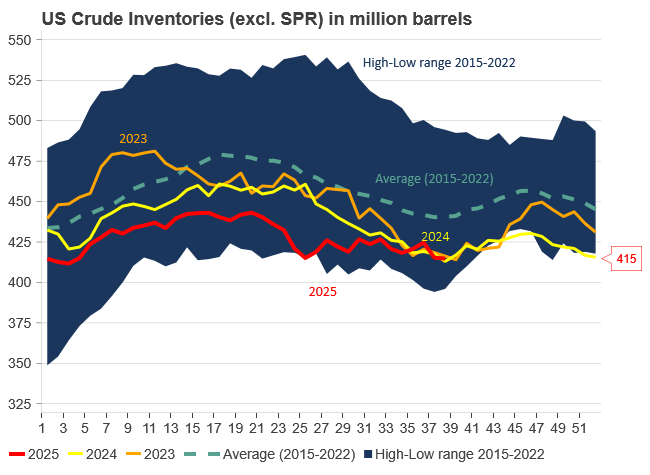

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

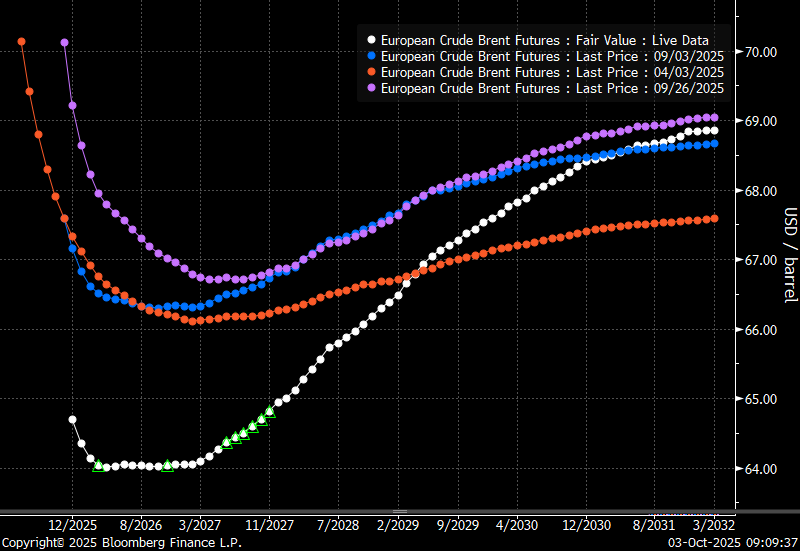

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

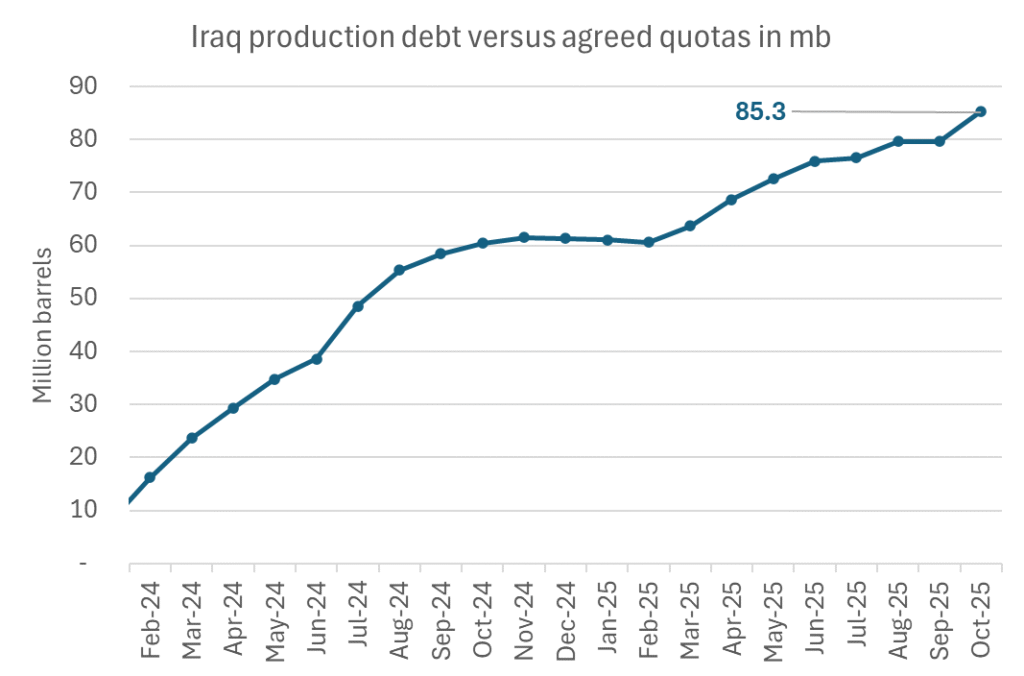

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

Analys

Modest draws, flat demand, and diesel back in focus

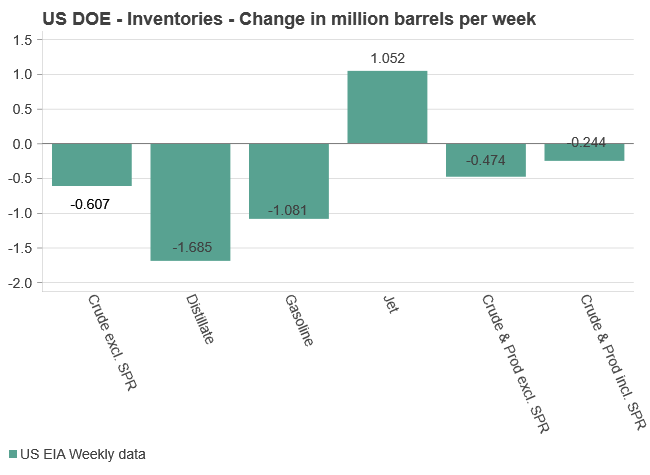

U.S. commercial crude inventories posted a marginal draw last week, falling by 0.6 million barrels to 414.8 million barrels. Inventories remain 4% below the five-year seasonal average, but the draw is far smaller than last week’s massive 9.3-million-barrel decline. Higher crude imports (+803,000 bl d WoW) and steady refinery runs (93% utilization) helped keep the crude balance relatively neutral.

Yet another drawdown indicates commercial crude inventories continue to trend below the 2015–2022 seasonal norm (~440 million barrels), though at 414.8 million barrels, levels are now almost exactly in line with both the 2023 and 2024 trajectory, suggesting stable YoY conditions (see page 3 attached).

Gasoline inventories dropped by 1.1 million barrels and are now 2% below the five-year average. The decline was broad-based, with both finished gasoline and blending components falling, indicating lower output and resilient end-user demand as we enter the shoulder season post-summer (see page 6 attached).

On the diesel side, distillate inventories declined by 1.7 million barrels, snapping a two-week streak of strong builds. At 125 million barrels, diesel inventories are once again 8% below the five-year average and trending near the low end of the historical range.

In total, commercial petroleum inventories (excl. SPR) slipped by 0.5 million barrels on the week to ish 1,281.5 million barrels. While essentially flat, this ends a two-week streak of meaningful builds, reflecting a return to a slightly tighter situation.

On the demand side, the DOE’s ‘products supplied’ metric (see page 6 attached), a proxy for implied consumption, softened slightly. Total demand for crude oil over the past four weeks averaged 20.5 million barrels per day, up just 0.9% YoY.

Summing up: This week’s report shows a re-tightening in diesel supply and modest draws across the board, while demand growth is beginning to flatten. Inventories remain structurally low, but the tone is less bullish than in recent weeks.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

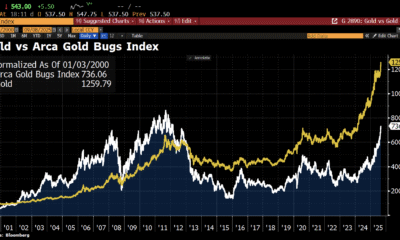

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet