Nyheter

Great Panther Silver, how to become a successful and profitable silver producer

Introduction

Henk J Krasenberg

I had the pleasure to discover Great Panther when it was in the early stages of growing into the successful and profitable silver producer that it is today. I was fascinated by the mining developments in Mexico and it was the dedication of the two driving forces that have been behind the emergence of Great Panther from an exploration company to a mature silver producer with two fully operating mines. After several years of exploration activities, Bob Archer and his business partner Francisco Ramos made choices. They set their goals and they followed the path that they had set out. Great Panther was to become a profitable primary silver producer with a strong leverage to future rises in the price of silver.

It was May 2005, when I introduced the company to my readers, just a little over 12 months after they acquired the then idle Topia Mine. The shares were selling at C$0.45 while silver prices averaged around $7.00 per ounce. Based on my evaluation, I concluded my report with ”I find Great Panther distinctly undervalued at a current market capitalization of just over C$10 million. This will not last very much longer, mark my words!”

The path has not been particularly easy, but which business is? The two mines that they acquired each had their problems. They were not in good shape technologically, there were management problems, the price of silver was low, and the popularity of the mines in their regions left a lot to be desired. But Bob and Francisco had the vision that they could improve those circumstances and accomplish it over time, helped by their ability to recognize mining talent and assemble a good team and by their ability to raise the necessary capital.

And look at how things are today. Their two mines, the Guanajuato Mine and the Topia Mine, are 100% owned, fully operating, well-managed, in excellent shape, producing profitably in a mining-friendly environment and set out to grow over the next few years.

From exploration to two profitable silver producing mines

For 2012, total production is estimated to be appr. 20% higher than in 2011:

silver: 1.72 to 1.90 million ounces, up from appr. 1.51 million ounces,

gold: 10,000 to 11,000 ounces, up from appr. 7,800 ounces,

lead: 2.50 to 2.80 million pounds, up from appr. 2.00 million pounds,

zinc: 3.30 to 3.60 million pounds, up from appr. 2.90 million pounds.

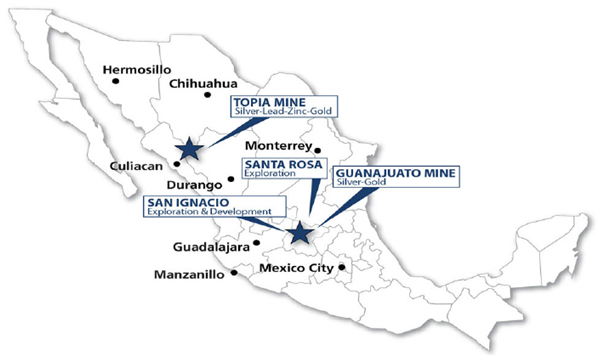

In addition to the two producing properties, the project pipeline includes the San Ignacio Property which is in development and the Santa Rosa Project where the first drilling programs have started this year. Intensive drilling is continuing at all four projects.

The development of Great Panther over the last few years can best be demonstrated by the following graphics:

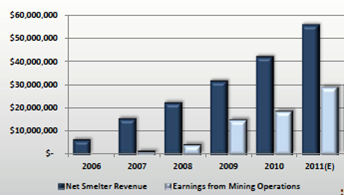

this chart shows the continuous growth of the ’net smelter revenue’ and ’earnings from mining operations’:

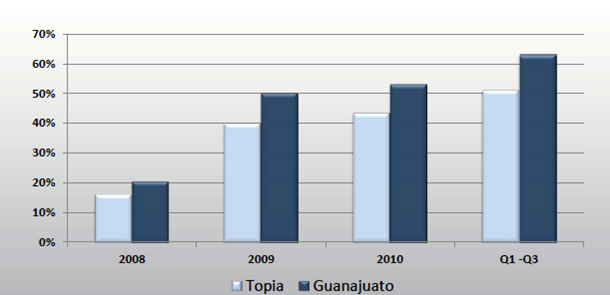

this chart shows the development of the ’gross margin percentage’ at the two mines, it has been steadily increasing over the past four years:

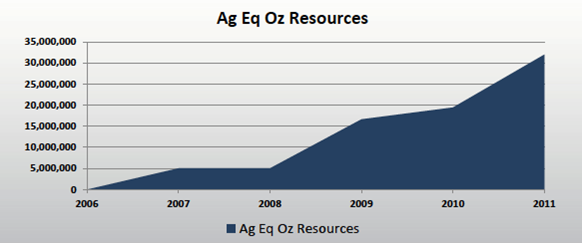

this chart reflects that the ’NI 43-101 compliant resources’ started from zero in 2006 and have increased with every drill program, even after substracting what has been mined:

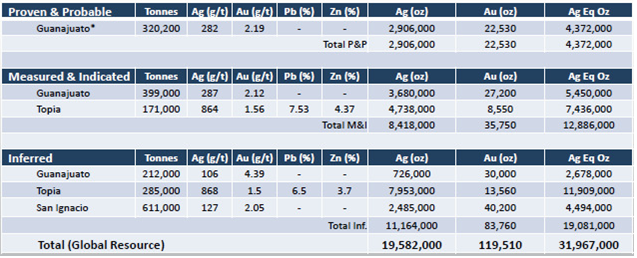

this table gives the total ’reserves & resources’ at both mines:

These figures show that on basis of the currently known reserves and resources the production can continue to run smoothly and allow increasing the production capacities at the mines. They also show that there are healthy quantities of ore in the pipeline to eventually be upgraded from the inferred to the measured & indicated and from the measured & indicated to the proven & probable categories.

I think it would suffice to say that these graphics show the remarkable progress that Great Panther made over the last 5 years in a way that most serious and longer-term shareholders like to see.

The Projects

Topia Mine

As mentioned before, the current success started to shape up with the acquisition of the situated in the Sierra Madre mineral belt in the State of Durango. The mine had been in production from 1952 to 1999, the largest period by Peñoles, the largest silver producer of Mexico. When Great Panther acquired it in February 2004, the mine was idle and not particularly in an up-to-date shape. Upon reviewing the geological documentation and initial exploration drilling, management estimated they could bring the mine back to production by the end 2005. They started up operations and the first net smelter revenues came by 2006 and very modest first earnings by 2007.

As mentioned before, the current success started to shape up with the acquisition of the situated in the Sierra Madre mineral belt in the State of Durango. The mine had been in production from 1952 to 1999, the largest period by Peñoles, the largest silver producer of Mexico. When Great Panther acquired it in February 2004, the mine was idle and not particularly in an up-to-date shape. Upon reviewing the geological documentation and initial exploration drilling, management estimated they could bring the mine back to production by the end 2005. They started up operations and the first net smelter revenues came by 2006 and very modest first earnings by 2007.

The Topia mine is a high grade, narrow vein underground mining operation where the ores are mined from 16 different veins and are transported by trucks to the central processing plant. In 2011, metal production amounted to 789,609 ounces of silver equivalent, including 535,881 ounces of silver with an estimated cash cost of $14- 15 per ounces of silver, net of by-product proceeds. The principal mining areas are the Argentina and San Gregorio zones where production will be further expanding while mining will be commencing now also from the La Prieta zone. Next to the ongoing intensive exploration activities at the Topia property, the company is expanding its territory by acquiring additional claims in the district.

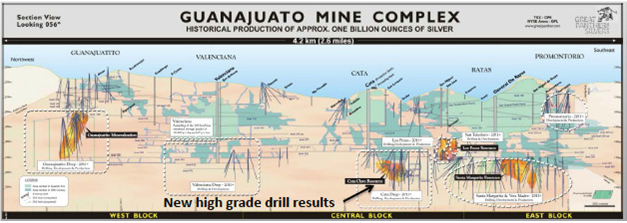

When the Topia Mine was not yet up and running, Great Panther found another opportunity and acquired an 100% interest in the Guanajuato Mine Complex comprising a group of producing silver-gold mines, including the Valenciana Mine, once said to be the richest silver mine in the world, situated in the State of Guanajuato. Great Panther acquired this mine in May 2005 after completing a satisfactory due diligence and having received a positive NI 43-101 technical report. They acquired it from a mining-cooperative where debts and losing money had negatively influenced the mining operations and not allowed any appreciable amount of exploration. This Guanajuato Mine is now Great Panther’s flagship operation. The Guanajuato mines are underground operations using primarily cut-and-fill mining methods. The ore is mined from two operating shafts and three ramps, and then processed to produce high quality, precious metal-rich concentrate which is transported to smelters for extraction of silver and gold. Silver and gold production over 2011 amounted to a total of 959,490 ounces of silver and 7,515 ounces of gold. Net of the credit from the proceeds of the byproduct gold, the silver is produced at an estimated cost of $7-8 per ounce.

Currently, mining and developing are mainly focused at the Cata Shaft and at the Guanajuatito area, while a new exploration program is being conducted at the famous Valenciana area with surface and deep drilling. Exploration and development are ongoing with the objective to building resources to increase mine life and production. The plant was recently totally refurbished with the objective to further increase through-put and improve recoveries.

The next project in Great Panther’s pipeline is situated near the Guanajuato, the San Ignacio Mine Property which was acquired in 2005 as part of the property package that came with the Guanajuato transaction. The property is located within trucking distance from the Cata Plant at the Guanajuato complex.

An interesting observation can be made at the San Ignacio Mine property. It covers approximately 4 km of strike length on the La Luz vein system –silver was discovered there as early as the year 1548 (!)- and is contiguous with Endeavour Silver’s producing Bolanitos Mine property. The San Ignacio Mine exploited only about 500 m of strike length along one of the three known structures on the property. There was no record of any previous exploration elsewhere on the claim block but recently, some drawings of old Spanish era mine workings in the southern part of the property were found. Production records from 1977 to 2001 indicate that a total of  617,455 tonnes at a grade of 113g/t silver and 1.01g/t gold were extracted from this small portion of the property. This is similar to the grade that was mined at Guanajuato prior to Great Panther’s purchase of the mines in 2005 after which it has more than doubled this grade since then with its increased grade control and improved mining methods. As there is no processing facility at San Ignacio, ore was trucked back to the Cata Plant in the main Guanajuato mine complex, approximately 20 km by road. History can repeat itself here!

617,455 tonnes at a grade of 113g/t silver and 1.01g/t gold were extracted from this small portion of the property. This is similar to the grade that was mined at Guanajuato prior to Great Panther’s purchase of the mines in 2005 after which it has more than doubled this grade since then with its increased grade control and improved mining methods. As there is no processing facility at San Ignacio, ore was trucked back to the Cata Plant in the main Guanajuato mine complex, approximately 20 km by road. History can repeat itself here!

As Great Panther needed all its attention and human resources to reviving and developing the main Guanajuato complex, no work was conducted on the property and the being placed on care-and-maintenance San Ignacio mine until September 2010. Since then however, things have been moving in the right direction quite swiftly. Ex- and intensive work programs included sampling, surface drilling, silver discoveries from the first drill hole, more drilling, more multiple zone silver discoveries, phases II and III drilling, again encouraging results, preparing an Environmential Impact Assessment, positive decision to establish a mine portal and drive a decline ramp from surface to access the veins for underground mining, permitting, trucking ore to the Guanajuato plant where capacity allows for doubling ore throughput, an initial NI 43-101 Inferred mineral resource estimate of 4.5 million ounces of silver equivalent, continuing drilling extending strike length. At this time, the permitting process for a new portal and ramp is underway. Similar to the San Ignacio property but in an earlier stage of exploration is the Santa Rosa Project also situated in the vicinity of the Guanajuato Cata plant, having old mine workings but no production records and no known resources. This property is on a similar trend to and bear the same characteristics as the El Cubo goldsilver mine, where AuRico Gold has established 620,000 ounces of gold equivalent in reserves. After initial exploratory work, drilling is scheduled to commence in the first quarter of this year.

Social Aspects

One of the major ingredients for conducting mining and exploration actvities successfully is to focus on sustainable mining operations and making social community programs an imminent part of total operations. Certainly in a guest country as Mexico where in many cases, the population did not really prosper from the mining operations in their region. I know that management have taken these responsibilities very seriously so they fully deserved receiving their first distinction as a ”Socially Responsible Company” from CEMEFI, Centro Mexicano para la Filantropía in March 2011. A milestone and accomplishment. Bravo!

My Comment

Back in 2005, the shares were selling for C$0.45, good for a market capitalization of C$10.1 million. After reaching an all-time high of C$4.90 in the spring of 2011, the shares now trade at C$2.60, giving the company a current market cap of over C$370 million. In the same period, the price of silver has increased from US$7.00 to US$34.35. Considering the comparisons, we may conclude that the share price of Great Panther is more following the price of silver than the real corporate developments. Does that mean that it doesn’t matter which silver stock you buy, to get rewarded equally to what the silver price directs? I don’t think so.

But I do think that the real difference will be made when the markets of silver and silver shares will finally get what they deserve, which is true attention and demand from worldwide investors. That will certainly happen when the currently lingering gold price will finally break through to the upside as I and several other metal watchers expect. Quite a few of them expect that then silver will be likely to outperform gold. Although a case for that thesis can be made for good reasons, I am not truly convinced that will indeed happen. In my opinion gold and silver shares are equal plays to the gold and silver prices. They should both be in every decent investment portfolio, expressly in these times.

But I do think that the real difference will be made when the markets of silver and silver shares will finally get what they deserve, which is true attention and demand from worldwide investors. That will certainly happen when the currently lingering gold price will finally break through to the upside as I and several other metal watchers expect. Quite a few of them expect that then silver will be likely to outperform gold. Although a case for that thesis can be made for good reasons, I am not truly convinced that will indeed happen. In my opinion gold and silver shares are equal plays to the gold and silver prices. They should both be in every decent investment portfolio, expressly in these times.

I consider the shares of Great Panther an excellent investment idea, because management, both at the corporate end in Vancouver and at the mining end in Mexico, have proven that they will be able to further build the company to reach the goal that was set in 2004: to become a leading and profitable primary silver producer and establish long-term shareholder value. I am convinced that they will accomplish reaching that goal over the next few years.

Summarizing, why do I feel so strong about Great Panther? Among other things because of the following stimulants:

- capable, expertised, dedicated, target-driven, innovative management,

- primary silver producer with good product mix, 71% silver, 20% gold and 9% lead-zinc,

- two technically up-to-date, 100% owned mines in Mexico, unhedged silver and gold, no royalties,

- strong organic growth in existing project portfolios and alert for producing acquisitions,

- target set to reach production of 5+ million ounces of silver equivalent,

- target set to reach 40+ million ounces silver equivalent resource,

- corporate development will increase value when silver prices remain steady,

- well-positioned in Mexico, the largest silver producer in the world,

- attractive project portfolio pipeline with 2 mines in production, 1 project in development and 1 project in exploration,

- great potential for internal growth from existing projects, strongly growing profitability from current production level,

- well-financed and strong cash and cash equivalents base, no long term debt, excellent liquidity on TSX and NYSE Amex,

- my appreciation for what has been accomplished in the last 5 years and my confidence in what will be accomplished in the next 5 year,

- my personal outlook for much higher gold and silver prices in the next few years, based on current and future world fundamentals and political/economical developments.

It will be my pleasure to continue following Great Panther Silver as a company and as an investment vehicle for a long time to come. You should too!

Henk J. Krasenberg

European Gold Centre

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

USA ska införa 50 procent tull på koppar

USA:s president Donald Trump har precis meddelat att landet ska införa en tull på 50 procent på basmetallen koppar. Priset på råvarubörsen i USA stiger omgående med 10 procent.

USA har viss inhemsk produktion av koppar, men den inhemska efterfrågan överstiger produktionen. Därför måste landet importera koppar för att täcka behovet, särskilt för användning inom elnät, elektronik, byggindustri och fordonssektorn. De största exportörerna till USA är Chile, Kanada, Mexiko och Peru.

När tullar av denna typ införs uppstår prisskillnader i världen. Handlar man koppar på börsen är det därför viktigt att veta vilken börs man handlar på eller om man använder certifikat så är det viktigt att veta vilka underliggande värdepapper de följer.

Sedan är det som alltid med Trump, begreppet är som bekant TACO, Trump Always Chickens Out. Man ska alltså inte ta några definitiva stora beslut baserat på vad han säger. Saker och ting kan ändra sig från dag till dag.

Nyheter

Ryska staten siktar på att konfiskera en av landets största guldproducenter

En våg av panik sprider sig bland Moskvas elit sedan Vladimir Putins regim inlett en dramatisk offensiv för att beslagta tillgångarna hos Konstantin Strukov – en av Rysslands rikaste affärsmän och ägare till landets största guldgruvföretag, Yuzhuralzoloto. Åtgärden ses som ett tydligt tecken på hur långt Kreml är villigt att gå för att säkra ekonomiska resurser i takt med att kostnaderna för kriget i Ukraina stiger.

Strukovs förmögenhet, som uppskattas till över 3,5 miljarder dollar, byggdes upp under decennier i nära relation med maktens centrum i Ryssland. Men den 5 juli stoppades hans privatjet från att lyfta mot Turkiet. Enligt flera ryska medier deltog den federala säkerhetstjänsten FSB i ingripandet, och Strukovs pass beslagtogs. Händelsen ska vara kopplad till en omfattande rättsprocess där åklagare kräver att hela hans företagsimperium förverkas – med hänvisning till påstådd korruption och användning av skalbolag och familjemedlemmar för att dölja tillgångar.

Företaget själva förnekar att något inträffat och kallar rapporteringen för desinformation. De hävdar att Strukov befann sig i Moskva hela tiden. Trots det bekräftar rättsdokument att både han och hans familj förbjudits att lämna landet, och att myndigheterna snabbt verkställt beslutet.

Det som nu sker är en del av ett större mönster i ett Ryssland präglat av krigsekonomi: staten tar tillbaka kontrollen över strategiska sektorer som guld, olja och försvarsindustri – industrier som nu allt mer mobiliseras för att finansiera och stödja krigsinsatsen. Intressant nog handlar det inte om att Strukov ska ha varit illojal mot regimen – tvärtom har han varit en lojal allierad, med politiska uppdrag knutna till Putins parti. Men lojalitet räcker inte längre som skydd.

Medan tidigare utrensningar ofta riktade sig mot krigskritiker eller de som flydde landet, drivs dagens tillgångsövertaganden av något mer fundamentalt: ekonomisk nöd. De växande sanktionerna har nästan helt strypt inflödet av utländskt kapital. Statens oljeintäkter minskar och budgetunderskotten växer. Putins lösning är att vända sig inåt – till de oligarker han själv lyfte fram – för att fylla statskassan.

Det här är inte ett enskilt fall. På senare tid har flera framstående affärspersoner hamnat i plötsliga rättsliga tvister, omkommit under mystiska omständigheter eller sett sina bolag tas över av staten. Den oskrivna överenskommelsen som länge gällde i Putins Ryssland – rikedom i utbyte mot lojalitet – håller på att kollapsa.

Den 8 juli väntar en rättsförhandling som kan avgöra framtiden för Strukovs affärsimperium. Men budskapet till Rysslands näringslivselit är redan tydligt: ingen är för rik, för lojal eller för nära den politiska makten för att gå säker. I ett Ryssland där kriget kräver allt större uppoffringar riskerar oligarker att snabbt förvandlas till måltavlor.

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras