Analys

SEB – Råvarukommentarer vecka 24 2012

Sammanfattning: Denna vecka

- Brett råvaruindex: +0,02 %

UBS Bloomberg CMCI TR Index - Energi: +0,45 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller:+ 2,06 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +1,23 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: -1,67 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral/köp

- Olja: Neutral/köp

- Koppar: Sälj

- Majs: Sälj

- Vete: Neutral

- Sojabönor: Sälj

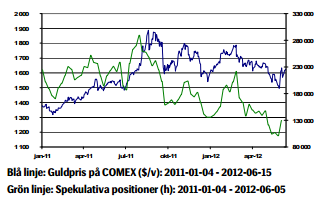

Guld

Vi tycker att man ska vara köpt guld. Förra helgen fick Spanien det lån marknaden länge fruktat men samtidigt hoppats på för att stötta landets krisande banksektor. Lånet uppgick till 100 mdr euro. Guldet reagerade positivt på stimulanspaketet och har stigit två procent under veckan.

Kreditvärderingsinstitutet Fitch sänkte betyget för 18 spanska banker och Moody´s sänkte landets långfristiga kreditbetyg till Baa3 från A3. Igår handlade landets räntor på de högsta nivåerna under euro-tiden. Tioårsräntan steg till 6,99 procent. Stigande räntor i Spanien ökar farhågan att Spanien måste söka ett mer omfattande stöd. Guldet steg åter något på torsdagen då både räntan på tysklands Bund (10-åriga statsobligation) och tyska CDS:er (säkerheter mot en statskonkurs) steg. Brist på förtroende för tyska statspapper är mycket oroande för marknaden.

Oroade blickar riktas även mot Italien som också tyngs att höga räntor. Italiens premiärminister deklarerade dock tydligt i veckan att Italien inte kommer att behöva något räddningspaket eftersom stimulans av tillväxten och ett minskat underskott finns på den italienska agendan.

Råvarubörsen CME minskade marginalkraven för guldterminer med 10 procent i slutet av maj. Sänkningen gav ett visst stöd åt guldpriset men var samtidigt förväntad eftersom marginalkraven är proportionella mot volatilitet och prisnivå. Ökar eller minskar de faktorerna ökar eller minska kraven.

Världens största fysiska guld ETF, SPDR, har sett utflöden för första gången på tre veckor och fonden innehåller nu 1 274,37 ton. Efterfrågan på US Mint coin är fortsatt svag med 53000 ozt i maj (1 troy ounce = ca 31 gram) mot 107 000 ozt i maj 2011.

”Ödesvalet” i Grekland på söndag är en stor osäkerhetsfaktor och vinner den koalition som önskar riva upp besparingskrav kan landet tvingas att lämna euron och osäkerheten om guldet kommer att regera med övriga risktillgångar eller snarare som en säker hamn i orostider är stor.

Teknisk analys: Stadigt högre, igen. Efter en lika oväntad som stor sättning från toppen den sjätte juni har marknaden så sakteliga envist arbetat sig tillbaka upp till de tidigare toppnivåerna. Detta visar med all tydlighet, tycker vi, att nedgången ska etiketteras korrektiv. Det underliggande vågmönstret är också fortsatt positivt varför vi räknar med ytterligare uppgång den närmaste tiden.

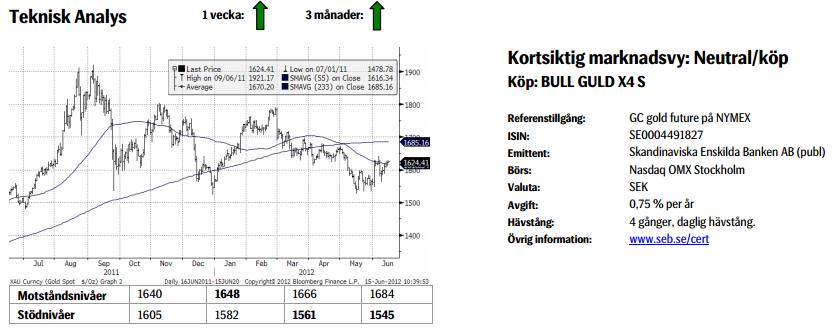

Olja

Opec´s 12 medlemsländer höll möte igår i Wien. Saudiarabien har inför mötet begärt en ökning av kartellens produktionsmål som i dagsläget motsvarar 30 miljoner fat per dag., något som går stick i stäv med Opec´s irakiske ordförandes önskningar. Saudiarabien har genom en rekordhög produktion (högsta sedan 1980-talet), verbala påtryckningar fått ner oljepriset till önskvärda100 dollar. Inför mötet har man emellertid taktiskt minskat oljeproduktionen för att undgå kritik för att man producerar mer än tilldelade kvoter. Fortsätter produktionen på aktuell nivå kommer marknaden ha ett överskott på olja under det tredje och fjärde kvartalet i år.

Oförändrade produktionskvoter ger stöd åt oljepriset vilket gynnar de mindre oljeproducerande länderna som haft inkomstbortfall p.g.a. det prisfall vi sett nyligen. Brentpriset föll i veckan till 97,14 dollar, den lägsta nivån sedan januari 2011.

Iran, Venezuela och Angola önskar se ett lägre tak för produktionskvoter. Många länder behöver ett pris på 100 dollar för att kunna balansera sina statsbudgetar.

Saudiarabien är mån om att undvika ett stigande oljepris från en högre säsongsrelaterad efterfrågan och ett från EU:s sida Iranskt embargo som träder ikraft den 1:a juli. Saudiarabien är mycket oroligt för Irans kärnvapenenergiprogram och man vill indirekt inte gynna landet med ett högre oljepris.

Opec behöll emellertid produktionstaket på 30 miljoner fat per dag

Spekulativa positioner i Brent har sjunkit till de lägsta nivåerna sedan november 2011. Efter gårdagen Opec möte är vi neutrala till svagt positiva till ett högre pris men helgens val i Grekland utgör även här en stor osäkerhet. Den tekniska bilden ser emellertid negativ ut.

Teknisk analys: Pass upp för falluckan! Efter en mindre korrektiv uppgång är vi nu redan på väg ner igen. Området runt 96 är av stor vikt och ett brott riskerar att utlösa ytterligare ett ras ned mot 80/85.

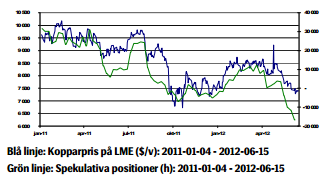

Koppar

Kopparpriset fann i bättre än förväntad japansk statistik där maskinordrar, d.v.s. beställningar av maskiner inom industrin, långt överträffade analytikers förväntningar. Kopparn fann även stöd i en ökad kinesisk kopparimport och Shanghaibörsens lager nu är på de lägsta nivåerna sedan januari.

Vi har sett bra statistik från Kina. Exporten för maj växte med 15,3 procent i årstakt vilket var mer än en fördubbling av analytikers förväntan och mer än tre gånger ökningstakten i april.

Kinesiskt konsumentprisindex (inflation) föll något mer än förväntat vilket öppnar upp för möjligheter till ytterligare stimulanser från kinesiska myndigheter vilket ger stöd åt kopparn. Fed ledamöter i USA inleder den 19:e juni ett tvådagarsmöte och skulle man ge marknaden förhoppningar om ytterligare stimulanser kommer detta att påverka kopparn positivt. USA är världens andra största kopparkonsument.

Efter att förra veckan ha varit nära sexmånaderslägsta har kopparpriset nu stigit med 2,6 procent. Framförallt har den positiva statistiken från Kina bidragit.

Valet i Grekland på söndag är en stor osäkerhetsfaktor även för kopparn och en eskalering av krisen i Europa med ett Grekiskt euroutträde kan avsevärt minska riskapptiten. Oron växer även kring Cypern vars ekonomi är tätt sammankopplad med den grekiska. Aktiviteten i marknaden är generellt låg inför valet.

Teknisk analys: På väg mot trend nacklinjen. Inte mycket har hänt sedan förra veckan. En viss stabilisering har dock inträtt men denna bör ses som temporär, en paus i nedåttrenden. Väl avklarad tar vi nästa steg ned emot nacklinjen (av den potentiella huvud skuldra toppformationen).

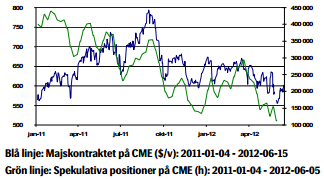

Majs

Priset på decembermajs fortsätter sin negativa trend som marknaden haft sedan september förra året. Vi fortsätter at räkna med lägre priser och tror att priset kommer att bryta 500 cent för att sedan fortsätta ner.

USDA höjde produktionsestimatet för 2012/13. Rapporten räknar även med att utgående majslager ökar. Efterfrågan från Kina och andra tillväxtländer samt efterfrågan på majs till etanoltillverkning har hållit lagren pressade. När det gäller etanol är ökningen i efterfrågan med största sannolikhet över.

USDA reviderar upp sin prognos för Rysslands majsproduktion 2012/13 och den beräknade produktionen slår därmed det tidigare produktionsrekordet från 2008/09 som även matchades 2011/12.

Majsproduktionen i Kina 2012/13 beräknas vara oförändrad jämfört med förra året. Lantbrukarna i landet förväntas öka majsarealen p.g.a. lägre vinstmarginaler för andra grödor.

Teknisk analys: Upp inom kanalen. Den övergripande bilden är fortfarande rätt svårtydd. Dock kan vi noterar att det falska brottet på nedsidan vid månadsskiftet har lett till ett normalt utfall, ett återtest av golvet med på följande uppgång. Troligtvis kommer kraften i studsen att räcka till ungefär 630. Faller vi under 575 ½ så är studsen redan över och ett nytt bottentest på väg.

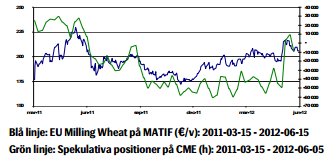

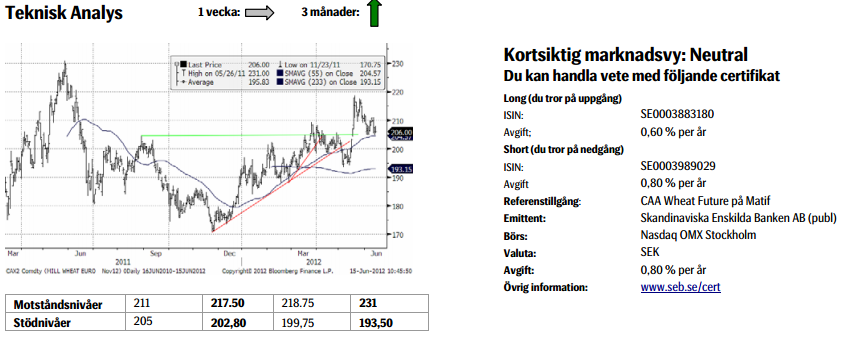

Vete

Det USDA har publicerat juni månads WASDE (World Agricultural Supply and Demand Estimates) rapport för produktion, konsumtion och utgående lager. Prognosen för den globala veteproduktionen 2012/13 visar en nedjustering från förra säsongen till 680 ton, vilket dock är fem ton högre än tidigare prognos och fortfarande en bra bit över genomsnittet de senaste fem åren.

Det europeiska Matifvetet föll tillbaka efter Wasde-rapporten. Vi har en negativ grundsyn på prisutvecklingen.

Skicket (crop condition) på amerikanskt vintervete som rapporterade i måndags ligger på 53 % /good/excellent, vilket är en procent högre än förra veckan.

Globala vetelager är på en relativt låg nivå och förväntas inte stiga 2012/13. Nedsiderisken är alltså begränsad.

Ryssland som är en viktig veteproducent har haft problem med ihållande torka och varma temperaturer under april och större delen av maj vilket har hämmat grödornas utveckling.

Dessutom har ogynnsamma väderförhållanden i Centraleuropa gör att USDA reviderat ned produktionsestimat.

Vi fortsätter att ha en neutral syn på veteprisets utveckling på kort sikt.

Teknisk analys: Tillbaka i 55dagars bandet. Tanken om en fortsatt uppgång har, givet de senaste dagarnas nedgång, skjutits på framtiden. Återigen ligger fokus på huruvida köparna kommer, att som vanligt, återkomma i 55dagars bandet eller inte? Om vi följer det tidigare mönstret bör vi snart försöka högre igen.

Sojabönor

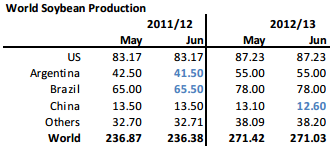

Nedan ser vi WASDE-rapportens produktionsestimat i miljoner ton, som publicerades i onsdags. Det är inga större förändringar för innevarande år, dock en liten uppjustering av Brasiliens skörd och en lika stor nedjustering av Argentinas. För 2012/13 justerades endast Kinas produktion nedåt.

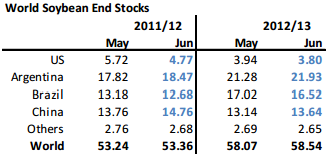

Utgående lager ser vi nedan. Det är otroligt låga utgående lagerestimat för USA. Globalt är dock lagren på en hyggligt bra nivå.

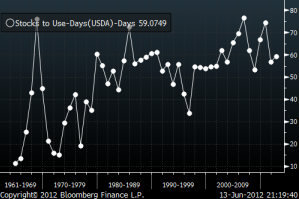

Nedan ser vi nuvarande utgående lager i historiskt perspektiv. Lager som räcker i 59 dagar är en relativt hög nivå, trots allt.

Lägre ekonomisk tillväxt runtom i världen tynger sojabönorna. Vi ser ett lite längre prisdiagram på novemberkontraktet nedan. Så länge det inte blir någon störning av höstens sådd i Sydamerika bör priset kunna hålla sig under 1400 cent. Vi tycker att man ska vara såld sojabönor nu, med stop-loss på drygt 1400 cent. Det finns goda möjligheter till lägre priser framöver.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

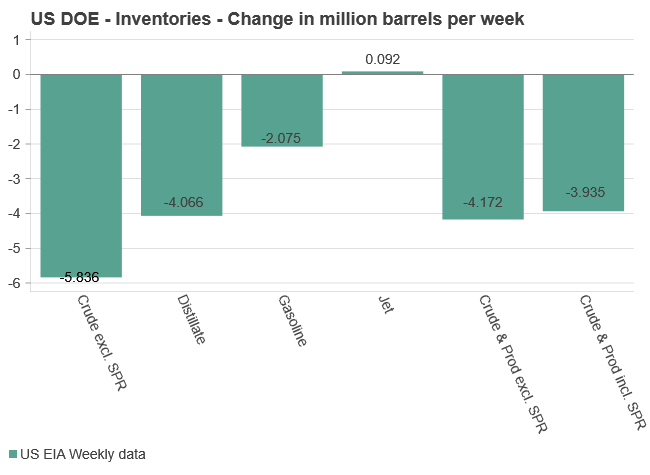

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

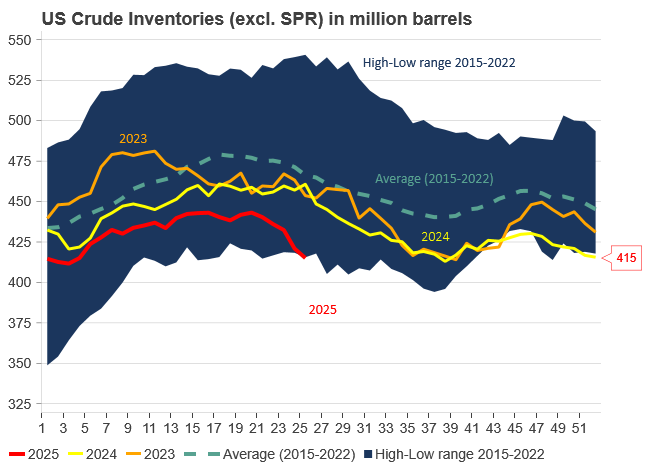

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning