Analys

SEB – Råvarukommentarer vecka 9 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: +2,98 %

Brett råvaruindex: +2,98 %

UBS Bloomberg CMCI TR Index- Energi: +3,47 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: +3,62 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +5,05 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: +0,90 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadssyn:

- Guld: Köp

- Olja: Köp

- Koppar: Neutral/sälj

- Majs: Neutral/sälj

- Vete: Sälj

Guld

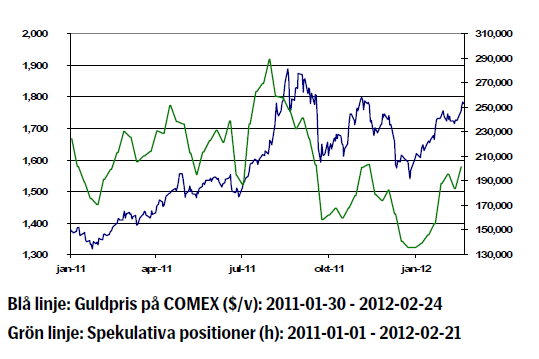

Guldpriset har stigit på det allmänt positiva marknadssentimentet i råvaror och handlade i veckan på de högsta nivåerna på tre månader. På torsdagen handlade guld till 1.784 dollar per troy uns.

- Alla ratinginstitut för diskussioner kring ytterligare nedgraderingar av Greklands kreditvärdighet vilket skulle kunna liknas vid en default. Grekiska parlamentet måste senast onsdag genomföra en rad besparingsåtgärder för att få utbetalt de stödpaket som lovats. Det är fortfarande osäkert om privata lågivare kommer att acceptera den nedskrivning av utlånat kapital som man förhandlat fram. All osäkerhet kommer att ge stöd åt guldpriset.

- Den fortsatta stimulansen från världens centralbanker ger bränsle åt guldpriset. Bank of England köpte förra veckan obligationer för 50 miljoner pund vilket ökar likviditeten i marknaden och driver på inflationsförväntningarna. I många länder är de reala räntorna, det vill säga marknadsräntan minus inflation, negativa vilket också gör guldinvesteringar attraktiva eftersom alternativkostnaden är låg.

- Efterfrågan på guld från Asien har varit stabilt 2012 och efterfrågan från Indien har ökat sedan novembers och decembers kraftiga nedgångar.

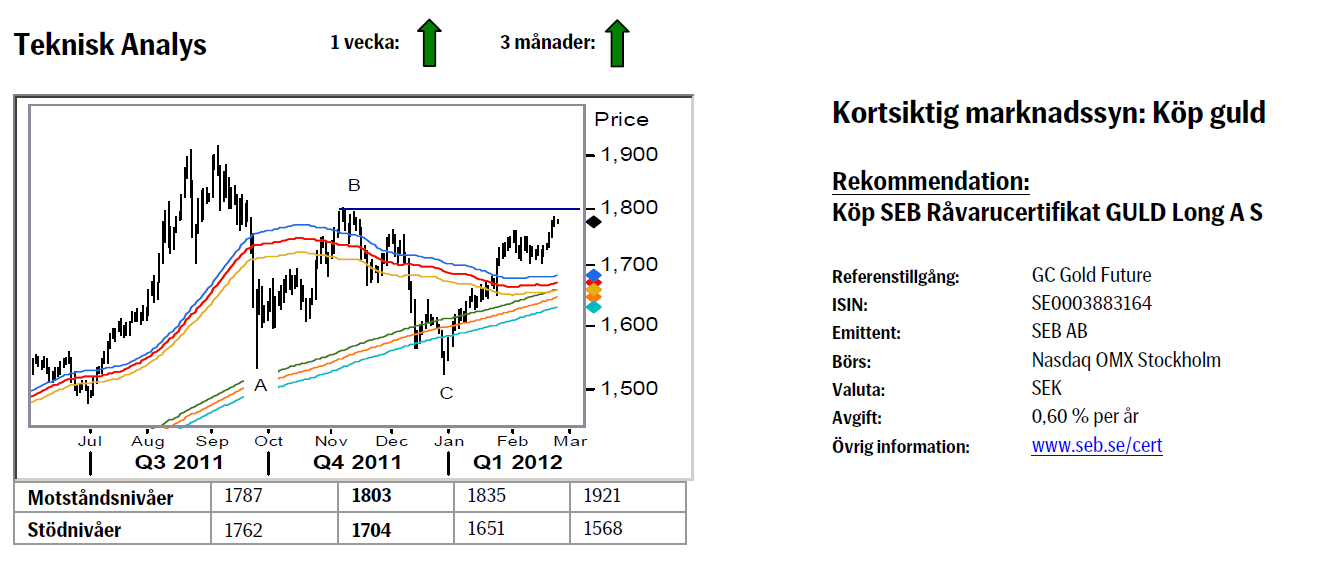

- Teknisk Analys: Marknaden har även denna vecka fortsatt att utveckla sig positivt och vi är nu ytterst nära ett test (och troligt brott) av huvudmotståndet, 1803. Ett lyckat brott dvs. stängning över 1803 är den bekräftelse vi söker för att kunna måtta in nya historiska toppar (som vi ser som mycket sannolika).

Olja

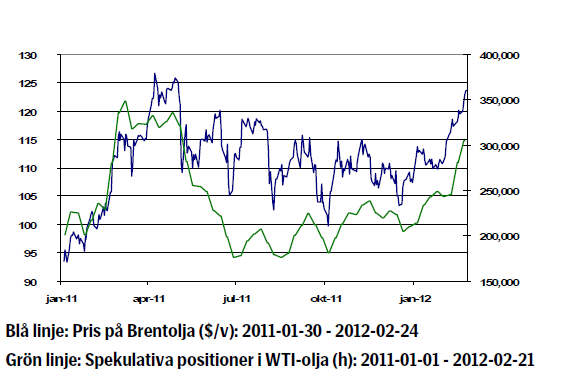

- Oljepriset har skjutit i höjden till följd av den försämrade relationen mellan Iran och Västvärlden och sedan årsskiftet har priset på Brentolja stigit med mer än 10 %. Förra veckan steg priset med 4,5 procent.

- Oroligheterna kring Iran fortsätter. Iran hotar med att landet kommer att agera i förebyggande syfte om ”nationens intressen” hotas av omvärlden. Trots brist på konkreta hot så är varningen ännu ett exempel på den senaste tidens upptrappade konflikt mellan Väst och Iran som i grunden handlar om att det internationella atomenergiorganet IAEA i november presenterade en rapport som antydde att Iran har ett pågående kärnvapenprogram.

- Swift (Society for Worldwide Interbank Financial Telecommunications) hotar med att stänga ute för betalningar de iranska finansinstitut som är anslutna. Skulle Europas lagstiftning godkänna denna avstängning så kommer Iran helt stängas ute från internationell handel. Den iranska regimen är redan pressad av sanktionerna som påverkar landets befolkning och de har mycket att förlora på en väpnad konflikt och en blockad av Hormuzsundet.

- Osäkerheten är stor den närmsta tiden. Den tekniska bilden talar för att vi på kort sikt kan se ett högre oljepris.

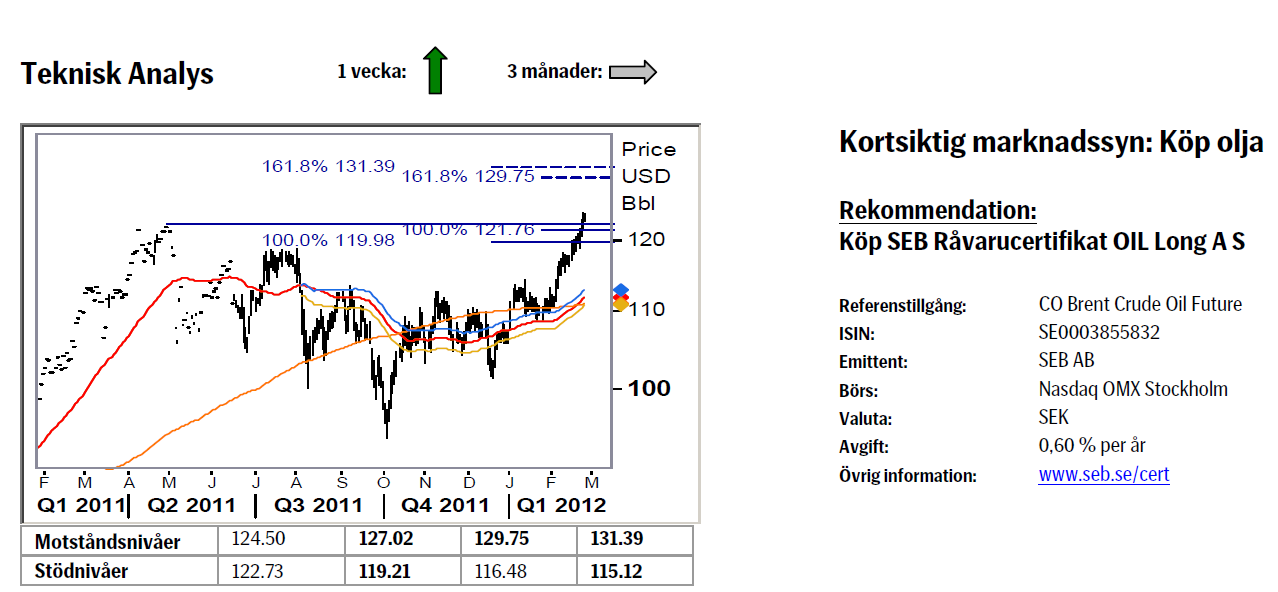

- Teknisk Analys: I och med brottet över aprilkontraktets tidigare topp förstärks uppåt potentialen. Nästa givna mål ska sökas vid 129.75/131.39 området, nästa Fibonacci projektionsområde. Där ovanför återfinns också toppen från 2007, 147.50. Det är dock noterbart att i €uro termer så handlas Brentoljan nu på nya rekordnivåer.

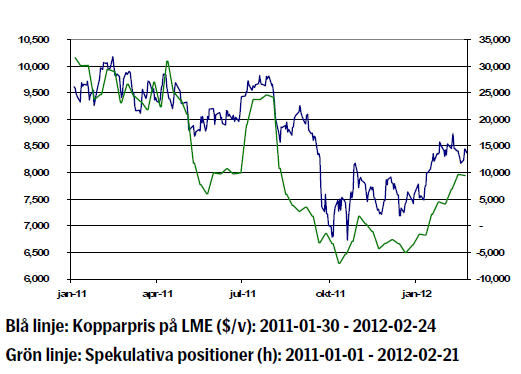

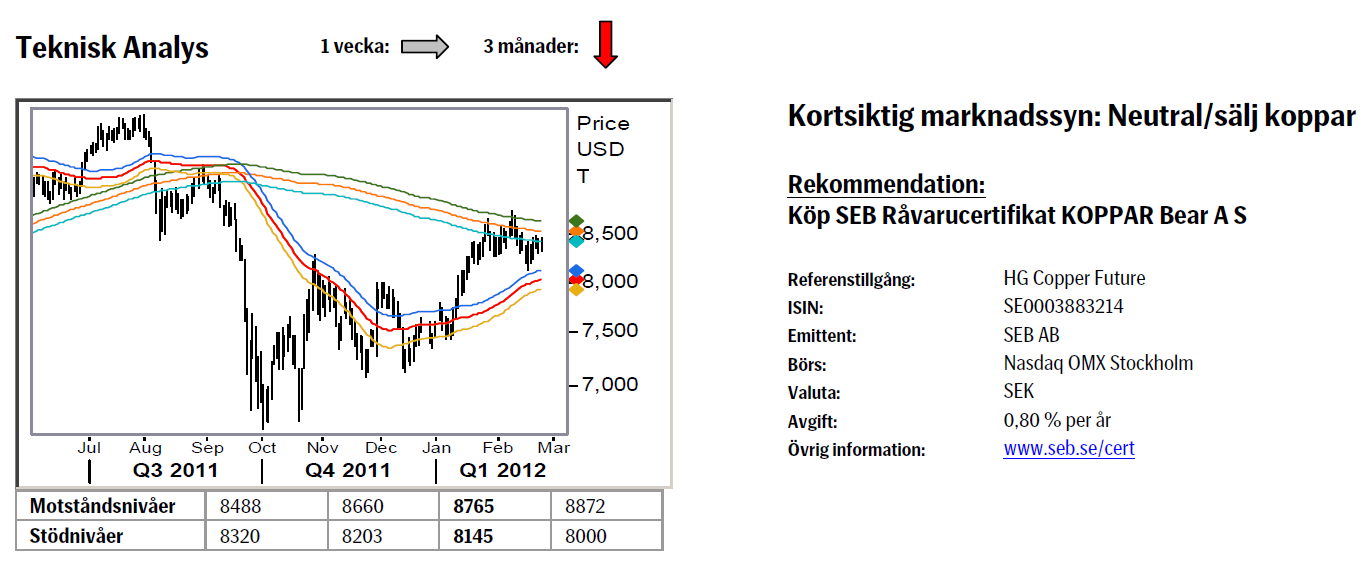

Koppar

- Kopparpriset steg 3,8 procent förra veckan vilket till viss del har sin förklaring i att Kina sänkte bankernas reservkrav förra helgen, ett sätt att stimulera inhemsk ekonomi. De nya kraven trädde i kraft i fredags.

- En stabilisering av affärsklimatet för tillverkningsindustrin indikerar att Kinas ekonomi fortsätter att gå mot en mjuklandning. HSBCs PMI för tillverkningen var i februari 49,7 jämfört med 48,8 i januari. Officiellt inköpschefsindex publiceras den förste mars. Man ska dock komma ihåg att det kinesiska nyåret försämrar tillförlitligheten för den statistik som publiceras i januari och februari. Kinas uppbyggande av kopparlager har mattats av och i Japan är efterfrågan av koppar låg.

- Indonesien som är världens tredje största producent av koppar planerar att införa ett exportförbud av all obearbetat metall fram till 2014 i syfte att stimulera inhemsk förädlingsindustri. Med ett oljepris över 120 dollar/fat dämpas möjligheten till en ekonomisk återhämtning vilket även kommer att dämpa den globala efterfrågan på koppar.

- Kortsiktigt tror vi att risken för ett högre pris dämpas av Greklandsuppgörelsen som fortsätter att oroa marknaden. Att Kinas premiärminister förväntas signalera ett tillväxtmål under 8 procent för 2012 på partikongressen den 5:e mars verkar också dämpande på kopparpriset.

- Teknisk Analys: Efter det första ”benet” ned från 233 dagars bandet befinner vi nu oss i vad vi anser vara en korrektion på nedgången. Följaktligen söker vi ett nytt säljläge under kommande vecka(or) och allra helst finner vi det under 8660.

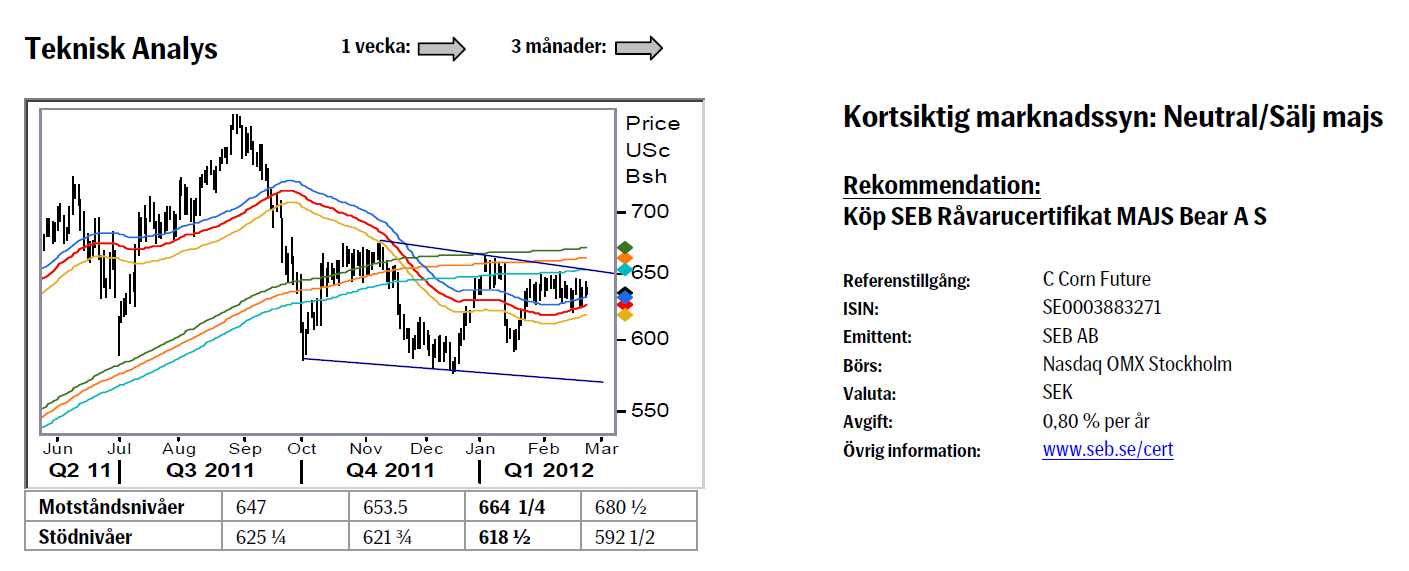

Majs

- The International Grains Council (IGC) gick i torsdags ut med sin senaste prognos avseende det globala utbudet av spannmål, där man justerade upp utbudsestimatet för majs med 0,3 procent jämfört med den senaste rapporten.

- Under de senaste månaderna har det spekulerats mycket kring den påverkan Kinas ökade importbehov av majs kan få på majspriset, detta särskilt då de två senaste årens la Niña-relaterade produktionsproblem fått de globala lagernivåerna att falla ned till rekordlåga nivåer. Så sent som i fredags kom det ut nya indikationer om ökade kinesiska importer från USA, vilket, tillsammans med de nya handelsavtalen mellan Kina och Argentina, stärker denna tes ytterligare. Nyhetsvärdet kan i detta fall ge visst stöd åt majspriset denna vecka.

- I torsdags och fredags höll USDA sitt årliga Agricultural Outlook Forum i Arlington (Virginia), vilket brukar innebära startskottet för de mer detaljerade prognoserna avseende det amerikanska spannmålsutbudet för det kommande skördeåret. Enligt vår bedömning var det inga större utropstecken, den kommande amerikanska skörden av majs ser fortfarande god ut. Därmed bör marknadens ögon under de kommande veckorna riktas in mot Brasilien och Ukraina igen.

- Det är i nuläget svårt att fundamentalt ge några starka argument för att majspriset kortsiktigt ska lämna nuvarande prisnivåer.

- Teknisk Analys: Marknaden har fortsatt att handla mellan 55 & 233 dagars medelvärdesband och befinner sig följaktligen fortsatt inklämd i det neutrala området.

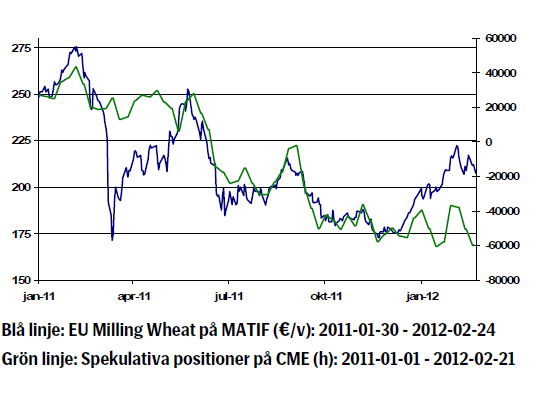

Vete

- Under förra veckan kunde vi verkligen se hur proppen gick ur marknaden, detta från en för oss omotiverat hög prisnivå. Totalt sett gick priset i Paris ned med 4,5 procent, men vi är fortfarande av åsikten att det bör fortsätta nedåt mot en nivå under 200 EUR/ton inom kort.

- I sin prognos avseende vetemarknaden justerade IGC i torsdags upp sitt produktionsestimat för innevarande skördeår. De globala vetelagren är redan på historiskt sett rekordhög nivå, där denna typ av bekräftelse ger ytterligare tryck nedåt på vetepriset.

- Diskussionen kring Ukrainas eventuella restriktioner av spannmål fortsätter. Stor osäkerhet råder fortsatt avseende bortfallet av vete i landet efter den senaste tidens köldknäpp runt Svarta havet. Även om landet endast producerar 3-4 procent av vetet i världen anses landet vara en viktig exportör.

- Efter att ha stigit något den senaste månaden har nu andelen spekulativa köpare av vete i Chicago fallit ned mot tidigare bottennivåer igen. Vi väljer att hålla med spekulanterna i terminsmarknaden och ser negativt på priset kommande veckor.

- Teknisk Analys: Brottet under trendlinjen, återtestet och det förnyade fallet stärker oss i vår vy att lägre nivåer ska sökas. Ett viktigt test av 55/233dagars medelvärdesbanden ser ut att kunna komma under nästa vecka. Hur handeln i detta område utvecklar sig kommer att ge en hel del viktig information om den lite större utvecklingen så håll ögonen öppna efter signaler.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering