Analys

SEB – Råvarukommentarer vecka 10 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: -0,57 %

Brett råvaruindex: -0,57 %

UBS Bloomberg CMCI TR Index- Energi: -2,33 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -3,50 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +0,17 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: +1,59 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadssyn:

- Guld: Neutral

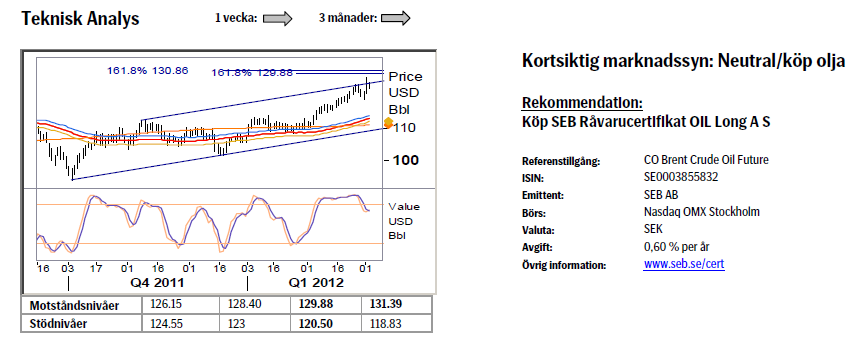

- Olja: Neutral/köp

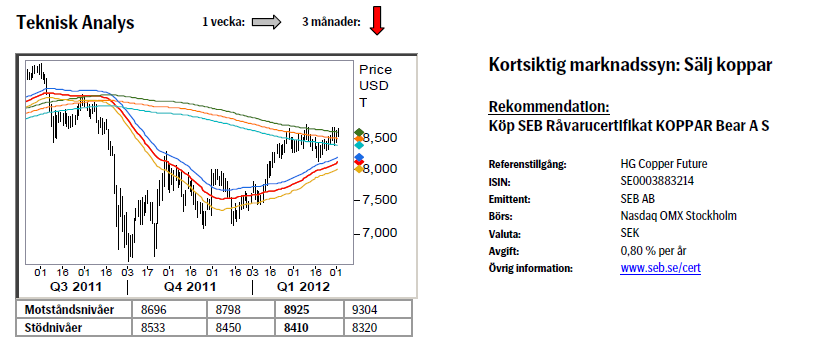

- Koppar: Sälj

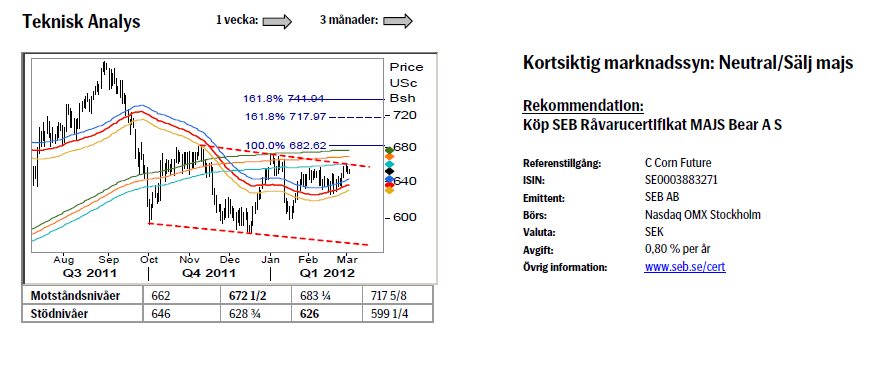

- Majs: Neutral/sälj

- Vete: Neutral/sälj

Guld

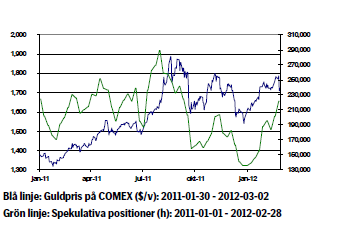

- Guldet föll 4,3 procent under onsdagen, detta efter att Ben Bernanke i Fedskonjunkturrapport bekräftade mer positiva signaler inom tillverkningsindustrin,hushållens konsumtion, bostads-/byggsektorn samt arbetsmarknaden. Förbättringarna är visserligen små, men visar ändå tecken på att USA:s ekonomi fortsätter att förbättras. Eftersom Bernanke inte nämnde något om fortsatta kvantitativa lättnader i sitt tal föll priset på guld som tillfälligtvis handlade under 1700 dollar/ozt. Dollarn stärktes efter Bernankes tal, vilket spädde på fallet ytterligare.

- Enligt Bloomberg ökade under förra veckan inflödet i börshandlade produkter med fysiskt guld som underliggande och uppnådde ett rekordhögt 2404 ton.

- Marknaden reagerade inte nämnvärt på ECBs 3-åriga repa där banker mot säkerheter får låna ett obegränsat belopp till en procents ränta. Denna ökning av likviditet hade marknaden redan prisat in och guldpriset påverkades inte heller av denna åtgärd.

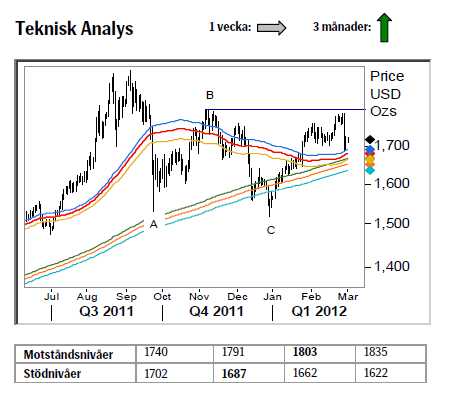

- Teknisk Analys: Marknaden nådde nästan ända upp till huvudmotståndet, 1803, innan en lite starkare vinsthemtagning slog till. Givet styrkan i nedgången är det troligt att det nu tar någon/några veckor innan marknaden samlat kraft och mod nog för ett nytt försök. Kommande veckan bör säljarna återfinnas runt 1740, dvs. mitten av onsdagens nedgång och om vi stiger över denna punkt så pekar det mesta på en redan avslutad korrektion och följaktligen ett nytt test högre.

Kortsiktig marknadssyn: Neutral

Olja

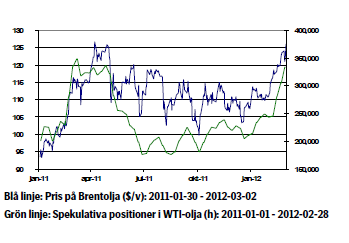

- För att kompensera för läget i Iran ökar nu de övriga OPEC-länderna sin oljeproduktion.

- Även Ryssland ökar produktionen som nu uppgår till 10,36 miljoner fat per dag, de högsta nivåerna sedan Sovjetunionens kollaps.

- I torsdags steg Brentpriset till 128,4 USD/fat efter rykten, som spreds genom Iransk media, om att en oljeledning i Saudiarabien exploderat. Landet dementerade ryktet och oljan föll tillbaka något på fredagen.

- Oljelagernivåerna i industrialiserade länder är på de lägsta nivåerna på fyra år och inom Europa på de lägsta nivåerna på 15 år. Det finns inga tillförlitliga siffror på hur stor reservkapaciteten är, men en sommar med ökad konsumtion på grund av luftkonditionering och utebliven Iransk export skulle kunna öka riskpremien i oljemarknaden ytterligare.

- Konflikterna mellan Sudan och Sydsudan fortsätter: Sudan har krävt att Sydsudan betalar motsvarande 30 dollar per fat olja i transitavgift för raffinering och användning av landets oljeledningar. Sydsudan har meddelat att man som mest är beredd att betala motsvarande 1 dollar per fat olja, detta med hänvisning till att regeringen redan betalar avgifter till bolagen som äger infrastrukturen.

- I Syrien, som är en nära allierad till Iran, fortsätter inbördeskriget. Syrien är ingen stor oljeproducent, men oroligheterna i MENA-regionen ökar även den riskpremien i oljepriset

- Teknisk Analys: Gårdagens spik ovanför parallellkanalen ska nog ses som det första tecknet på att köparna börjar bli mättade. Även faktumet att stochastic uppvisar en potentiell negativ divergens (högre topp i pris, lägre topp i indikator) indikerar att vi nu närmar oss åtminstone en temporär topp. Tills denna är bekräftad (under 120.50) så kvarstår en öppning för att nå nästa Fibonacci nivå, 130/131.

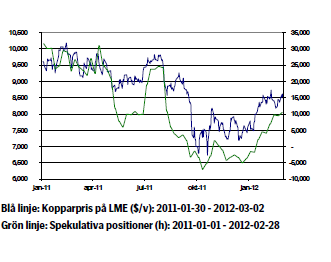

Koppar

- Världsbankens chef Robert Zoellick tror Kina sannolikt kommer att få se en ”mjuklandning” av sin tillväxt i år.

- Det officiella kinesiska PMI-indexet som publicerades förra veckan visade en uppgång till 51,0 i februari, en uppgång från 50,5 månaden före. HSBC:s inköpschefsindex för tillverkningsindustrin stannade dock under den viktiga 50- nivån, trots en ökning från 48,8 till 49,6.

- Produktionen vid Grasberggruvan i Indonesien ligger fortfarande nere på grund av strejk om arbetsförhållanden, men arbetet bör återupptas denna vecka. Grasberg i Indonesien är världens största guldgruva och den tredje största koppargruvan.

- Enligt handlare i marknaden har kopparlagren i Shanghai ökat till 400 000 ton förra veckan, vilket kan jämföras med 350 000 ton föregående vecka. Låg inhemsk efterfrågan och låga inhemska priser har lett till att importörer valt att tillfälligt lagra metallen.

- Teknisk Analys: Vår huvudsakliga vy är fortfarande att markanden bör vända nedåt i eller runt 233dagars bandet. Så länge inte 8765 (alternativt 8925) inte bryts bör fokus ligga på att söka en säljsignal.

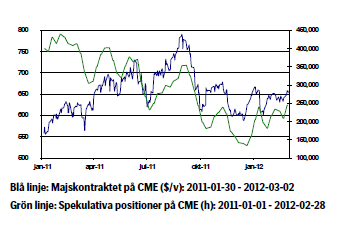

Majs

- Efter ökad oro för utbudet av majs och sojabönor kunde vi i tisdags se hur priserna gick upp till de högsta nivåerna sedan början av året. Framförallt torkan i Sydamerika har skapat oro i marknaden.

- Under slutet av förra veckan strejkade hamnarbetarna i ett flertal av de argentinska spannmålshamnarna. Då landet är en av världens största majs- och sojabönsexportör kan detta eventuellt ge ytterligare stöd uppåt i det korta perspektivet.

- I torsdags meddelade USDA att de bedömer att Kinas grisuppfödning kommer att öka med drygt 4 procent under 2012. Då den huvudsakliga delen av majsproduktionen går till djuruppfödning kan denna typ av uttalanden ge tillfälligt stöd åt priset.

- De spekulativa köparna kommer tillbaka i allt större utsträckning, där vi nu är på de högsta nivåerna under hela 2012.

- På fredag kommer det amerikanska jordbruksdepartementet ut med årets tredje WASDE-rapport. Vi förhåller oss svagt negativa till majspriset inför denna publikation.

- Teknisk Analys: Marknaden har sedan sist byggt lite positivare momentum vilket föranleder lite noggrannare bevakning av motstånden då det ju fortfarande förhåller sig så att om ett brott över trend linjen (och kanske ännu viktigare januari toppen 672 ½) sker bör vi kunna måla in en fortsatt uppgång till 717/741 området.

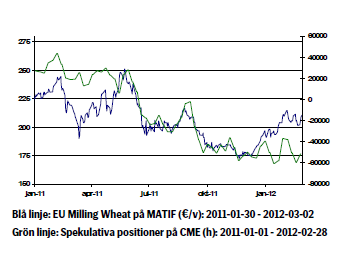

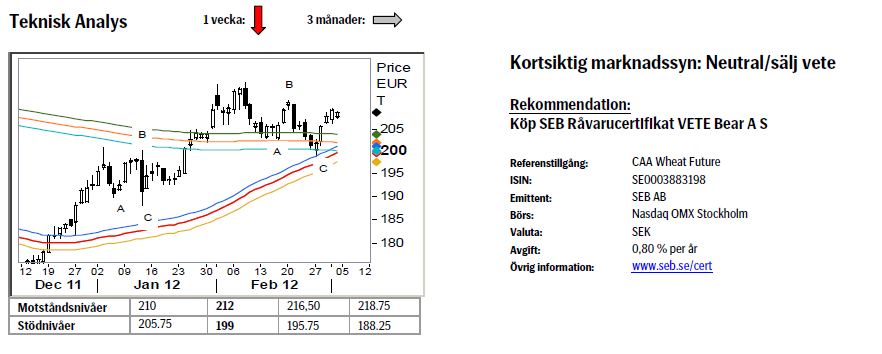

Vete

- Vetepriset gick starkt i Paris under hela förra veckan, bland annat baserat på rapporter om svagare veteskörd i Europa, detta som en konsekvens av den ovanligt svåra kylan under början av året.

- Det skrivs för tillfället mycket om de amerikanska bönderna och vad de förväntas så under 2012. Efter att sojabönspriset har gått väsentligen starkare än både majs och vete de senaste veckorna spekuleras det nu kring huruvida en stor del av bönderna i USA kommer att så detta istället för vete de kommande månaderna.

- Enligt U.S. Wheat Associates talar mycket för att vi på kort tid bör kunna se priserna mellan det relativt sett starka europeiska och det i jämförelse svaga amerikanska vetet gå ihop. Efterfrågan på amerikanskt vete bör öka i det korta perspektivet till stor del på grund av en försvagad dollar, låga fraktpriser samt förhållandevis goda utbudssiffror relativt Europa.

- I torsdags kom nyheten om att Iran har börjat köpa amerikanskt vete, vilket stärker tesen ytterligare om att prisnivån i nuläget ser intressant ut ur ett globalt perspektiv.

- De spekulativa köparna av vete fortsätter att lysa med sin frånvaro. Trots att priset gått förhållandevis starkt under 2012 väljer många investerare att undervikta vete, vilket känns rimligt då utbudet av vete i nuläget fortsatt får anses vara omfattande. Vi tycker att man ska vara försiktig med att ta några positioner före WASDE-rapporten på fredag. Men vill man spekulera är vår uppfattning att risken är störst på nedsidan.

- Teknisk Analys: Studsen från 55dagars bandet kan mycket väl ha avslutat korrektionen. Följer vi tidigare A-B-C mönster borde nästa steg kunna vara ett brott över B-vågens topp, 212, något som i sådan fall skulle indikera ytterligare uppgång emot 245.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

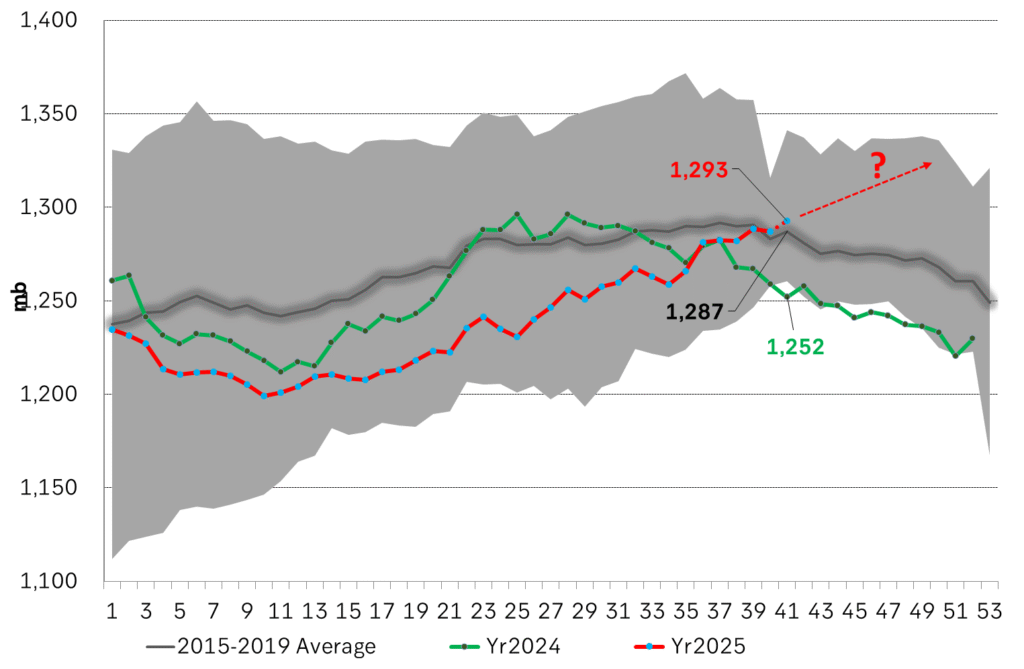

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

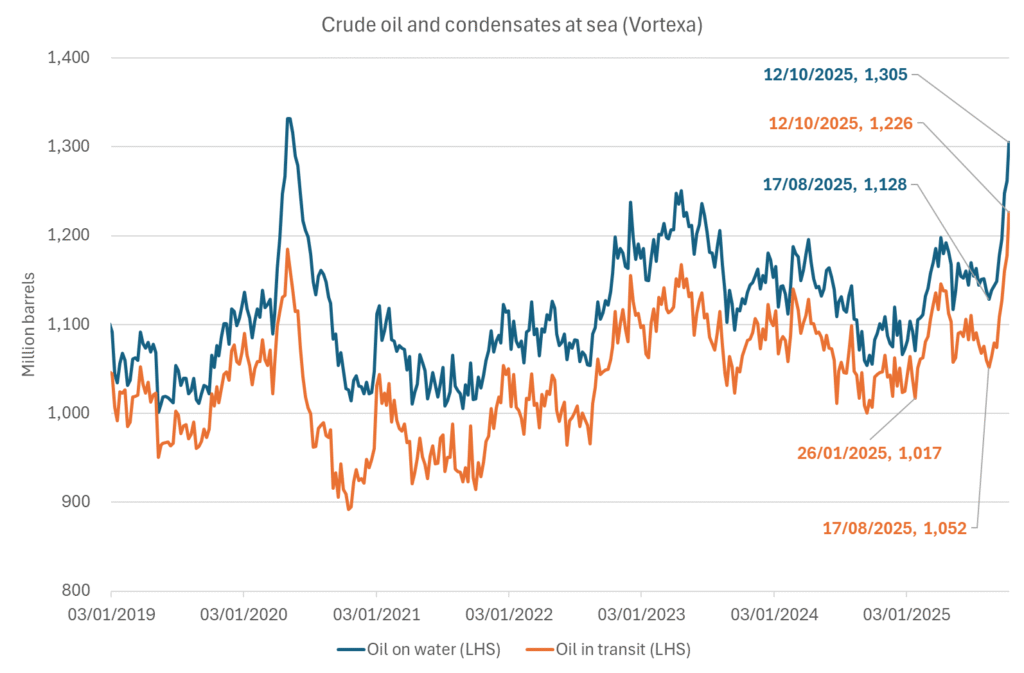

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

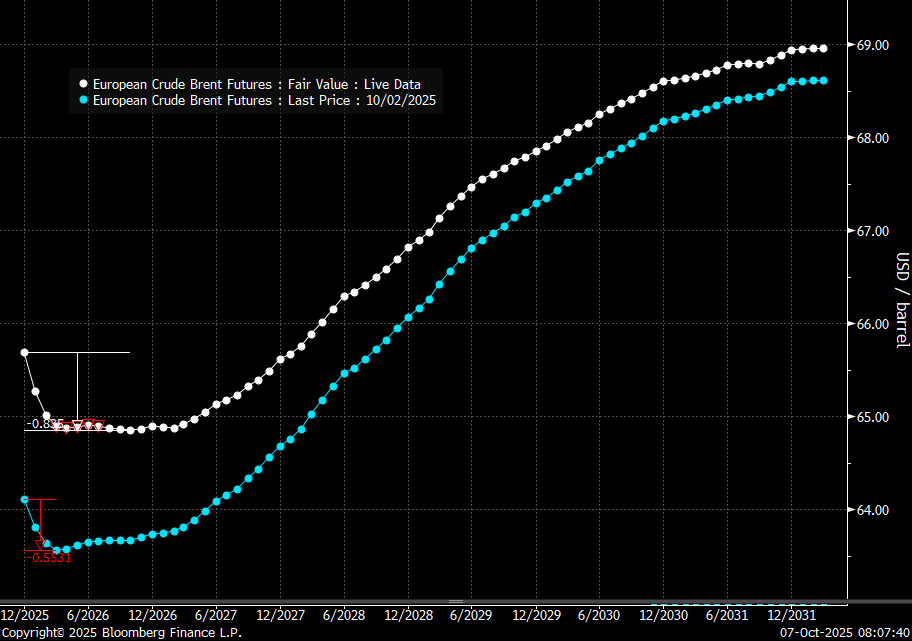

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

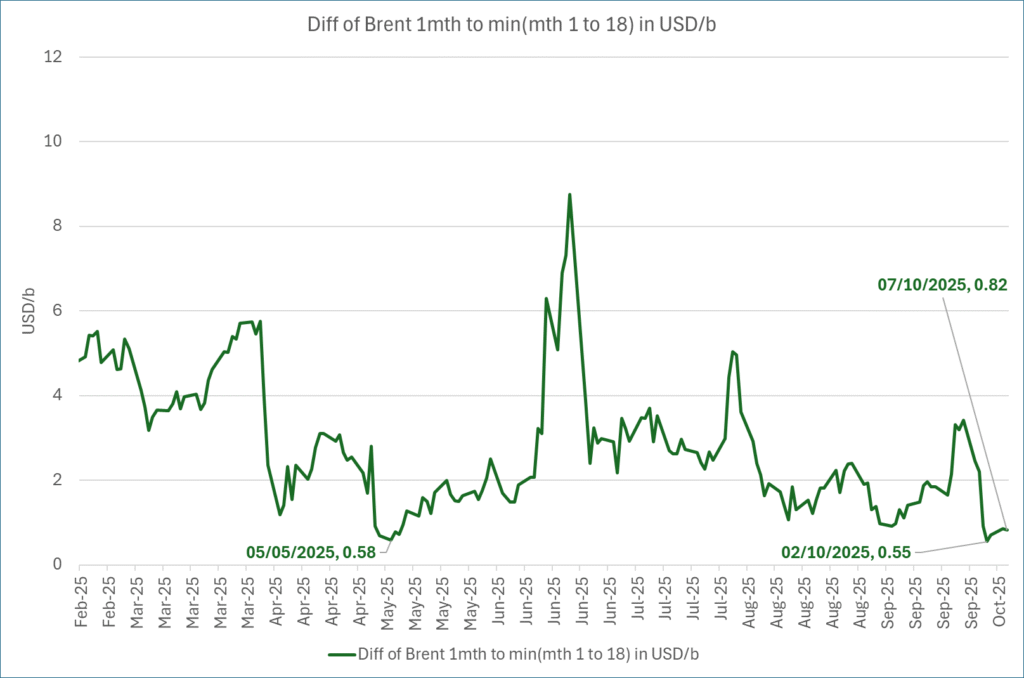

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål