Analys

Crude oil comment – Strong rise in US oil inventories, but oil companies’ spending cuts accelerates

In terms of my oil view: Repeated lows during H1-16. Gradual recovery medium term. Price recovery likely to be gradual rather than stellar. I think the oil price is going to have a rough time during H1-16 with a strong rise in global oil inventories and that we are probably going to see new lows in prices ahead. Thus I don’t think that from here onwards it is happy days are here again with a strong rise in the oil price from here. I think it would be negative for the oil market balance if the oil price repeated what it did last year with a rapid rise from January low to above $60/b in May/June last year. This would not induce the neccessary adjustments needed to balance the market and would push the point in time when the market finally moves into balance further out in time. HOWEVER, I do believe that there is good risk/reward in buying Brent crude oil with delivery December 2016 at $35/b. It saw a low close of $33.9/b last week and currently trades at $37.5/b and thus not too far away. I think that the longer dated contracts should not trade much lower than what we have recently witnessed. I did expect the 2020 Brent crude oil price to traded down towards $50/b before it would stabilize after long, long decline from $100/b in mid-2014. The contract traded down to $45.9/b last week and now trades at $49/b. So I think the sell-off in the longer dated contracts probably should be fairly done by now. So what remains from here is probably some more contango, more discount for front end contracts versus longer dated contracts, due to strongly rising inventories. The main argument why the price recovery is likely to be gradual rather than stellar is: 1) No quick fix balancing of the market from OPEC as in the previous two oil price cycles. The oil price needs to do the job of balancing the market and that is a more length process than an OPEC quick fix. 2) Flexible shale oil supply which can ramp up rather quickly is likely to restrict the oil price from moving up too quickly during the period when the market needs to run a deficit in order to draw down current record oil inventories.

In terms of my oil view: Repeated lows during H1-16. Gradual recovery medium term. Price recovery likely to be gradual rather than stellar. I think the oil price is going to have a rough time during H1-16 with a strong rise in global oil inventories and that we are probably going to see new lows in prices ahead. Thus I don’t think that from here onwards it is happy days are here again with a strong rise in the oil price from here. I think it would be negative for the oil market balance if the oil price repeated what it did last year with a rapid rise from January low to above $60/b in May/June last year. This would not induce the neccessary adjustments needed to balance the market and would push the point in time when the market finally moves into balance further out in time. HOWEVER, I do believe that there is good risk/reward in buying Brent crude oil with delivery December 2016 at $35/b. It saw a low close of $33.9/b last week and currently trades at $37.5/b and thus not too far away. I think that the longer dated contracts should not trade much lower than what we have recently witnessed. I did expect the 2020 Brent crude oil price to traded down towards $50/b before it would stabilize after long, long decline from $100/b in mid-2014. The contract traded down to $45.9/b last week and now trades at $49/b. So I think the sell-off in the longer dated contracts probably should be fairly done by now. So what remains from here is probably some more contango, more discount for front end contracts versus longer dated contracts, due to strongly rising inventories. The main argument why the price recovery is likely to be gradual rather than stellar is: 1) No quick fix balancing of the market from OPEC as in the previous two oil price cycles. The oil price needs to do the job of balancing the market and that is a more length process than an OPEC quick fix. 2) Flexible shale oil supply which can ramp up rather quickly is likely to restrict the oil price from moving up too quickly during the period when the market needs to run a deficit in order to draw down current record oil inventories.

Crude oil comment – Strong rise in US oil inventories, but oil companies’ spending cuts accelerates

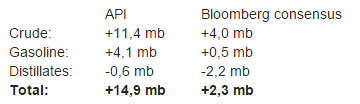

Brent crude gained 4.3% yesterday with a close of $31.8/b. Thus the rise in oil prices which started Thursday last week was not all dead after all after Monday’s 5.2% decline. Intraday high yesterday was $31.8/b and thus only $1.3/b below the 30 dma line. While we do not in general place too much emphasis on such measures they certainly have an important role in the volatile short term picture. This morning the 30 dma sits at $33.8/b and not very far avway from the Brent crude oil price this morning of $31.2/b. The 30 dma still has the potential to work as a magnet on the oil price in the short term picture. One of the bullish drivers yesterday was a statement by Iraqi’s oil minister saying that Russia and Saudi Arabia had become more flexible regarding possible production cuts. In our view there is no chance at all that we are going to see a production cut from OPEC this spring. Saudi Arabia’s strategy of not cutting and instead demanding that a balancing of the market shall happen outside of OPEC is still intact. At the moment we are seeing massive capex cuts outside of OPEC, thus the strategy is obviously working. It just takes some time. The latest signals from the US oil space is that Hess cuts its capital spending for 2016 by 40%, Continental by 66% and Noble by 50% for 2016 which will lead to reduced production by up to 10% y/y already in 2016 in the US shale oil space. Such a decline in US shale oil production is however probably already factore into most oil market balance projections for 2016. This morning the oil price falls back 1.9% to $31.2/b on the back of bearish indicative oil inventory data in the US last night. The API yesterday indicated that US oil inventories changed as follows last week:

The API thus saw in its partial data set reported by its members a much stronger rise than what was consensus in Bloomberg yesterday. Usually the API data are in the ball-park correct. So do expect a solid rise in US inventory data today at 16.30 CET. As we have stated before, if global inventories outside of the US are starting to struggle to store more oil, then a major part of the running global oil surplus needs to be stored in the US. Assuming a running surplus of 1.5 mbpd on average in H1-16 it would indicated that US oil inventories could rise by some 10 mb per week. Total US crude and product inventories have risen by 5.5 mb per week on average during the last 10 weeks, but has average 9.9 mb per week the last 4 weeks. During the first 10 weeks of the year US total oil inventories normally rise by some 1.1 mb per week and by 2.4 mb per week the first 5 weeks of the year.

US oil inventories. Marker in organge is if API indicative numbers last night is what comes out of US data today at 16.30 CET.

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

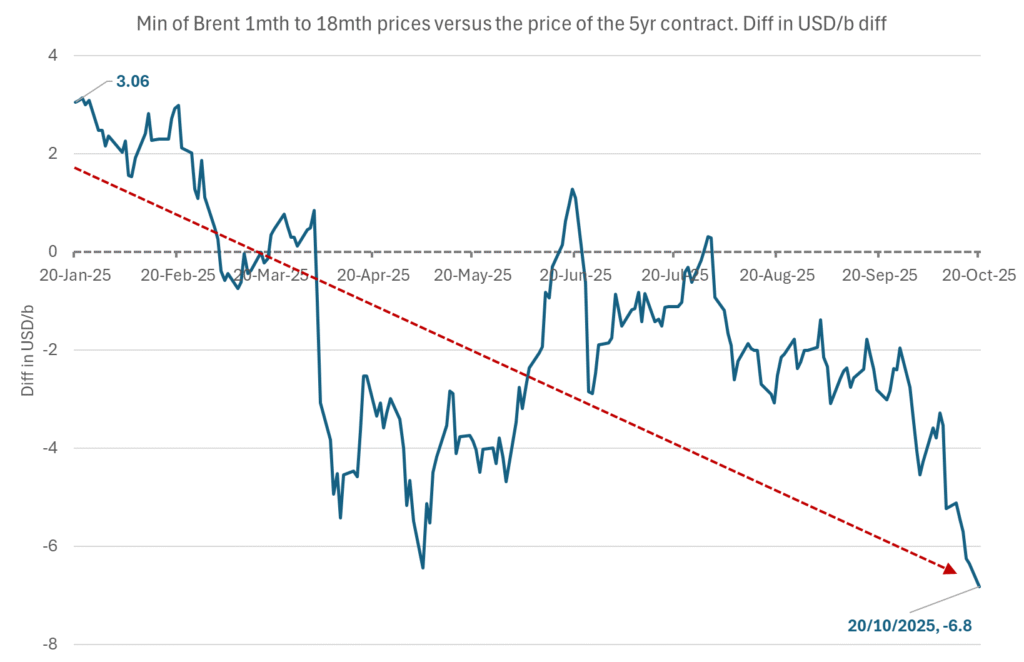

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

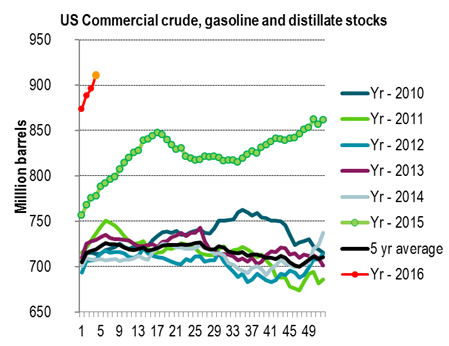

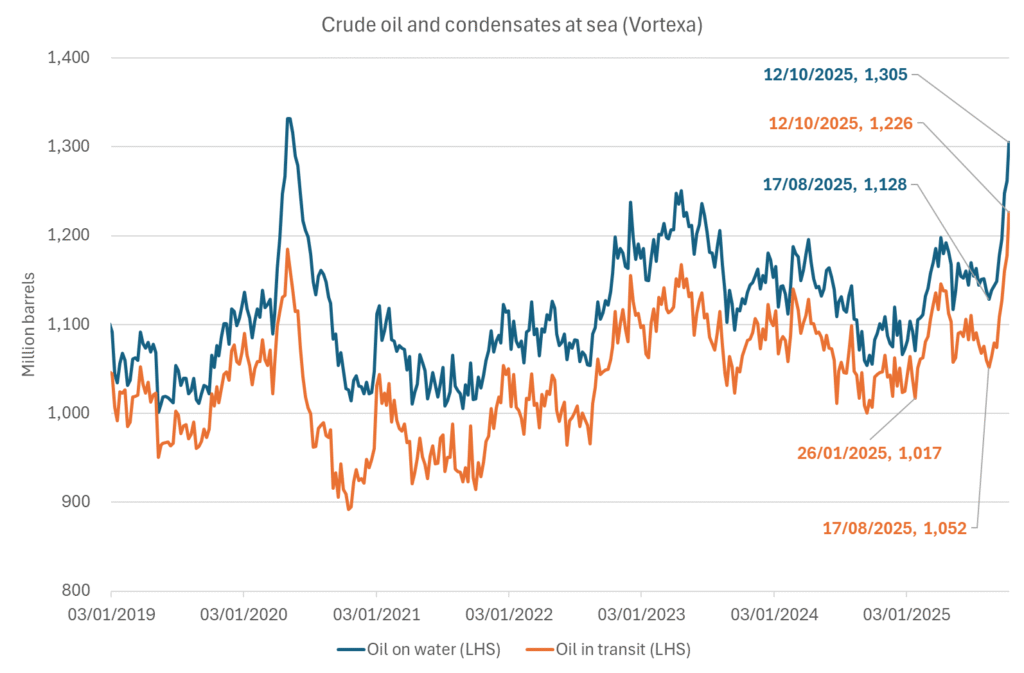

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

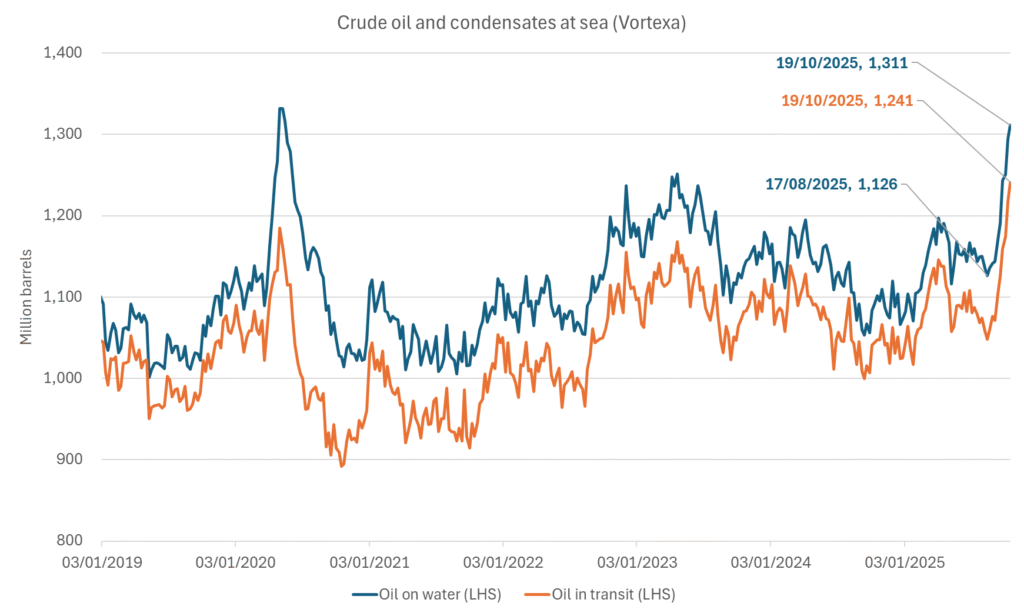

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

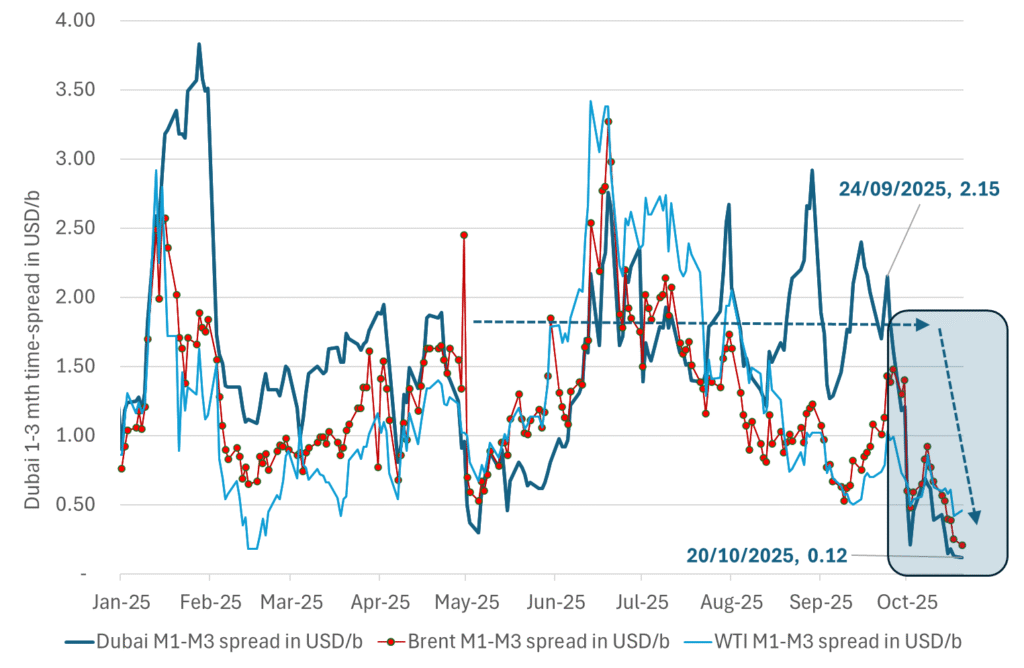

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

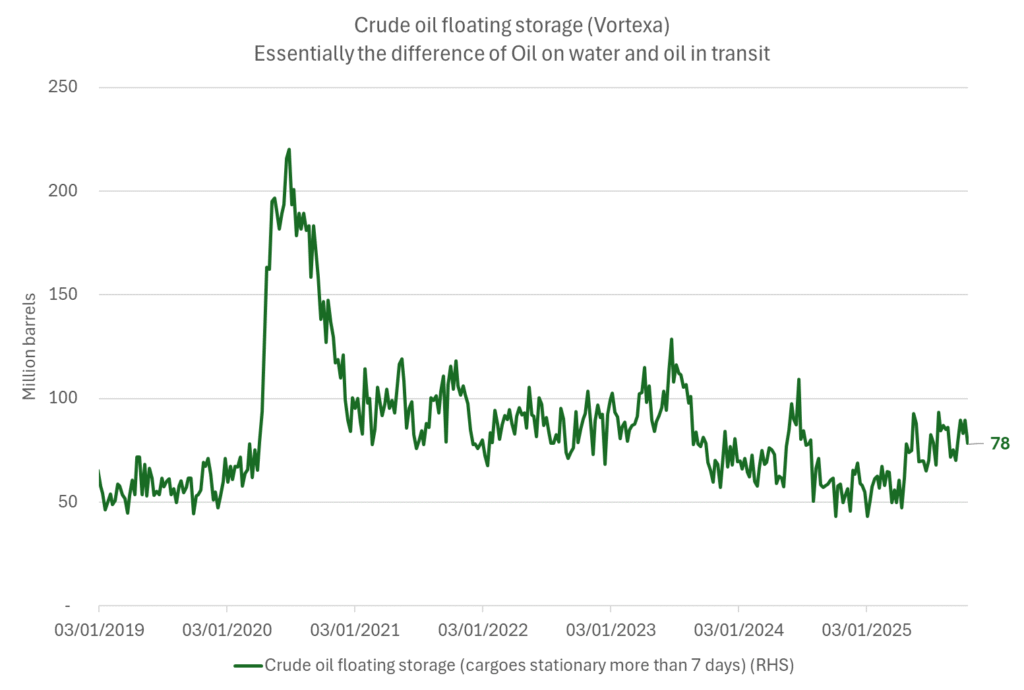

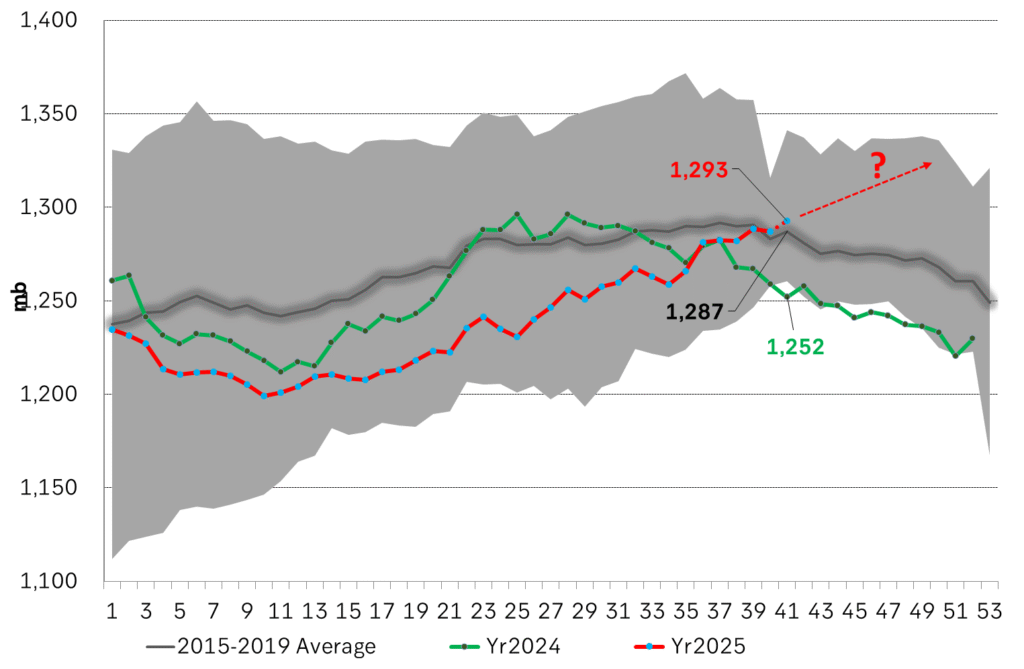

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål