Analys

Rebounding on expectations for a tightening Q3-17 while US shale oil rigs continues to rise

Brent crude front month contract lost 3.9% last week closing the week at $45.54/b. Even the longer dated December 2020 contract lost 1.7% with a close of $51.86/b. WTI crude prices lost a comparable amount with the WTI 1 mth contract closing at $43.01/b.

Brent crude front month contract lost 3.9% last week closing the week at $45.54/b. Even the longer dated December 2020 contract lost 1.7% with a close of $51.86/b. WTI crude prices lost a comparable amount with the WTI 1 mth contract closing at $43.01/b.

Oil prices staged a 1.6% rebound during the last two days of the week following a more or less continuous sell-off since late May. There were no obvious bull-drivers lifting prices higher. Technical indicators however pointed to solid oversold territory. Headlines started to air views that “when all headlines are bearish, that’s the time to buy” etc.

Crude oil prices are gaining another 1% this morning with Brent 1mth contract trading at $46.0/b. Again there is no obvious bull-driving headline. The price recovery of 2.7% since the bottom last week cannot really be said to be explosive and there is currently no headline bullish driver pushing it higher.

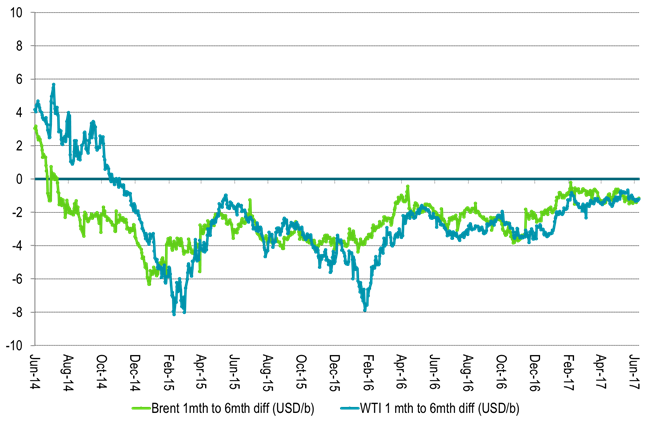

We do have a strong, seasonal increase in oil demand ahead of us for Q3 and Q4 with a substantial amount of refineries heading back into operation. Thus the current weakness in the physical crude oil market could be the final bear-point before a tightening crude oil market and significant inventory draw downs in Q3 and Q4. We do believe that inventories will draw down significantly during the coming two quarters. The price effect could however be a firming of the 1 to 18 mth contract where the 1 mth contract gains versus the 18 mth contract rather than a lifting of the whole forward crude price curve.

The strong rise in floating storage was also suddenly look upon as a sign that physical crude traders are taking long position in physical cargoes awaiting better prices. The reason being that it is not economical to store oil at sea since the contango isn’t really deep enough. Thus the only explanation would thus be that physical traders are proactively taking on floating cargoes in order to position for an oil price rebound. We are however not all that convinced about this argument. The 2 mn bl Sea Lynx VLCC has now been circling in the North Sea for several weeks with oil from the vessel being offered repeatedly to the market. The same goes for the 2 mn bl Desimi with has been circling in the North Sea since late April, early May.

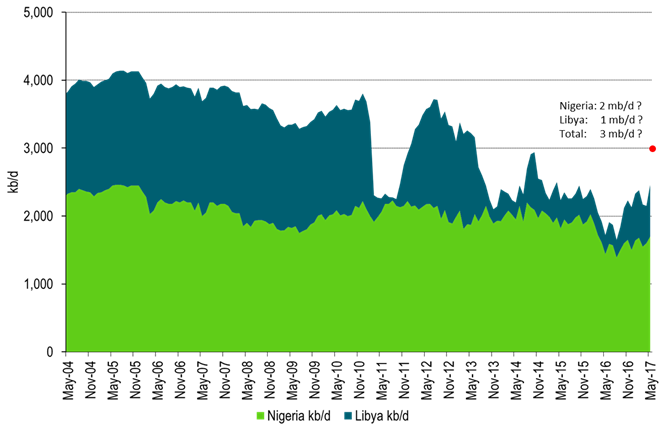

The production revival in Libya and Nigeria is creating concerns for the effect of OPEC’s cuts. Exports from Nigeria now look set to reach 2 mn bl in August while Libya’s NOC last week stated that they reached 0.9 mb/d with a target of 1 mb/d in July. This adds up to 3 mb/d for the two versus a production of 2.2 mb/d in November when OPEC & Co agreed on its production cut.

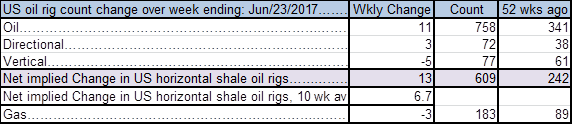

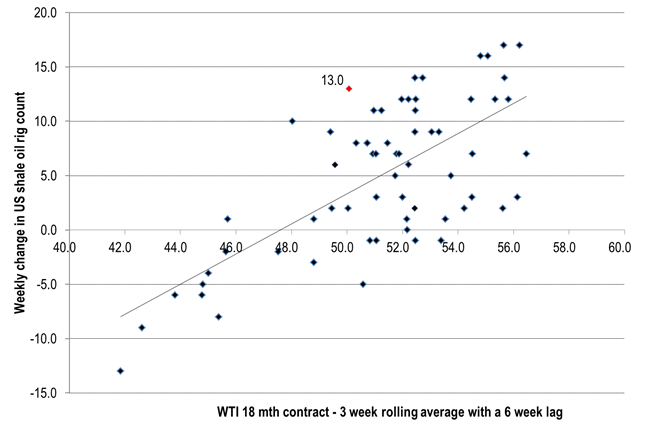

Last week 11 oil rigs were added in the US. Implied shale oil rigs rose by 13 which is the highest weekly addition since mid-April. Looking 6 weeks back the WTI 18 mth price contract traded at $49-50/b which obviously was not low enough to deter drillers from adding more oil rigs. On average there has been added 6.7 shale oil rigs each week the last 6 weeks. The average weekly additions since June last year are 6.8 rigs/week. The high of rig additions was from mid-Jan to mid-March when 11.6 rigs/week were added. Thus seen from the US shale oil drilling side of things the oil price has not yet become low enough for long enough in order to stem a further rise in active shale oil rigs.

Table1: 11 additional oil rigs last week in the US

Ch1: Changes in US shale oil rig count versus WTI 18 mth contract price some 6 weeks ago.

Ch2: The 1-6 mth contango has not deepened

This part of the curve should tighten in Q3 and Q4

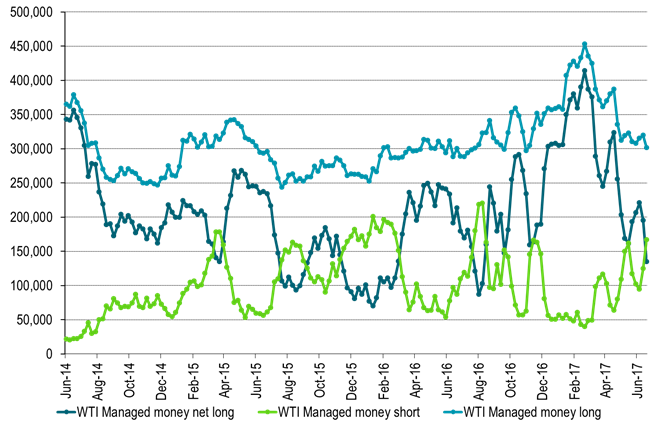

Ch3: Hedgefund speculative positioning – Net-long close to previous lows

Ch4: Total net long speculative WTI positioning – Into neutral territory but still some way to go to previous lows

Ch5: Production revival in Libya and Nigeria partially countering the effect of OPEC cuts

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Market waiting and watching for when seasonally softer demand meets rising OPEC+ supply

Brent down 0.5% last week with a little bounce this morning. Brent crude fell 0.5% last week to USD 66.68/b with a high of the week of USD 68/69/b set early in the week and the low of USD 66.44/b on Friday. This morning it is up 0.6% and trading at USD 67.1/b and just three dollar below the year to date average of USD 70/b.

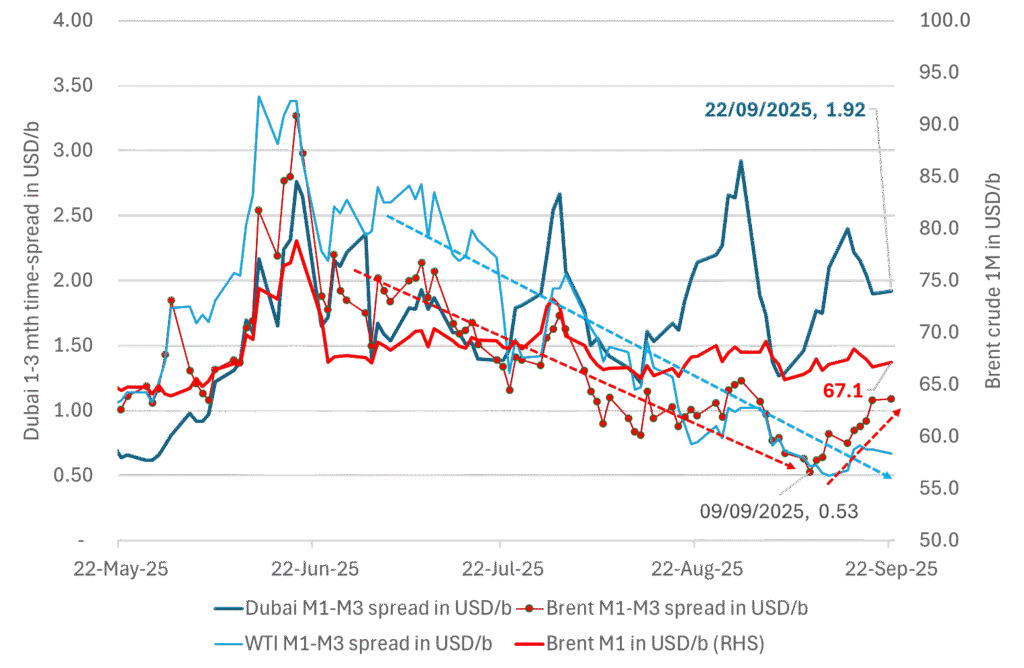

The Dubai crude curve is holding strong. Flat prices will move lower when/if that starts to weaken. The front-end of the Brent crude oil curve has been on a strengthening path since around 10 September, but the front-month contract is more or less at the same level as 10 September. But the overall direction since June has been steadily lower. The recent strengthening in the front-end of the Brent curve is thus probably temporary. The WTI curve has also strengthened a little but much less visibly. What stands out is the robustness in the front-end of the Dubai crude curve. With tapering crude burn for power in the Middle East as we move away from the summer heat together with increasing production by OPEC+, one should have expected to see a weakening in the Dubai curve. The 1 to 3mth Dubai time-spread is however holding strong at close to USD 2/b. When/if the Dubai front-end curve starts to weaken, that is probably when we’ll see flat prices start to taper off and fall lower. Asian oil demand in general and Chinese stockpiling specifically is probably what keeps the the strength in the front-end of the Dubai curve elevated. It is hard to see Brent and WTI prices move significantly lower before the Dubai curve starts to give in.

The 1mth to 3mth time spreads of Brent, WTI and Dubai in USD/b

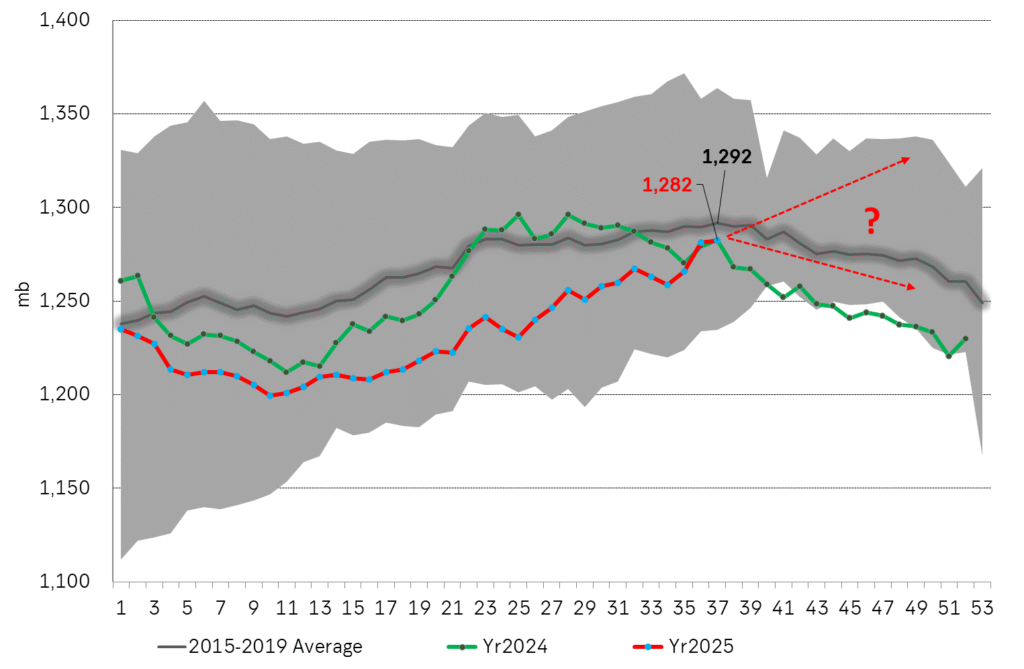

If US oil stocks continues higher in Q4 we’ll start to feel the bearish pressure more intensely. US commercial crude and product stocks have been below normal and below levels from last year as well all until now. Inventories have been rising since week 10 and steadily faster than the normal seasonal trend and today are finally on par with last year and only 10 mb below normal. From here to the end of the year is however is the interesting part as inventories normally decline from now to the end of the year. If US inventories instead continues to rise, then the divergence with normal inventories will be very explicit and help to drive the price lower. So keep a keen eye on US commercial inventories in the coming weeks for such a possible divergence.

US Commercial crude and product stocks in million barrels.

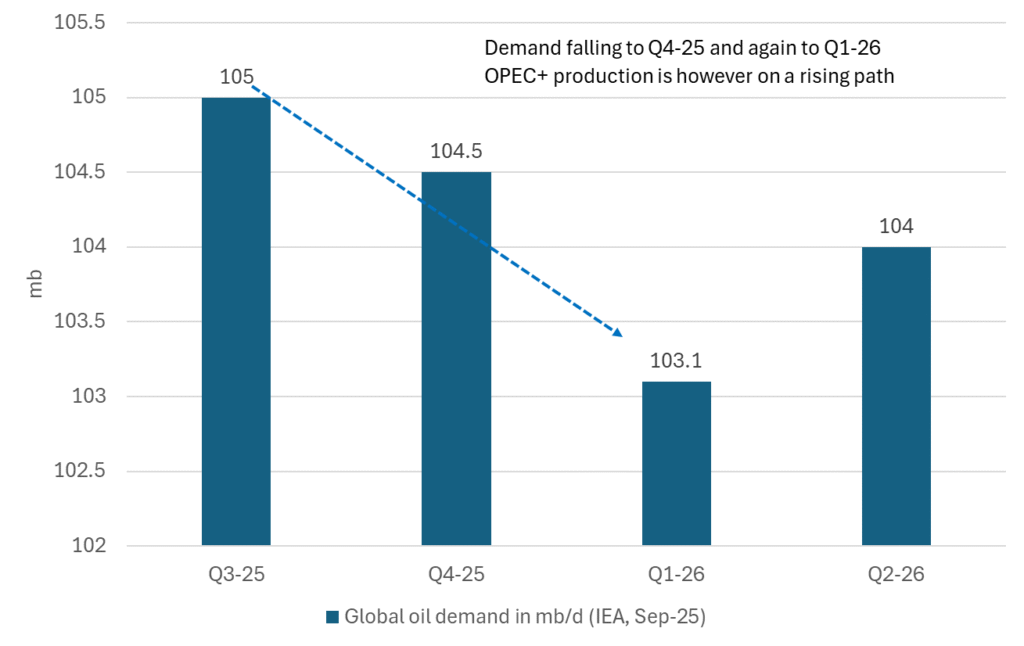

Falling seasonal demand and rising OPEC+ supply will likely drive oil lower in Q4-25. The setup for the oil market is that global oil demand is set to taper off from Q3 to Q4 and again to Q1-26. At the same time production by OPEC+ is on a rising path. The big question this is of course if China will stockpile the increasing surplus or whether the oil price will be pushed lower into the 50ies. We believe the latter.

Outlook for global oil demand by IEA in the OMR September report

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys4 veckor sedan

Analys4 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Analys3 veckor sedan

Analys3 veckor sedanOPEC+ in a process of retaking market share

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter1 vecka sedan

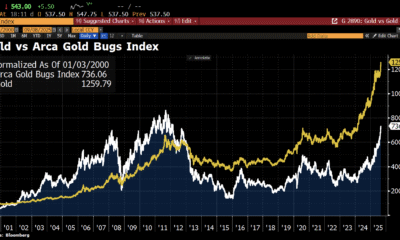

Nyheter1 vecka sedanAktier i guldbolag laggar priset på guld