Analys

More oil from OPEC+ is the base case

Saudi Arabia and Russia have already started to lift production and are arguing for an increase in production at the upcoming OPEC+ meeting next week. Unofficial sources have said that Russia will propose to return production back to the October 2016, i.e. removing the cap altogether over a period of three months. The countries who do not have any capacity to increase production are naturally opposing any suggestion of an end to the current cap as they will have no gain from higher production and just face a loss due to a relatively lower price due to production increases by the others. So Iran, Iraq and Venezuela are all opposing any removal of the cap. We think there is no way around an increase in production by Russia and Saudi Arabia. It does not make sense to risk an overly tight oil market in 2H18 just when global economic growth is cooling down with 16 of the world’s largest financial institutions having moved into bear market in a sign that higher interest rates, a stronger USD and higher oil prices are problematic for the global economy. It makes no sense for Saudi Arabia to break the OPEC+ cooperation either as it will likely be needed at another occasion further down the road. The challenge at next week’s OPEC+ meeting will thus be how to formulate a proposal for a gradual revival of production which all members can sign on to.

Saudi Arabia and Russia have already started to lift production and are arguing for an increase in production at the upcoming OPEC+ meeting next week. Unofficial sources have said that Russia will propose to return production back to the October 2016, i.e. removing the cap altogether over a period of three months. The countries who do not have any capacity to increase production are naturally opposing any suggestion of an end to the current cap as they will have no gain from higher production and just face a loss due to a relatively lower price due to production increases by the others. So Iran, Iraq and Venezuela are all opposing any removal of the cap. We think there is no way around an increase in production by Russia and Saudi Arabia. It does not make sense to risk an overly tight oil market in 2H18 just when global economic growth is cooling down with 16 of the world’s largest financial institutions having moved into bear market in a sign that higher interest rates, a stronger USD and higher oil prices are problematic for the global economy. It makes no sense for Saudi Arabia to break the OPEC+ cooperation either as it will likely be needed at another occasion further down the road. The challenge at next week’s OPEC+ meeting will thus be how to formulate a proposal for a gradual revival of production which all members can sign on to.

Price action: Ticking lower with more production from OPEC+ on the horizon

Brent crude fell back 0.8% to $75.88/bl with the longer dated contracts down almost as much as the Dec-2021 contract settled 0.6% lower at $65.94/bl. The WTI benchmark however gained 0.4% to $66.36/bl thus leading to a narrowing of the spread which blew out lately. The Brent to Midland (Permian) WTI spread narrowed to $17.9/bl having recently been trading as wide as $22.0/bl. This morning Brent pulls back another 0.3% to $75.64/bl as production revival by OPEC+ next week seems more and more like the most likely outcome.

OPEC’s MOMR report yesterday contains ammunition for those in OPEC+ who do not want a production revival

OPEC’s monthly oil market report yesterday was somewhat confusing. At the start of the report it highlighted significant uncertainty for Call-on-OPEC for 2H18. It set an uncertainty range of 1.8 m bl/d with a span from 31.5 m bl/d to 33.3 m bl/d and a mean expectation of 32.1 m bl/d. In its supply/demand balance later in the report it still set forecasted a call-on-OPEC at 33.3 m bl/d for 2H18, i.e. at the absolute high end of its uncertainty range highlighted at the start of its report. There must obviously have been some considerable disagreement between different writers participating in the writing of the report. As the report said in the Feature Article “World oil market prospects for the second half of 2018”: “Given the Secretariat’s forecast for 2H18, demand for OPEC crude is projected at 33.3 m bl/d..” Thus the Secretariat seems to have more or less dictated what the official Call-on-OPEC for 2H18 should be thus overruling the analysis that the mean expected call-on-OPEC for 2H18 was projected at 32.1 m bl/d. Or it is basically just two separate pieces of analysis.

OPEC produced 32.1 m bl/d on average from January to May. Thus according to the average forecasted sensitivity analysis in OPEC’s latest MOMR report in the Feature Article there is no room for any increase in production from OPEC in 2H18. Keeping production at current level of about 32.0 would actually keep the market at a neutral balance though OECD. The story in the MOMR Feature Article is thus strong ammunition for all those in the OPEC+ group who are arguing that production should not be lifted from the current production level. Production in Venezuela is of course declining by 50 k bl/d MoM and Iran’s production is likely going to decline a little as well. There is thus obviously some room to increase production by some of the other members in order to compensate for this. The caps set in Nov-2016 are however individual caps so increasing production by Saudi Arabia and Russia in order to compensate for lost supply in Venezuela and possibly Iran needs a vote.

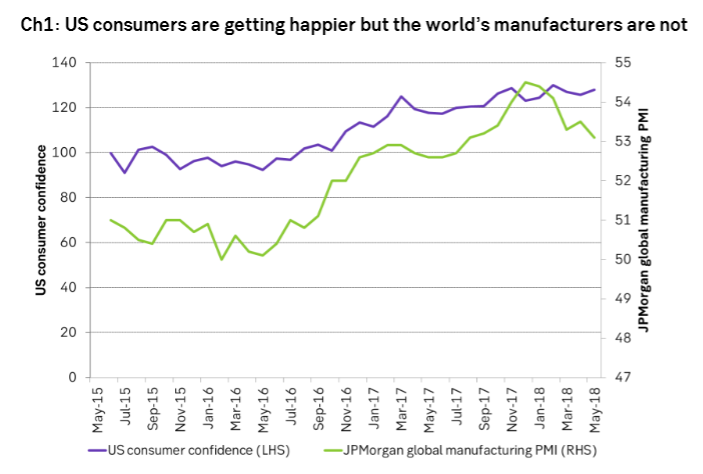

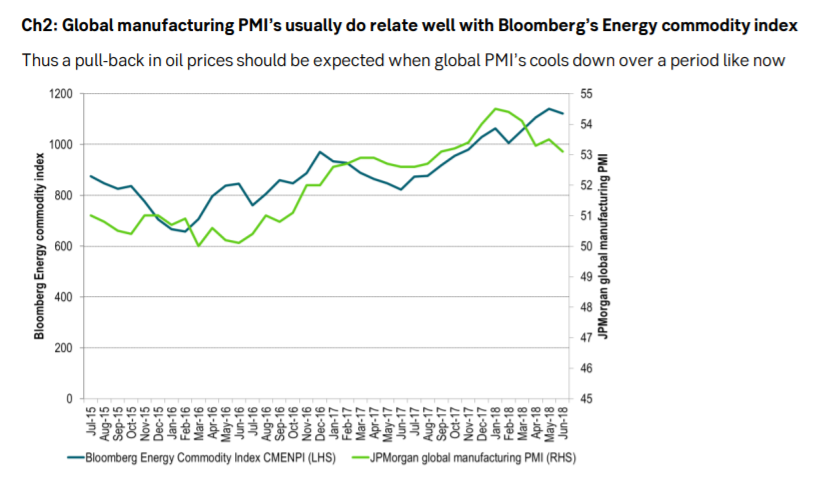

Uncertainty for Call-On-OPEC in 2H18 clearly warrants serious attention. While US consumer confidence is ticking higher the JPMorgan global PMI manufacturing index has ticked lower and lower since its peak in December last year even though it is still in positive territory of 53.1. Global growth has definitely cooled in 1H18. At the moment it does not seems as if a booming US economy is able to drag the rest of the world with it. Rather it seems like higher interest rates, a stronger USD and a higher oil price increasingly is creating a headwind for the global economy. The story in the FT today that 16 large global financial companies are down more than 20% from their peaks is highlighting the fact that the global economy is having a problem swallowing higher interest rates, stronger dollar and more expensive oil.

We expect OPEC+ to decide next week to increase production by 0.5 m bl/d in 2H18 at a gradual and measured pace.

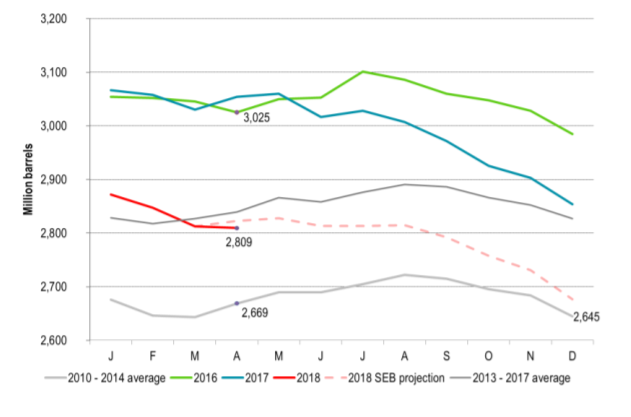

Ch3: Solid OECD inventory decline in April if adjusting for normal seasonal trendsThe OECD inventories declined

MoM by 3.1 million barrels in April. However, inventories normally rise by 26 million barrels in April. So versus seasonal trends the OECD inventories fell 28.6 million barrels in April which is equal to a seasonally adjusted deficit of 0.95 m bl/d.

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

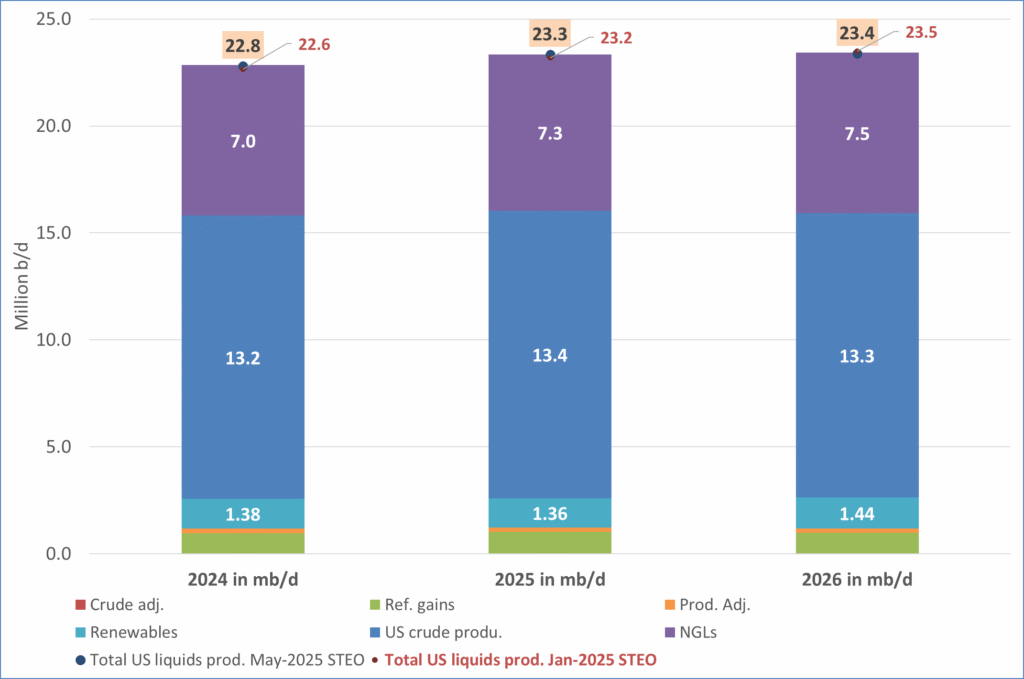

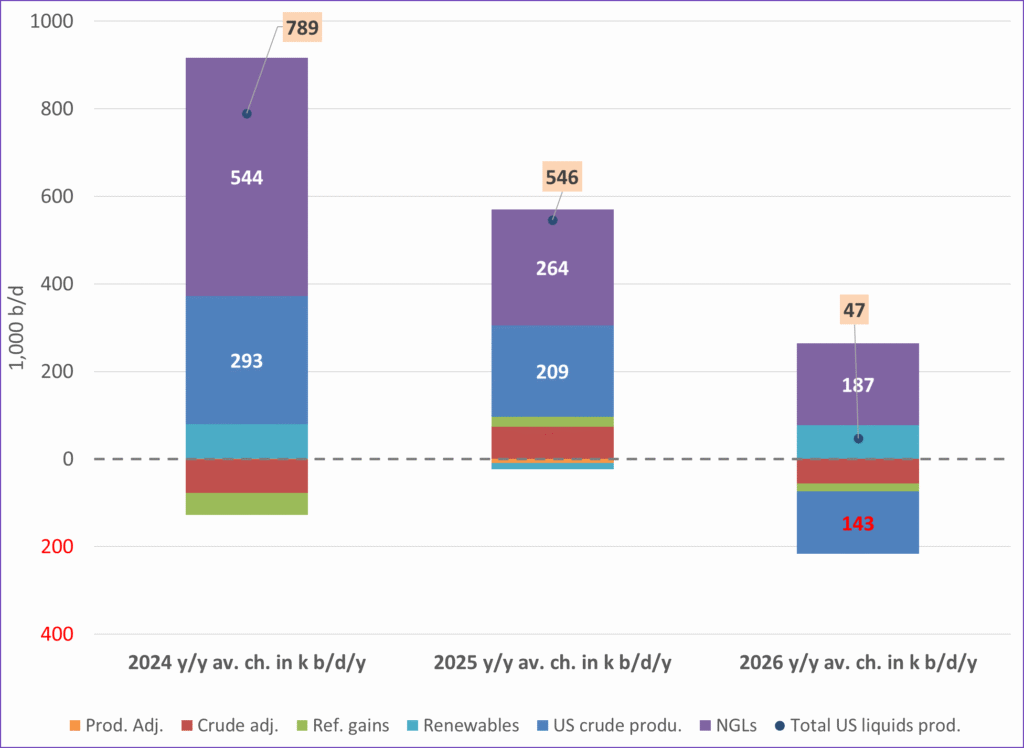

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September