Nyheter

Mining and exploration in Africa, the richest natural resources continent on earth

Why would anyone invest in african mining?

A new phase of excitement has begun

Companies should reach out to wider audience

Some time ago, a good and highly appreciated friend of mine asked me the question “Why would anyone invest in African Mining” after I told him about the positive impressions I had experienced at this year’s version of the Mining Indaba in Cape Town, South Africa. I was kind of surprised because that friend has been part of the resource investment industry for many years but on the other hand, I already knew that he didn’t really liked the idea of investing in Africa. Yet, it showed that I had not been able to generate any enthusiasm in my friend, despite the fact that since 2007, I have translated my long-time fascination for the African continent into writing about the development of its abundantly present natural resources in my MINING IN AFRICA publications. Which I do with much fun and pleasure, driven by my belief that although Africa has been through a long stretch of all possible changes in its social structure, its status and its way of living, its way of conducting business. Although I am sure that many more of changes are still ahead, I am convinced that Africa is on its way to move considerably forward as is illustrated so clearly by the economic growth that several African countries have been generating and reporting. Their percentages of economic growth are now nearing, equalling and will be soon surpassing the 7% mark that China is having now. Percentages that investors like to see!

I have decided to give my rebuttal to my friend’s statement in this issue because I feel his remark cannot stay unanswered. I hope to be able to paint my view on the on-going progress of Africa’s resource developments as I see it, and bring across that in spite of what many investors and members of the international investment communities think, the potential of several international resource companies with projects in Africa remains remarkably vast and to a large extent, not generally and certainly not enough recognized. Africa is still largely under-explored or in many countries and regions, even un-explored.

I have decided to give my rebuttal to my friend’s statement in this issue because I feel his remark cannot stay unanswered. I hope to be able to paint my view on the on-going progress of Africa’s resource developments as I see it, and bring across that in spite of what many investors and members of the international investment communities think, the potential of several international resource companies with projects in Africa remains remarkably vast and to a large extent, not generally and certainly not enough recognized. Africa is still largely under-explored or in many countries and regions, even un-explored.

For everyone who is following what is happening in the fascinating world of Africa’s resources, it is common knowledge that there have been quite dramatic developments, in some cases dramatic as less desirable but in more cases dramatic as substantial. Since African countries liberated themselves from the long and suppressive colonial governments, countries became their own bosses and one of their new responsibilities was recognizing the potential of their resources which had been exploited all those past years, mostly to the benefit of the colonial rulers.

Historically, South Africa was the leading mining nation because that is where the glimmer of diamonds and shine of gold began in South Africa when the original big discoveries were made in the second half of the 19th century. Other countries followed and became significant producers of different resources. Gold played a major role in the development of Ghana as its previous name so clearly indicated, copper was the driver of the resource industries in Zambia and the Democratic Republic of Congo, diamonds and gold in Zimbabwe when it was still Rhodesia, diamonds became the name of the game in Botswana and Angola and later also Sierra Leone and Liberia.

Over the last 40 years in general and in particular, in the last 10 years when the prices of metals in the world markets increased to today’s levels, there has been a tremendous shift in the order of mining and exploration countries in Africa. The mines in South Africa had to go and find the gold and diamonds deeper and deeper, resulting in steadily higher production costs, the flourishing mining industry in Rhodesia went down like a sinking ship after Mugabe and his friends transferred it into Zimbabwe, the long-lasting civil and ethnic clinches in Angola paralyzed its diamond industry, as similar causes diminished the importance of Sierra Leone and Liberia.

Over time, Ghana and the DRC kept their resource developments going and Angola, Zambia and Botswana recovered nicely to being back on track. In the meantime, other nations started to develop and earn internationally recognized statuses as successful and promising resource countries with intensive and growing mining and exploration industries. In this respect, I mention Tanzania in East Africa and Burkina Faso, Mali and Guinea in West Africa while subsequently, in several other countries producing mines and exploration projects have become beneficial parts of life such as in Mauritania, Niger, Eritrea, Ethiopia, Egypt and Namibia. Even more recently, interesting developments can be seen in countries like Mozambique, Madagascar, Senegal, Gabon, Cameroon, Kenya, Malawi, Uganda, Sudan, Togo and South Sudan. The most disappointing exception in this (re-)emergence of African resource successes remains Zimbabwe where the significant production of diamonds continues to be mainly in the greedy hands of the Mugabe-dominated government while their ridiculous and unacceptable 51%-indigenization rule stangles the returning to former glory of their once 800 operating gold mines.

As said above, at the recent Mining Indaba in Cape Town, I experienced a new awareness, a new breeze. In general, I would say I was impressed with the confidence in the future, the outlook in general and in particular in the resource developments in Africa. At my usual attending of the country presentation sessions, it was good to notice more determination, more realism and more constructive attitudes from governments. They seem to recognize the benefits and prospects of a successful mining and exploration industry in their countries. Also they seem to be more aware that the development of their resources should be undertaken in cooperation with international companies whereas in the past, they were more seeing them as intruders that wanted to get the benefits for themselves, rather than share them with the governments, the regions and the people in the areas where they work. Mining seems to be transferring from a curse into a blessing and rightfully so.

As said above, at the recent Mining Indaba in Cape Town, I experienced a new awareness, a new breeze. In general, I would say I was impressed with the confidence in the future, the outlook in general and in particular in the resource developments in Africa. At my usual attending of the country presentation sessions, it was good to notice more determination, more realism and more constructive attitudes from governments. They seem to recognize the benefits and prospects of a successful mining and exploration industry in their countries. Also they seem to be more aware that the development of their resources should be undertaken in cooperation with international companies whereas in the past, they were more seeing them as intruders that wanted to get the benefits for themselves, rather than share them with the governments, the regions and the people in the areas where they work. Mining seems to be transferring from a curse into a blessing and rightfully so.

Yes, there were quite a few questions asked about the seemingly growing concern about “nationalization” and “indigenization”. All of the governments at the Indaba waved away the threats of nationalization and as to indigenization, they made clear that they just want to make sure that a fair share of the mining and exploration results will come to the benefit of the country and their people. Of course, there is nothing against that, on the contrary, as long as the word “fair” will be applied to all parties concerned.

So new countries, new regions, new companies, new projects, new rules, new techniques, more professionalism will be the name of the new game. Answers to the question “Why would anyone invest in African Mining?” are more readily coming to surface in international media such as

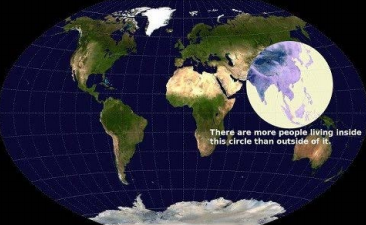

I am sure that we will continue to experience exciting times in the world of African resources. The demand for metals and minerals does not seem to be impacted too much by the economic slowdowns in some parts of the world as they are outgrown by the continuing expansion in other countries. Canada, Europe, Australia and less visibly Japan and the United States will continue to need the metals and more in particular, that will be valid for later entrants like Brazil, Russia, India and of course China, which is truly omnipresent on the African continent. By the way, just the other day, I came across a picture on the internet that illustrates where we can expect the main demand for Africa’s resources to come from. Among all the intelligent deliberations that we can have about the prospects of African mining and exploration, it is amazing how just this simple fact explains it.

Africa stands to benefit from this development, not only because the metals and minerals are there; I am convinced that there are much more resources in Africa than we know, more than anyone ever expected. I am sure that the search is on, maybe more on than ever before! There is no doubt in my mind that the generally increasing attention for Africa as an emerging economic continent will result in gaining more and more interest from international investors, institutional and private.

Is China outsmarting the rest of the world?

Another observation from the MINING INDABA. As we all know, from the media and all the reports that appear about mining and resources, one of or maybe even the most significant driving factor for international metals base metals like copper, zinc and lead, but now also gold, silver and rare earth metals and specialty minerals like graphite and grapheme, is coming from China. Their apparently insatiable hunger for these resources is the result for their economic growth in the last 10 to 15 years. Granted, some people in the western world are making continuous efforts to downplay the growth rates that they are currently showing but that is based on wrong and possibly envious assumptions. Yes the general economic growth rate is coming down but in no way the Chinese economy is resembling the difficulties that we are experiencing here in Europe and those that the USA is coping with. Growth from 8% down to 7% or even maybe to 6%, yes it is lower than before but still an amazing percentage. It is obvious that there is no end in sight of all those Chinese people that are emerging from old and simple economic circumstances to a more general and also attainable sharing of prosperity and wealth. Hence, the Chinese will be in a continuous need for metals, in particular for copper. And Africa is the place where to get it.

We all know the stories that the Chinese are all over the African continent, applying their vast abundance of money to buy and build their supply of metals for the future. Yet, at the Indaba there was not really a sign of that. They were there, with a prominent reception (unfortunately without Chinese food…..), held by the Ministry of Land and Resources of The People’s Republic of China. But otherwise, their presence at the Conference and Exhibition was very modest, as it usually is. Quite a difference with the actual situation in the many African countries where they are very active in absorbing interests in many resource projects, but also there in an almost invisible way. In the past, I have been writing about some of my observations and yes, I did express my concern about the possibility that in the future also the western world would become highly independent on the Chinese when it comes to the supply of metals that also we do need. I am not so sure that I would like a situation where we would become too depending on the Chinese rulers.

However, also at the Indaba there was talk about that. But honesty and fairness demands to say that the overall feeling was that the Chinese are only preserving their own current and future need of the base metals. Noteworthy in this respect was what Dr. Dambisa Moyo, the Zambian-born international economist and author of bestselling books “Dead Aid”, “How The West Was Lost” and “Winner Take All”, said in her highly interesting address to the MINING INDABA audience. She reiterated what she had written as intro to “Winner Take All”, her most recent book on China’s race for resources and what it means to the world: “Hardly a day passes when newspaper headlines or media commentators don’t scream warnings of impending doom – shortages of arable land, clashes over water, and political Armageddon as global demand for fossil fuels far outstrips supply. The picture painted is bleak, and shortages in the commodities markets have the potential to dramatically affect the way we live. Only one country appears to understand the importance of controlling these crucial assets – China.” This book is one of the best ways for anyone interested in the world’s natural resources in general and especially in the specific roles that both China and Africa have in the world of metals and minerals, to obtain an intelligent view on the subject from a highly skilful and knowledgeable economist and writer. For more information: www.dambisamoyo.com.

However, also at the Indaba there was talk about that. But honesty and fairness demands to say that the overall feeling was that the Chinese are only preserving their own current and future need of the base metals. Noteworthy in this respect was what Dr. Dambisa Moyo, the Zambian-born international economist and author of bestselling books “Dead Aid”, “How The West Was Lost” and “Winner Take All”, said in her highly interesting address to the MINING INDABA audience. She reiterated what she had written as intro to “Winner Take All”, her most recent book on China’s race for resources and what it means to the world: “Hardly a day passes when newspaper headlines or media commentators don’t scream warnings of impending doom – shortages of arable land, clashes over water, and political Armageddon as global demand for fossil fuels far outstrips supply. The picture painted is bleak, and shortages in the commodities markets have the potential to dramatically affect the way we live. Only one country appears to understand the importance of controlling these crucial assets – China.” This book is one of the best ways for anyone interested in the world’s natural resources in general and especially in the specific roles that both China and Africa have in the world of metals and minerals, to obtain an intelligent view on the subject from a highly skilful and knowledgeable economist and writer. For more information: www.dambisamoyo.com.

It may indeed be that China is only after securing their needs for the metals, which Dr. Moyo underwrote, but the danger is in what she wrote in the last sentence of her intro, “controlling these crucial assets”. I cannot escape my own feeling of discomfort that being in control of the bulk of the supply of base and strategic metals, may give the Chinese an edge that we would not like to see. It could very well be that they are outsmarting the rest of the world more than we think.

Mining events, mingle, people and information

International mining events, such as conferences, seminars, exhibitions are a suitable and worthwhile place to gather with all levels of expertise from the resource industry, the financial communities around the world, internationally renowned analysts, editors and writers, bankers, mining financiers, fund managers, institutional and private investors and people who want to know and hear more about this fascinating industry of metals and minerals, mining and exploration, money and investments. I have already mentioned the MINING INDABA, the most important event on Africa’s resources, but there are several others, as you can see on the next page.

A newcomer in the world of mining events has scheduled its main event on Africa for early next week in London. They demonstrate clearly that being a newcomer does not necessarily mean that it is just an event “to try something out” as we so often see. On the contrary, their program shows how serious they are and also their ambition to become one of the major events in Europe on Africa’s resources and mining.

Preceded by an afternoon of workshops, the two-day event brings an interesting program with speakers from several African governments, agencies, mining and exploration companies, analysts, legal and regulation specialists, mining financiers and fund managers.

It will be good to hear what the governments of Ghana, Cameroon, Kenya, Rwanda and Zambia will say on the on-going and emerging development of resources in their countries, how InterraRMG’s Chris Hinde and Glen Jones see “The State of African Mining”, what UNECA’s Director East Africa will channel the upcoming search for resources in East African countries, and listen to the panel on the Investment Outlook, chaired by Paul Burton. And of course, to hear how mining and exploration companies like Anglo American, Wesizwe Platinum, Montero Mining, Energold Drilling, Banro and DeBeers are looking forward to the future at a time that their company shares have not particularly been the darlings of the markets. In addition, it will be a great opportunity to meet existing friends and make new ones; the summary of people attending is quite promising which reflects that the MINING ON TOP event is being received with enthusiasm and expectations. It would be nice if I would meet several of my readers and followers too. In my next issue, I will tell you more about how it was.

New elan, new disoveries, choices and opportunities

The new elan vital, fresh looks and open minds that I sensed at the Mining Indaba are not yet reflected in the recent markets and current prices of resource shares in times that many mining and exploration companies report very good progress and highly encouraging results, internationally and certainly in Africa. This offers an excellent opportunity for investors to take advantage from the current situation.

For investors who are already invested in resource shares, including Africa shares, it may be wise to look at the companies that are in your portfolio. This is a good time to adapt and upgrade the quality of the stocks you own. Of course, you run into the old and famous dilemma that you would have to sell some of your holdings at painful losses. But it is better to make sure that your glass will be changed from half empty into half full: the shares you will buy to replace the ‘dogs’ are also selling at those low levels! So, as our most famous soccer player Johan Cruyff once said “every disadvantage has its advantage”, you can upgrade the quality of your portfolio without any real financial pain.

For investors who are already invested in resources shares but have not included shares of companies with projects in Africa in the portfolio, this is the time to make that correction by adding a nice contingent of such shares. There are many mining and exploration companies from all over the world active in Africa and quite many of them have the qualities that would justify investing in them. This is a good time to do it!

And for those investors that are not into resource shares…….what can I say? Only that you are not an exception and that you belong to the estimated 98% of all investors worldwide that have not (yet) invested in gold, silver, platinum, palladium in whichever form and in shares of companies that are active in the worldwide industry of mining and exploration. I am convinced that that is bound to change in the next few years!

In line with my belief that

- the demand for precious and base metals will continue to be strong,

- the prices of precious and base metals are bound to go higher,

- the maturing resource industry in Africa will continue to expand,

- the search for known and lesser, more rare metals and minerals will intensify,

- the exploration will be more professionalized and stretch to newer regions,

- Africa in general will be increasingly recognized as an emerging economic continent,

- there is a vast potential of natural resources can and will be tapped,

- more experienced investors will be inclined to include Africa in their focus,

I am determined to improve and intensify my efforts to bring the fascinating and prospective developments of a more widely diversified and stronger group of resource companies with projects in Africa to you, my audience.

In my work and writings, I take pleasure to find new opportunities because that is where the seeds for successful participation in Africa’s current and future progress can be found. Next to the still remarkably vast potential of the generally recognized resource nations in Africa, the newer emerging countries and the exploration companies that have been attracted by their possibilities, represent a new generation of investment vehicles. They appeal to the continuing curiosity that I have as an analyst and writer. It is my challenge to make my own early discoveries. Finding emerging companies in emerging regions or countries and recognizing their potential in an early stage. They are not only more fun but they also are likely the most rewarding. As to the current low prices for most resource shares, I continue to be confident that in the years ahead, we are likely to see prices that make those of today pale.

Henk J. Krasenberg

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

Nyheter

Lundin Mining ska bli en av de tio största kopparproducenterna i världen

Lundin Mining är bolaget i Lundin-sfären som satsar stort på Vicuña-projektet i Argentina. Det ska lyfta Lundin Mining till att bli en av de tio största kopparproducenterna i världen skriver Affärsvärlden och upprepar sin köprekommendation för aktien.

”Även om en framgång inte är på förhand given tror vi att Vicuña har goda chanser att bli bra. Vi förnyar vårt köpråd för Lundin Mining”

Enligt Lundin Minings ledning kommer man att klara att finansiera sin del av investeringarna i Vicuña genom det löpande kassaflödet som man förväntar sig ska bli omkring 5 miljarder dollar kommande fem år i kombination med lån.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras