Analys

Waiting for the next bullish catalyst – but do sell the rally when/if it comes

My key takeaways (Sales Summary)

My key takeaways (Sales Summary)

Oil prices have been volatile lately due to the hurricanes in the U.S Gulf coast, with Brent testing the important support of $53/bbl yesterday, and confirmed it. The Brent front end curve is now again in backwardation. OPEC+ is standing firm on its cuts and they seem open to extending them beyond Q1-18. Oil inventories are declining and the number of US Shale Oil rigs have been declining for four weeks in a row and we believe this trend will continue. US crude production have fallen 700kbbl/d due to hurricane Harvey, which would result in a 5 mbbl outage if it lasts for a week. These factors together with low overall net long speculative positions makes us believe that there is great chance that oil prices will increase during H2. However, spikes should be good opportunities for producers to hedge as we believe there will be plenty of oil in 2018.

Price action – Testing support at $53/b – it held

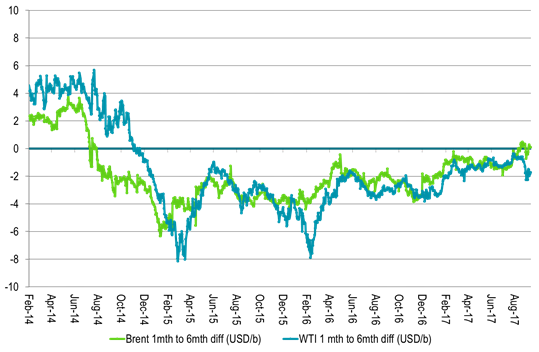

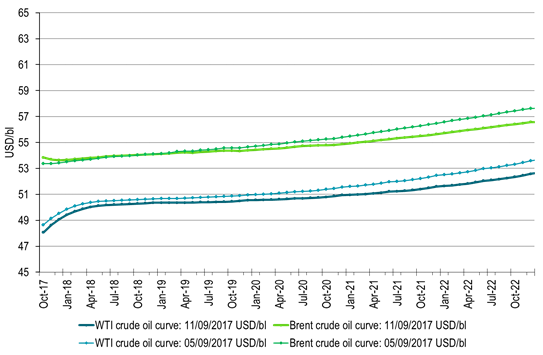

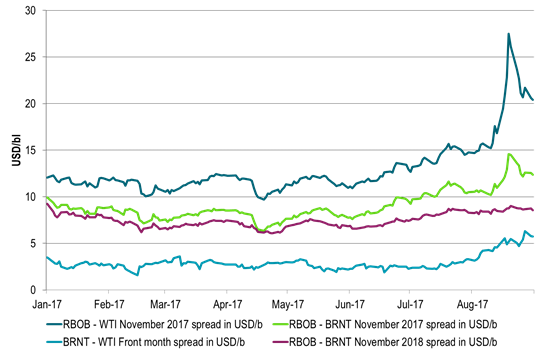

Brent crude traded with some intraday noise yesterday fluctuating between gains and losses before settling up 0.1% on the day at $53.84/b. Intraday it traded down to $53.04/b which seems to have been a pure technical move to test the technical support at $53/b which it recently broke above. Following the price noise from the hurricanes in the U.S. Gulf the Brent crude oil curve is again back in backwardation at the front end of the curve. The WTI curve is however still left in solid contango as the bottlenecks created by Harvey are still problematic. The WTI to Brent November spread has moved out to $5.2/b. The WTI October contract closed up 1.2% ydy as some of the bottlenecks have started to clear but still closed as low as $48.07/b

Crude oil comment – Waiting for the next bullish catalyst – but do sell the rally when/if it comes

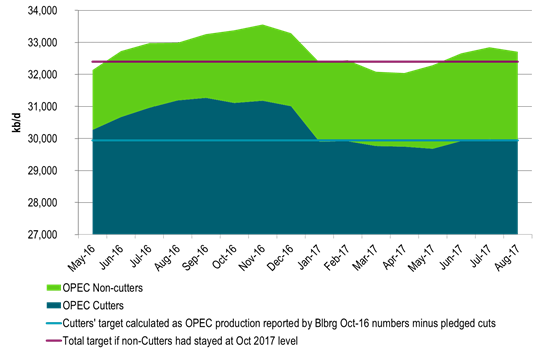

Brent crude is back in backwardation at the front of the curve. OPEC+ is standing firm on its cuts. It’s delivering on them and also seems open for extensions beyond 1Q18. Oil inventories are declining and front end crude prices and oil product curve structures are firming.

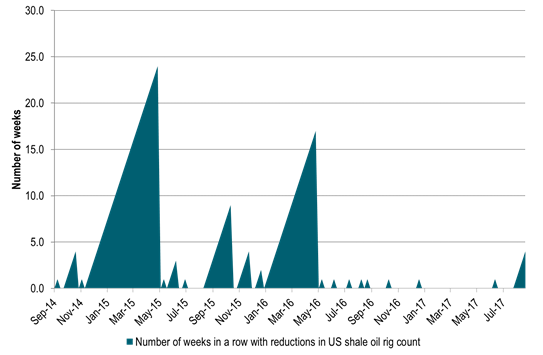

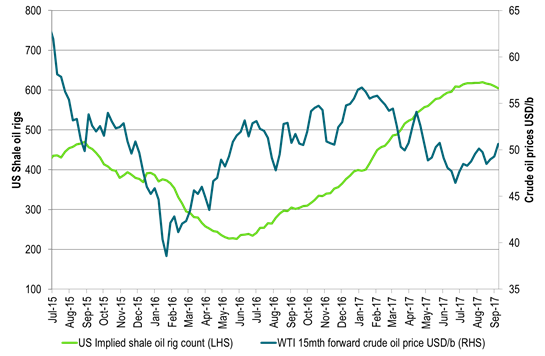

The number of US shale oil rigs declined by 5 rigs again last week to 605 rigs. It has now fallen four weeks in a row which is the first time since May 2016. We think this trend of declining US shale oil rigs is likely to continue towards the end of the year as there are too many rigs with completions struggling to catch up to drilling.

We do not think that this matters too much fundamentally with respect to the oil market balance in 2018 because there is such a large inventory of drilled but uncompleted wells to complete from. For the autumn however we think that seeing the number of drilling rigs declining when the WTI 1-2 year forward prices holds above $50/b could add a positive, bullish sentiment to the oil price: “See, WTI crude is above $50/b and rigs are declining! Shale oil players need a higher price to be profitable!” And maybe they do need a higher price in order to do what they do. That is at least the verdict of equity market which has punished the shale oil sector so far this year in lack of show of profits.

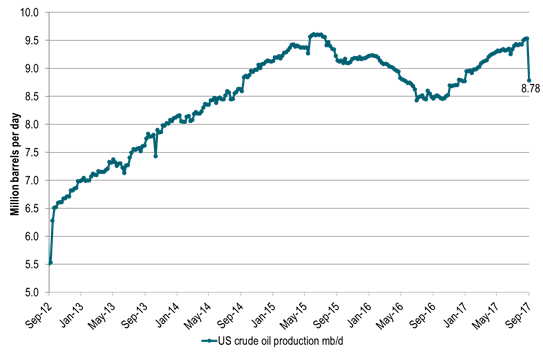

At the moment we also see that that US crude oil production has fallen back some 700 kb/d due to hurricane Harvey. If the outage lasts for a week it will shave 5 million barrels from global oil inventories. However, it will revive and rise strongly towards the end of the year in our view. Thus later in 4Q17 it could take away some of the current optimism of a firming oil market.

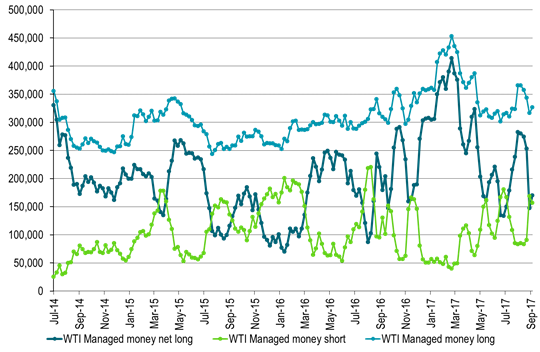

Hedge funds as of Tuesday last week had a fairly low overall net long position. I.e. there is quite a bit of room to the upside in terms of closing down shorts and adding length to their speculative positions.

North Korea has been in the news lately. What would happen to oil if a nuclear event developed is hard to say. For now we have sanctions of oil exports to North Korea on the table. This would of course reduce oil demand and so could be interpreted as potentially bearish. However, the magnitude of their consumption probably does not amount to more than some 20 kb/d. That is no more than the current weekly growth in US crude oil production (baring the recent set-back due to hurricane Harvey).

In the shorter term we have a constructive price situation. OPEC+ is firm on cuts, US shale oil rigs are declining, global oil inventories are declining, US crude production is currently down 700 kb/d, oil production in Libya has recently seen set-backs (though back up again now), hedge funds net speculative positions were at a low level last Tuesday. Technically the Brent crude price has broken up above the important $53/b level. It was tested as support yesterday and it held. Now Brent is set to test the $55.33/b level before the year to date high of $58.37/b (January 3rd) could be challenged.

However, we think there will be plenty of oil in 2018 with the need for OPEC+ to hold cuts through all of next year. Thus a bounce in crude oil prices near term should be utilized as an opportunity to hedged 2018 for the natural sellers, the producers. A new round of hard hitting hurricanes approaching the U.S. Gulf thus creating supply disruption risks could be the catalyst for such a bounce. A new and slightly longer set-back in Libya’s crude oil production could be another one. Producers and natural sellers should stay ready to utilize such a bounce.

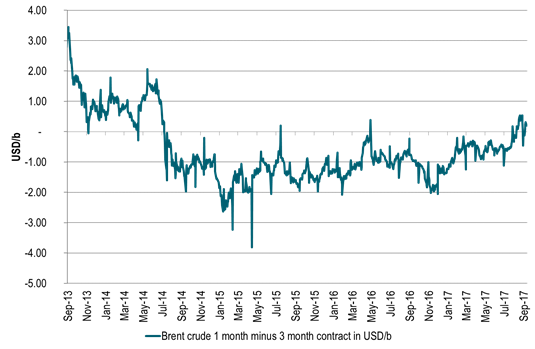

Ch1: Brent crude front end curve back in backwardation

We have not had a lasting backwardation like this since 2014

Ch2: The WTI crude curve is still in contango however. Clogged with bottlenecks from hurricane Harvey

Ch4: Crude oil forward curves now and one week ago

Ch5: Hedge funds net long spec at low level as of Tuesday last week

Room to add length which would give bullish impetus to oil prices

Ch6: The spike in product cracks created by hurricane Harvey have fallen back

Ch7: OPEC is delivering on its pledge cuts

Ch8: US implied shale oil rigs have fallen back 4 weeks in a row – first since May 2016

Ch9: US implied shale oil rigs falling back

Ch10: US crude oil production disrupted some 700 kb/d by hurricane Harvey

Shaving some 5 mb off global inventories if it lasts for a week

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Crude inventories builds, diesel remain low

U.S. commercial crude inventories posted a 3-million-barrel build last week, according to the DOE, bringing total stocks to 426.7 million barrels – now 6% below the five-year seasonal average. The official figure came in above Tuesday’s API estimate of a 1.5-million-barrel increase.

Gasoline inventories fell by 0.8 million barrels, bringing levels roughly in line with the five-year norm. The composition was mixed, with finished gasoline stocks rising, while blending components declined.

Diesel inventories rose by 0.7 million barrels, broadly in line with the API’s earlier reading of a 0.3-million-barrel increase. Despite the weekly build, distillate stocks remain 15% below the five-year average, highlighting continued tightness in diesel supply.

Total commercial petroleum inventories (crude and products combined, excluding SPR) rose by 7.5 million barrels on the week, bringing total stocks to 1,267 million barrels. While inventories are improving, they remain below historical norms – especially in distillates, where the market remains structurally tight.

Analys

OPEC+ will have to make cuts before year end to stay credible

Falling 8 out of the last 10 days with some rebound this morning. Brent crude fell 0.7% yesterday to USD 65.63/b and traded in an intraday range of USD 65.01 – 66.33/b. Brent has now declined eight out of the last ten days. It is now trading on par with USD 65/b where it on average traded from early April (after ’Liberation day’) to early June (before Israel-Iran hostilities). This morning it is rebounding a little to USD 66/b.

Russia lifting production a bit slower, but still faster than it should. News that Russia will not hike production by more than 85 kb/d per month from July to November in order to pay back its ’production debt’ due to previous production breaches is helping to stem the decline in Brent crude a little. While this kind of restraint from Russia (and also Iraq) has been widely expected, it carries more weight when Russia states it explicitly. It still amounts to a total Russian increase of 425 kb/d which would bring Russian production from 9.1 mb/d in June to 9.5 mb/d in November. To pay back its production debt it shouldn’t increase its production at all before January next year. So some kind of in-between path which probably won’t please Saudi Arabia fully. It could stir some discontent in Saudi Arabia leading it to stay the course on elevated production through the autumn with acceptance for lower prices with ’Russia getting what it is asking for’ for not properly paying down its production debt.

OPEC(+) will have to make cuts before year end to stay credible if IEA’s massive surplus unfolds. In its latest oil market report the IEA estimated a need for oil from OPEC of 27 mb/d in Q3-25, falling to 25.7 mb/d in Q4-25 and averaging 25.7 mb/d in 2026. OPEC produced 28.3 mb/d in July. With its ongoing quota unwind it will likely hit 29 mb/d later this autumn. Staying on that level would imply a running surplus of 3 mb/d or more. A massive surplus which would crush the oil price totally. Saudi Arabia has repeatedly stated that OPEC+ it may cut production again. That this is not a one way street of higher production. If IEA’s projected surplus starts to unfold, then OPEC+ in general and Saudi Arabia specifically must make cuts in order to stay credible versus what it has now repeatedly stated. Credibility is the core currency of Saudi Arabia and OPEC(+). Without credibility it can no longer properly control the oil market as it whishes.

Reactive or proactive cuts? An important question is whether OPEC(+) will be reactive or proactive with respect to likely coming production cuts. If reactive, then the oil price will crash first and then the cuts will be announced.

H2 has a historical tendency for oil price weakness. Worth remembering is that the oil price has a historical tendency of weakening in the second half of the year with OPEC(+) announcing fresh cuts towards the end of the year in order to prevent too much surplus in the first quarter.

Analys

What OPEC+ is doing, what it is saying and what we are hearing

Down 4.4% last week with more from OPEC+, a possible truce in Ukraine and weak US data. Brent crude fell 4.4% last week with a close of the week of USD 66.59/b and a range of USD 65.53-69.98/b. Three bearish drivers were at work. One was the decision by OPEC+ V8 to lift its quotas by 547 kb/d in September and thus a full unwind of the 2.2 mb/d of voluntary cuts. The second was the announcement that Trump and Putin will meet on Friday 15 August to discuss the potential for cease fire in Ukraine (without Ukraine). I.e. no immediate new sanctions towards Russia and no secondary sanctions on buyers of Russian oil to any degree that matters for the oil price. The third was the latest disappointing US macro data which indicates that Trump’s tariffs are starting to bite. Brent is down another 1% this morning trading close to USD 66/b. Hopes for a truce on the horizon in Ukraine as Putin meets with Trump in Alaska in Friday 15, is inching oil lower this morning.

Trump – Putin meets in Alaska. The potential start of a process. No disruption of Russian oil in sight. Trump has invited Putin to Alaska on 15 August to discuss Ukraine. The first such invitation since 2007. Ukraine not being present is bad news for Ukraine. Trump has already suggested ”swapping of territory”. This is not a deal which will be closed on Friday. But rather a start of a process. But Trump is very, very unlikely to slap sanctions on Russian oil while this process is ongoing. I.e. no disruption of Russian oil in sight.

What OPEC+ is doing, what it is saying and what we are hearing. OPEC+ V8 is done unwinding its 2.2 mb/d in September. It doesn’t mean production will increase equally much. Since it started the unwind and up to July (to when we have production data), the increase in quotas has gone up by 1.4 mb/d, while actual production has gone up by less than 0.7 mb/d. Some in the V8 group are unable to increase while others, like Russia and Iraq are paying down previous excess production debt. Russia and Iraq shouldn’t increase production before Jan and Mar next year respectively.

We know that OPEC+ has spare capacity which it will deploy back into the market at some point in time. And with the accelerated time-line for the redeployment of the 2.2 mb/d voluntary cuts it looks like it is happening fast. Faster than we had expected and faster than OPEC+ V8 previously announced.

As bystanders and watchers of the oil market we naturally combine our knowledge of their surplus spare capacity with their accelerated quota unwind and the combination of that is naturally bearish. Amid this we are not really able to hear or believe OPEC+ when they say that they are ready to cut again if needed. Instead we are kind of drowning our selves out in a combo of ”surplus spare capacity” and ”rapid unwind” to conclude that we are now on a highway to a bear market where OPEC+ closes its eyes to price and blindly takes back market share whatever it costs. But that is not what the group is saying. Maybe we should listen a little.

That doesn’t mean we are bullish for oil in 2026. But we may not be on a ”highway to bear market” either where OPEC+ is blind to the price.

Saudi OSPs to Asia in September at third highest since Feb 2024. Saudi Arabia lifted its official selling prices to Asia for September to the third highest since February 2024. That is not a sign that Saudi Arabia is pushing oil out the door at any cost.

Saudi Arabia OSPs to Asia in September at third highest since Feb 2024

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStargate Norway, AI-datacenter på upp till 520 MW etableras i Narvik

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKina har ökat sin produktion av naturgas enormt, men konsumtionen har ökat ännu mer