Analys

The Damocles Sword of OPEC+ hanging over US shale oil producers

Lower as OPEC+ sticks to plan of production hike while Trump-Tariff-Turmoil creates growth concerns. Brent crude traded up at the start of the day yesterday along with Trump-tariffs hitting Mexico and Canada. These were later called off and Brent ended down 1% at USD 75.96/b. OPEC+ standing firm on its planned 120 kb/d production hike in April also drove it lower. Brent is losing another 1% this morning down to USD 75.2/b. The Trump-Tariff-Turmoil is no good for economic growth. China now hitting back by restricting exports of critical metals. Fear for economic slowdown as a consequence of Trump-Tariffs is the biggest drag on oil today.

The Damocles Sword of OPEC+. OPEC+ decided yesterday to stick with its plan: to lift production by 120 kb/d every month for 18 months starting April. Again and again, it has pushed the start of the production increase further into the future. It could do it yet again. That will depend on circumstances of 1) Global oil demand growth and 2) Non-OPEC+ supply growth. All oil producers in the world knows that OPEC+ has a 5-6 mb/d of reserve capacity at hand. It wants to return 2-3 mb/d of this reserve to the market to get back to a more normal reserve level. The now increasingly standing threat of OPEC+ to increase production in ”just a couple of months” is hanging over the world’s oil producers like a Damocles Sward. OPEC+ is essentially saying: ”Produce much more and we will do too, and you will get a much lower price”.

If US shale oil producers embarked on a strong supply growth path heeding calls from Donald Trump for more production and a lower oil price, then OPEC+ would have no other choice than to lift production and let the oil price fall. Trump would get a lower oil price as he wishes for, but he would not get higher US oil production. US shale oil producers would get a lower oil price, lower income and no higher production. US oil production might even fall in the face of a lower oil price with lower price and volume hurting US trade balance as well as producers.

Lower taxes on US oil producers could lead to higher oil production. But no growth = lots of profits. Trump could reduce taxes on US oil production to lower their marginal cost by up to USD 10/b. It could be seen as a 4-year time-limited option to produce more oil at a lower cost as such tax-measures could be reversed by the next president in 4 years. It would be very tempting for them to produce more.

Trump’s energy ambition is boe/d and not b/d and will likely be focused on nat gas and LNG exports. Strong US energy production growth will likely instead be focused on increased natural gas production and a strong rise in US LNG exports. Donald Trump has actually said ”3 m boe/d” growth and not ”3 m b/d” (boe: barrels of oil equivalents). So, some growth in oil and a lot of growth in natural gas production and exports will easily fulfill his target.

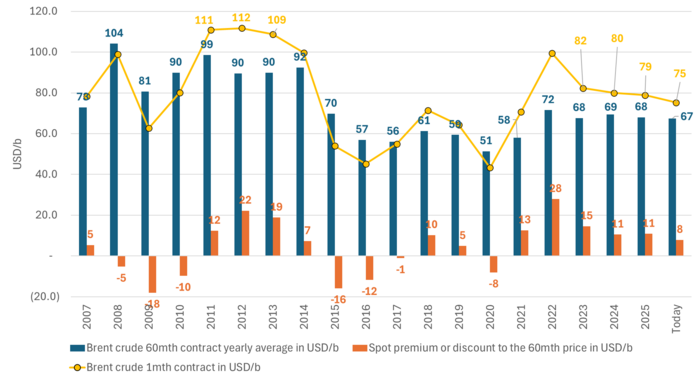

Brent crude historical average prices for the 1mth contract and the 60mth contract (5yr) in USD/b and the spread between them. When the market is tight there is a spot premium (orange) on top of the longer dated price. When the market is in surplus there is a discount in the spot price versus the 5yr. We have now had 5 consecutive years with backwardation and spot premiums between USD 11/b and USD 28/b (2022). Now the spot premium to 5yr is at USD 8/b. If market turns to surplus in mid-2025 and inventories starts to rise, then this USD 7/b premium will fall to zero or maybe even turn negative if the surplus is significant. This will depend on global oil demand growth, US shale oil discipline and decisions by OPEC+ in response to that.

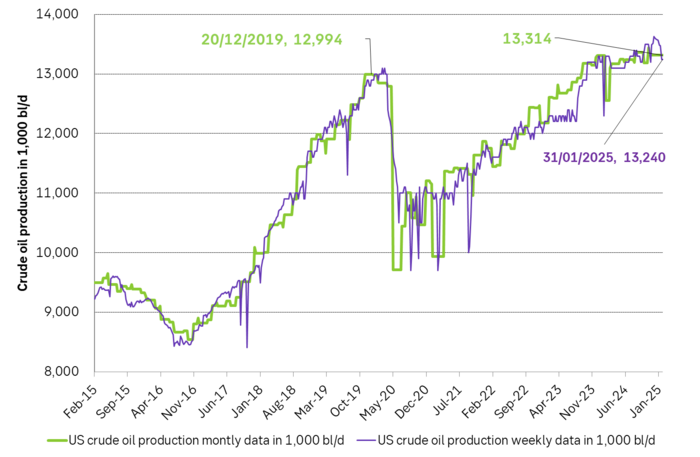

US production in November averaged 13.3 mb/d and was only 0.33 mb/d above its pre-Covid high in December 2019. Growth over the past 12mths has definitely slowed down.

Analys

Brent whacked down yet again by negative Trump-fallout

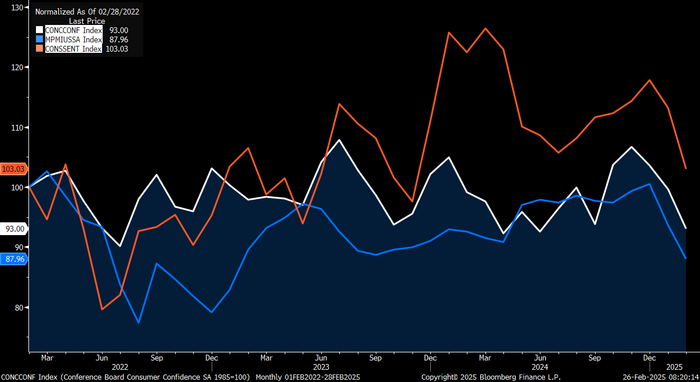

Sharply lower yesterday with negative US consumer confidence. Brent crude fell like a rock to USD 73.02/b (-2.4%) yesterday following the publishing of US consumer confidence which fell to 98.3 in February from 105.3 in January (100 is neutral). Intraday Brent fell as low as USD 72.7/b. The closing yesterday was the lowest since late December and at a level where Brent frequently crossed over from September to the end of last year. Brent has now lost both the late December, early January Trump-optimism gains as well as the Biden-spike in mid-Jan and is back in the range from this Autumn. This morning it is staging a small rebound to USD 73.2/b but with little conviction it seems. The US sentiment readings since Friday last week is damaging evidence of the negative fallout Trump is creating.

Evidence growing that Trump-turmoil are having negative effects on the US economy. The US consumer confidence index has been in a seesaw pattern since mid-2022 and the reading yesterday was reached twice in 2024 and close to it also in 2023. But the reading yesterday needs to be seen in the context of Donald Trump being inaugurated as president again on 20 January. The reading must thus be interpreted as direct response by US consumers to what Trump has been doing since he became president and all the uncertainty it has created. The negative reading yesterday also falls into line with the negative readings on Friday, amplifying the message that Trump action will indeed have a negative fallout. At least the first-round effects of it. The market is staging a small rebound this morning to USD 73.3/b. But the genie is out of the bottle: Trump actions is having a negative effect on US consumers and businesses and thus the US economy. Likely effects will be reduced spending by consumers and reduced capex spending by businesses.

Brent crude falling lowest since late December and a level it frequently crossed during autumn.

White: US Conference Board Consumer Confidence (published yesterday). Blue: US Services PMI Business activity (published last Friday). Red: US University of Michigan Consumer Sentiment (published last Friday). All three falling sharply in February. Indexed 100 on Feb-2022.

Analys

Crude oil comment: Price reaction driven by intensified sanctions on Iran

Brent crude prices bottomed out at USD 74.20 per barrel at the close of trading on Friday, following a steep decline from USD 77.15 per barrel on Thursday evening (February 20th). During yesterday’s trading session, prices steadily climbed by roughly USD 1 per barrel (1.20%), reaching the current level of USD 75 per barrel.

Yesterday’s price rebound, which has continued into today, is primarily driven by recent U.S. actions aimed at intensifying pressure on Iran. These moves were formalized in the second round of sanctions since the presidential shift, specifically targeting Iranian oil exports. Notably, the U.S. Treasury Department has sanctioned several Iran-related oil companies, added 13 new tankers to the OFAC (Office of Foreign Assets Control) sanctions list, and sanctioned individuals, oil brokers, and terminals connected to Iran’s oil trade.

The National Security Presidential Memorandum 2 now calls for the U.S. to ”drive Iran’s oil exports to zero,” further asserting that Iran ”can never be allowed to acquire or develop nuclear weapons.” This intensified focus on Iran’s oil exports is naturally fueling market expectations of tighter supply. Yet, OPEC+ spare capacity remains robust, standing at 5.3 million barrels per day, with Saudi Arabia holding 3.1 million, the UAE 1.1 million, Iraq 600k, and Kuwait 400k. As such, any significant price spirals are not expected, given the current OPEC+ supply buffer.

Further contributing to recent price movements, OPEC has yet to decide on its stance regarding production cuts for Q2 2025. The group remains in control of the market, evaluating global supply and demand dynamics on a monthly basis. Given the current state of the market, we believe there is limited capacity for additional OPEC production without risking further price declines.

On a more bullish note, Iraq reaffirmed its commitment to the OPEC+ agreement yesterday, signaling that it would present an updated plan to compensate for any overproduction, which supports ongoing market stability.

Analys

Stronger inventory build than consensus, diesel demand notable

Yesterday’s US DOE report revealed an increase of 4.6 million barrels in US crude oil inventories for the week ending February 14. This build was slightly higher than the API’s forecast of +3.3 million barrels and compared with a consensus estimate of +3.5 million barrels. As of this week, total US crude inventories stand at 432.5 million barrels – ish 3% below the five-year average for this time of year.

In addition, gasoline inventories saw a slight decrease of 0.2 million barrels, now about 1% below the five-year average. Diesel inventories decreased by 2.1 million barrels, marking a 12% drop from the five-year average for this period.

Refinery utilization averaged 84.9% of operable capacity, a slight decrease from the previous week. Refinery inputs averaged 15.4 million barrels per day, down by 15 thousand barrels per day from the prior week. Gasoline production decreased to an average of 9.2 million barrels per day, while diesel production increased to 4.7 million barrels per day.

Total products supplied (implied demand) over the last four-week period averaged 20.4 million barrels per day, reflecting a 3.7% increase compared to the same period in 2024. Specifically, motor gasoline demand averaged 8.4 million barrels per day, up by 0.4% year-on-year, and diesel demand averaged 4.3 million barrels per day, showing a strong 14.2% increase compared to last year. Jet fuel demand also rose by 4.3% compared to the same period in 2024.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBelgien gör en u-sväng, går från att lägga ner kärnkraft till att bygga ny

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanPrisskillnaden mellan råoljorna WCS och WTI vidgas med USA:s tariffkrig

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanPriset på arabica-kaffebönor är nu över 4 USD per pund för första gången någonsin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGlansen är tillbaka på guldet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVirke, råvaran som är Kanadas trumfkort mot USA

-

Analys4 veckor sedan

Analys4 veckor sedanCrude oil comment: Balancing act

-

Analys4 veckor sedan

Analys4 veckor sedanCrude oill comment: Caught between trade war fears and Iranian supply disruption risk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset stiger till över 1 miljon kronor per kilo