Analys

SEB – Råvarukommentarer, 4 februari 2013

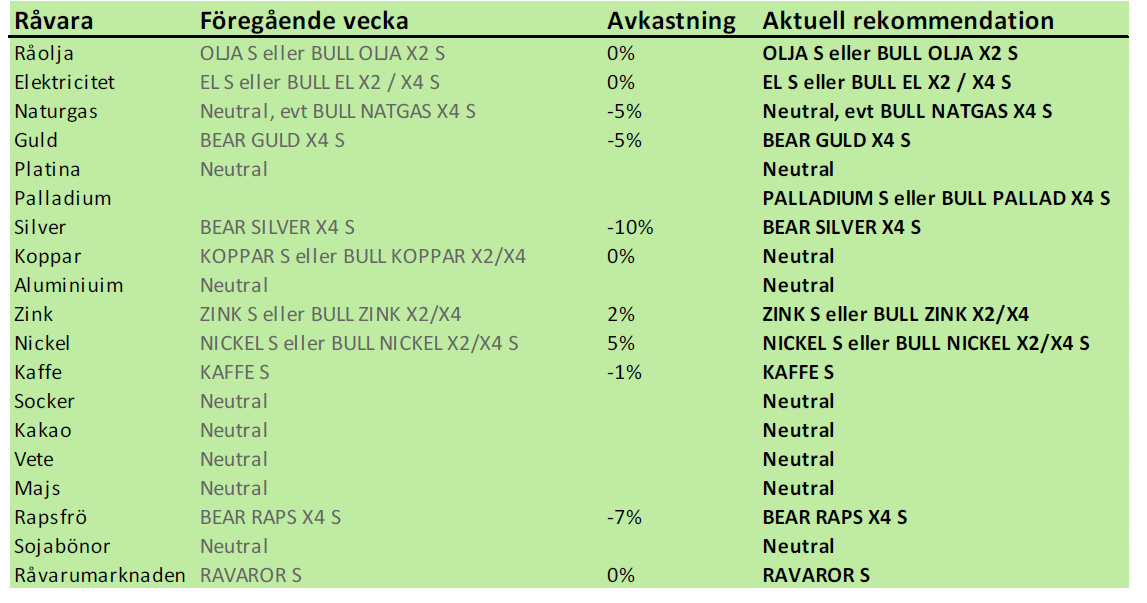

Rekommendationer

Inledning

Oljepriset fortsatte att stiga i veckan. Nickel bröt en långre tids kräftgång och rusade i pris. Elmarknaden fortsatte att konsolidera sig efter att ha backat i två veckor. Mot slutet av veckan vände priset på tysk el och utsläppsrätter tvärt uppåt, vilket kan ge stöd för den nordiska elmarknaden.

I fredags noterades certifikat på palladium: PALLADIUM S, BULL PALLAD X4 S och BEAR PALLAD X4 S.

Dessutom noterades bull och bear på kaffe och socker – två “softs” som i nästan exakt två års tid fallit i pris hela vägen ner till där de låg innan den stora prisuppgången inleddes. Vi tror att båda står inför en kraftig prisuppgång. Kaffe tycks ha etablerat en botten att starta från, medan det är mer osäkert för sockermarknaden.

Råolja – Brent

I torsdags kom rapporten från Libyen att utländska oljearbetare lämnar landet, med lägre produktion som direkt konsekvens. Det finns samma oro som i Algeriet. Landets mål att nå upp till 2 mbbl/dag i produktion kommer inte att uppnås. Detta fick oljepriset att stiga rakt genom det tekniska motståndet på strax över 115 dollar. Nästa motstånd ligger på 117.95 dollar. Dit är det inte långt från fredagens stängning på 116.76.

Oil & Gas Journal skrev i lördags om att de ser ett lägre oljepris som osannolikt. De citerar IFP Energy Nouvelles(IFPEN) i Paris, som nämner några faktorer som är nödvändiga för ett lägre oljepris: För det första en lägre global tillväxt än i IMF:s ”base case” i sin World Economic Outlook. För det andra, mer stabilitet och mindre politiska spänningar i Mellanöstern och slutligen en snabbare tillväxt i USA:s produktion från skifferreservoarer.

IFPEN identifierar Iran som ett ”damoklessvärd”, eftersom det allt längre fortskridande kärnvapenprogrammet kan leda till ett militärt ingripande. Efter nyvalet i Israel måste förloraren Netanyahu bilda regering i koalition med mer nationalistiska partier, vilket ytterligare ökar spänningen i regionen.

I förra veckans veckobrev såg vi att inköpschefsindex pekar uppåt i viktiga ekonomier i världen. Konjunkturen bör ge bra stöd för oljepriset.

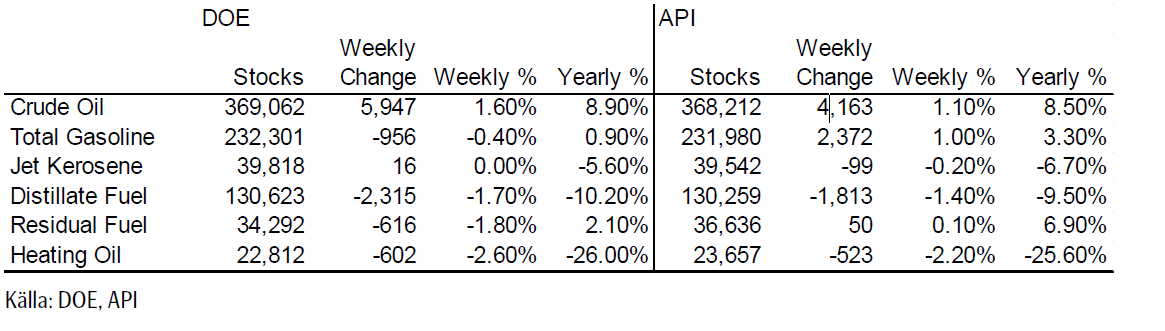

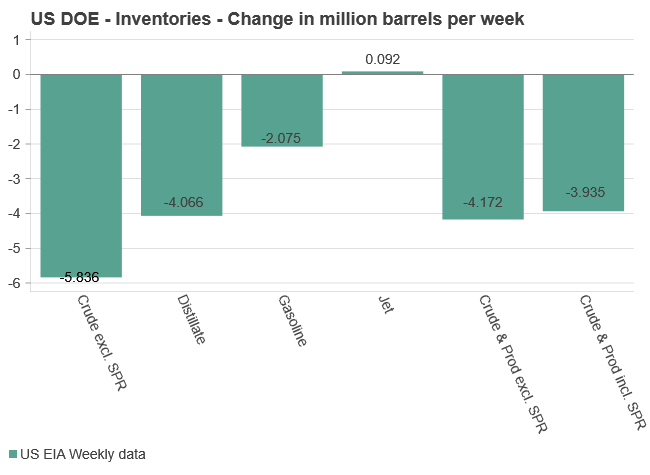

Lagren och lagerförändringarna i USA per den 25 januari ser vi nedan, enligt Department of Energy och American Petroleum Institute.

Det var inga stora förändringar. Destillat och eldningsolja har betydligt lägre lager än förra året. Råoljelagren fortsätter att byggas på.

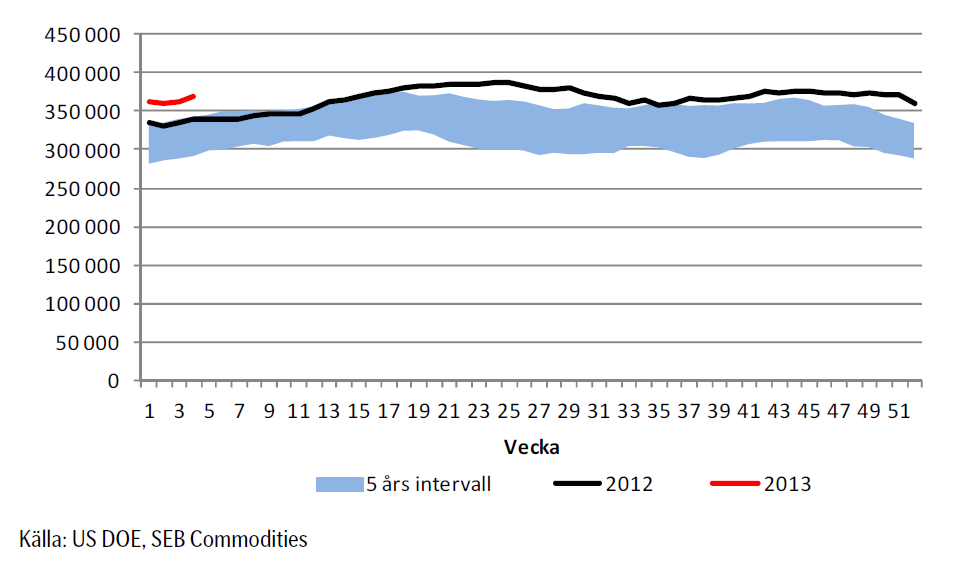

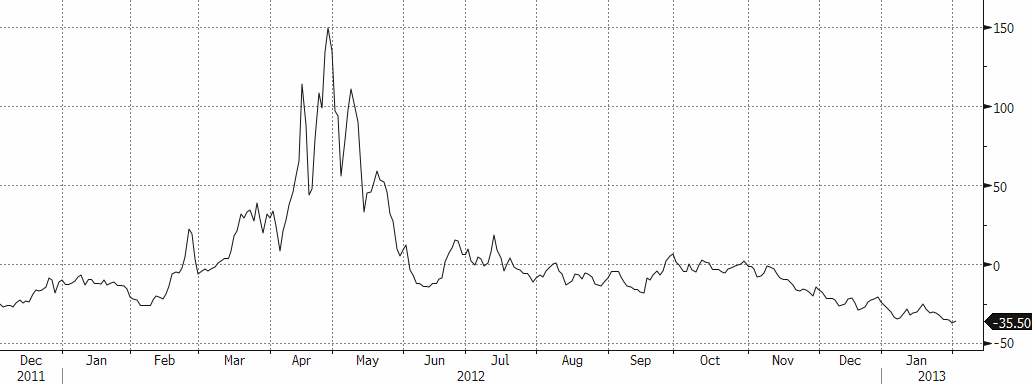

Nedan ser vi amerikanska råoljelager enligt DOE i tusen fat. Den svarta kurvan är 2012 års lagernivåer vecka för vecka och den lilla röda linjen är 2013 års nivå. Vi ser att lagernivåerna fortsätter att vara högre än de varit sedan 2007 för den här tiden på året.

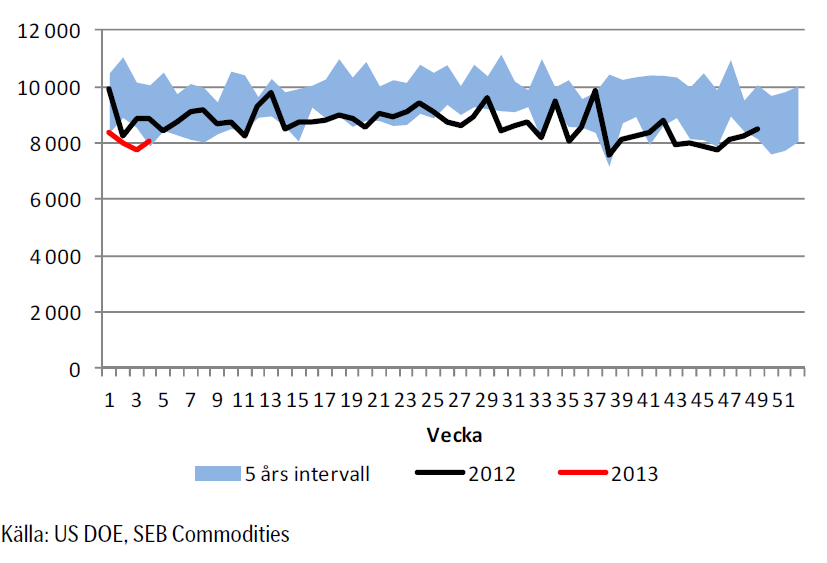

Lagren ökar samtidigt som vi ser att importen av råolja till USA fortsätter att minska. Man kan ana att konjunktur och den nya ”fracking” tekniken ligger bakom. Om vi antar att hela förklaringen är frackingtekniken, kan det innebära att USA kan bli självförsörjande på råolja. Med den takt importminskningen har haft sedan 2007, upphör USA:s import om 29 år, om trenden fortsätter. Y-axeln är angiven i 1000 fat per vecka.

Sammanfattningsvis: På kort sikt påverkar den minskade produktionen i Saudiarabien och produktionsbortfallen från Algeriet och nu också Libyen. En konjunkturell återhämtning i världsekonomin, som ger stöd även för efterfrågan på olja, kan leda till högre priser. Tekniska motstånd strax ovanför fredagens prisnivå gör dock att det kan komma vinsthemtagningar. Vi tror att man ska försöka komma in på den långa sidan i t ex OLJA S eller BULL OLJA X2/X4 S när en rekyl i priset har inträffat.

Elektricitet

Elpriset har kommit ner så pass, till 35 euro per ton, att de kan vara en god idé att försöka köpa BULL EL X2 eller X4 S på de här nivåerna.

Samtidigt steg priset på utsläppsrätter kraftigt i fredags, som vi ser i diagrammet nedan. Den starka kursuppgången kan vara ett tecken på att det stora prisfallet är över.

Den hydrologiska balansen för NordPools börsområde låg i veckan still på -10 TWh.

Sammanfattningsvis. Vi tror att det finns goda chanser att elpriset vänder uppåt efter att ha rekylerat nedåt de två senaste veckorna. Vi rekommenderar alltså köp av EL S eller BULL EL X2 / X4 S för den som vill ta mer risk.

Naturgas

Naturgasterminen på NYMEX (mars 2013) fick stöd vid 3.40 dollar per MMBtu. Det är mitt emellan förra botten på 3.20 och förra toppen på 3.60. Neutralt läge, alltså. Men det senaste trendbrottet skedde uppåt, så vi letar hellre tillfälle att köpa BULL än att gå in i BEAR.

Den som kortsiktigt vill prova på att handla naturgas, kan kanske försöka sig på ett mycket kortsiktigt inhopp i BEAR NATGAS X4 S. På längre sikt tror vi att man bör vara neutral.

Guld och Silver

Guldpriset började förra veckan med att stiga från en bas på 1650 dollar. En fallande dollar gav stöd (för noteringen på guld i dollar). I svenska kronor slog dock guldets svaghet igenom och föll hela veckan. Certifikatet GULD S, som följer priset i svenska kronor, precis som om det vore en guldtacka prissatt i svenska kronor, backade därför med 2%.

Den tekniska analysen förutspår lägre priser. Det senaste utbrottet skedde på nedsidan från en triangelformation. De två senaste månadernas kursrörelser kan betraktas som rekyler efter utbrottet. Så länge det nedåtgående motståndet inte bryts tycker vi att man bör handla guld från den korta sidan. Å andra sidan har utbrottet följts av vad som ändå får betecknas som ganska svagt momentum på nersidan. Att marknaden inte med någon övertygelse handlar ner priset får kanske tas som ett observandum.

Nedan ser vi kursdiagrammet för silver i dollar per troy ounce. Situationen är snarlik den för guld. Rekyl ner till 30 dollar är att vänta. Kortsiktig BEAR-rekommendation för silver också.

Platina

Platina har konsoliderat prisuppgången i två veckor. En växande efterfrågan från fordonstillverkning, framförallt i Kina, ger stöd för priset. Motsvarande efterfrågefaktor saknas för guld och silver. En återhämtning i global ekonomi verkar stödjande för platina, men eftersom oron för statsfinansiell bankrutt minskar, får detta en negativ effekt på priserna på silver och guld. Ska man vara köpt en ädelmetall är därför platina eller palladium att föredra.

Det går just nu inte att ge en rekommendation på kort sikt, eftersom konsolideringsfasen fortfarande pågår. Vi får vänta och agera på utbrott från den. Sker det uppåt – köp BULL. Sker det nedåt – köp BEAR.

Notera att det finns ett tämligen välprövat och starkt motstånd på 1734 dollar. Om detta bryts inleds troligtvis en stark prisuppgång.

Nedan ser vi priset på platina i termer av guld, eller ”växelkursen” mellan XPT och XAU, valutakoderna för de två ädelmetallerna. Kvoten ligger precis på toppen från mars förra året. Det innebär att platina är ”dyrt” i förhållande till guld i ett historiskt perspektiv. Och fundamentalt är det kanske inte något fel i det. Men det kan ändå finnas en del säljordrar just vid eller bara strax ovanför dagens kursnivå.

Slutsats: avvakta utbrott från konsolideringen vad gäller platina. Relationen till guld i priset på platina indikerar att det finns motstånd på uppsidan. Ska man gissa, så kanske utbrottet för platinas del därför sker på nersidan.

Palladium fortsätter att stiga. Palladium används i katalysatorer för bensindrivna bilar. Pristrenden är som vi ser i kursdiagrammet nedan, stadigt uppåtriktad.

Vi rekommenderar en köpt position i palladium, t ex med certifikatet PALLADIUM S eller med BULL PALLAD X4 S, för den som önskar ta mer risk.

Basmetaller

Vi noterar starka uppgångar under veckan som gick. Koppar och aluminium ca 3 %, zink 4,5 och nickel sticker ut med 7 %. Metallerna har brutit ur sina tidigare ”tradingintervall”, vilket har satt igång aktivitet framför allt från finansiella aktörer. Industrin i Europa är emellertid fortsatt avvaktande. Asien är mer aktiva och anses ”boka upp” material före det kinesiska nyåret med förväntningar om ökad efterfrågan längre fram. Aktörerna köper således på förväntningar om ökad efterfrågan. Basen för all handel i basmetaller på Londons metallbörs är 3-månadersnoteringen, och det är ungefär i det perspektivet som den fysiska efterfrågan måste ta fart för att försvara prisuppgången. Rapporter från den fysiska marknaden gör gällande att tillgången är god. Ett tecken på detta är att alla basmetaller har ”Contango”, vilket på råvaruspråk innebär att terminspriset är högre än spot. En viktig tumregel på råvarumarknaden är: contango= gott om material, det motsatta förhållandet, backwardation=ont om material. Slutsatsen av resonemanget är således att den fysiska marknaden måste ”komma ifatt” den finansiella för att prisbilden skall hålla. Det som driver finansmarknaden är de makroekonomiska indikatorerna som onekligen talar för en starkare konjunktur. I fredags kom inköpsindex, som är en av de mer relevanta framåtblickande indikatorerna för basmetallefterfrågan. USA uppvisade en stark siffra på 53,1 i januari mot 50,2 i december. Europa stiger men är fortfarande under 50, medan Sverige ryckte från 44,6 i december till 49,2. Den samlade konjunkturbilden ser stark ut globalt även om ingen tror på någon kraftig uppgång. Måttlig men stabil tillväxt är vad som väntas. När det gäller basmetallpriser finns risken att marknaderna har överreagerat på uppsidan just nu. Rekyler är att vänta. För den som köpt tidigare kan det vara värt att ta hem vinst (se nickel och zink nedan), för den som inte kommit in i marknaden kan eventuella rekyler ge ypperliga köptillfällen i veckorna som kommer. Kina går på helgfirande om en vecka så aktiviteten därifrån lär vara begränsad, vilket också talar för en svagare marknad de kommande två veckorna.

Koppar

Koppar, som normalt leder basmetallkomplexet, släpar efter just. Förklaringen finns delvis i grafen nedan som visar LME-lagrets förändring. Lagret har nästan fördubblats de senaste 3 månaderna. Kopparlagren har varit kroniskt låga i flera år, men det ser ut att vända.

LME-lager

Nästa graf visar skillnaden mellan spot (cash) och 3 månaderspriset (minus betyder att 3 månaderspriset är högre än spot = contango). Som nämndes i ingressen betyder det god tillgång på fysisk vara, vilket således avspeglas i ökande contango. Som vi tidigare nämnt rapporterar producenterna om ett ökat utbud det kommande året. Ökande smältlöner (se förra veckans brev) är också ett tecken på detta.

Spreaden Cash-3m

Tekniskt sett får vi en mer positiv bild av marknaden. LME-noteringen bröt i veckan ur den stora ”triangelformationen” och strävar nu uppåt i trendkanalen. Om LME-noteringen (3 månaders) kommer ned mot ”utbrottsläget” $8200 är det köpläge. Detta stämmer bra med vår generella bedömning att metallerna är redo för en rekyl.

Vi rekommenderar en neutral position i koppar. Om konjunkturscenariot i Kina skulle gå in ett mindre positivt läge (vi bedömer det som mindre sannolikt) är koppar den bästa kandidaten för placering i prisnedgång.

Aluminium

Aluminium är den mest omsatta metallen på LME, i ton räknat. Logiskt eftersom det är den största metallen vad gäller utbud och efterfrågan. Det produceras ca 45 miljoner ton aluminium jämfört med kopparns ca 20 miljoner ton. Det är ändå koppar som oftast leder prismässigt. Vi har tidigare diskuterat den fundamentala situationen för aluminium som till stor del ”lider” av ett överutbud. Efterfrågan är det som håller uppe priset, med väldigt goda utsikter för året. Tillväxten är mellan 5 och 7 % årligen, således väl över den generella efterfrågan i världsekonomin.

Tekniskt sett ser det stark ut. Bilden liknar den för koppar. Veckans genombrott uppåt, öppnar för ytterligare uppgång till motståndet vid tidigare toppar kring $2200. Nästa motstånd kommer in vid $2350.

Vi rekommenderar en neutral position i aluminium.

Zink

Zinken gick fortsatt starkt i veckan med en uppgång på LME med 4,5 %. Även här diskonterar marknaden en ökad efterfrågan. Vi tror att den kommer och att prisbilden kommer hålla sig stabil, med fortsatt bra potential på uppsidan. Med vår generella bedömning (se ingressen) finns dock risk för en rekyl. Vi har tidigare angett $2150 som en vinsthemtagningsnivå. Med den styrka vi såg i veckan så kan mycket väl priset stärkas ytterligare på kort sikt, men från nuvarande nivå kring $2175 upp till $2200 tror vi marknaden kommer att möta motstånd, så för den som köpt tidigare kan det vara värt att ta hem en del vinst. För den som vill komma in i marknaden, bör en rekyl ned mot $2100 utnyttjas till köp.

Vi rekommenderar köp av ZINK S eller BULL ZINK X2 / X4 S för den som vill ta mer risk. Efter de senaste veckornas kraftiga uppgång finns risk för en rekyl. För nya köp bör man avvakta en eventuell rekyl ned mot intervallet $2000-$2100. För den som köpt tidigare bör man kortsiktigt ta hem vinst vid motståndsnivån $2150-$2200. På lite längre sikt är potentialen större med målet $2400 på 1-2 månaders sikt.

Nickel

Nickel är veckans raket med en uppgång på nästan 8 %. Det är den mest volatila metallen. När väl basmetaller vänder så går oftast nickel mest (det gäller naturligtvis också när priserna faller!) Vi ser det tydligt när ett tradingintevall som gällt så pass länge (se diagrammet nedan) bryter, så skakar det om marknaden rejält. Den fundamentala situationen är dock lite knepig för nickel. Utbudet ökar och stålindustrin har överkapacitet. Det är inte riktigt bäddat för den stora uppgången ännu. Som vi tidigare skrivit kan dock nickel erfarenhetsmässigt ofta överraska. Den tekniska bilden är väldigt tydlig med nästa motståndsnivå vid $19000 och därefter $22000. Kortsiktigt är det värt att ta hem vinst.

Vi rekommenderar köp av NICKEL S eller BULL NICKEL X2 / X4 S för den som vill ta mer risk. Efter de senaste veckornas kraftiga uppgång finns risk för en rekyl. För nya köp bör man avvakta en eventuell rekyl ned mot ”utbrottsnivån” $18000. För den som köpt tidigare bör man kortsiktigt ta hem vinst vid motståndsnivån $19000. På lite längre sikt är potentialen större med målet $22 000 på 1-2 månaders sikt.

Kaffe

Kaffepriset rörde sig svagt nedåt / sidledes i veckan, efter att prisuppgången för två veckor sedan hejdades vid motståndet på 157.35 cent per pund.

Vi fortsätter att dela den uppfattningen och tycker att man ska handla kaffe från den ”långa” sidan. Vi fortsätter därför att generellt sett rekommendera köp av KAFFE S.

För den som vill ta mer risk, börsnoterade vi på SEB Commodities i fredags även BULL KAFFE X4 S (och BEAR KAFFE X4 S), som kostar ca 50 kr per certifikat.

Socker

Sockerpriset (mars 2013) rörde sig svagt uppåt från stödet på 18.31 cent i veckan som gick. De senaste två månadernas prisrörelse skulle kunna vara en början på en konsolidering efter det kraftiga prisfallet på socker, som pågått i mer än två år. Den 2 februari 2011 var priset uppe på 31.35 cent som högst.

Vi fortsätter med neutral rekommendation på socker, i avvaktan på mer tecken på att prisfallet är över.

För övriga jordbruksråvaror se dagens nyhetsbrev SEB Jordbruksprodukter.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

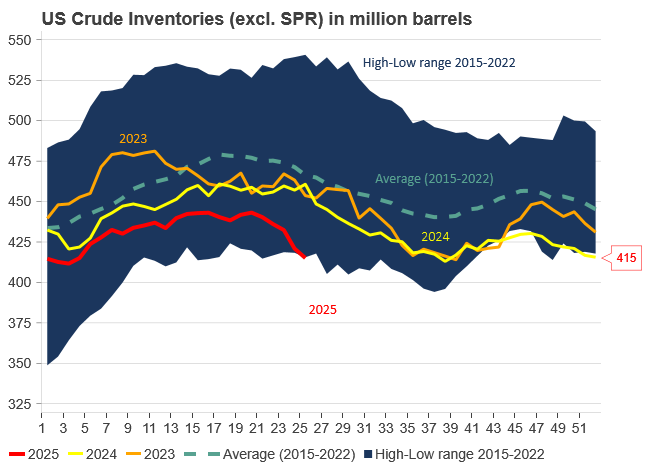

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen