Analys

Crude oil comment: Tight here and now

Brent crude prices have risen by USD 2.75 per barrel (3.7%) since the start of the week, now trading at USD 74.5 per barrel. This price jump follows significant macroeconomic developments, most notably the Federal Reserve’s decision to implement a “larger” rate cut of 0.50 percentage points, bringing the target range to 4.75-5.00%. The move, driven by progress in managing inflation, reflects the Fed’s shift in focus towards supporting the labor market and the broader economy. Initially, the announcement led to market optimism, boosting stock prices and weakening the US dollar. However, equity markets quickly reversed as concerns grew that the aggressive cut might signal deeper economic issues.

In the oil market, the softer monetary policy outlook has fostered expectations of stronger future demand, supporting a more likely bullish outlook for crude prices further out. Despite this, speculative positions remain heavily short, particularly amid ongoing worries about China’s economic recovery, as highlighted in recent comments. Still, there are near-term signals of increased Chinese crude purchases, helping to mitigate some of the market’s demand-related concerns.

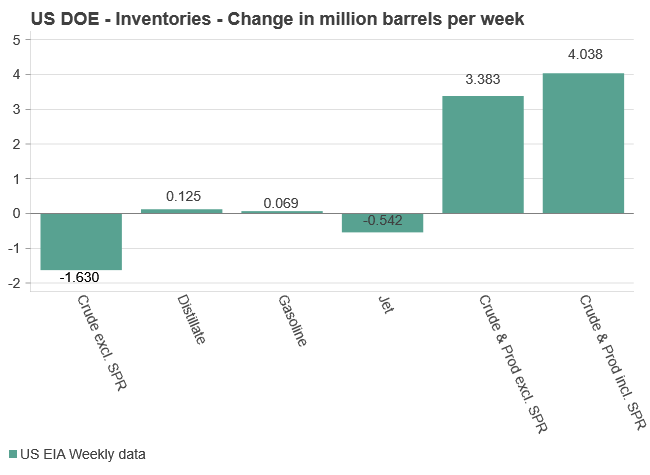

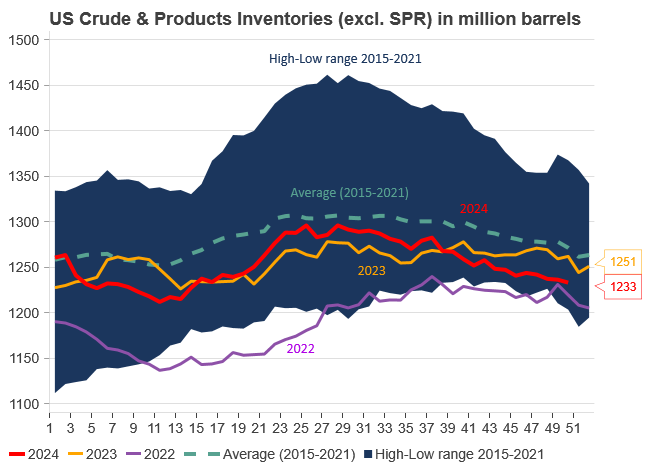

On the supply side, US commercial crude oil inventories decreased by 1.6 million barrels last week, defying the API’s forecast of a 2-million-barrel increase (see page 12 attached). Gasoline and distillate inventories saw minimal changes, underscoring the persistent market tightness. OPEC+, led by Saudi Arabia, continues to play a pivotal role in stabilizing prices through prolonged production cuts, maintaining discipline (so far) in the wake of uncertainty around global demand. Despite tightness in the short term, broader demand fears, especially regarding China, are limiting more significant price increases.

Beyond inventory draws and the Fed’s double rate cut, escalating tensions in the Middle East have also contributed to the recent uptick in the oil price. Israel’s defense minister declared a “new phase” in its regional conflict, sparking concerns of a broader confrontation that could potentially involve Iran, a key OPEC producer.

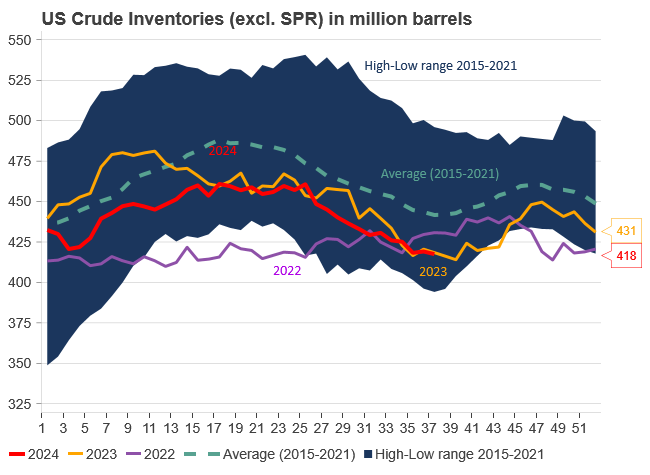

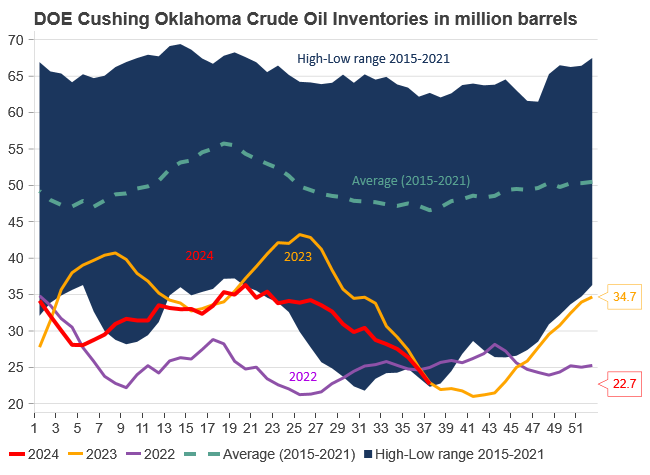

Despite the recent price gains, Brent crude is still on track for its largest quarterly loss of the year, driven by China’s slowdown and ample global supply. Data from the DOE highlighted weaker demand for diesel (down 0.9% year-on-year) and jet fuel (down 1.4% year-on-year), while gasoline demand saw a slight 1.1% uptick but remained below 9 million barrels per day. However, shrinking US inventories are expected to support further price increases. Crude inventories at the Cushing, Oklahoma, in particular, are well below (!!) the five-year seasonal average, nearing critical low levels.

Analys

Brent prices slip on USD surge despite tight inventory conditions

Brent crude prices dropped by USD 1.4 per barrel yesterday evening, sliding from USD 74.2 to USD 72.8 per barrel overnight. However, prices have ticked slightly higher in early trading this morning and are currently hovering around USD 73.3 per barrel.

Yesterday’s decline was primarily driven by a significant strengthening of the U.S. dollar, fueled by expectations of fewer interest rate cuts by the Fed in the coming year. While the Fed lowered borrowing costs as anticipated, it signaled a more cautious approach to rate reductions in 2025. This pushed the U.S. dollar to its strongest level in over two years, raising the cost of commodities priced in dollars.

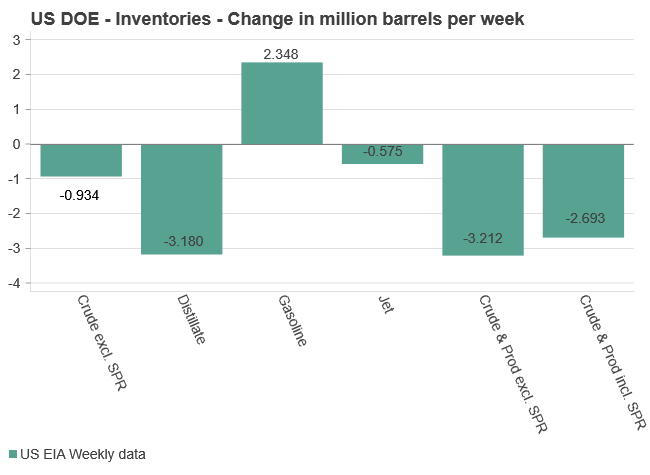

Earlier in the day (yesterday), crude prices briefly rose following reports of continued declines in U.S. commercial crude oil inventories (excl. SPR), which fell by 0.9 million barrels last week to 421.0 million barrels. This level is approximately 6% below the five-year average for this time of year, highlighting persistently tight market conditions.

In contrast, total motor gasoline inventories saw a significant build of 2.3 million barrels but remain 3% below the five-year average. A closer look reveals that finished gasoline inventories declined, while blending components inventories increased.

Distillate (diesel) fuel inventories experienced a substantial draw of 3.2 million barrels and are now approximately 7% below the five-year average. Overall, total commercial petroleum inventories recorded a net decline of 3.2 million barrels last week, underscoring tightening market conditions across key product categories.

Despite the ongoing drawdowns in U.S. crude and product inventories, global oil prices have remained range-bound since mid-October. Market participants are balancing a muted outlook for Chinese demand and rising production from non-OPEC+ sources against elevated geopolitical risks. The potential for stricter sanctions on Iranian oil supply, particularly as Donald Trump prepares to re-enter the White House, has introduced an additional layer of uncertainty.

We remain cautiously optimistic about the oil market balance in 2025 and are maintaining our Brent price forecast of an average USD 75 per barrel for the year. We believe the market has both fundamental and technical support at these levels.

Analys

Oil falling only marginally on weak China data as Iran oil exports starts to struggle

Up 4.7% last week on US Iran hawkishness and China stimulus optimism. Brent crude gained 4.7% last week and closed on a high note at USD 74.49/b. Through the week it traded in a USD 70.92 – 74.59/b range. Increased optimism over China stimulus together with Iran hawkishness from the incoming Donald Trump administration were the main drivers. Technically Brent crude broke above the 50dma on Friday. On the upside it has the USD 75/b 100dma and on the downside it now has the 50dma at USD 73.84. It is likely to test both of these in the near term. With respect to the Relative Strength Index (RSI) it is neither cold nor warm.

Lower this morning as China November statistics still disappointing (stimulus isn’t here in size yet). This morning it is trading down 0.4% to USD 74.2/b following bearish statistics from China. Retail sales only rose 3% y/y and well short of Industrial production which rose 5.4% y/y, painting a lackluster picture of the demand side of the Chinese economy. This morning the Chinese 30-year bond rate fell below the 2% mark for the first time ever. Very weak demand for credit and investments is essentially what it is saying. Implied demand for oil down 2.1% in November and ytd y/y it was down 3.3%. Oil refining slipped to 5-month low (Bloomberg). This sets a bearish tone for oil at the start of the week. But it isn’t really killing off the oil price either except pushing it down a little this morning.

China will likely choose the US over Iranian oil as long as the oil market is plentiful. It is becoming increasingly apparent that exports of crude oil from Iran is being disrupted by broadening US sanctions on tankers according to Vortexa (Bloomberg). Some Iranian November oil cargoes still remain undelivered. Chinese buyers are increasingly saying no to sanctioned vessels. China import around 90% of Iranian crude oil. Looking forward to the Trump administration the choice for China will likely be easy when it comes to Iranian oil. China needs the US much more than it needs Iranian oil. At leas as long as there is plenty of oil in the market. OPEC+ is currently holds plenty of oil on the side-line waiting for room to re-enter. So if Iran goes out, then other oil from OPEC+ will come back in. So there won’t be any squeeze in the oil market and price shouldn’t move all that much up.

Analys

Brent crude inches higher as ”Maximum pressure on Iran” could remove all talk of surplus in 2025

Brent crude inch higher despite bearish Chinese equity backdrop. Brent crude traded between 72.42 and 74.0 USD/b yesterday before closing down 0.15% on the day at USD 73.41/b. Since last Friday Brent crude has gained 3.2%. This morning it is trading in marginal positive territory (+0.3%) at USD 73.65/b. Chinese equities are down 2% following disappointing signals from the Central Economic Work Conference. The dollar is also 0.2% stronger. None of this has been able to pull oil lower this morning.

”Maximum pressure on Iran” are the signals from the incoming US administration. Last time Donald Trump was president he drove down Iranian oil exports to close to zero as he exited the JCPOA Iranian nuclear deal and implemented maximum sanctions. A repeat of that would remove all talk about a surplus oil market next year leaving room for the rest of OPEC+ as well as the US to lift production a little. It would however probably require some kind of cooperation with China in some kind of overall US – China trade deal. Because it is hard to prevent oil flowing from Iran to China as long as China wants to buy large amounts.

Mildly bullish adjustment from the IEA but still with an overall bearish message for 2025. The IEA came out with a mildly bullish adjustment in its monthly Oil Market Report yesterday. For 2025 it adjusted global demand up by 0.1 mb/d to 103.9 mb/d (+1.1 mb/d y/y growth) while it also adjusted non-OPEC production down by 0.1 mb/d to 71.9 mb/d (+1.7 mb/d y/y). As a result its calculated call-on-OPEC rose by 0.2 mb/d y/y to 26.3 mb/d.

Overall the IEA still sees a market in 2025 where non-OPEC production grows considerably faster (+1.7 mb/d y/y) than demand (+1.1 mb/d y/y) which requires OPEC to cut its production by close to 700 kb/d in 2025 to keep the market balanced.

The IEA treats OPEC+ as it if doesn’t exist even if it is 8 years since it was established. The weird thing is that the IEA after 8 full years with the constellation of OPEC+ still calculates and argues as if the wider organisation which was established in December 2016 doesn’t exist. In its oil market balance it projects an increase from FSU of +0.3 mb/d in 2025. But FSU is predominantly part of OPEC+ and thus bound by production targets. Thus call on OPEC+ is only falling by 0.4 mb/d in 2025. In IEA’s calculations the OPEC+ group thus needs to cut production by 0.4 mb/d in 2024 or 0.4% of global demand. That is still a bearish outlook. But error of margin on such calculations are quite large so this prediction needs to be treated with a pinch of salt.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDe tre bästa olje- och naturgasaktierna i Kanada

-

Analys3 veckor sedan

Analys3 veckor sedanCrude oil comment: OPEC+ meeting postponement adds new uncertainties

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOklart om drill baby drill-politik ökar USAs oljeproduktion

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVad den stora uppgången i guldpriset säger om Kina

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMeta vill vara med och bygga 1-4 GW kärnkraft, begär in förslag från kärnkraftsutvecklare

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina gör stor satsning på billig kol i Xinjiang

-

Analys2 veckor sedan

Analys2 veckor sedanBrent crude rises 0.8% on Syria but with no immediate risk to supply

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC takes center stage, but China’s recovery remains key