Analys

Brent crude inches higher as ”Maximum pressure on Iran” could remove all talk of surplus in 2025

Brent crude inch higher despite bearish Chinese equity backdrop. Brent crude traded between 72.42 and 74.0 USD/b yesterday before closing down 0.15% on the day at USD 73.41/b. Since last Friday Brent crude has gained 3.2%. This morning it is trading in marginal positive territory (+0.3%) at USD 73.65/b. Chinese equities are down 2% following disappointing signals from the Central Economic Work Conference. The dollar is also 0.2% stronger. None of this has been able to pull oil lower this morning.

”Maximum pressure on Iran” are the signals from the incoming US administration. Last time Donald Trump was president he drove down Iranian oil exports to close to zero as he exited the JCPOA Iranian nuclear deal and implemented maximum sanctions. A repeat of that would remove all talk about a surplus oil market next year leaving room for the rest of OPEC+ as well as the US to lift production a little. It would however probably require some kind of cooperation with China in some kind of overall US – China trade deal. Because it is hard to prevent oil flowing from Iran to China as long as China wants to buy large amounts.

Mildly bullish adjustment from the IEA but still with an overall bearish message for 2025. The IEA came out with a mildly bullish adjustment in its monthly Oil Market Report yesterday. For 2025 it adjusted global demand up by 0.1 mb/d to 103.9 mb/d (+1.1 mb/d y/y growth) while it also adjusted non-OPEC production down by 0.1 mb/d to 71.9 mb/d (+1.7 mb/d y/y). As a result its calculated call-on-OPEC rose by 0.2 mb/d y/y to 26.3 mb/d.

Overall the IEA still sees a market in 2025 where non-OPEC production grows considerably faster (+1.7 mb/d y/y) than demand (+1.1 mb/d y/y) which requires OPEC to cut its production by close to 700 kb/d in 2025 to keep the market balanced.

The IEA treats OPEC+ as it if doesn’t exist even if it is 8 years since it was established. The weird thing is that the IEA after 8 full years with the constellation of OPEC+ still calculates and argues as if the wider organisation which was established in December 2016 doesn’t exist. In its oil market balance it projects an increase from FSU of +0.3 mb/d in 2025. But FSU is predominantly part of OPEC+ and thus bound by production targets. Thus call on OPEC+ is only falling by 0.4 mb/d in 2025. In IEA’s calculations the OPEC+ group thus needs to cut production by 0.4 mb/d in 2024 or 0.4% of global demand. That is still a bearish outlook. But error of margin on such calculations are quite large so this prediction needs to be treated with a pinch of salt.

Analys

Brent crude falling back along with softer nat gas prices

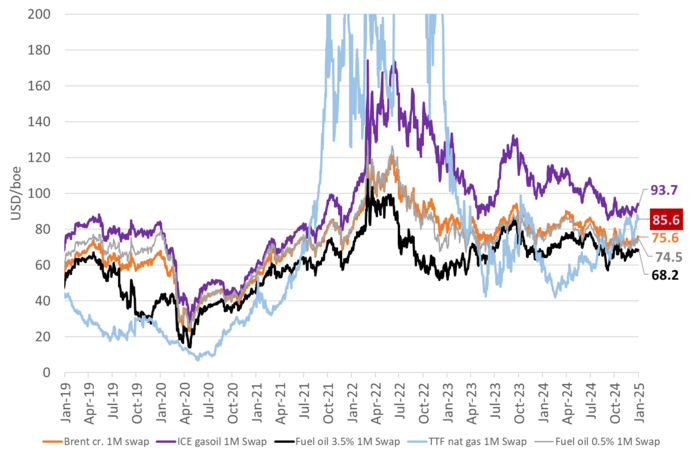

Brent crude jumped USD 2.3/Brent crude to Friday 3 January. got off to a good start in 2025 with a gain of USD 2.3/b from Friday 27 December to Friday January 3. The close on Friday at USD 76.51/b was the highest close since October. Brent also rallied through the 100-day moving average last week with that measure now sitting at USD 74.35/b which is not too far below the current price after all. The RSI has crawled closer to overbought (70) with latest level at 63.7. This morning Brent is falling back 0.5% to USD 76.2/b along with softer industrial metals and initially at least a decline in EU nat gas prices of 2-3%.

Cold weather and end to Russian piped gas helped Brent higher. Brent crude probably got some help from lower US crude stocks, colder than normal weather in North-West Europe and the US, a rally in EU nat gas prices (cold weather and end of Russian piped gas to EU) and higher oil refining margins because of all that.

OPEC+ proved strong resolve on supply restraint in 2024. Supportive for 2025 outlook. On the positive side we have solid resolve by OPEC+ to keep oil prices steady. They have confirmed and reconfirmed this solid resolve again and again over the past half year by postponing heralded production hikes time and time again. There will be no increase in Q1-25, and then the latest plan is to increase production gradually by 2.2 m b/d over 18 months from April. If need be, they will likely postpone yet again if needed when we get towards April.

Curbs to Iranian oil exports are necessary for US oil production to rise strongly. Donald Trump has promised a large increase in US crude oil production. That is however only possible if oil prices do not fall. If the US embarked on a rapid increase in its crude oil production of 3 m b/d then OPEC+ would throw in the towel of production cuts, the oil price would crash, and US production would fall by 3 m b/d rather than to rise by 3 m b/d. US oil producers knows this very well and Donald Trump probably also understands this. The only possible way for a significant production increase in US crude oil production without crashing the price is if someone else in the global oil supply leaves the party. In the eyes of Donald Trump, that someone is probably Iran. Donald Trump has forced Iranian oil exports out of the market once before in 2018 when they went from around 2 m b/d to close to zero. A repeat of this would probably require cooperation from China. In a trade deal between the US and China it is not at all impossible with such a clause (that China stops importing oil from Iran). China may be content if oil supply is plentiful and affordable. And if troubles arise, China could always restart imports of Iranian crude oil.

China weakness is still disturbing. Chinese crude oil imports rose 1.3 m b/d to November as Chinese Teapot refineries got to borrow quotas from 2025. That gave strength to crude oil at the end of the year. But oil products supplied in China were down 380 k b/d y/y in November (Argus) to an estimated 15.3 m b/d. Chinese economy turning the corner in 2025 would blow away a lot of the bearish sentiment in the market.

Cold weather and an end to piped nat gas from Russia has probably helped Brent crude higher into the new year. Higher heating oil demand and higher refinery margins gave helped to lift Brent crude higher. Fuel oil 3.5%, 0.5% as well as Brent crude is now cheaper than nat gas. Historically very unusual except for the period since the Russian invasion of Ukraine.

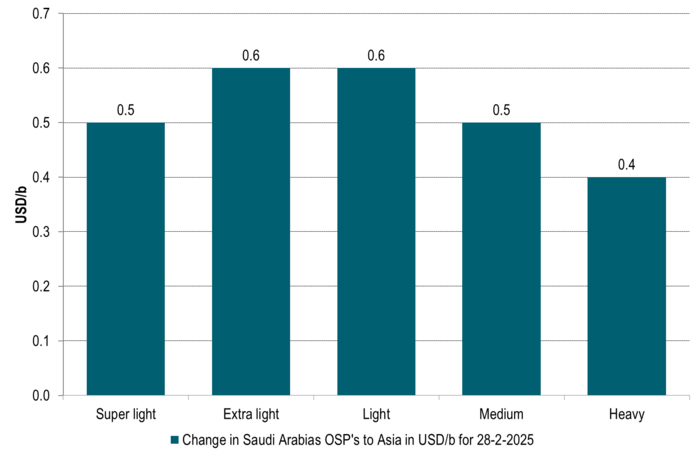

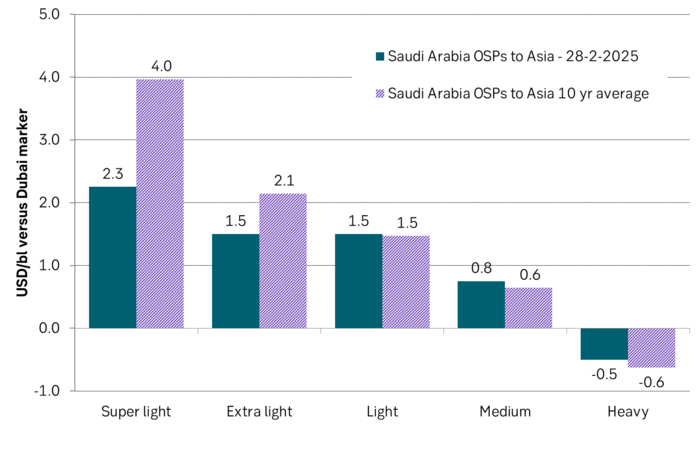

Saudi Arabia lifted its Official Selling Prices (OSPs) to Asia by USD 0.5-0.6/b. Proves confidence that they will sell their crude even at higher relative prices to the Dubai Marker. Stronger front-end backwardation in the Dubai marker in December is probably the reason.

Saudi Arabia’s OSPs to Asia for February are softer than 10yr average in the light-ends as the US shale oil boom has hurt that part, while OSPs are slightly stronger than the 10yr for the heavy end of the complex.

Analys

Brent prices slip on USD surge despite tight inventory conditions

Brent crude prices dropped by USD 1.4 per barrel yesterday evening, sliding from USD 74.2 to USD 72.8 per barrel overnight. However, prices have ticked slightly higher in early trading this morning and are currently hovering around USD 73.3 per barrel.

Yesterday’s decline was primarily driven by a significant strengthening of the U.S. dollar, fueled by expectations of fewer interest rate cuts by the Fed in the coming year. While the Fed lowered borrowing costs as anticipated, it signaled a more cautious approach to rate reductions in 2025. This pushed the U.S. dollar to its strongest level in over two years, raising the cost of commodities priced in dollars.

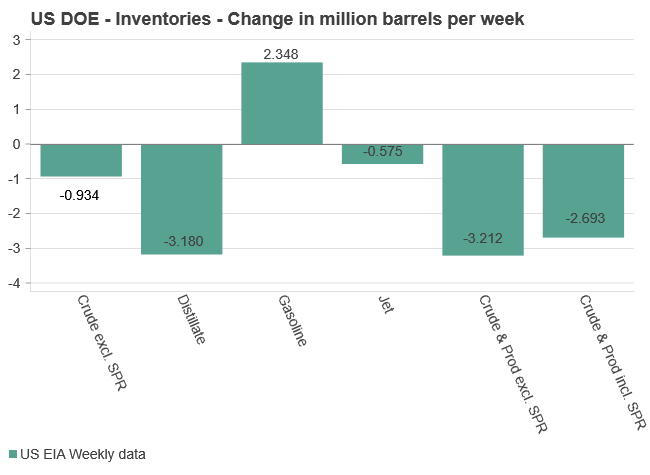

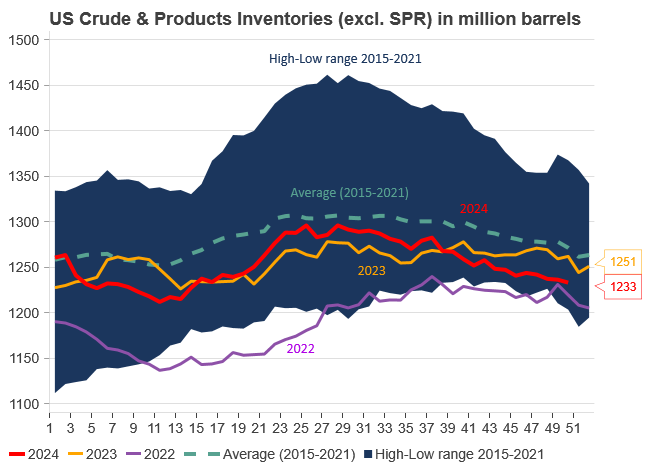

Earlier in the day (yesterday), crude prices briefly rose following reports of continued declines in U.S. commercial crude oil inventories (excl. SPR), which fell by 0.9 million barrels last week to 421.0 million barrels. This level is approximately 6% below the five-year average for this time of year, highlighting persistently tight market conditions.

In contrast, total motor gasoline inventories saw a significant build of 2.3 million barrels but remain 3% below the five-year average. A closer look reveals that finished gasoline inventories declined, while blending components inventories increased.

Distillate (diesel) fuel inventories experienced a substantial draw of 3.2 million barrels and are now approximately 7% below the five-year average. Overall, total commercial petroleum inventories recorded a net decline of 3.2 million barrels last week, underscoring tightening market conditions across key product categories.

Despite the ongoing drawdowns in U.S. crude and product inventories, global oil prices have remained range-bound since mid-October. Market participants are balancing a muted outlook for Chinese demand and rising production from non-OPEC+ sources against elevated geopolitical risks. The potential for stricter sanctions on Iranian oil supply, particularly as Donald Trump prepares to re-enter the White House, has introduced an additional layer of uncertainty.

We remain cautiously optimistic about the oil market balance in 2025 and are maintaining our Brent price forecast of an average USD 75 per barrel for the year. We believe the market has both fundamental and technical support at these levels.

Analys

Oil falling only marginally on weak China data as Iran oil exports starts to struggle

Up 4.7% last week on US Iran hawkishness and China stimulus optimism. Brent crude gained 4.7% last week and closed on a high note at USD 74.49/b. Through the week it traded in a USD 70.92 – 74.59/b range. Increased optimism over China stimulus together with Iran hawkishness from the incoming Donald Trump administration were the main drivers. Technically Brent crude broke above the 50dma on Friday. On the upside it has the USD 75/b 100dma and on the downside it now has the 50dma at USD 73.84. It is likely to test both of these in the near term. With respect to the Relative Strength Index (RSI) it is neither cold nor warm.

Lower this morning as China November statistics still disappointing (stimulus isn’t here in size yet). This morning it is trading down 0.4% to USD 74.2/b following bearish statistics from China. Retail sales only rose 3% y/y and well short of Industrial production which rose 5.4% y/y, painting a lackluster picture of the demand side of the Chinese economy. This morning the Chinese 30-year bond rate fell below the 2% mark for the first time ever. Very weak demand for credit and investments is essentially what it is saying. Implied demand for oil down 2.1% in November and ytd y/y it was down 3.3%. Oil refining slipped to 5-month low (Bloomberg). This sets a bearish tone for oil at the start of the week. But it isn’t really killing off the oil price either except pushing it down a little this morning.

China will likely choose the US over Iranian oil as long as the oil market is plentiful. It is becoming increasingly apparent that exports of crude oil from Iran is being disrupted by broadening US sanctions on tankers according to Vortexa (Bloomberg). Some Iranian November oil cargoes still remain undelivered. Chinese buyers are increasingly saying no to sanctioned vessels. China import around 90% of Iranian crude oil. Looking forward to the Trump administration the choice for China will likely be easy when it comes to Iranian oil. China needs the US much more than it needs Iranian oil. At leas as long as there is plenty of oil in the market. OPEC+ is currently holds plenty of oil on the side-line waiting for room to re-enter. So if Iran goes out, then other oil from OPEC+ will come back in. So there won’t be any squeeze in the oil market and price shouldn’t move all that much up.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDe tre bästa aktierna inom olja, gas och råvaror enligt Rick Rule

-

Analys4 veckor sedan

Analys4 veckor sedanBrent nears USD 74: Tight inventories and cautious optimism

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKina har förbjudit exporten av gallium till USA, Neo Performance Materials är den enda producenten i Nordamerika

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanChristian Kopfer ger sin syn på den stora affären mellan Boliden och Lundin Mining

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude rises 0.8% on Syria but with no immediate risk to supply

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanAtnorth ska etablera ett mega-datacenter i Långsele

-

Nyheter3 veckor sedan

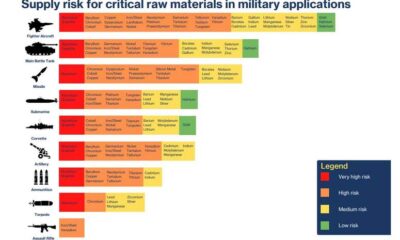

Nyheter3 veckor sedan12 kritiska råvaror för NATO:s försvarsförmåga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTurbulent elår avslutas med lugnare julvecka