Analys

Iran – Reactive Saudi means price will tick higher

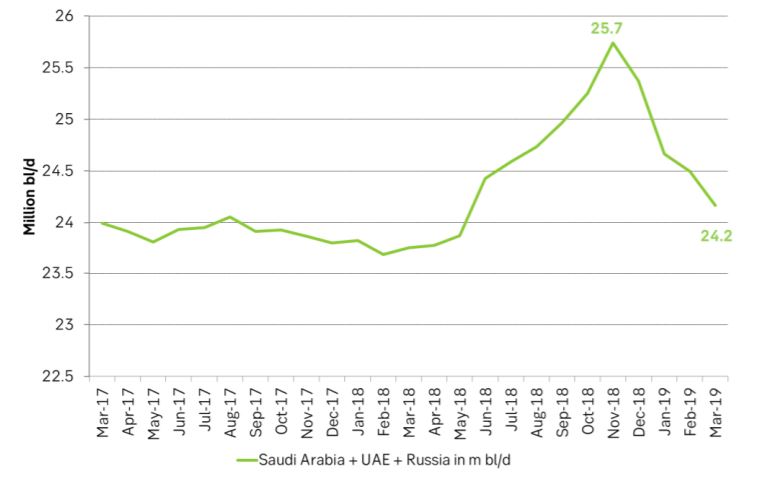

Saudi Arabia pre-emptively and proactively lifted oil production last year in anticipation of US sanctions towards Iran. Sanctions were supposed to be more or less “cold turkey” starting November last year but Donald caved in and handed out a large portion of waivers. The result was that the pre-emptive production increase by OPEC+ last year instead managed to crash the oil price down to below $50/bl. Saudi Arabia is unlikely to make the same mistake again and is in our view likely to be reactive this time. First see how much oil supply is really lost and then increase production according to needs.

That means that the oil price is likely going to continue on its current bull-ride for a while before Saudi Arabia (++) decides to pitch in with substantially more production.

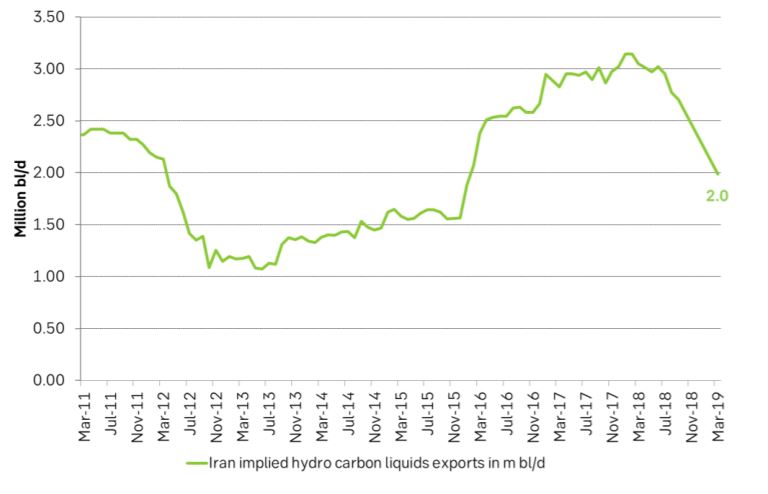

Iran probably exported about 2 m bl/d in March according to tanker tracker news. That is down 1 m bl/d from one year ago when they exported about 3.0 m bl/d liquids.

South Korea, India, Japan imported 0.75 m bl/d in March. They are likely going to comply fully so that their imports will likely fall to close to zero in May/June.

China imported 0.61 m bl/d in March versus waivers allowed by the US of 0.36 m bl/d. China has strongly opposed the US sanctions towards Iran: “The US is reaching beyond its jurisdiction” and “Our cooperation with Iran is open, transparent, lawful and legitimate”. We think that China can’t and won’t back down this time and that we could easily see an increase of Chinese oil imports from Iran up towards maybe 1.0 m bl/d

China Iran oil imports to increase and more Iran oil under the radar. There will also be an increasing amount of oil exports out of Iran which will go “under the sanctions radar”. This could probably amount to some 0.5 m bl/d and were probably already standing at around 0.3 m bl/d in March. So if China lifts imports from 0.6 m bl/d in March to instead 1.0 m bl/d and “under the radar” exports increase from 0.3 m bl/d in March to instead 0.5 m bl/d then Iran oil exports will continue at around 1.5 m bl/d versus around 2.0 m bl/d in March

Increasing collision course between the US and China. The “cold turkey” Iran sanctions from the US will force China to decide what to do, to hold its turf and claim its right to import oil from Iran. It will drive Iran closer to China and enable China to settle yet more oil in renminbi.

Russia is unlikely to hold back production in 2H-19. It reduced its production by some 0.2 m bl/d to 11.3 m bl/d in March in order to comply with the OPEC+ agreement from early December. It’ll probably lift production back up to 11.5 m bl/d in 2H-19 and then tick higher. It has been sensibly reluctant to pre-emptively promise to hold back production in 2H-19 and stated very clearly that it’ll manage production according to circumstances and that these circumstances will be evaluated when they meet with OPEC+ in Vienna in June 25/26.

Russian willingness to cut probably vanishes around $65/bl. Saudi Arabia would happily see the oil price back up at $85/bl. Russia’s willingness to cut in order to support the oil price probably vanishes around $65/bl. Russia is all-in joining Saudi Arabia on production cuts in times of surplus, rising stocks and Brent below $50/bl. It has however communicated very clearly that it is not all too eager to hold the oil price much above $65/bl as it will boost shale oil investments and production. That is alright as long as we are losing more and more supply from Iran and Venezuela. But what if those supplies come back into the market while US shale production growth is booming at the same time? Thus better to be safe than sorry and keep the oil price at around $65/bl and US shale oil activity at medium temperature.

The market will lose some 0.5 – 1.0 m bl/d. We cannot really know how much supply will now be lost from Iran. We don’t think it will go to zero but rather that exports will decline from 2.0 m bl/d in March to instead some 1.0 – 1.5 m bl/d along with increasing imports by China and “unknowns”. I.e. the market will lose some 0.5 – 1.0 m bl/d. OPEC+ can easily adjust for this. Saudi Arabia could actually do it alone.

Saudi Arabia (OPEC+) in very good control of the market. OPEC+ in general and Saudi Arabia specifically will have a very good handle of the supply situation of the oil market. I.e. Saudi will put current cuts partially back into the market and can then cut again at a later time instead.

John Bolton aiming for Iran regime shift. It has been stated that Donald Trump does not know what he want to achieve in the Middle East but that John Bolton does: a regime shift. The zero waivers is a victory for John Bolton’s politics. It increases the risk for turmoil in the Middle East.

A higher oil price is good for the US. Donald Trump has for a long time tried to aim for a low oil price in support of the US consumer and his core voters. His economic advisors have however this spring argued that a high oil price is now increasingly positive for the US economy as a whole as it is now increasingly becoming a net oil exporter. The negative for the consumers is increasingly outweighed by the positives for the oil producers. Thus Donald going for no waivers means that Donald is now increasingly siding with the producers rather than the consumers.

A more fragile oil market balance and yet more supply from the US. Less oil from Iran and a higher oil price means more US shale oil drilling and more supply growth from the US. But we are also getting a more fragile oil market. Supply from Venezuela continues to decline while supply from Libya and Nigeria is unstable as well.

Crude quality matters – IMO 2020 and diesel. Global oil supply is losing more and more medium to heavy sour crude oil which instead is largely replaced by ultralight US shale oil supply. The former is rich on medium to heavy molecule chains where the heavy chains can be converted to medium. The ultralight is rich on gasoline and light products which cannot be converted to medium elements. Medium elements mean Diesel, Gasoil and Jet fuel. Due to new fuel regulations in global shipping from 1 January 2020 the global shipping fleet will consume a lot more diesel/Gasoil like molecules. So less supply of diesel/Gasoil rich crudes but more demand means yet stronger mid-dist cracks.

Medium sour crude is typically the crude Saudi Arabia and OPEC and Russia. So if the world is craving for more Diesel, Gasoil and Jet fuel it is also craving for more of this crude. It means that Saudi Arabia and Russia (and OPEC) are in very good control of the oil market, even better than headline numbers indicate due to quality issues.

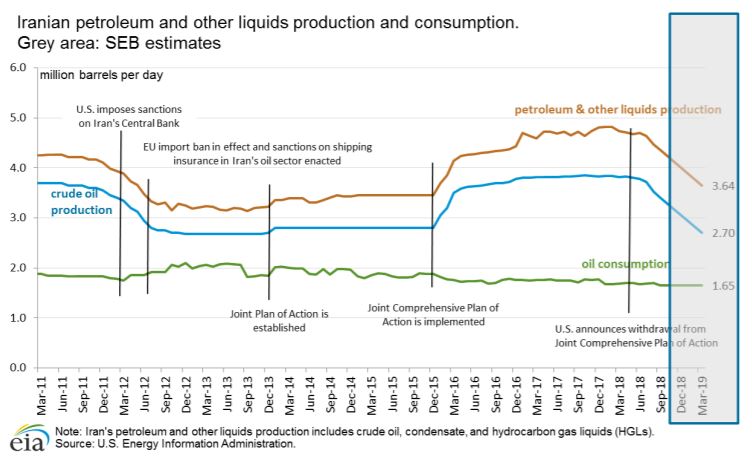

Ch1: Iran consumes some 1.7 m bl/d. In addition to 2.7 m bl/d of crude production in March 2019 it probably also produced some 0.95 m bl/d of condensates with total production of liquids of about 3.65 m bl/d. Exports thus probably stood at around 2.0 m bl/d in March which is also what tanker tracker data indicates. Exports are probably going to decline to about 1.0 to 1.5 m bl/d in May June

Ch2: Implied Iran hydro carbon liquids exports in m bl/d. US IEA data up to Sep 2018. Last data point estimated by SEB

Ch3: Saudi Arabia, UAE and Russia can easily lift production by 1.5 m bl/d

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

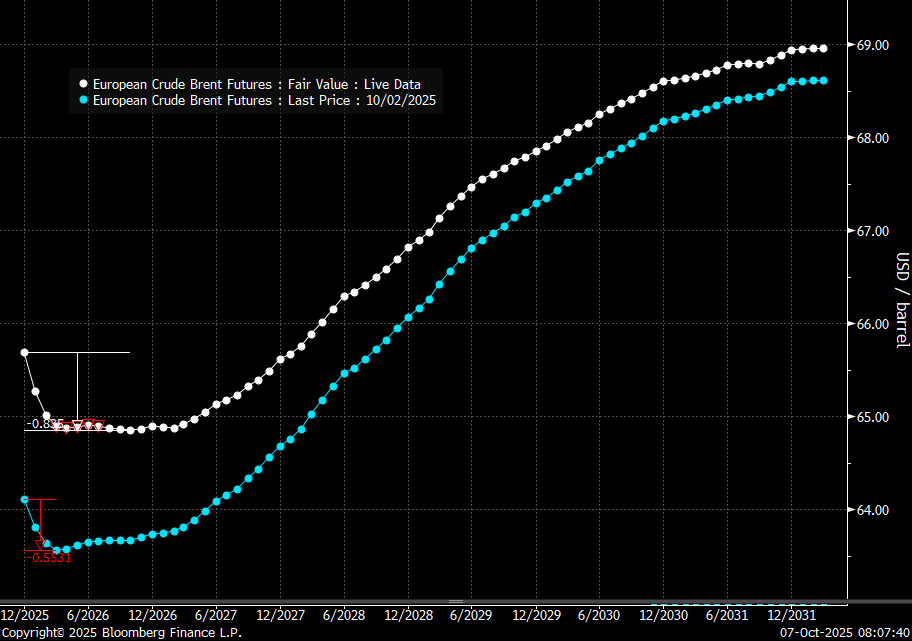

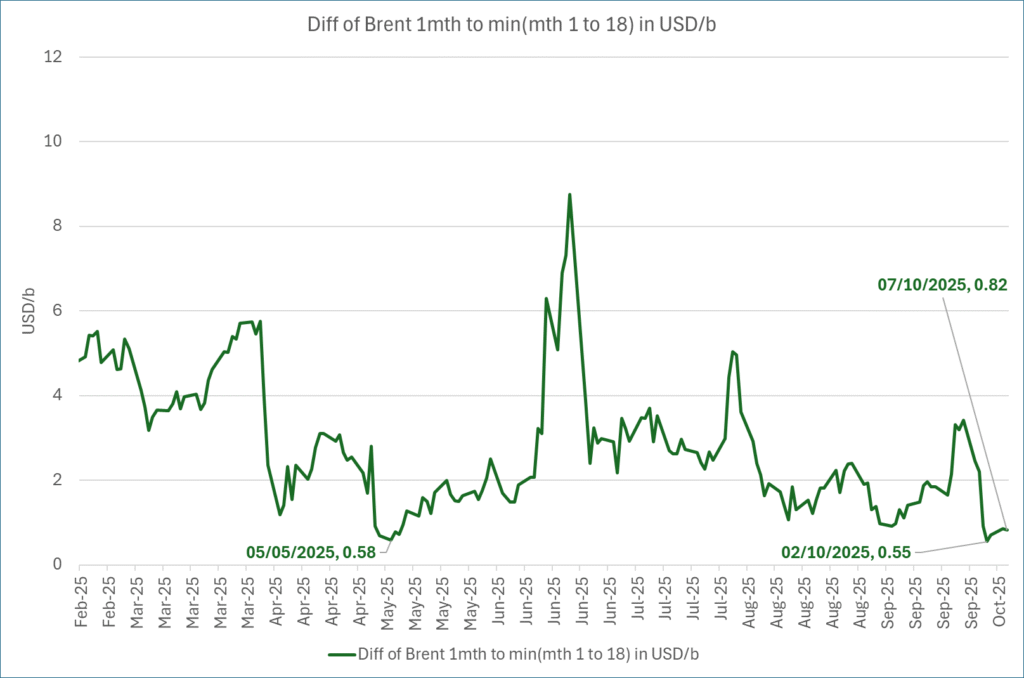

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

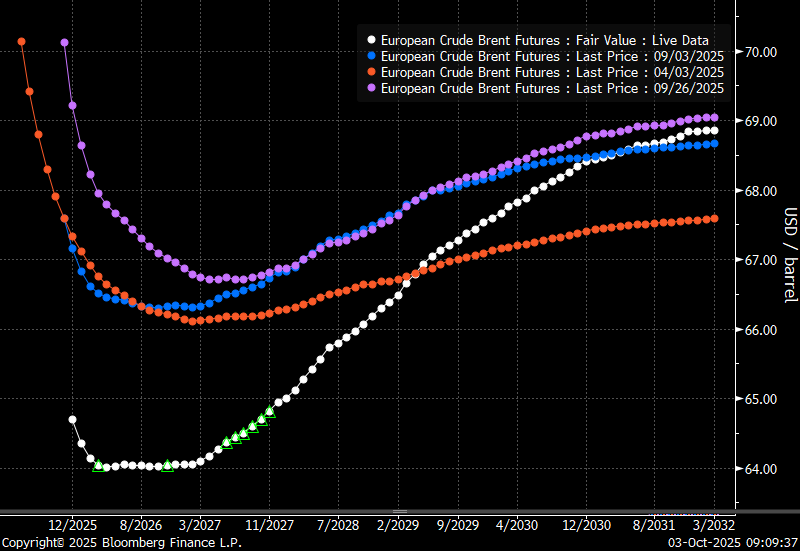

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

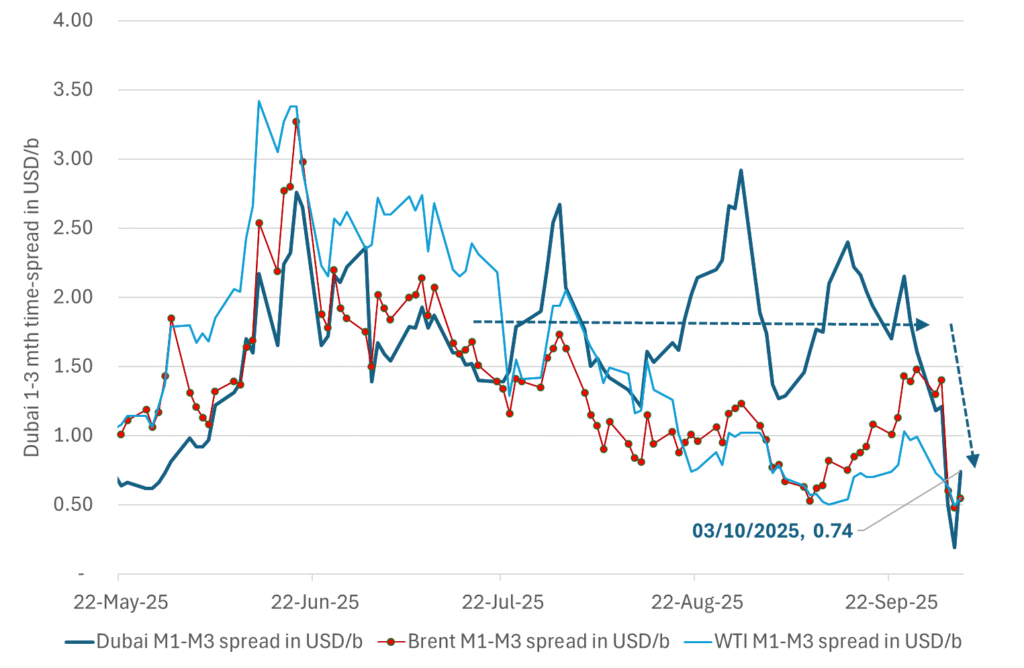

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

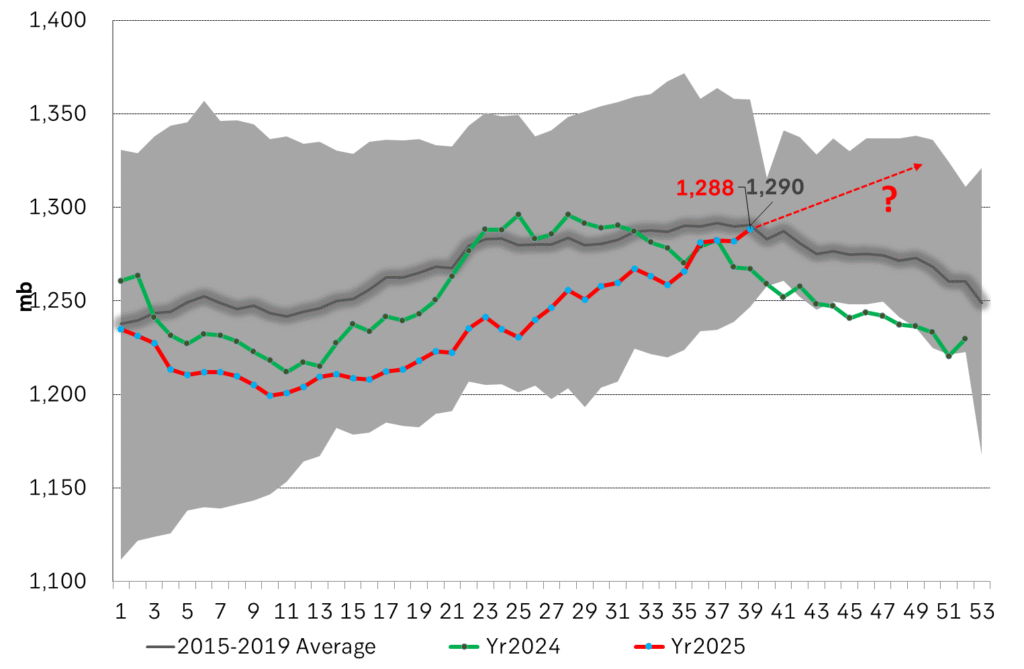

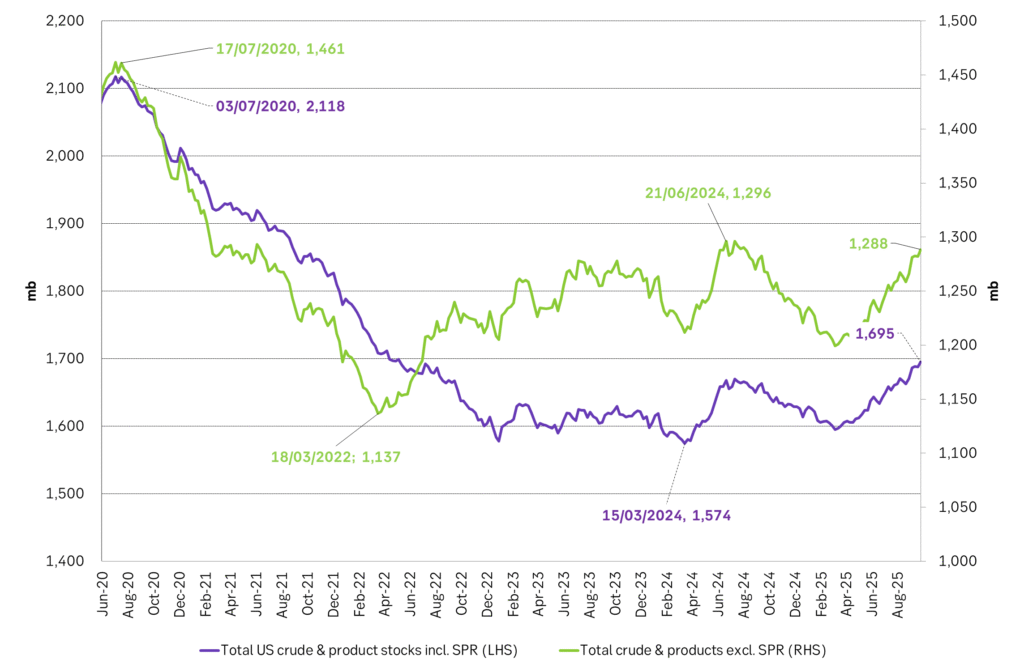

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

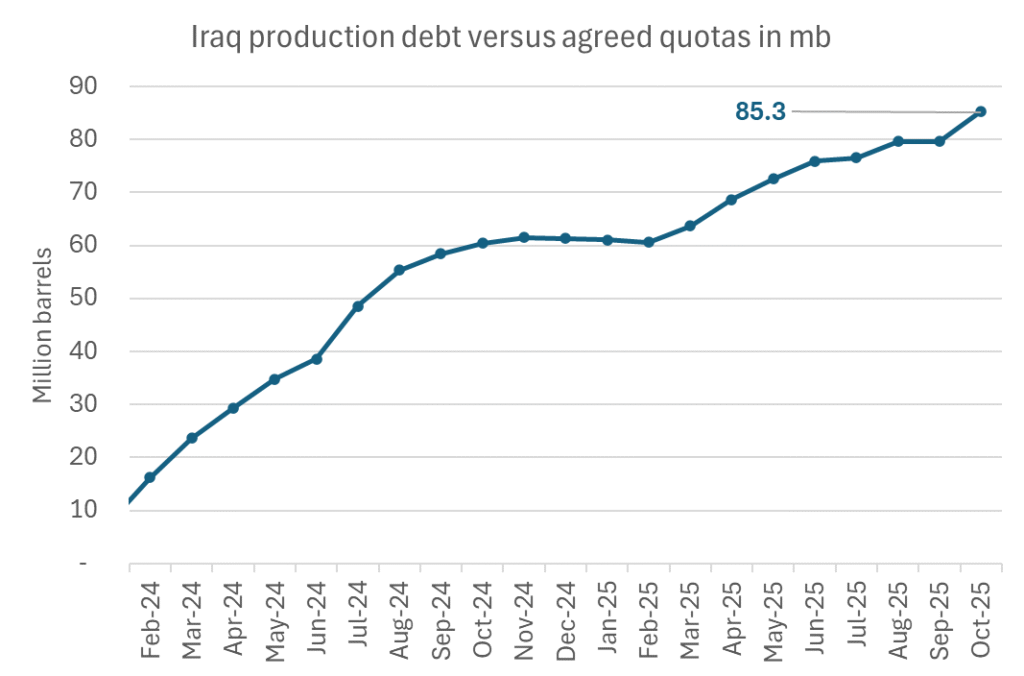

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

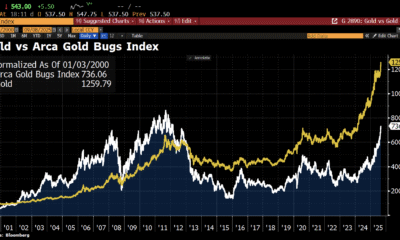

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys3 veckor sedan

Analys3 veckor sedanBrent crude ticks higher on tension, but market structure stays soft