Analys

SEB – Jordbruksprodukter, vecka 12 2012

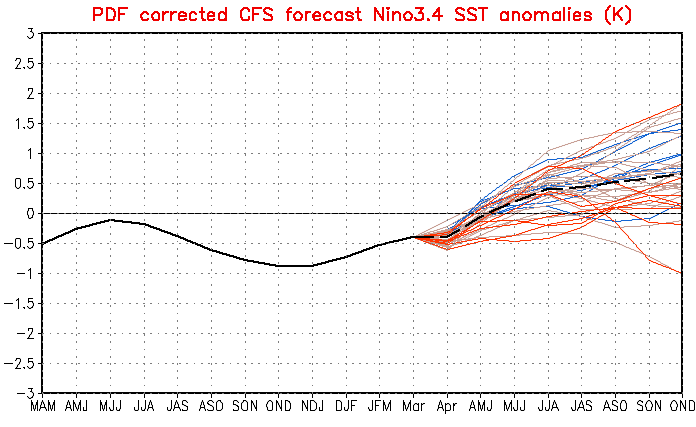

Majs och vete, i Chicagovete mer än Matif har fallit i pris sedan förra veckan. Den främsta orsaken är förmodligen de negativa nyheterna om Kinas ekonomi, mest inom stål, bil och energisektorerna. Kina höjde även priset på drivmedel häromdagen med 6 – 7% för att rädda de inhemska raffinaderierna, som trots detta ändå går med förlust. Måndagens crop condition statistik på höstvete var också positiv (negativ för priset) och vädret har gett nederbörd framförallt i USA och klimatet förutspås bli bättre när det blir blir allt tydligare att ENSO lämnar La Niña senast i april och ser ut att troligtvis glida över till ett El Niño till hösten (starten på Argentinas och Brasiliens odlingssäsong, vilket då ger dem och världen en superskörd i så fall).

Majs och vete, i Chicagovete mer än Matif har fallit i pris sedan förra veckan. Den främsta orsaken är förmodligen de negativa nyheterna om Kinas ekonomi, mest inom stål, bil och energisektorerna. Kina höjde även priset på drivmedel häromdagen med 6 – 7% för att rädda de inhemska raffinaderierna, som trots detta ändå går med förlust. Måndagens crop condition statistik på höstvete var också positiv (negativ för priset) och vädret har gett nederbörd framförallt i USA och klimatet förutspås bli bättre när det blir blir allt tydligare att ENSO lämnar La Niña senast i april och ser ut att troligtvis glida över till ett El Niño till hösten (starten på Argentinas och Brasiliens odlingssäsong, vilket då ger dem och världen en superskörd i så fall).

Odlingsväder

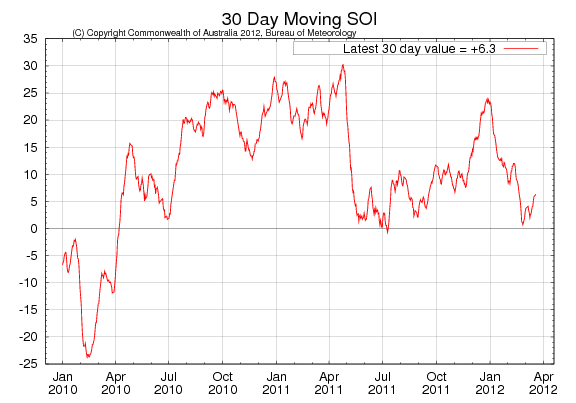

Southern Oscillation Index, som mäter ENSO och indikerar La Niña om SOI > +8 och El Niño om SOI < – 8, har stigit till +6.3 i den senaste rapporten från Australiens meteorologiska byrå.

Nedan ser vi en av ensembleprognoserna från amerikanska Climate Prediction Center. Den är publicerad den 19 mars. Som vi ser förutspås närmast El Niño till hösten. En Argentinsk kommentator talade om att det ska plaska på Pampas och att Argentinas lantbrukare förbereder sig för en ”bumper crop” 2012/13.

NOAA Climate Prediction Center sammanfattar läget så här:

- La Niña har försvagats över den tropiska delen av Stilla Havet.

- Atomosfäriska cirkulationsanomalier stämmer överens med La Niña-förhållanden.

- La Niña väntas gå över till neutrala ENSO-förhållanden inom en månad.

Vete

Novemberterminen på Matif, som steg upp till det tekniska motståndet på 205 euro per ton, har de senaste tre dagarna fallit pga överraskande mycket nederbörd i USA, som förbättrar förutsättningarna för amerikanskt höstvete.

Lantbrukare i västra Europa håller ett noga öga på väderprognoserna just nu och hoppas på regn. Oro finns att det torra vädret kan komma att ytterligare minska avkastningen efter köldknäppen tidigare i år. Den senaste tiden har flera analysfirmor justerat ned sina estimat för nordeuropeiska höstgrödor, däribland vete, korn och durumvete, då osäkerheten nu har flyttats från tidigare låga temperaturer och otillräckligt snötäcke till det torra vädret som, om det skulle hålla sig, skulle kunna minska avkastningen. Med det sagt, kom ändå en rapport häromdagen från Polen som rapporterar om upp till 25% utvintring.

I Frankrike ligger grundvattennivåerna under det normala vilket kan bli ett problem för bevattnade vårgrödor.

I Storbritannien är spannmål och oljeväxter i allmänhet i gott skick även om det torra vädret kan bli ett problem om det kvarstår.

Spanien, som har upplevt den torraste vintern på 40 år, är i stort behov av regn men räknar redan nu med ett bortfall i produktionen. Europeiska kommissionens enhet MARS kommer inom kort att publicera sin första preliminära prognos för årets skördar.

Däremot har utsikterna för vintergrödor i USA förbättrats på vissa håll. Delar av Kansas, Oklahoma och Texas fick mellan 1 och 10 cm regn de senaste sju dagarna, mer än dubbelt så mycket som normalt.

Det har varit väldigt torrt i de här områdena. Rapporter om den förbättrade vädersituationen har också påverkat terminspriserna på vete i Chicago i fallande riktning.

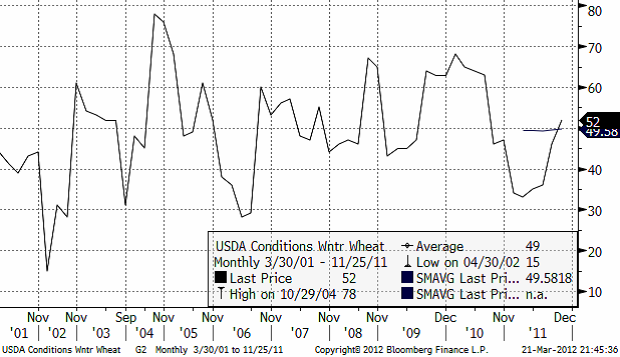

Nedan ser vi de senaste 11 årens Crop Condition för amerikanskt höstvete. Diagrammet avser naturligtvis olika skördar, över tiden, men ger ändå en bild på att vetet i USA mår ”normalbra” just nu. 52% är i ”good” eller ”excellent” condition.

Vårveteterminerna har inte fallit lika mycket på Minneapolis Grain Exchange. Det beror på att man tror att bönder kommer att välja att producera majs eller sojabönor istället, som ger högre vinster. Alla dessa tre grödor sås i april och maj i USA. Förra året såddes den minsta arealen sedan 1983 med vårvete, efter att skyfall och vårflod svämmat över fälten. USDA publicerar arealstatistik den 30 mars.

På den internationella marknaden fortsätter Egypten med sina inköp av vete och statliga GASC köpte 120 000 ton fördelat på kanadensiskt och amerikanskt vete i förra veckan för leverans 1-10 maj. USA, som har dominerat i de senaste försäljningarna, känner nu av en ökad konkurrens då prisgapet till konkurrenterna har krympt. Det kanadensiska vetet låg väl under flera av buden för amerikanskt vete och det argentinska vetet, som har vunnit en handfull av GASC:s tidigare upphandlingar under säsongen, har återigen seglat upp som en stark konkurrent. Det franska vetet prisar fortfarande ut sig på en hög nivå.

[ USA; 261.50$/t + frakt 26.11$/t från Venus I Kanada; 263.50$/t + frakt 24$/t från Louis Dreyfus I Frankrike; 289.90$/t från Glencore I Argentina; 263.90$/t från Glencore I Ukraina; 275.00$/t från Venus (exkluderad då den inte uppfyllde anbudets krav) ]

Även Irak har köpt 300 000 ton vete av kanadensiskt ursprung enligt styrelsen för Iraqi Grain Board. Det här är andra gången på mindre än en månad som Irak köper kanadensiskt vete (400 000 tonköptes den 22 feb) och ytterligare nya anbud för att köpa vete planeras till april. Irak konsumerar 3.5-4 mt vete per år och merparten av vetet importeras.

[ 100 000 ton; 361$/t C&F från Jresat I 100 000 ton; 356$/t C&F från Glencore I 50 000 ton; 361.22$/t C&F från Louis Dreyfus I 50 000 ton; 361$/t C&F från ADM ]

Lite överraskande bekräftar USA:s regering att Iran, trots USA:s sanktioner mot landet, har köpt ytterligare 60 000 ton amerikanskt vete, vilket gör att den totala mängden nu är uppe i 180 00 ton (bekräftade). Ytterligare 200 000 ton förväntas bli bekräftade. Prislappen för det hela tros ligga 25-30 usd/t över världsmarknadspriserna till följd av ett visst risktagande i exporten till den instabila regionen. Den senaste tiden har Iran köpt eller försökt att köpa nästan 3 mt vete då Teherans rädsla över att rådande sanktioner så småningom kommer att påverka importen av livsmedel och att bristen på bröd kan komma att orsaka upplopp i landet. Iran har bl.a försökt att importera 1 mt vete från Pakistan i en byteshandel och även Indien är tillfrågade. Sista gången som Iran köpte amerikanskt vete var under 2009 (men försäljningen i början på mars på 120 00 ton är den största försäljningen av amerikanskt vete sedan aug 2008, året då svår torka halverade Iraks grödor och utlöste en rekordimport). All försäljning av spannmål till Iran kräver tillstånd från det amerikanska finansdepartementet och försäljningarna ovan är godkända av humanitära skäl för att garantera att mat och andra förnödenheter som behövs når det iranska folket.

Ryssland har tillräckligt med spannmål för att kunna exportera 27 mt under säsongen 2011/12 enligt regeringen som också tillade att ”företag som exporterar spannmål lugnt kan skriva under avtal för april, maj och juni”. Hittills har Ryssland exporterat 22 mt spannmål under säsongen. Ingående lager (carry over) förväntas uppgå till 15 mt per den 1 juli när den nya säsongen 2012/13 börjar, vilket skulle vara tillräckligt för att säkra inhemska behov. Regerings beslut att fortsätta spannmålsexporten utan några restriktioner kommer att stödja jordbruksföretagen samt frigöra lagerutrymme inför den nya skörden.

Regeringen i Kazakstan, den största veteproducenten i Centralasien, planerar att mer än fördubbla stödet för att öka landets spannmålsexport via Ryssland till Svarta havet och Östersjön samt till Kina, enligt jordbruksministeriet, och avsätter därmed ytterligare ca 100 miljoner usd. I januari, estimerade ministeriet landets spannmålsexport till 8.7 mt fram till 1 juli. Kazakstans exportpotential ligger på 15 mt men begränsas av bristen på järnvägsvagnar för export. För att täcka behovet behövs 10 500 st järnvägsvagnar men landet har endast 5200 st varav endast 4500 är i ”fullgott skick”.

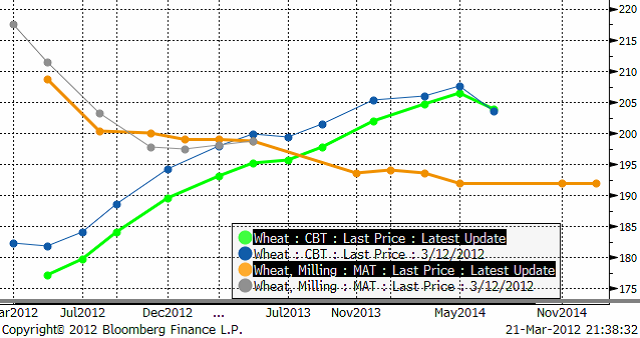

Nedan ser vi terminskurvorna för Chicagovete och Matif-vete. Notera att marknaden på Matif är kraftigt utökad i löptid, vilket gör det möjligt att tillämpa den effektiva ”trappstegsmetoden” för att prissäkra variation i priser över flera år. Vi ser att i synnerhet korta terminskontrakt på CBOT sjunkit kraftigt i pris, medan Matifs korta terminskontrakt fallit och de längre är oförändrade, till och med högre vad gäller november 2012. Det är på tiden att de korta Matif-kontrakten faller i pris, vartefter lantbrukarna tömmer sina lager.

Vi fortsätter att ha en negativ vy på i synnerhet Matifs terminspriser och då särskilt de med kort löptid, de med leverans det närmaste året.

Maltkorn

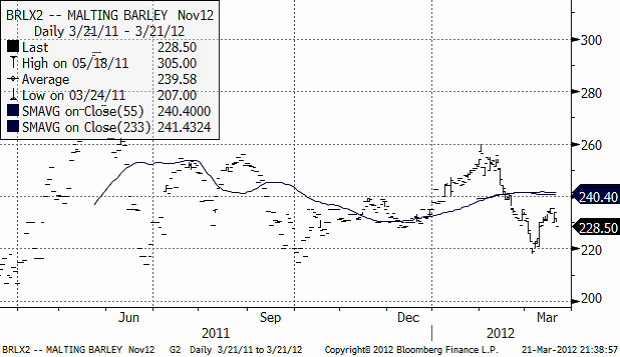

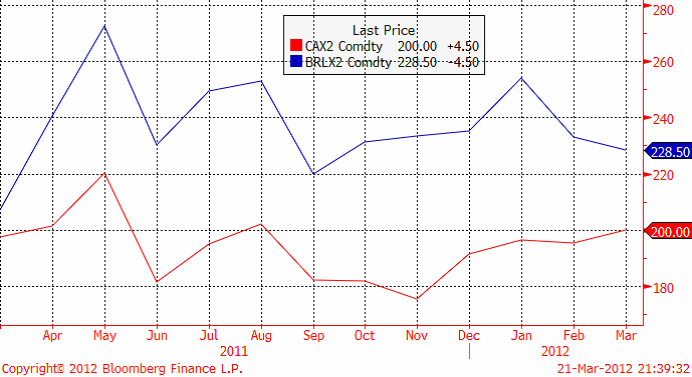

Novemberkontraktet på maltkorn har vänt ner, efter att ha rekylerat upp från 220-nivån.

Nedan ser vi kursdiagrammet på novemberkontrakten på maltkorn (dyrare) och kvarnvete (billigare). Prisskillnaden har gått ihop den senaste tiden, så att maltkornet har den lägsta premien över kvarnvete på ett år. Det gör att vi tycker att kvarnvetet är mer säljvärt än maltkornet. Kanske kan man överväga att sälja kvarnveteterminer istället för maltkornsterminer om man vill prissäkra en kommande maltkornsskörd. Det går alltid att växla över till en maltkornshedge när / om prisskillnaden ökar någon gång i framtiden.

Potatis

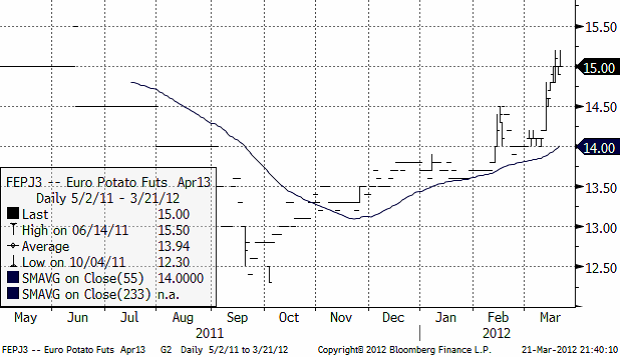

Priset på industripotatis för leverans nästa år steg ganska ordentligt i veckan som vi ser i nedanstående kursdiagram.

Majs

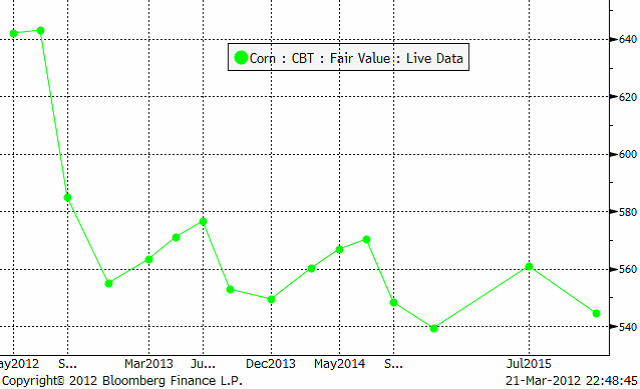

Majspriset fortsätter att handlas inom ett intervall och kommer antagligen att fortsätta med det fram till nästa veckas USDA-rapport om lager och väntad sådd.

I terminskurvan ser vi marknadens övertygade förväntan om högre skördar kommande år – även i år 2012.

Sojabönor

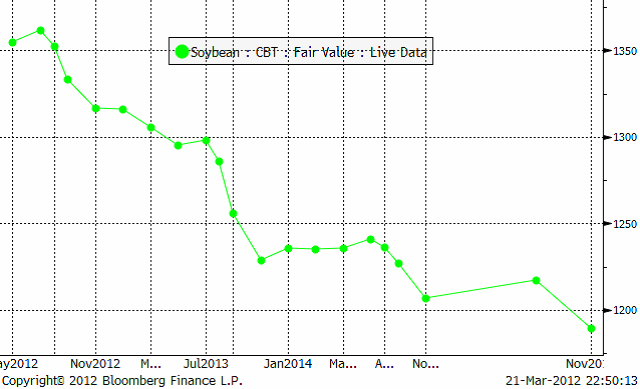

Novemberkontraktet kom på fall efter en stadig uppgång, på oro för Kinas tillväxt.

Det har inte kommit så mycket ny information om sojabönorna. Effekterna av torkan i Argentina och södra Brasilien hänger fortfarande kvar. Kinas importtakt ligger kvar under USDA:s prognos. Vädret håller på att svänga runt i Sydamerika och till hösten kan det bli idealiskt väder för en rekordstor skörd.

Terminskurvan avslöjar att marknaden förväntar sig mycket större skördar kommande år.

Nästa vecka kommer USDA med viktig statistik på lager och väntad sådd areal i USA.

Raps

Sådden av kanadensisk canola kan komma att bli rekordhög i år till följd av attraktiva höga priser. Sådden av canola i Kanada beräknas att för första gången överstiga EU:s kombinerade sådd av höst och vårraps enligt Oil World. Produktionen av oljeväxten kan komma att uppgå till mellan 15 och 15.4 mt från ca 14.4 mt året innan och 13.1 mt under 2010. Arealen beräknas öka till 8.1 – 8.5 miljoner hektar (jämfört med 7.6 miljoner hektar året innan).

Nedan ser vi kursdiagrammet för novemberkontraktet.

440 euro utgör nu, när den nivån är bruten, ett tekniskt stöd. Vi fortsätter därför att ha en neutral vy, om inte 440-nivån bryts igen.

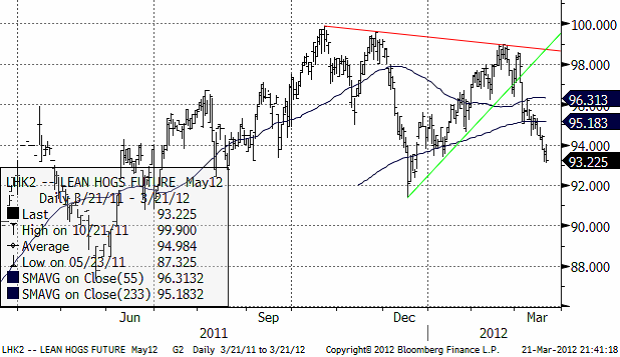

Gris

Majkontraktet som vi säljrekommenderade för en tre veckor sedan har fortsatt att falla och gått under 94 cent, som vi trodde var ”tillräckligt”, en nivå som vi skulle ha tagit hem vinsterna på i denna korta position. Vid 92 till 93 får man nog säga att marknaden är ”översåld” och det finns också tekniska stöd vid den här nivån. Bakom marknadens extra svaghet ligger sannolikt de förvånande svaga ekonominyheterna från Kina. Världen har vant sig vid att Kinas ekonomi ska vara stark och ett draglok för råvaruefterfrågan, däribland gris.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

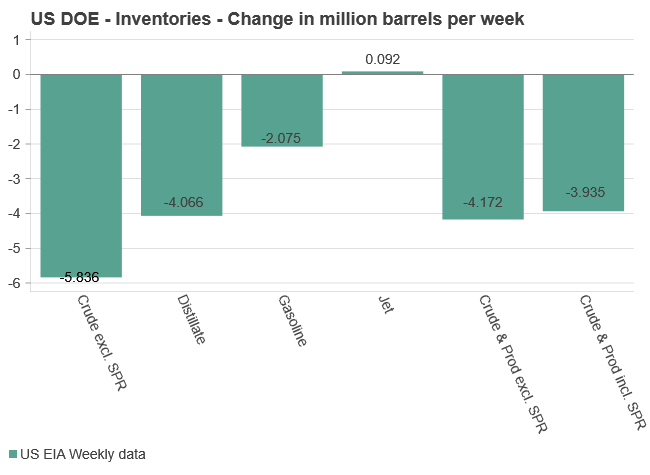

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

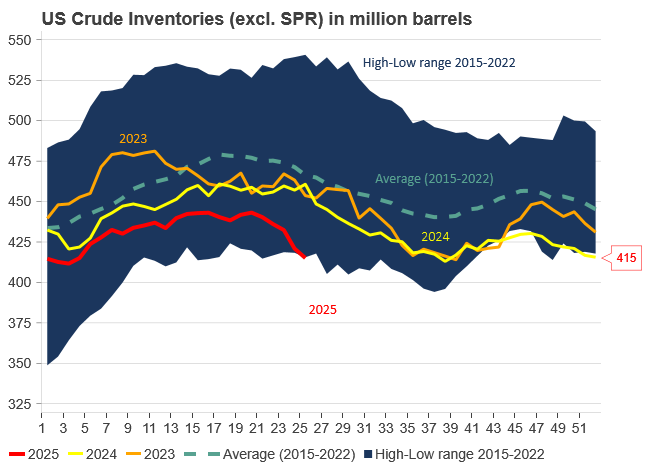

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering