Analys

Ultra tight market for medium sour crude and middle distillates

The world is craving for medium sour crude, middle distillates and heavier products. Deep cuts by OPEC+ has created a super tight market for medium to heavy crudes. So tight that Dubai crude now trades at a USD 0.6/b premium to Brent crude rather than a normal discount. All of Russia’s crudes are now trading above the USD 60/b price cap set by the US. Scarcity of such crudes, rich on middle distillates and heavy products, is naturally leading to a scarcity of middle distillates and heavier products. Global inventories of such products are now very low and refining margins are skyrocketing with diesel in Europe now at USD 125/b. There is no sign that Saudi Arabia will shift away from its current ”price over volume” strategy as it is expected to lift its official selling prices for October. Crude oil at USD 85/b is a blissful heaven for Saudi Arabia. As long as US shale oil is shedding drilling rigs at a WTI oil price of USD 80/b there is no reason for Saudi Arabia to fear any shale oil boom which potentially could rob if of market shares. So ”price over volume” is the name of the game.

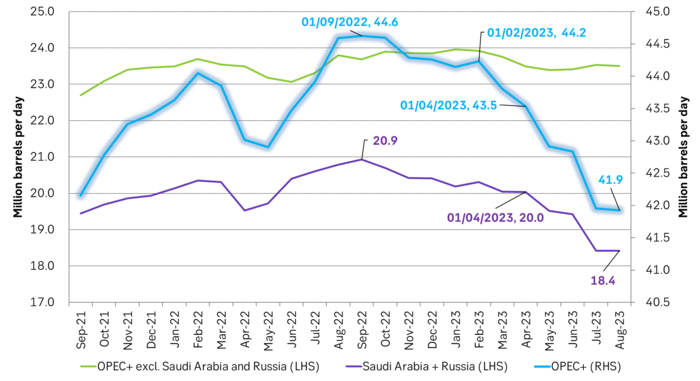

Production by OPEC+ has declined by 2.7 m b/d from Sep-2022 to Aug-2023. Most of this reduction has taken place since February this year. Global demand on the other hand has increased by 2.4 m b/d from Q3-2022 to Q3-2023. This counter move between supply from OPEC+ vs. global demand has been partially eased by a 1.4 m b/d increase in supply by OECD producers, mostly US shale oil (light sweet crude).

There has thus been a massive tightening in the supply of medium sour crude (medium weight and sulfur > 1%) from OPEC+. Naturally so because this is the type of crude which OPEC+ predominantly is producing. So when the organisation makes deep cuts it leads to a tightening of the medium sour crude market.

The situation has been exacerbated by several factors. The first is Europe which no longer is importing neither crude nor oil products from Russia. The EU28 used to import 4.3 m b/d of crude and products from Russia before the war in Ukraine. Predominantly medium sour crude (Urals), lots of diesel but also lots of heavier components like VGO and different kinds of heavy refinery residues like bunker oil etc. Refineries are huge, complex, specialized machines which are individually tailor made for specific tasks and feed stocks. Without the specific feed stocks they were made for they typically cannot run optimally and have to run at reduced rates thus churning out less finished oil products. Europe has to some degree been able to import medium sour crude from the Middle East and other places to replace the 4.3 m b/d of lost supply from Russia, but it has also been forced to replace it with light sweet crude from the US which is yielding much less diesel or heavier products. The Vacuum Gasoil (VGO) and other heavy feed stocks which the EU used to import from Russia were typically converted to diesel products in deep conversion units. The second factor which has added to the problem is that more than 5 m b/d of global refining capacity has been decommissioned globally since 2020. Global refining capacity actually contracted in 2021 for the first time!

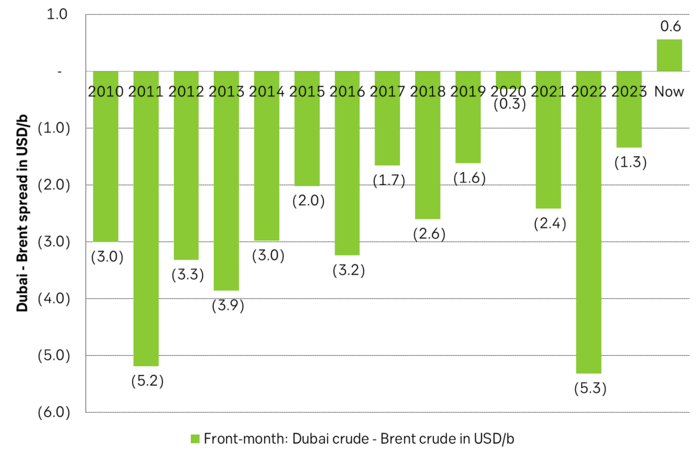

But bottom line here is that the global market for medium sour crude is now super tight. Predominantly as a result of deep cuts by OPEC+. This has amplified the factors above and led to a super tight situation in medium heavy to heavy products (diesel, jet, bunker oil, etc). It is so tight that bunker oil (HSFO 3.5%) in Europe recently traded at a premium to Brent crude rather than a normal discount of USD 10-20/b. This hasn’t happened since the 1990ies! Another sign of the tightness in medium sour crude is that Dubai crude (API = 31, Sulfur = 2%) now is trading at a premium to Brent crude (API = 38, Sulfur = 0.5%) versus a normal discount of more than USD 2/b.

Global middle distillate stocks are very low as we now head into winter. Inventories of middle distillates and jet fuel in the US is almost equally low as they were one year ago.

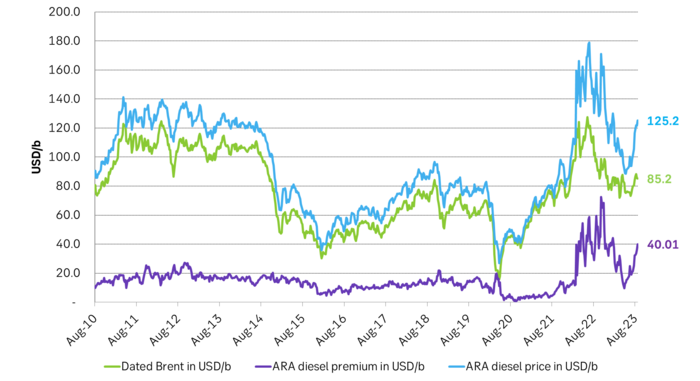

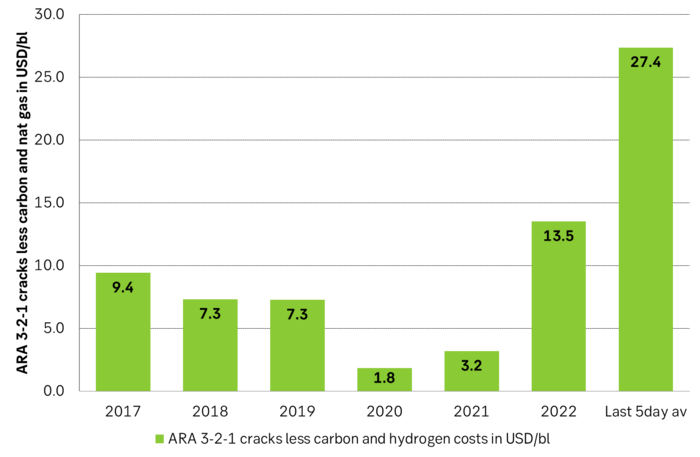

The tightness in medium sour crude and diesel products has sent refinery margins skyrocketing. The price of diesel in Europe ARA is now standing at USD 125.2/b. That is down from the crazy prices we had one year ago when diesel prices in Europe almost reached USD 180/b. But current diesel price is on par with the price of diesel from 2011 to 2014 when Brent crude averaged USD 110/b. The diesel refining premium in ARA is now USD 40/b and the premium for jet fuel is USD 45/b. Refineries usually make a profit on diesel, jet and gasoline, a loss on bunker oil and a total refining margin for turning crude oil to products of maybe just USD 5/b before operating and capital cost leaving them with limited or even negative margins overall. Now they are making a killing. As a result they will buy as much crude as they can and turn it into the needed products. What they want more than anything is medium sour crudes which have rich contents of middle distillates. But the supply of that crude is now super tight due to deliberate cuts by Saudi Arabia and now also Russia.

There is no sign that Saudi Arabia and Russia will back down any time soon. Saudi Arabia is about to set its official selling prices (OSPs) for October and indications are that they will increase their prices. That implies that Saudi Arabia will continue its ”price over volume” strategy. No signs that they will change on this any time soon. US shale oil producers are still shedding drilling rigs and supply growth there is slowing = Power to OPEC+ to control the market.

Saudi Arabia will also decide over the coming days what they will do with their unilateral production cut for October. Will it roll forward their current production of 9 m b/d or will they add some crude and lift it to for example 9.5 m b/d? Hard to say, but what is clear is that the global market currently is craving for more diesel, heavy products and medium sour crude. Our view is that Saudi Arabia will not risk driving crude oil prices to USD 100 – 110/b or higher through deliberate cuts as this will lead to elevated political storm from the US and maybe also from China. We think that Saudi Arabia is utterly happy with the current oil price of USD 85/b and want to keep it at that level. Getting it exactly right is of course tricky, but they do have the capacity to at least get it ballpark right.

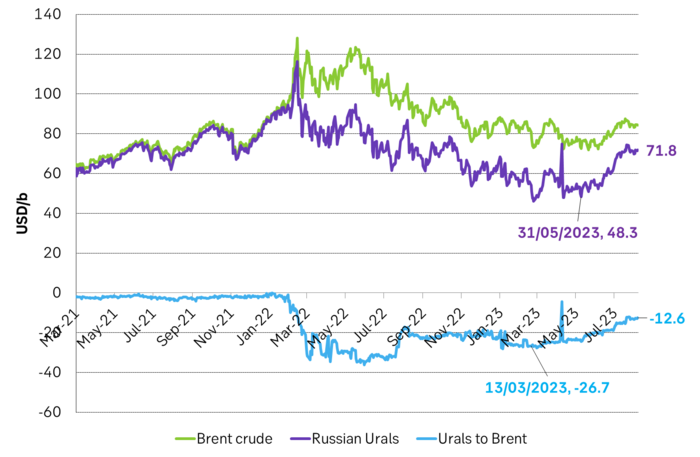

Russia should be super happy. The tight medium sour crude market has sent the price of all their crude exports to above the USD 60/b cap. The price of Urals has increased from USD 50/b in May to now USD 71/b. This is of course a headache for the western who is trying to limit Russian oil revenue.

Deep cuts by OPEC+ over the past year. In total 2.7 m b/d since Sep 2022. But accelerating cuts since February 2023. Deliberate cuts by Saudi Arabia and in part by Russia. It has created a super tight market for medium sour crude as global demand has rallied 2.4 m b/d over the past year.

Price spread Dubai – Brent. Dubai usually trades at a discount to Brent crude. Now it trades at a premium of USD 0.6/b. Highly unusual! A sign of a very tight medium sour crude oil market.

The price discount for Russian Urals crude is evaporating as the market for medium sour crude oil has tightened.

ARA diesel prices have rallied since their low point in April. Diesel in ARA now costs USD 125/b and equally much as it did from 2011 to 2014 when Brent crude traded at USD 110/b.

Refineries are making a killing as refining margins for diesel, jet and gasoline have skyrocketed while the usual loss making component, bunker oil, now almost trades on par with Brent crude. Refineries, the primary buyers of crude, will buy as much crude oil as they can to make yet more money. This should help to keep demand for crude oil elevated and thus prices for crude oil elevated.

Analys

What OPEC+ is doing, what it is saying and what we are hearing

Down 4.4% last week with more from OPEC+, a possible truce in Ukraine and weak US data. Brent crude fell 4.4% last week with a close of the week of USD 66.59/b and a range of USD 65.53-69.98/b. Three bearish drivers were at work. One was the decision by OPEC+ V8 to lift its quotas by 547 kb/d in September and thus a full unwind of the 2.2 mb/d of voluntary cuts. The second was the announcement that Trump and Putin will meet on Friday 15 August to discuss the potential for cease fire in Ukraine (without Ukraine). I.e. no immediate new sanctions towards Russia and no secondary sanctions on buyers of Russian oil to any degree that matters for the oil price. The third was the latest disappointing US macro data which indicates that Trump’s tariffs are starting to bite. Brent is down another 1% this morning trading close to USD 66/b. Hopes for a truce on the horizon in Ukraine as Putin meets with Trump in Alaska in Friday 15, is inching oil lower this morning.

Trump – Putin meets in Alaska. The potential start of a process. No disruption of Russian oil in sight. Trump has invited Putin to Alaska on 15 August to discuss Ukraine. The first such invitation since 2007. Ukraine not being present is bad news for Ukraine. Trump has already suggested ”swapping of territory”. This is not a deal which will be closed on Friday. But rather a start of a process. But Trump is very, very unlikely to slap sanctions on Russian oil while this process is ongoing. I.e. no disruption of Russian oil in sight.

What OPEC+ is doing, what it is saying and what we are hearing. OPEC+ V8 is done unwinding its 2.2 mb/d in September. It doesn’t mean production will increase equally much. Since it started the unwind and up to July (to when we have production data), the increase in quotas has gone up by 1.4 mb/d, while actual production has gone up by less than 0.7 mb/d. Some in the V8 group are unable to increase while others, like Russia and Iraq are paying down previous excess production debt. Russia and Iraq shouldn’t increase production before Jan and Mar next year respectively.

We know that OPEC+ has spare capacity which it will deploy back into the market at some point in time. And with the accelerated time-line for the redeployment of the 2.2 mb/d voluntary cuts it looks like it is happening fast. Faster than we had expected and faster than OPEC+ V8 previously announced.

As bystanders and watchers of the oil market we naturally combine our knowledge of their surplus spare capacity with their accelerated quota unwind and the combination of that is naturally bearish. Amid this we are not really able to hear or believe OPEC+ when they say that they are ready to cut again if needed. Instead we are kind of drowning our selves out in a combo of ”surplus spare capacity” and ”rapid unwind” to conclude that we are now on a highway to a bear market where OPEC+ closes its eyes to price and blindly takes back market share whatever it costs. But that is not what the group is saying. Maybe we should listen a little.

That doesn’t mean we are bullish for oil in 2026. But we may not be on a ”highway to bear market” either where OPEC+ is blind to the price.

Saudi OSPs to Asia in September at third highest since Feb 2024. Saudi Arabia lifted its official selling prices to Asia for September to the third highest since February 2024. That is not a sign that Saudi Arabia is pushing oil out the door at any cost.

Saudi Arabia OSPs to Asia in September at third highest since Feb 2024

Analys

Breaking some eggs in US shale

Lower as OPEC+ keeps fast-tracking redeployment of previous cuts. Brent closed down 1.3% yesterday to USD 68.76/b on the back of the news over the weekend that OPEC+ (V8) lifted its quota by 547 kb/d for September. Intraday it traded to a low of USD 68.0/b but then pushed higher as Trump threatened to slap sanctions on India if it continues to buy loads of Russian oil. An effort by Donald Trump to force Putin to a truce in Ukraine. This morning it is trading down 0.6% at USD 68.3/b which is just USD 1.3/b below its July average.

Only US shale can hand back the market share which OPEC+ is after. The overall picture in the oil market today and the coming 18 months is that OPEC+ is in the process of taking back market share which it lost over the past years in exchange for higher prices. There is only one source of oil supply which has sufficient reactivity and that is US shale. Average liquids production in the US is set to average 23.1 mb/d in 2025 which is up a whooping 3.4 mb/d since 2021 while it is only up 280 kb/d versus 2024.

Taking back market share is usually a messy business involving a deep trough in prices and significant economic pain for the involved parties. The original plan of OPEC+ (V8) was to tip-toe the 2.2 mb/d cuts gradually back into the market over the course to December 2026. Hoping that robust demand growth and slower non-OPEC+ supply growth would make room for the re-deployment without pushing oil prices down too much.

From tip-toing to fast-tracking. Though still not full aggression. US trade war, weaker global growth outlook and Trump insisting on a lower oil price, and persistent robust non-OPEC+ supply growth changed their minds. Now it is much more fast-track with the re-deployment of the 2.2 mb/d done already by September this year. Though with some adjustments. Lifting quotas is not immediately the same as lifting production as Russia and Iraq first have to pay down their production debt. The OPEC+ organization is also holding the door open for production cuts if need be. And the group is not blasting the market with oil. So far it has all been very orderly with limited impact on prices. Despite the fast-tracking.

The overall process is nonetheless still to take back market share. And that won’t be without pain. The good news for OPEC+ is of course that US shale now is cooling down when WTI is south of USD 65/b rather than heating up when WTI is north of USD 45/b as was the case before.

OPEC+ will have to break some eggs in the US shale oil patches to take back lost market share. The process is already in play. Global oil inventories have been building and they will build more and the oil price will be pushed lower.

A Brent average of USD 60/b in 2026 implies a low of the year of USD 45-47.5/b. Assume that an average Brent crude oil price of USD 60/b and an average WTI price of USD 57.5/b in 2026 is sufficient to drive US oil rig count down by another 100 rigs and US crude production down by 1.5 mb/d from Dec-25 to Dec-26. A Brent crude average of USD 60/b sounds like a nice price. Do remember though that over the course of a year Brent crude fluctuates +/- USD 10-15/b around the average. So if USD 60/b is the average price, then the low of the year is in the mid to the high USD 40ies/b.

US shale oil producers are likely bracing themselves for what’s in store. US shale oil producers are aware of what is in store. They can see that inventories are rising and they have been cutting rigs and drilling activity since mid-April. But significantly more is needed over the coming 18 months or so. The faster they cut the better off they will be. Cutting 5 drilling rigs per week to the end of the year, an additional total of 100 rigs, will likely drive US crude oil production down by 1.5 mb/d from Dec-25 to Dec-26 and come a long way of handing back the market share OPEC+ is after.

Analys

More from OPEC+ means US shale has to gradually back off further

The OPEC+ subgroup V8 this weekend decided to fully unwind their voluntary cut of 2.2 mb/d. The September quota hike was set at 547 kb/d thereby unwinding the full 2.2 mb/d. This still leaves another layer of voluntary cuts of 1.6 mb/d which is likely to be unwind at some point.

Higher quotas however do not immediately translate to equally higher production. This because Russia and Iraq have ”production debts” of cumulative over-production which they need to pay back by holding production below the agreed quotas. I.e. they cannot (should not) lift production before Jan (Russia) and March (Iraq) next year.

Argus estimates that global oil stocks have increased by 180 mb so far this year but with large skews. Strong build in Asia while Europe and the US still have low inventories. US Gulf stocks are at the lowest level in 35 years. This strong skew is likely due to political sanctions towards Russian and Iranian oil exports and the shadow fleet used to export their oil. These sanctions naturally drive their oil exports to Asia and non-OECD countries. That is where the surplus over the past half year has been going and where inventories have been building. An area which has a much more opaque oil market. Relatively low visibility with respect to oil inventories and thus weaker price signals from inventory dynamics there.

This has helped shield Brent and WTI crude oil price benchmarks to some degree from the running, global surplus over the past half year. Brent crude averaged USD 73/b in December 2024 and at current USD 69.7/b it is not all that much lower today despite an estimated global stock build of 180 mb since the end of last year and a highly anticipated equally large stock build for the rest of the year.

What helps to blur the message from OPEC+ in its current process of unwinding cuts and taking back market share, is that, while lifting quotas, it is at the same time also quite explicit that this is not a one way street. That it may turn around make new cuts if need be.

This is very different from its previous efforts to take back market share from US shale oil producers. In its previous efforts it typically tried to shock US shale oil producers out of the market. But they came back very, very quickly.

When OPEC+ now is taking back market share from US shale oil it is more like it is exerting a continuous, gradually increasing pressure towards US shale oil rather than trying to shock it out of the market which it tried before. OPEC+ is now forcing US shale oil producers to gradually back off. US oil drilling rig count is down from 480 in Q1-25 to now 410 last week and it is typically falling by some 4-5 rigs per week currently. This has happened at an average WTI price of about USD 65/b. This is very different from earlier when US shale oil activity exploded when WTI went north of USD 45/b. This helps to give OPEC+ a lot of confidence.

Global oil inventories are set to rise further in H2-25 and crude oil prices will likely be forced lower though the global skew in terms of where inventories are building is muddying the picture. US shale oil activity will likely decline further in H2-25 as well with rig count down maybe another 100 rigs. Thus making room for more oil from OPEC+.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanStargate Norway, AI-datacenter på upp till 520 MW etableras i Narvik

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export