Analys

SEB – Råvarukommentarer, 17 december 2012

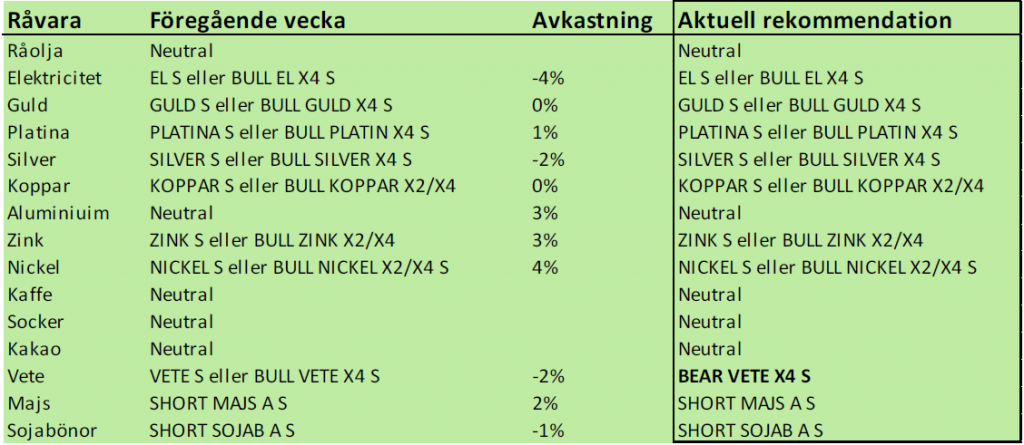

Sammanfattning av rekommendationer

Avkastning ovan visar avkastningen på de linjära alternativen och inte på bull och bear-alternativen.

Vi har nu gått över till en säljrekommendation på vete, vilket innebär att vi även på kort sikt rekommenderar sälj på jordbruksprodukter. Med det sagt, är det inte omöjligt att det kommer en rekyl uppåt på vetepriset med några euro per ton i veckan, vilket vi ser som ett säljtillfälle.

Vi köprekommendation på alla basmetaller och de positionerna har utvecklat sig väl.

Ädelmetallerna ser återigen svagare ut och eventuellt brott av tekniska stöd i marknaden bör bevakas noga.

Oljan är fortsatt “sidledes”, utan trend och med ett pris som varken motiverar köp- eller sälj.

Elen rekylerade ner i veckan. Vi tror fortfarande att man bör handla elen från den långa sidan och behåller köprekommendationen.

Råolja – Brent

Förra veckan präglades av stark statistik från Kina och FED:s besked om förnyade stimulanser. Det var mer fokus på ”bull” faktorer jämfört med veckan innan då bl a Fiscal-Cliff och Europaproblem tyngde sentimentet. Dessutom bidrog kallare väder på norra halvklotet bidragit till att lyfta marknaden något.

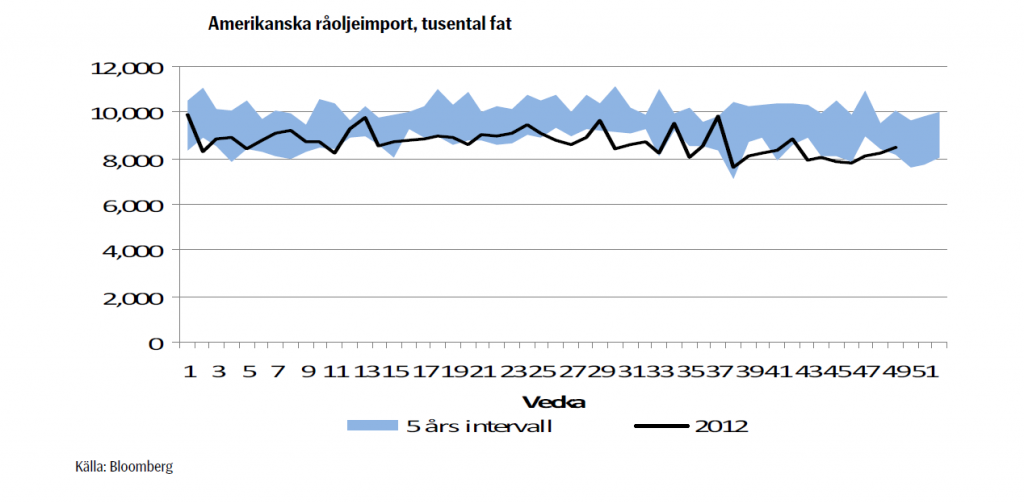

OPEC höll möte den 12 december. Inga stora överraskningar levererades. Produktionsmålet är fortsatt 30 mfat per dag. Istället för att kalla kvoten ”tak” benämndes det nu istället nivå, vilket indikerar lite mildare retorik. Kanske är det inte heller så konstigt då verklig produktion under en lång tid (i mer än ett år…) överskridit målet som ju är ett gemensamt mål. Organisationen är uppenbart orolig för hur efterfrågan ska utvecklas nästa år. I realiteten är det sannolikt Saudiarabien som måste minska sin produktion om man på allvar vill nå målet. En vanlig uppfattning i marknaden är att den ökande amerikanska produktionen kommer tvinga Saudiarabien att strypa utbudet för att förhindra en priskollaps. Amerikans råoljeimport är redan kring 5-års lägsta, se graf, och kommer om, produktion ökar enlig förväntan, fortsätta falla.

Vid nuvarande pris är Saudierna nöjda, priset är där man kommunicerat att man vill det ska vara. Samtidigt är man orolig för vad ökande utbud och svagare efterfrågan kan komma att innebära. Man önskar stabilitet och lagom högt pris och landet måste sannolikt stå beredd att kraftigt strypa utbudet i fall ett större prisfall realiseras. Vi förväntar oss också att OPEC (läs Saudi) kommer justera ned oljeproduktionen när vi efter vintern går in i svagare säsongmässig efterfrågan.

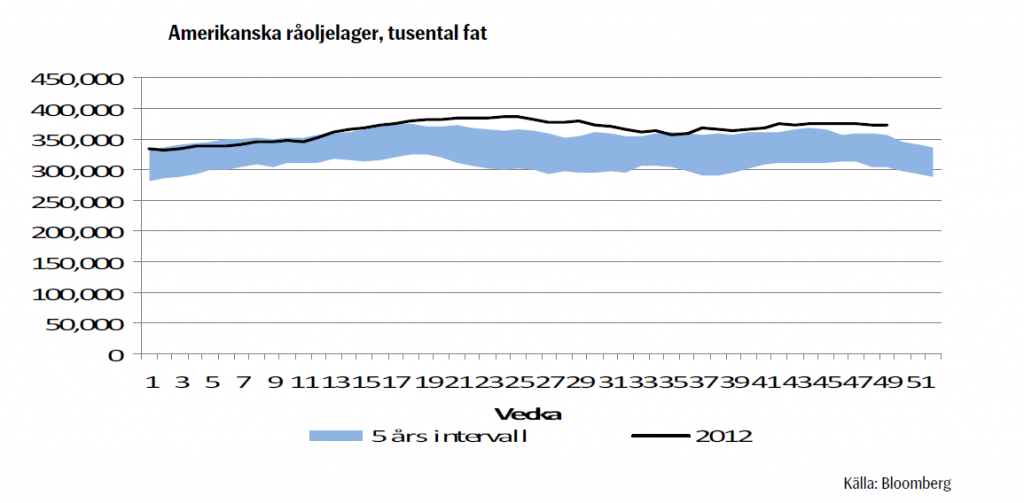

Förra veckans DOE oljelagerstatistik visade att råoljelagren ökade med 0.8 mfat. Nedanstående graf visar den nuvarande höga råoljelagernivån i USA i förhållande till 2007-2011 års nivåer. Med förväntat högre amerikansk produktion nästa år, så förstärks problemet för WTI-oljan, vilken handlar med betydlig rabatt mot andra jämförbara kvaliteter och dessutom i contango till skillnad mot t ex brentolja. Produktlagren följde också upp föregående veckas ökningar med ytterligare stora uppgångar, distillates ökade med 3.0 mfat medan bensinlagren ökade med 5.0 mfat.

Washington förbereder ytterligare åtgärder mot banker som deltar vi transaktioner med Irans centralbank vid oljeexportaffärer. Iran är uppenbart pressat, exportvolymerna uppgår f n till drygt 1 mfat per dag, sannolikt också kraftigt rabatterad, vilket påverkar landet negativt ekonomiskt.

I veckan publicerade de stora oljeorganen rapporter. Det innebar inga omvälvande förändringar. IEA justerade upp prognosen för efterfrågan något till 90.5 mfat (+0.1). OPEC å sin sida lämnade efterfrågan oförändrad på 89.6 mfat.

Den geopolitiska risken kvarstår, speciellt som en nu en lite större del av riskpremien, efter prisfallet, försvunnit. Mellandestillaten, speciellt i Europa, utgör också en stödjande faktor för Brent, som lämpar sig väl för produktion av mellandestillat. I Europa är det också fortsatt stort fokus på den ansträngda lagersituationen för just mellandestillat. Vintern förstärker problemet, då efterfrågan på olja för uppvärmning på kontinenten säsongsmässigt ökar

I fredags stängde Brentkontraktet på 108.50 usd/fat. Kring nuvarande nivå håller vi en neutral vy.

Elektricitet

Förra veckan var en återgång till betydligt mildare väder. Så sent som helgen innan, såg det fortsatt kallt och relativt torrt ut. Vi valde därmed att fortsätta rekommendera long position, vilket med facit i hand inte blev lyckosamt. Den underliggande terminen, Q2-13, vände ned och tappade ungefär lika mycket i värde som den ökade veckan innan. Underliggande terminskontrakt för SEB:s BULL, BEAR och linjära EL S-certfikat är nu terminskontraktet för det andra kvartalets genomsnittliga spotpris på NordPool.

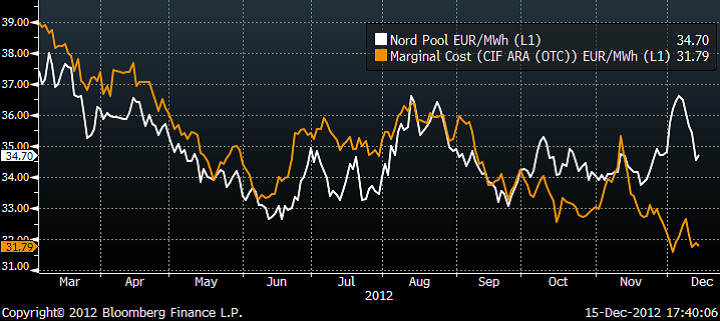

Som vi skrev om förra veckan, så krävs att marginalkostnaden för fossileldad kraftproduktion stiger för att ge en varaktig uppgång. Förra veckan innebar fallande marginalkostnad. Kolpriset steg visserligen men priset på både CO2 och dollar i förhållande till euro försvagades. Differensen mellan Q2-13 terminen och marginalkostnaden för koleldad kraftproduktion under samma period är nu rekordstor, se graf. Den försvagade hydrologiska balansen motiverar, visserligen, en del av avvikelsen men differensen är stor.

Kontinentala elpriser fortsatte därmed också falla. Trenden för kontinentala elpriser har varit ned sedan slutet av augusti, vilket illustreras nedan i grafen för elterminen för år 2013, Tyskland.

Inför kommande vecka ser det alltså åter ut att kunna bli kallare, men det finns, som alltid, en grad av osäkerhet i prognoserna. Blir prognoserna verklighet så är den hydrologiska balansen redan i svagt underskott i slutet av denna vecka. Samtidigt så går vi mot ett par veckor med låg förbrukning p g a helgfirande. Den fallande förbrukningen gör att det blir svårt att nå lika högt spotpris som det kan bli en vanlig vintervecka. Systemet får så att säga lite andrum.

Vi har under ett antal veckors tid rekommenderat en long position i SEB:s certifikat på el. Med tanke på hur mycket kontraktet fallit trots nuvarande prognoser, så väljer vi att fortsatt rekommendera long.

SEB har följande börshandlade certifikat kopplade till elterminer på Nasdaq OMX.

Long ———— Short

EL S ———— Bear El X2 S

Bull El X2 S —- Bear El X4 S

Bull El X4 S

Guld och Silver

Både guld och silver har med sjunkande toppnoteringar och stigande bottennoteringar sedan början på hösten, bildat så kallade ”triangelformationer”. Just nu ligger priserna an mot stödlinjerna i respektive triangel och testar dessa. Priset på guld och silver ”borde” gå upp när alla viktiga centralbanker trycker mer pengar i hopp om att stimulera igång ekonomin. Men marknaden handlar metallerna underligt svagt mot den bakgrunden. Det gör att vi känner en viss oro för kursutvecklingen framöver.

Nedan ser vi kursdiagrammet för silver i dollar per troy ounce. Situationen är identisk med den för guld.

Platina

Platinapriset har klarat rekylen bättre än guld och silver. Platina har varit och är fortfarande vår favorit bland ädelmetallerna.

Basmetaller

Veckan inleddes med starka siffror från Kina i ryggen som presenterades förra helgen. Industriproduktionen steg med 10,1 % i november och detaljhandeln med 14,9 %. Handelsbalansen var något svagare med ett lägre överskott än väntat (ett tecken på svaghet i övriga världen, framför allt Europa). Mer positivt för metallerna var att importen ökade (som väntat) av koppar. FED presenterade på onsdagkvällen nya stimulanserna, vilket i och för sig var väntat och följdes av en rekyl nedåt under torsdagen. HSBC:s inköpsindex kom samtidigt in på 50,9 vilket bekräftade den starkare tendensen i Kina. Den mer positiva bilden i USA bekräftades också under fredagen med en bättre siffra gällande industriproduktionen än väntat. Eurodollarn steg med 2 % i veckan vilket också gav stöd till metallpriserna, som gått starkt hela veckan. Nickel och zink är upp ca 3 %, aluminium 1 % och koppar oförändrad.

Koppar

Det relativt lägre kopparpriset på LME jämfört med Shanghai under november har som tidigare nämnts sannolikt lett till ökad import, vilket visades sig i förra helgens handelsiffror. Importen uppgick till 365 tton jämfört med 321 tton i oktober. Toppmånaderna brukar ligga kring 450 tton, så det är ingen hög siffra men stigande, och är i linje med återhämtningen av kopparkonsumtionen i Kina. Kopparpriset tvekar på uppsidan och är den av basmetallerna som haft sämst utveckling de senaste två veckorna. Orsaken är den allmänna uppfattningen i marknaden att den globala metallbalansen övergår till ett överskott nästa år. Med historiken i bakhuvudet (d.v.s. att utbudet konstant varit en besvikelse de senast åren) finns stor risk att så inte blir fallet. Vi tror på ett stabilt kopparpris framöver, även om andra basmetaller (nickel och zink) enligt vår uppfattning har bättre potential just nu.

Den tekniska bilden är relativt neutral för tillfället. Om LME-noteringen (3 månaders) kommer ned mot $7800 är det ett köp. Alternativet är att avvakta ett brott på uppsidan, vilket skulle vara definitivt över $8400.

Aluminium

Mycket kretsar kring terminspunkterna mellan december och januari. Det är backwardation (dvs priset i december är högre än i januari). Lagersituationen för aluminium har diskuterats i tidigare marknadsbrev. En stor del av överskottet ligger uppknutet i börstransaktioner, där finansiella aktörer utnyttjat den höga terminspremien, och ”låser upp” material under längre perioder. Detta i kombination med kapacitetsproblem i LME:s börslager, har skapt en tightare fysisk marknad än vad som annars skulle ha varit fallet. Detta speglas nu i stark efterfrågan för spotmaterial. Terminskurvan har gått över i s.k. backwardation, d.v.s. spotpriset är högre än terminspriset. Priset är ca 40 usd/ton högre i december jämfört med januari. Skillnaden mellan cash och3 månader är 16 dollar.Detta stärker hela marknaden och ger en känsla av korthet på material inför årsskiftet. 3 månaderspriset på LME är upp 1,3 % i veckan.

Tekniskt sett ligger priset och balanserar på trendlinjen, och med den ”tighta” terminsmarknaden som stöd finns risk/möjlighet att priset gör ett test upp mot $2200 i närtid.

Zink

Den förväntat starka utvecklingen infriades i veckan med en prisuppgång med 2,8 % för 3-månaders LME. Som vi skrivit tidigare är de största användningsområdena för zink bygg- och transportindustrin. Två områden som nu gynnas av en mer positivt syn på tillväxten i Kina och USA. Zink ligger väl placerad i det scenariot. De kommande årens begränsningar av utbudet talar också för en starkare zinkmarknad. Hotet är, som vi också nämnt tidigare, kortsiktigt överskott p.g.a. ökad gruvproduktion i Kina. Enligt bedömare avtar tillväxten nu av det kinesiska utbudet. Zinkpriset är fortfarande lågt ur ett produktionskostnadsperspektiv. Överskottet har också byggt stora lager som måste betas av. Ett troligt scenario är samma utveckling som för aluminium, d.v.s. att lagret knyts upp i finansieringsupplägg (se tidigare beskrivningar kring aluminiummarknaden) som kommer att undanhålla material från konsumenter, vilket framför allt gynnar de fysiska premierna, men också sannolikt zinkpriset. Omsvängningen av stämningsläget gör att vi nu bedömer att marknaden kommer diskontera starkare fundamental balans, vilket ofta innebär att investerare köper i ”förtid”.

Priset har nu brutit ut i en brantare trendkanal. Den ger motstånd kring $2150 där också toppen från september skapar ett motstånd. För den som köpt på tidigare rekommendation kan det vara en nivå att ta hem vinst på. Vi tror emellertid på en större potential på 2-3 månaders sikt på nivåer upp mot $2400. Se placeringsförslag råvaror för en djupare analys.

Vi rekommenderar köp av ZINK S eller BULL ZINK X2 / X4 S för den som vill ta mer risk. Man bör gå ur positionen om priset faller genom 1930 dollar per ton, som är stödet i den konsolideringsfas som varit rådande sedan prisfallet slutade i slutet av maj. Kortsiktigt bör man ta hem vinst vid motståndsnivån $2150. På lite längre sikt är potentialen större. Nästa motståndsnivå kommer in vid $2200, men målet är $2400 på 2- 3 månaders sikt.

Nickel

Efter rekylen veckan före tog det fart igen med uppgång på hela 3,4 %. Rapporter från den rostfria stålindustrin tyder på en försenad lagerbyggnadscykel. Industrifolk säger fortfarande att det släpar efter något, men det finns ett uppdämt köpbehov ute i industrin. Det är nog till stor del det vi ser nu. Frågan är hur mycket som finns kvar på uppsidan. Vi har tidigare prognostiserat att priset bara av lagercykeln lätt kan komma upp till $19000. Så länge inga stora besvikelser dyker upp på makroscenen kan vi mycket väl få se den nivån redan för årsskiftet. Det är ett tekniskt motstånd kring $18000 som måste röjas ur vägen först. Risken har ökat i och med den snabba uppgången, och det finns risk för rekyler. Precis som med koppar finns en oro i marknaden att utbudet skall komma att öka under nästa år och försätta marknaden i en överskottssituation.

Vi rekommenderar köp av NICKEL S eller BULL NICKEL X2 / X4 S för den som vill ta mer risk. Man bör gå ur positionen om priset faller genom 15,800 dollar per ton, som är stödet i den konsolideringsfas som varit rådande sedan prisfallet slutade i slutet av oktober. Kortsiktigt bör man ta hem vinst vid motståndsnivån $17500. På lite längre sikt är potentialen större. Nästa motståndsnivå kommer in strax under $19000

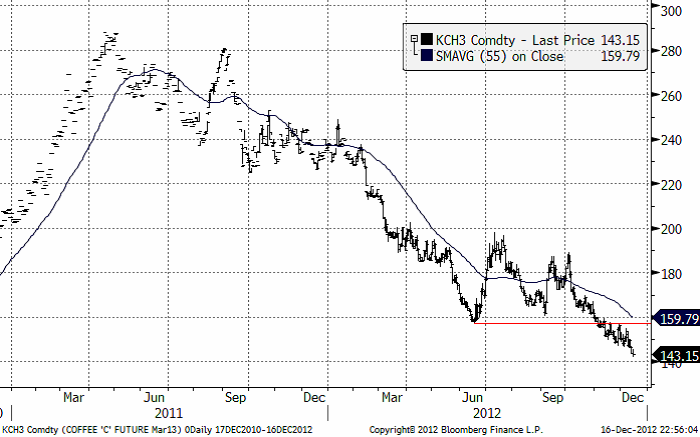

Kaffe

Kaffepriset (mars 2013) ligger i stadig fallande trend. Det är fortfarande bäst att vara såld kaffe.

För ytterligare jordbruksråvaror, se SEB Jordbruksprodukter från tidigare idag.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

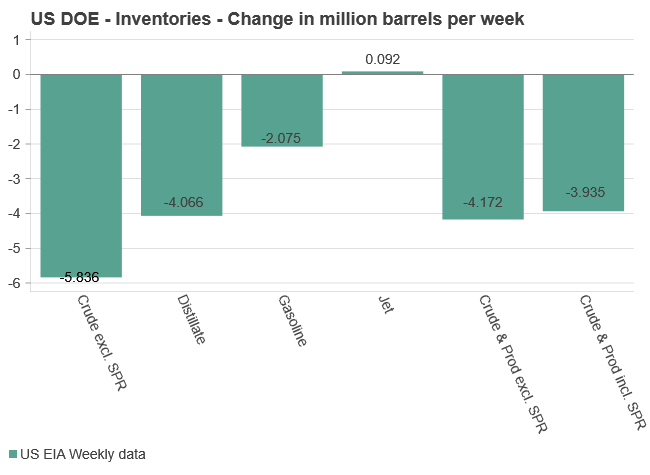

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

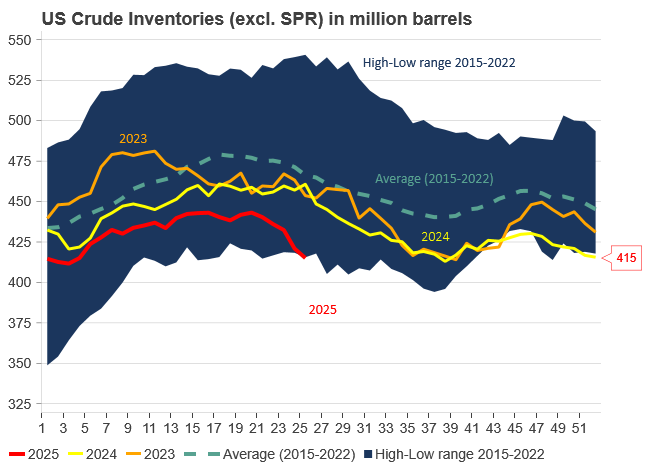

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering