Analys

A ”Game of Chicken”: How long do you dare to wait before buying?

The EUA market rallied 3.4% ydy and is adding another 0.5% this afternoon with EUA Dec-24 at EUR 54.2/ton. Despite the current bounce in prices we think that the ongoing sell-off in EUA prices still has another EUR 10/ton downside from here which will place the low-point of EUA Dec-24 and Dec-25 at around around EUR 45/ton. Rapidly rising natural gas inventory surplus versus normal and nat gas demand in Europe at 23% below normal will likely continue to depress nat gas prices in Europe and along with that EUA prices. The EUA price will likely struggle to break below the EUR 50/ton level, but we think it will break.

That said, our strong view is still that the deal of the year is to build strategic long positions in EUA contracts. These certificates are ”licence to operate” for all companies who are participants in the EU ETS irrespective whether it is industry, shipping, aviation or utilities. We have argued this strongly towards our corporate clients. The feedback we are getting is that many of them indeed are planning to do just that with board approvals pending. Issuance of EUAs is set to fall sharply from 2026 onward. The Market Stability Reserve (MSR) mechanism will clean out any surplus EUAs above 833 m t by 2025/26. Medium-term market outlook 2026/27 is unchanged and not impacted by current bearish market fundamentals with fair EUA price north of EUR 100/ton by then. Building strategic long position in EUAs in 2024 is not about pinpointing the low point which we think will be around EUR 45/ton, but instead all about implementing a solid strategic purchasing plan for EUAs for 2024.

The ingredients in the bottoming process will be: 1) Re-start of European industry as energy prices come down to normal, 2) Revival in nat gas demand as this happens, 3) Nat gas prices finding a floor and possibly rebounding a bit as this happens, 4) Asian nat gas demand reviving as nat gas now normally priced versus oil, 5) Strategic purchasing of EUA by market participants in the EU ETS, 6) Speculative buying of EUAs, 7) Bullish political intervention in H2-24 and 2025 as EU economies revive on cheap energy and politicians have 2024-elections behind them.

On #1 we now see calculations that aluminium smelters in Europe now are in-the-money but not restarted yet. On #2 we see that demand destruction (temp. adj.) in Europe is starting to fade a bit. On #3 we have not seen that yet. On #4 we see stronger flows of LNG to Asia. On #5 we see lots of our corporate clients planning to purchase strategically and finding current EUA prices attractive. On #6 it may be a bit early and so as well for #7.

For EU ETS participants it may be a ”Game of Chicken”: How long do you dare to wait before buying? Those who wait too long may find the carbon constrained future hard to handle.

Ydy’s short-covering rally lost some steam this morning before regaining some legs in the afternoon. The EUA Dec-24 ydy rallied 3.4% to EUR 53.97/ton in what looks like a short-covering-rally in both coal, nat gas, power and EUAs. This morning it gave almost all of the gains back again before regaining some strength in the afternoon to the point where it is now up at EUR 54.7/ton which is +1.4% vs. ydy. A weather forecast promising more seasonally normal temperatures and below normal winds could be part of the explanation.

The power market is currently the main driver and nat gas prices the most active agent. The main driver in the EUA market is the power market. When the EUA market is medium-tigh (not too loose and not too tight), then the EUA price will naturally converge towards the balancing point where the cost of coal fired electricity equals the cost of gas fired electricity. I.e. the EUA price which solves the equation: a*Coal_price + b*EUA_price = c*Gas_price + d*EUA_price where a, b, c and d are coefficients given by energy efficiency levels, emission factors and EURUSD fex forward rates. As highlighted earlier, this is not one unique EUA balancing price but a range of crosses between different efficiencies for coal power and gas power versus each other.

Coal-to-gas dynamics will eventually fade as price driver for EUAs but right now they are fully active. Eventually these dynamics will come to a halt as a price driver for the EUA price and that is when the carbon market (EU ETS) becomes so tight that all the dynamical flexibility to flex out of coal and into gas has been exhausted. At that point in time the marginal abatement cost setting the price of an EUA will move to other parts of the economy where the carbon abatement cost typically is EUR 100/ton or higher. We expect this to happen in 2026/27.

But for now it is all about the power market and the converging point where the EUA price is balancing the cost of Coal + CO2 equal to Gas + CO2 as described above. And here again it is mostly about the price of natural gas which has moved most dramatically of the pair Coal vs Gas.

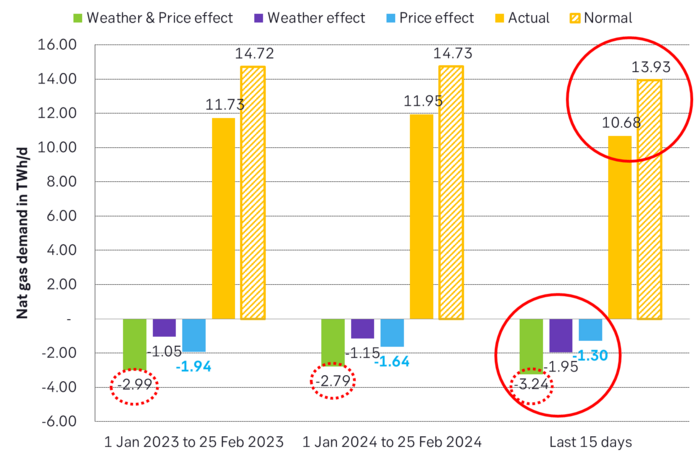

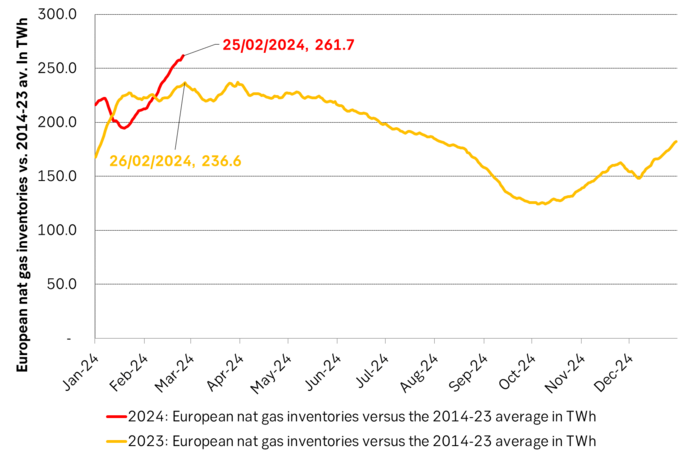

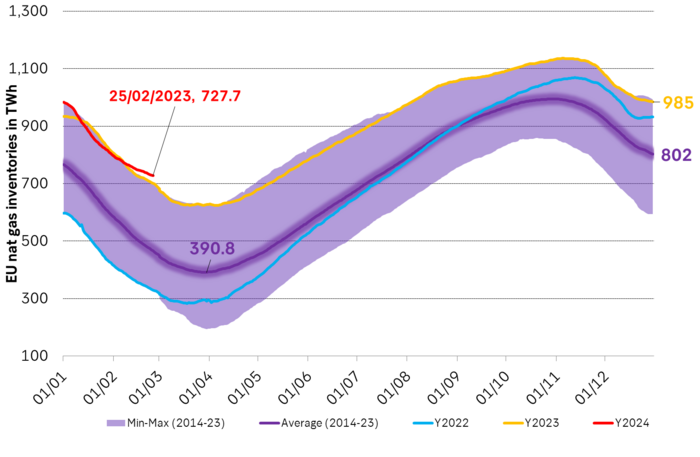

Nat gas demand in Europe is running 23% below normal and inventories are way above normal. And natural gas prices have fallen lower and lower as proper demand recovery keeps lagging the price declines. Yes, demand will eventually revive due low nat gas prices, and we can see emerging signs of that happening both in Europe and in Asia, but nat gas in Europe is still very, very weak vs. normal. But reviving demand is typically lagging in time vs price declines. Nat gas in Europe over the 15 days to 25. Feb was roughly 23% below normal this time of year in a combination of warm weather and still depressed demand. Inventories are falling much slower than normal as a result and now stand at 63.9% vs. a normal 44.4% which is 262 TWh more than normal inventories.

Bearish pressure in nat gas prices looks set to continue in the short term. Natural gas prices will naturally be under pressure to move yet lower as long as European nat gas demand revival is lagging and surplus inventory of nat gas keeps rising rapidly. And falling front-end nat gas prices typically have a guiding effect on forward nat gas prices as well.

Yet lower nat gas prices and yet lower EUA prices in the near term most likely. Nat gas prices in Europe will move yet lower regarding both spot and forwards and the effect on EUA will be continued bearish pressure on prices.

EUA’s may struggle a bit to break below the EUR 50/ton line but most likely they will. EUA prices will typically struggle a bit to cross below EUR 50/ton just because it is a significant number. But it is difficult to see that this price level won’t be broken properly as the bearish pressure continues from the nat gas side of the equation. Even if nat gas prices comes to a halt at current prices we should still see the EUA price break below the EUR 50/ton level and down towards EUR 45/ton for Dec-24 and Dec-25.

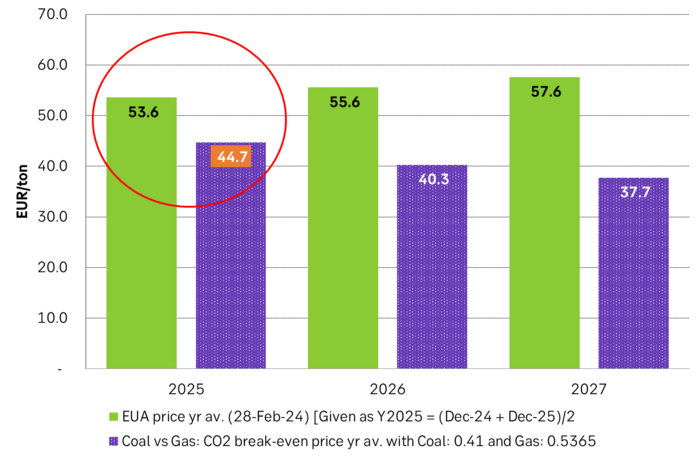

The front-year nat gas price is the most important but EUA price should move yet lower even if it TTF-2025 stays unchanged at EUR 27.7/ton. The front-year is the most important for the EUA price as that is where there is most turnover and hedging. The following attractors for the EUA forward prices is with today’s TTF forward price curve (TTF Cal-2025 = EUR 27.7/ton) and today’s forward EURUSD FX curve and with ydy’s ARA coal closing prices. What it shows is that the forward EUA attractors are down at EUR 45/ton and lower.

The front-year Coal-to-Gas differential is the most important ”attractor” for the EUA price (Cal-2025 = average of Dec-24 and Dec-25) and that is down to around EUR 45/ton with a TTF Cal-2025 price of EUR 27.7/ton. The bearish pressure on EUA prices will continue as long as the forward nat gas prices are at these price levels or lower.

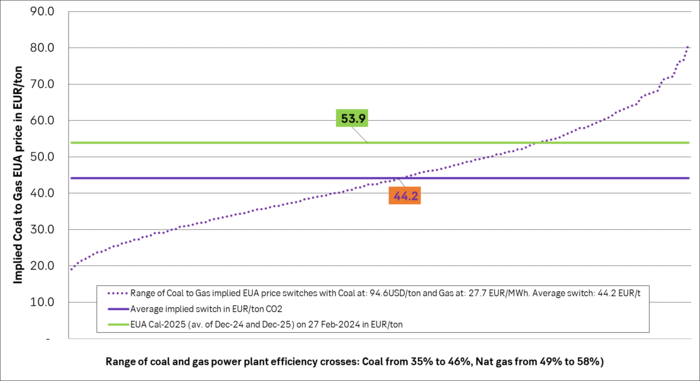

And if we take the EUA attractors from all the different energy efficiency crosses between coal and gas then we get an average attractor of EUR 44.2/ton for EUA Cal-2025 (= average of Dec-24 and Dec-25) versus a market price today of EUR 53.9/ton.

Calculating all the energy efficiency crosses between coal and gas power plants with current prices for coal and nat gas for 2025 we get an average of EUR 44.2/ton vs an EUA market price of EUR 53.9/ton. Bearish pressure on EUAs will continue as long as this is the case.

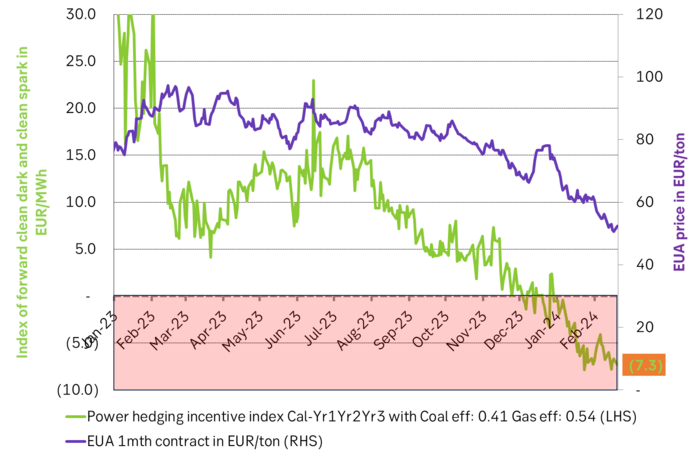

Utility hedging incentive index still deeply negative: Utilities have no incentive currently to buy coal, gas and EUAs forward and sell power forward against it as these forward margins are currently negative => very weak purchasing of EUAs from utilities for the time being.

Natural gas in Europe for different periods with diff between actual and normal decomposed into ”price effect” and ”weather effect”. Demand last 15 days were 23% below normal!

Natural gas inventories in Europe vs the 2014-2023 average. Surplus vs. normal is rising rapidly.

Nat gas inventories in Europe at record high for the time of year. Depressing spot prices more and more. Nat gas prices are basically shouting: ”Demand, demand, where are you?? Come and eat me!”

Analys

Crude stocks fall again – diesel tightness persists

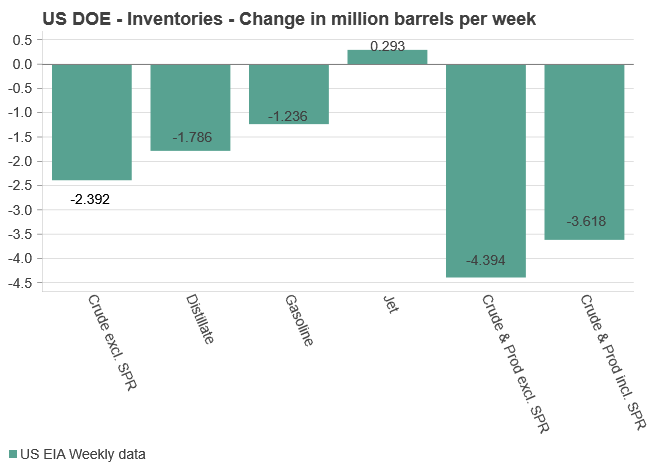

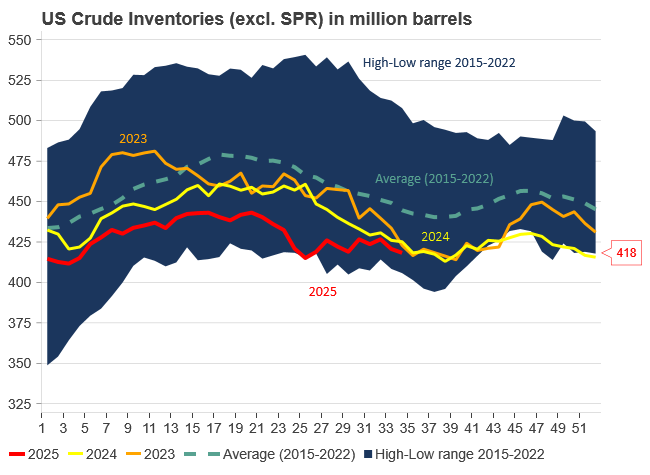

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

Analys

Increasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

Pushed higher by falling US inventories and positive Jackson Hall signals. Brent crude traded up 2.9% last week to a close of $67.73/b. It traded between $65.3/b and $68.0/b with the low early in the week and the high on Friday. US oil inventory draws together with positive signals from Powel at Jackson Hall signaling that rate cuts are highly likely helped to drive both oil and equities higher.

Ticking higher for a fourth day in a row. Bank holiday in the UK calls for muted European session. Brent crude is inching 0.2% higher this morning to $67.9/b which if it holds will be the fourth trading day in a row with gains. Price action in the European session will likely be quite muted due to bank holiday in the UK today.

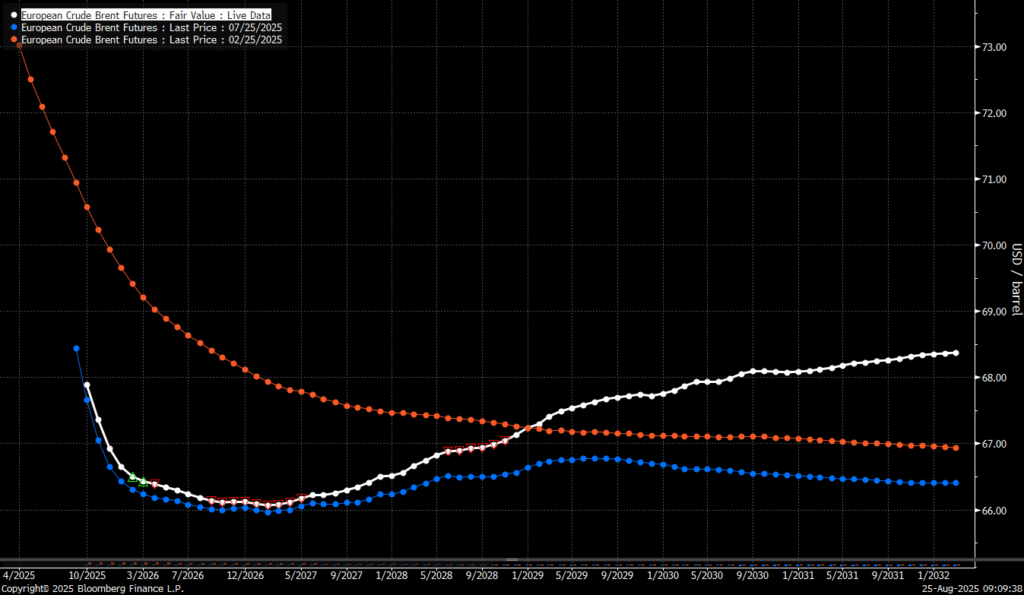

OPEC+ is lifting production but we keep waiting for the surplus to show up. The rapid unwinding of voluntary cuts by OPEC+ has placed the market in a waiting position. Waiting for the surplus to emerge and materialize. Waiting for OECD stocks to rise rapidly and visibly. Waiting for US crude and product stocks to rise. Waiting for crude oil forward curves to bend into proper contango. Waiting for increasing supply of medium sour crude from OPEC+ to push sour cracks lower and to push Mid-East sour crudes to increasing discounts to light sweet Brent crude. In anticipation of this the market has traded Brent and WTI crude benchmarks up to $10/b lower than what solely looking at present OECD inventories, US inventories and front-end backwardation would have warranted.

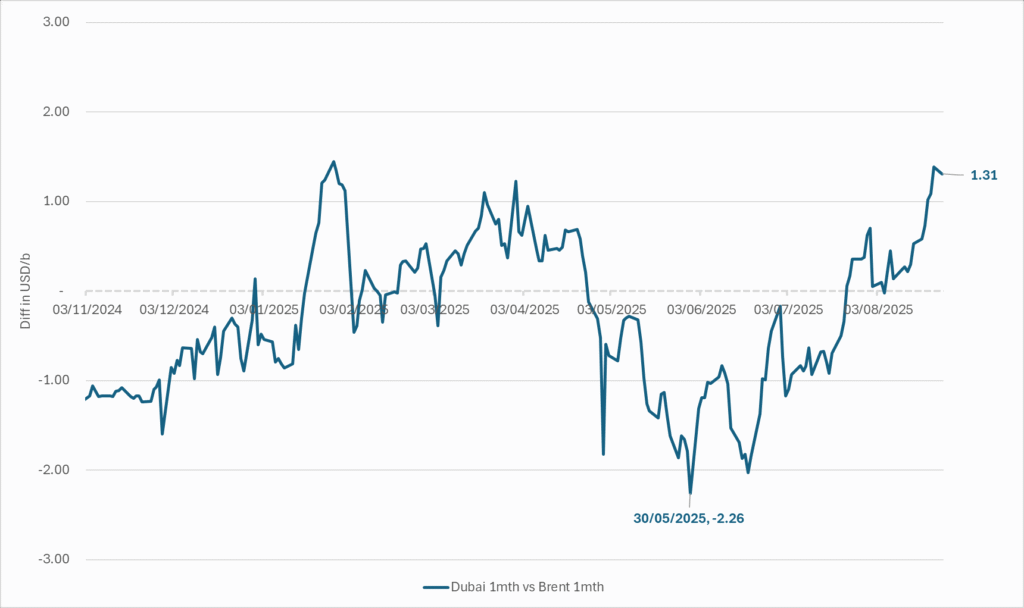

Quite a few pockets of strength. Dubai sour crude is trading at a premium to Brent crude! The front-end of the crude oil curves are still in backwardation. High sulfur fuel oil in ARA has weakened from parity with Brent crude in May, but is still only trading at a discount of $5.6/b to Brent versus a more normal discount of $10/b. ARA middle distillates are trading at a premium of $25/b versus Brent crude versus a more normal $15-20/b. US crude stocks are at the lowest seasonal level since 2018. And lastly, the Dubai sour crude marker is trading a premium to Brent crude (light sweet crude in Europe) as highlighted by Bloomberg this morning. Dubai is normally at a discount to Brent. With more medium sour crude from OPEC+ in general and the Middle East specifically, the widespread and natural expectation has been that Dubai should trade at an increasing discount to Brent. the opposite has happened. Dubai traded at a discount of $2.3/b to Brent in early June. Dubai has since then been on a steady strengthening path versus Brent crude and Dubai is today trading at a premium of $1.3/b. Quite unusual in general but especially so now that OPEC+ is supposed to produce more.

This makes the upcoming OPEC+ meeting on 7 September even more of a thrill. At stake is the next and last layer of 1.65 mb/d of voluntary cuts to unwind. The market described above shows pockets of strength blinking here and there. This clearly increases the chance that OPEC+ decides to unwind the remaining 1.65 mb/d of voluntary cuts when they meet on 7 September to discuss production in October. Though maybe they split it over two or three months of unwind. After that the group can start again with a clean slate and discuss OPEC+ wide cuts rather than voluntary cuts by a sub-group. That paves the way for OPEC+ wide cuts into Q1-26 where a large surplus is projected unless the group kicks in with cuts.

The Dubai medium sour crude oil marker usually trades at a discount to Brent crude. More oil from the Middle East as they unwind cuts should make that discount to Brent crude even more pronounced. Dubai has instead traded steadily stronger versus Brent since late May.

The Brent crude oil forward curve (latest in white) keeps stuck in backwardation at the front end of the curve. I.e. it is still a tight crude oil market at present. The smile-effect is the market anticipation of surplus down the road.

Analys

Brent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

Best price since early August. Brent crude gained 1.2% yesterday to settle at USD 67.67/b, the highest close since early August and the second day of gains. Prices traded to an intraday low of USD 66.74/b before closing up on the day. This morning Brent is ticking slightly higher at USD 67.76/b as the market steadies ahead of Fed Chair Jerome Powell’s Jackson Hole speech later today.

No Russia/Ukraine peace in sight and India getting heat from US over imports of Russian oil. Yesterday’s price action was driven by renewed geopolitical tension and steady underlying demand. Stalled ceasefire talks between Russia and Ukraine helped maintain a modest risk premium, while the spotlight turned to India’s continued imports of Russian crude. Trump sharply criticized New Delhi’s purchases, threatening higher tariffs and possible sanctions. His administration has already announced tariff hikes on Indian goods from 25% to 50% later this month. India has pushed back, defending its right to diversify crude sourcing and highlighting that it also buys oil from the U.S. Moscow meanwhile reaffirmed its commitment to supply India, deepening the impression that global energy flows are becoming increasingly politicized.

Holding steady this morning awaiting Powell’s address at Jackson Hall. This morning the main market focus is Powell’s address at Jackson Hole. It is set to be the key event for markets today, with traders parsing every word for signals on the Fed’s policy path. A September rate cut is still the base case but the odds have slipped from almost certainty earlier this month to around three-quarters. Sticky inflation data have tempered expectations, raising the stakes for Powell to strike the right balance between growth concerns and inflation risks. His tone will shape global risk sentiment into the weekend and will be closely watched for implications on the oil demand outlook.

For now, oil is holding steady with geopolitical frictions lending support and macro uncertainty keeping gains in check.

Oil market is starting to think and worry about next OPEC+ meeting on 7 September. While still a good two weeks to go, the next OPEC+ meeting on 7 September will be crucial for the oil market. After approving hefty production hikes in August and September, the question is now whether the group will also unwind the remaining 1.65 million bpd of voluntary cuts. Thereby completing the full phase-out of voluntary reductions well ahead of schedule. The decision will test OPEC+’s balancing act between volume-driven influence and price stability. The gathering on 7 September may give the clearest signal yet of whether the group will pause, pivot, or press ahead.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

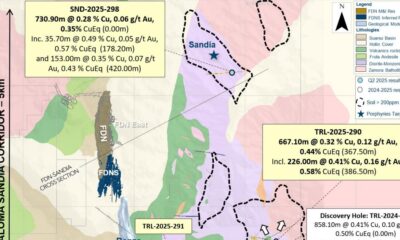

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland