Analys

SEB – Jordbruksprodukter, vecka 20 2012

Det här veckobrevet är tidigarelagt dels för att det är Kristi himmelsfärds dag på torsdag och dels för att vi har en WASDE-rapport att recensera.

Det här veckobrevet är tidigarelagt dels för att det är Kristi himmelsfärds dag på torsdag och dels för att vi har en WASDE-rapport att recensera.

Under helgen kom nyheten från Kina att landet sänkt reservkraven på kinesiska banker med 0.5%. Normalt borde det fått marknaderna för råvaror att stiga. Så sker inte. Merkels CDU har förlorat ett viktigt val i Tyskland. De flesta tolkar detta som att viljan att betala för resten av de skuldsatta länderna i Europa har minskat. Ett nytt politiskt kaos har drabbat Grekland och de flesta väntar sig att landet går i konkurs och får införa sin urgamla valuta drachman igen. Vi har en ny president vald i Frankrike, som inte tycks vara så inställd på att rädda sina grannländer. Räntan på spanska 10-åriga obligationer har stigit över 6% igen (6% innebär slutlig konkurs). Motsvarande ränta i Portugal är 11%. USA:s ekonomi hackar och Wall Street är i chock efter att JP Morgan, bankernas bank, redovisat 2 mdr dollar i vad som med rätta ska kallas kreditförluster. Kinas tillväxt hackar också, men de stimulerar den. Allt detta väcker tvivel om efterfrågan på råvaror.

Odlingsväder

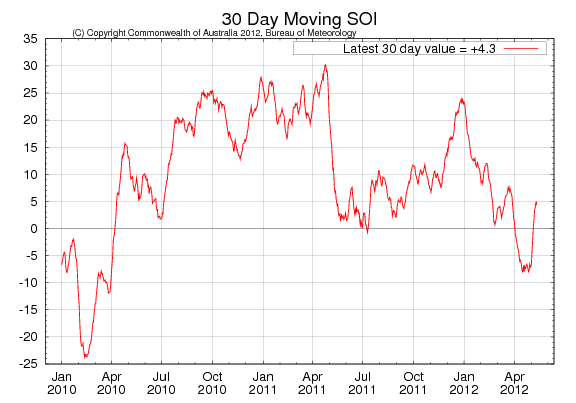

Southern Oscillation Index, ett mått på intensiteten i graden av La Niña eller El Niño, ligger kvar därdet låg förra veckan. Nu är indexet 4.3. En nivå mellan +8 och -8 indikerar neutrala ENSOförhållanden.

Vete

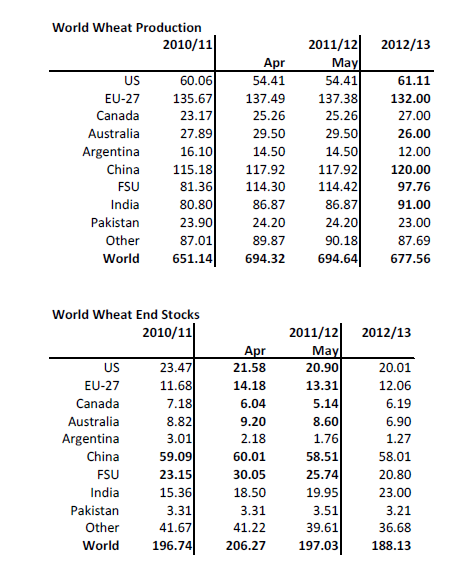

WASDE-rapporten i torsdags. För 2011/12 gjordes inga större förändringar vad gäller produktion. Konsumtionen justerades däremot upp med 8 mt för Kanada, EU och Kina. För kommande skörd, marknadsföringsåret 2012/13 sänktes skörden med 17 mt netto. Skörden väntas bli större i USA och Kanada, i Kina och i Indien, men skörden väntas bli lägre I EU-27, fd Sovjetunionen och på södra halvklotet. Konsumtionen väntas bli som i år.

Sammanfattningsvis: Utgående globala lager för 2012/13 är något ”bullish”, men för världsmarknaden betyder USA i egenskap av den största exportören väldigt mycket. En skörd i USA på 61 mt mot 54 mt förra året och 60 mt för två år sedan, är bearish. Summa summarum, innehåll rapporten alltså inte några nyheter som allvarligt kunde flytta på priset just för vete. Däremot var majs-rapporten bearish och sojarapporten bullish. Och av detta betyder majsen mest för vetet. Nedan ser vi novemberkontraktet på Matif. Uppåttrenden är bruten och 200 euro är nu ett psykologiskt motstånd. 190 euro ser ut att ligga inom räckhåll.

Nedan ser vi Chicagovetet med leverans i december. Priset trendar nedåt efter att ha brutit stödet på 650 cent.

Maltkorn

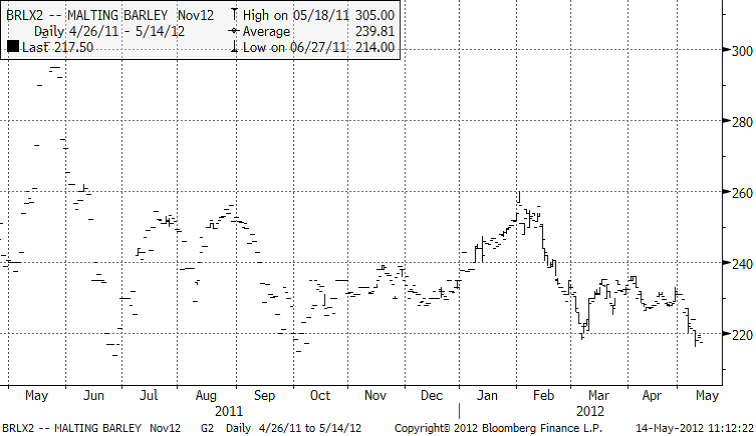

Novemberkontraktet på maltkorn har brutit stödnivån 220 euro per ton. Priset har vänt på den här nivån strax under 220 flera gånger förut, så det är inte någon teknisk säljsignal än.

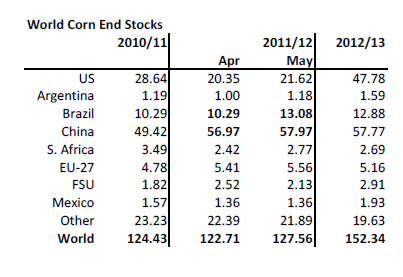

Majs

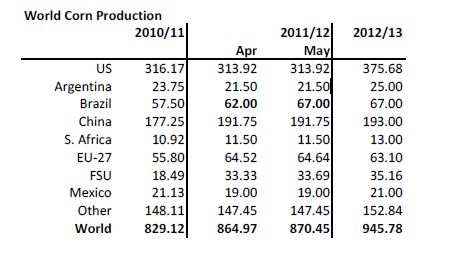

WASDE-rapporten i torsdag innehåll en uppjustering av Brasiliens just skördade skörd från 62 mt till 67 mt. Vi noterar att skörden 2012/13 väntas bli rekordstor. Orsaken är att ENSO slagit om från La Niña till neutrala förhållanden, eller rentav El Niño. Detta har vi sett i ensembleprognoserna sedan nyår. Skörden per acre i USA väntas öka med 20 bushels per acre eller med 13%. Efterfrågan väntas också hoppa uppåt med 54 mt. Det här är den första rapporten som ordentligt tagit in det riktigt goda odlingsklimatet på planeten under kommande år och den är därmed riktigt bearish.

Priset på decembermajs föll ner och ”rörde vid” 500 cent. Troligtvis ska marknaden testa den nivån igen. Bryts den får vi en förnyad säljsignal.

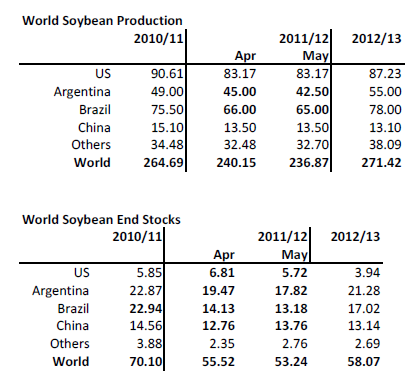

Sojabönor

WASDE-rapporten i torsdags: Lite mindre skörd antas ha bärgats i Sydamerika, framförallt gäller det Argentina. Utgående lager i höst väntas vara ännu lägre än tidigare trott. För kommande skörd väntas, som vi redan skrivit om, en rekordskörd i Sydamerika. Odlingsvädret, där ENSO slagit om till neutrala eller rentav El Niño-förhållanden är idealiskt inför sådden på södra halvklotet. Global produktion antas ligga 35 mt högre än i år. Konsumtionen väntas också öka och det innebär att utgående lager bara ökar något lite. Det är ännu lång tid kvar till skörd och mycket kan hända längs vägen. Majs är attraktivt att så och sojapriset måste hålla sig högt för att försvara arealen.

Marknaden har sålt på sojabönorna idag på grund av de ekonomiska nyheterna från Europa, som väcker farhågor om efterfrågan på ”bättre mat”.

1300 är en teknisk stödnivå då priset vände där i månadsskiftet mars-april. Återstår att se om nivån håller den här gången.

Raps

Priset på novemberterminen tycks ha toppat ur på 480 euro per ton.

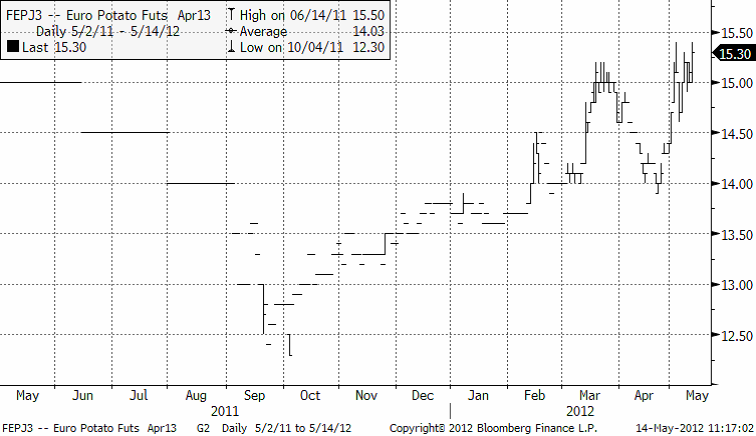

Potatis

Potatispriset för leverans nästa år fortsätter att stiga. Priset är definitivt i stigande trend.

Gris

Det har av naturliga skäl inte hänt speciellt mycket med lean hogs sedan förra veckobrevet. Priset ligger på samma (låga) nivå.

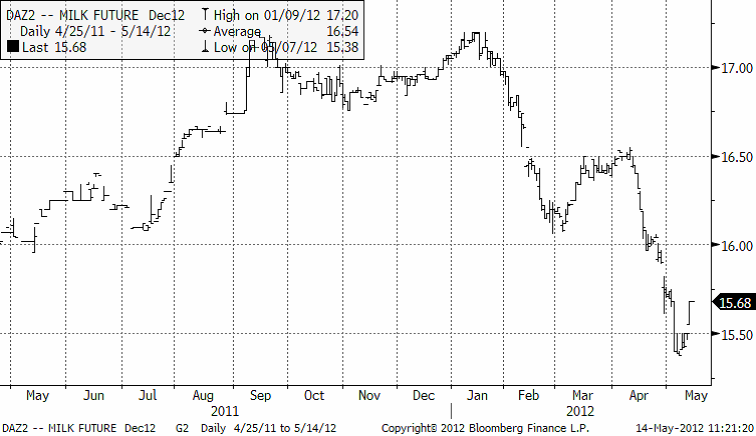

Mjölk

Mjölkpriset (decemberleverans) handlas lite högre än förra veckan, på 15.68. Lägsta förra veckan var 15.38. Vi ser detta som en naturlig rekyl när några tycker att priset fallit för mycket för fort.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

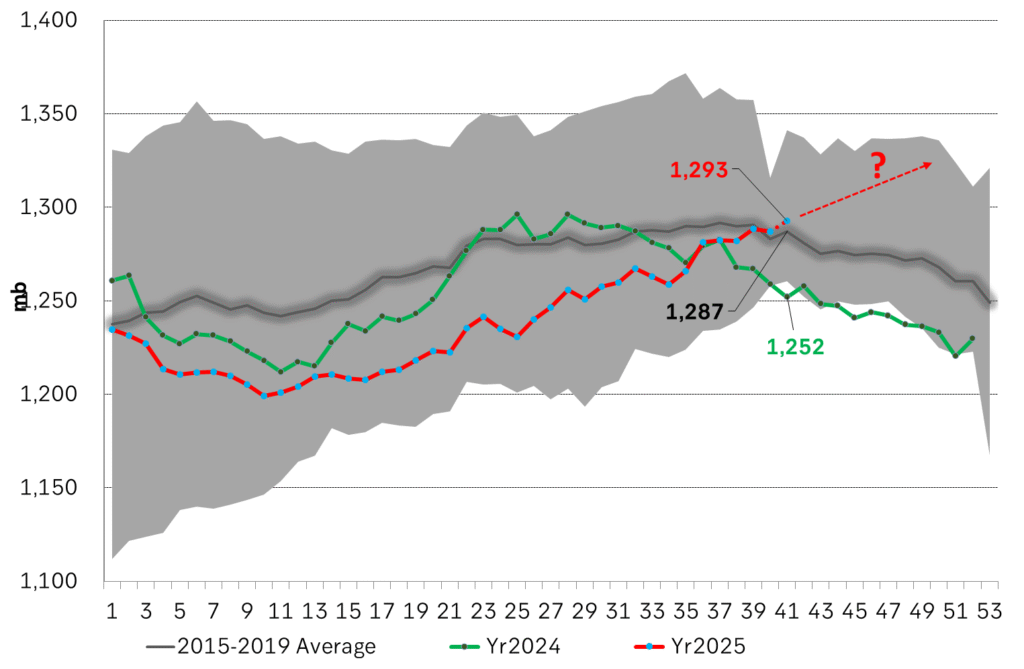

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

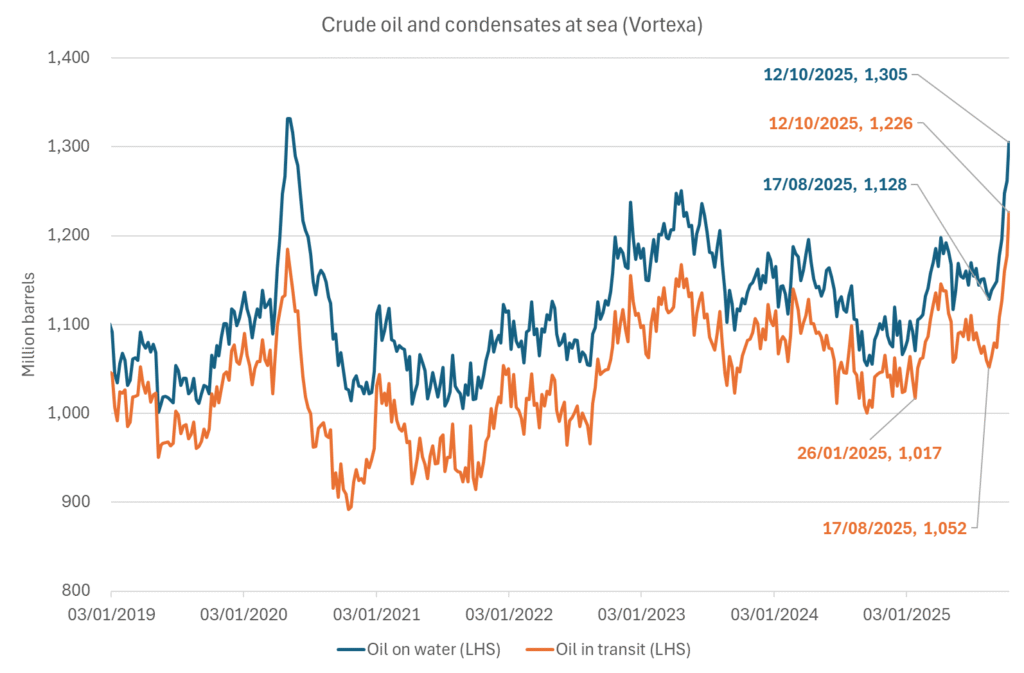

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

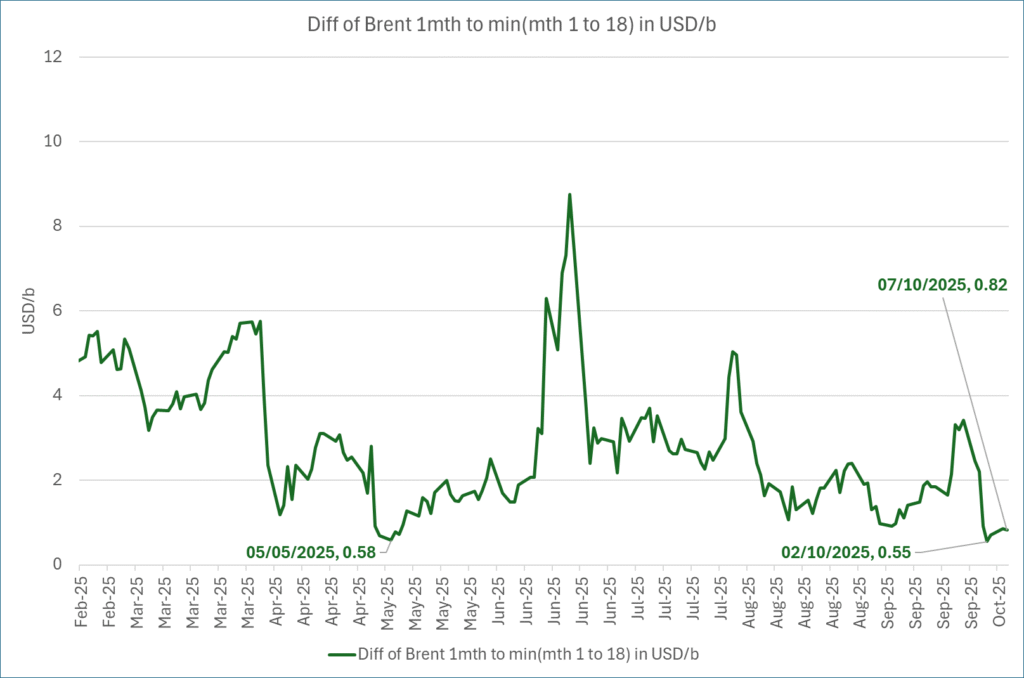

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

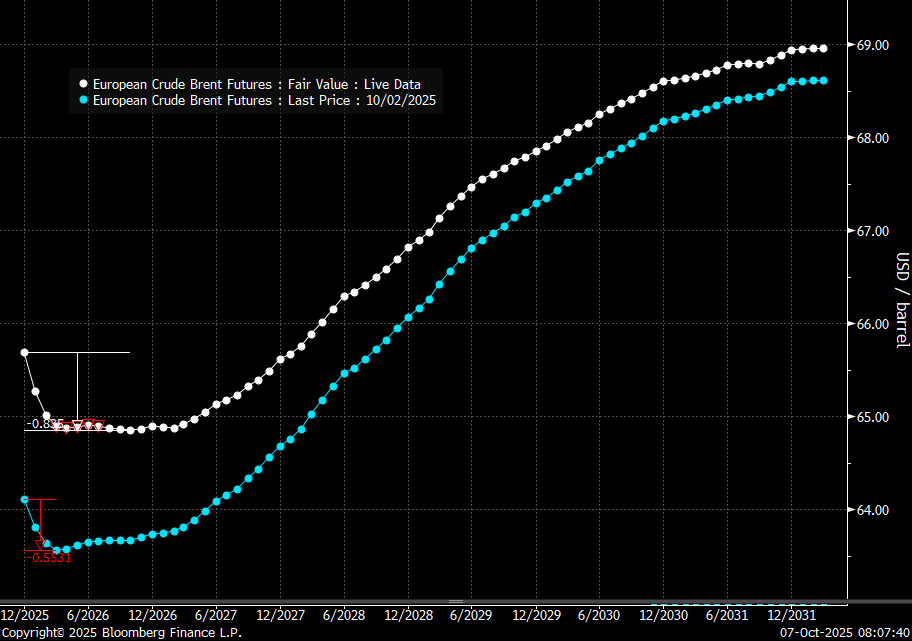

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål