Analys

SEB – Jordbruksprodukter, vecka 20 2012

Det här veckobrevet är tidigarelagt dels för att det är Kristi himmelsfärds dag på torsdag och dels för att vi har en WASDE-rapport att recensera.

Det här veckobrevet är tidigarelagt dels för att det är Kristi himmelsfärds dag på torsdag och dels för att vi har en WASDE-rapport att recensera.

Under helgen kom nyheten från Kina att landet sänkt reservkraven på kinesiska banker med 0.5%. Normalt borde det fått marknaderna för råvaror att stiga. Så sker inte. Merkels CDU har förlorat ett viktigt val i Tyskland. De flesta tolkar detta som att viljan att betala för resten av de skuldsatta länderna i Europa har minskat. Ett nytt politiskt kaos har drabbat Grekland och de flesta väntar sig att landet går i konkurs och får införa sin urgamla valuta drachman igen. Vi har en ny president vald i Frankrike, som inte tycks vara så inställd på att rädda sina grannländer. Räntan på spanska 10-åriga obligationer har stigit över 6% igen (6% innebär slutlig konkurs). Motsvarande ränta i Portugal är 11%. USA:s ekonomi hackar och Wall Street är i chock efter att JP Morgan, bankernas bank, redovisat 2 mdr dollar i vad som med rätta ska kallas kreditförluster. Kinas tillväxt hackar också, men de stimulerar den. Allt detta väcker tvivel om efterfrågan på råvaror.

Odlingsväder

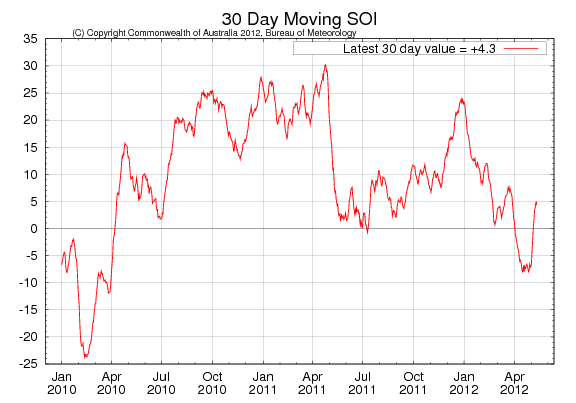

Southern Oscillation Index, ett mått på intensiteten i graden av La Niña eller El Niño, ligger kvar därdet låg förra veckan. Nu är indexet 4.3. En nivå mellan +8 och -8 indikerar neutrala ENSOförhållanden.

Vete

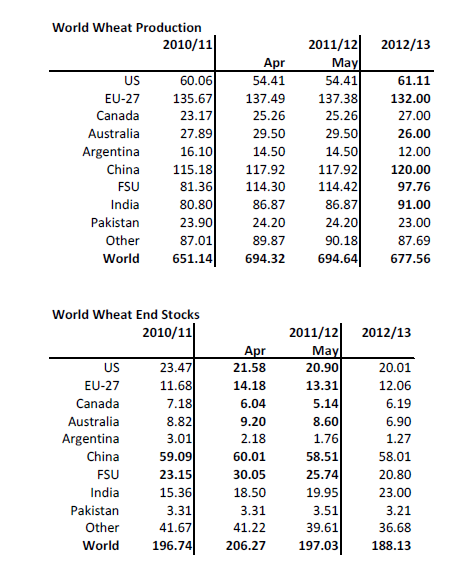

WASDE-rapporten i torsdags. För 2011/12 gjordes inga större förändringar vad gäller produktion. Konsumtionen justerades däremot upp med 8 mt för Kanada, EU och Kina. För kommande skörd, marknadsföringsåret 2012/13 sänktes skörden med 17 mt netto. Skörden väntas bli större i USA och Kanada, i Kina och i Indien, men skörden väntas bli lägre I EU-27, fd Sovjetunionen och på södra halvklotet. Konsumtionen väntas bli som i år.

Sammanfattningsvis: Utgående globala lager för 2012/13 är något ”bullish”, men för världsmarknaden betyder USA i egenskap av den största exportören väldigt mycket. En skörd i USA på 61 mt mot 54 mt förra året och 60 mt för två år sedan, är bearish. Summa summarum, innehåll rapporten alltså inte några nyheter som allvarligt kunde flytta på priset just för vete. Däremot var majs-rapporten bearish och sojarapporten bullish. Och av detta betyder majsen mest för vetet. Nedan ser vi novemberkontraktet på Matif. Uppåttrenden är bruten och 200 euro är nu ett psykologiskt motstånd. 190 euro ser ut att ligga inom räckhåll.

Nedan ser vi Chicagovetet med leverans i december. Priset trendar nedåt efter att ha brutit stödet på 650 cent.

Maltkorn

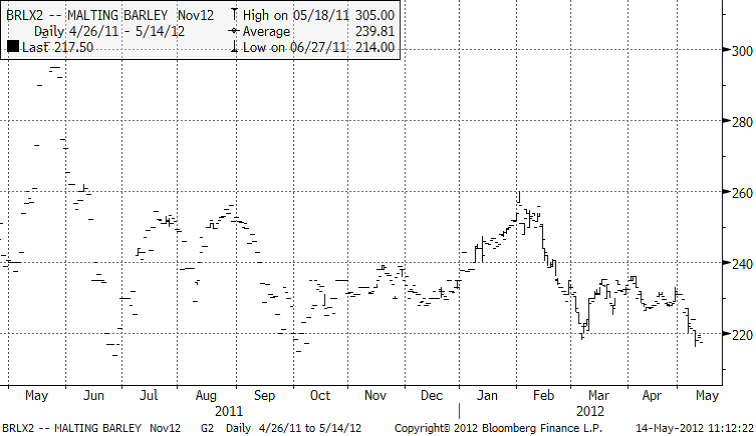

Novemberkontraktet på maltkorn har brutit stödnivån 220 euro per ton. Priset har vänt på den här nivån strax under 220 flera gånger förut, så det är inte någon teknisk säljsignal än.

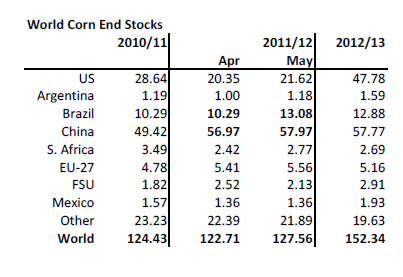

Majs

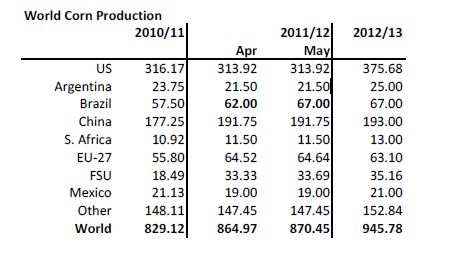

WASDE-rapporten i torsdag innehåll en uppjustering av Brasiliens just skördade skörd från 62 mt till 67 mt. Vi noterar att skörden 2012/13 väntas bli rekordstor. Orsaken är att ENSO slagit om från La Niña till neutrala förhållanden, eller rentav El Niño. Detta har vi sett i ensembleprognoserna sedan nyår. Skörden per acre i USA väntas öka med 20 bushels per acre eller med 13%. Efterfrågan väntas också hoppa uppåt med 54 mt. Det här är den första rapporten som ordentligt tagit in det riktigt goda odlingsklimatet på planeten under kommande år och den är därmed riktigt bearish.

Priset på decembermajs föll ner och ”rörde vid” 500 cent. Troligtvis ska marknaden testa den nivån igen. Bryts den får vi en förnyad säljsignal.

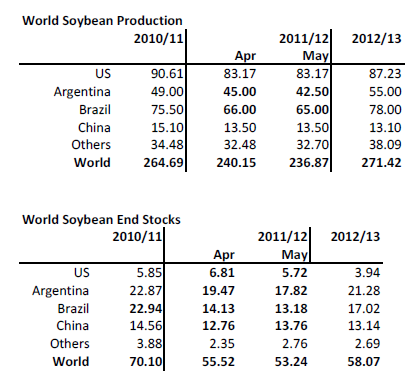

Sojabönor

WASDE-rapporten i torsdags: Lite mindre skörd antas ha bärgats i Sydamerika, framförallt gäller det Argentina. Utgående lager i höst väntas vara ännu lägre än tidigare trott. För kommande skörd väntas, som vi redan skrivit om, en rekordskörd i Sydamerika. Odlingsvädret, där ENSO slagit om till neutrala eller rentav El Niño-förhållanden är idealiskt inför sådden på södra halvklotet. Global produktion antas ligga 35 mt högre än i år. Konsumtionen väntas också öka och det innebär att utgående lager bara ökar något lite. Det är ännu lång tid kvar till skörd och mycket kan hända längs vägen. Majs är attraktivt att så och sojapriset måste hålla sig högt för att försvara arealen.

Marknaden har sålt på sojabönorna idag på grund av de ekonomiska nyheterna från Europa, som väcker farhågor om efterfrågan på ”bättre mat”.

1300 är en teknisk stödnivå då priset vände där i månadsskiftet mars-april. Återstår att se om nivån håller den här gången.

Raps

Priset på novemberterminen tycks ha toppat ur på 480 euro per ton.

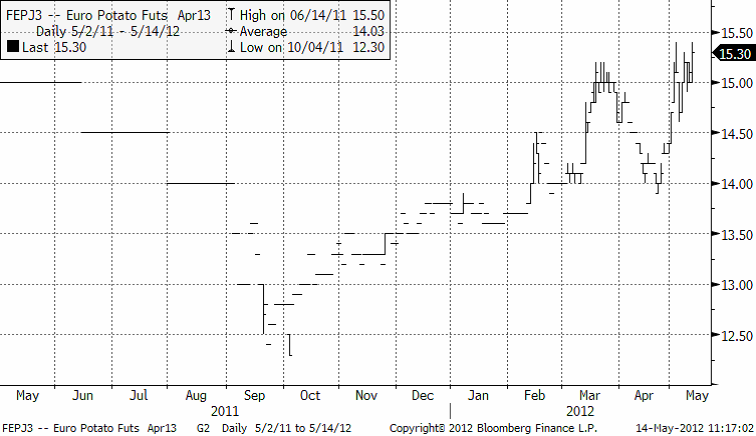

Potatis

Potatispriset för leverans nästa år fortsätter att stiga. Priset är definitivt i stigande trend.

Gris

Det har av naturliga skäl inte hänt speciellt mycket med lean hogs sedan förra veckobrevet. Priset ligger på samma (låga) nivå.

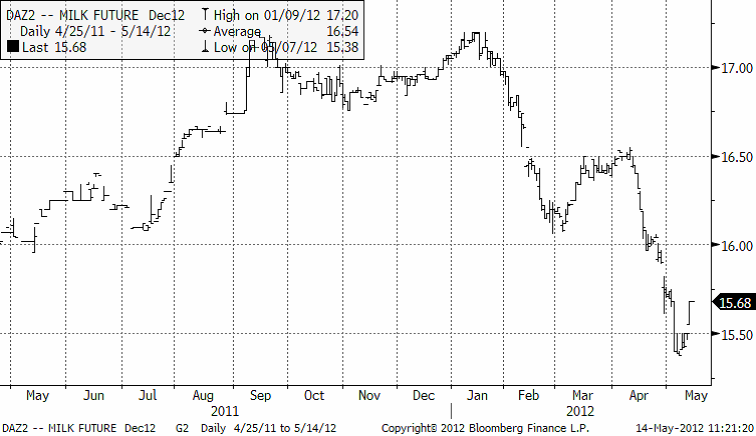

Mjölk

Mjölkpriset (decemberleverans) handlas lite högre än förra veckan, på 15.68. Lägsta förra veckan var 15.38. Vi ser detta som en naturlig rekyl när några tycker att priset fallit för mycket för fort.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Lowest since Dec 2021. Kazakhstan likely reason for OPEC+ surprise hike in May

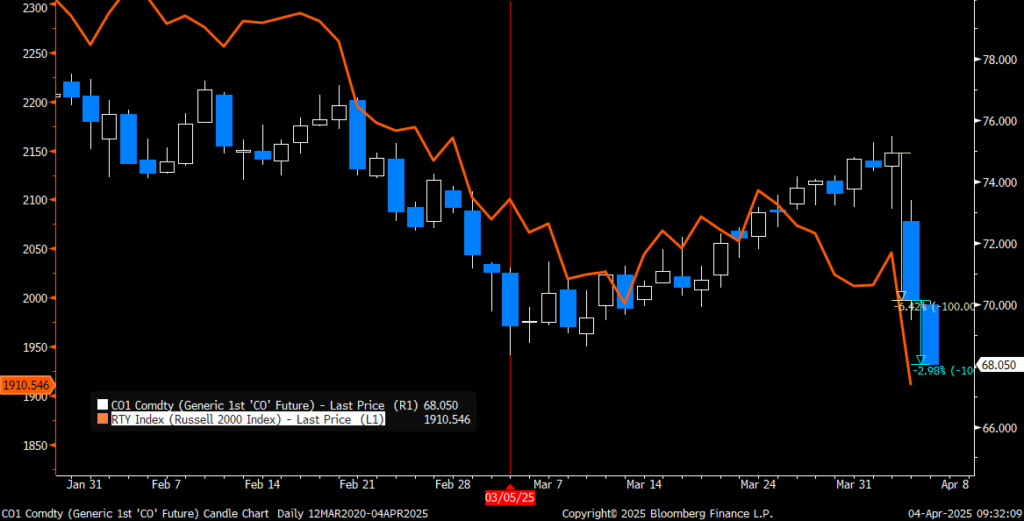

Collapsing after Trump tariffs and large surprise production hike by OPEC+ in May. Brent crude collapsed yesterday following the shock of the Trump tariffs on April 2 and even more so due to the unexpected announcement from OPEC+ that they will lift production by 411 kb/d in May which is three times as much as expected. Brent fell 6.4% yesterday with a close of USD 70.14/b and traded to a low of USD 69.48/b within the day. This morning it is down another 2.7% to USD 68.2/b. That is below the recent low point in early March of USD 68.33/b. Thus, a new ”lowest since December 2021” today.

Kazakhstan seems to be the problem and the reason for the unexpected large hike by OPEC+ in May. Kazakhstan has consistently breached its production cap. In February it produced 1.83 mb/d crude and 2.12 mb/d including condensates. In March its production reached a new record of 2.17 mb/d. Its crude production cap however is 1.468 mb/d. In February it thus exceeded its production cap by 362 kb/d.

Those who comply are getting frustrated with those who don’t. Internal compliance is an important and difficult issue when OPEC+ is holding back production. The problem naturally grows the bigger the cuts are and the longer they last as impatience grows over time. The cuts have been large, and they have lasted for a long time. And now some cracks are appearing. But that does not mean they cannot be mended. And it does not imply either that the group is totally shifting strategy from Price to Volume. It is still a measured approach. Also, by lifting all caps across the voluntary cutters, Kazakhstan becomes less out of compliance. Thus, less cuts by Kazakhstan are needed in order to become compliant.

While not a shift from Price to Volume, the surprise hike in May is clearly a sign of weakness. The struggle over internal compliance has now led to a rupture in strategy and more production in May than what was previously planned and signaled to the market. It is thus natural to assign a higher production path from the group for 2025 than previously assumed. Do however remember how quickly the price war between Russia and Saudi Arabia ended in the spring of 2020.

Higher production by OPEC+ will be partially countered by lower production from Venezuela and Iran. The new sanctions towards Iran and Venezuela can to a large degree counter the production increase from OPEC+. But to what extent is still unclear.

Buy some oil calls. Bullish risks are never far away. Rising risks for US/Israeli attack on Iran? The US has increased its indirect attacks on Iran by fresh attacks on Syria and Yemen lately. The US has also escalated sanctions towards the country in an effort to force Iran into a new nuclear deal. The UK newspaper TheSun yesterday ran the following story: ”ON THE BRINK US & Iran war is ‘INEVITABLE’, France warns as Trump masses huge strike force with THIRD of America’s stealth bombers”. This is indeed a clear risk which would lead to significant losses of supply of oil in the Middle East and probably not just from Iran. So, buying some oil calls amid the current selloff is probably a prudent thing to do for oil consumers.

Brent crude is rejoining the US equity selloff by its recent collapse though for partially different reasons. New painful tariffs from Trump in combination with more oil from OPEC+ is not a great combination.

Analys

Tariffs deepen economic concerns – significantly weighing on crude oil prices

Brent crude prices initially maintained the gains from late March and traded sideways during the first two trading days in April. Yesterday evening, the price even reached its highest point since mid-February, touching USD 75.5 per barrel.

However, after the U.S. president addressed the public and unveiled his new package of individual tariffs, the market reacted accordingly. Overnight, Brent crude dropped by close to USD 4 per barrel, now trading at USD 71.6 per barrel.

Key takeaways from the speech include a baseline tariff rate of 10% for all countries. Additionally, individual reciprocal tariffs will be imposed on countries with which the U.S. has the largest trade deficits. Many Asian economies end up at the higher end of the scale, with China facing a significant 54% tariff. In contrast, many North and South American countries are at the lower end, with a 10% tariff rate. The EU stands at 20%, which, while not unexpected given earlier signals, is still disappointing, especially after Trump’s previous suggestion that there might be some easing.

Once again, Trump has followed through on his promise, making it clear that he is serious about rebalancing the U.S. trade position with the world. While some negotiation may still occur, the primary objective is to achieve a more balanced trade environment. A weaker U.S. dollar is likely to be an integral part of this solution.

Yet, as the flow of physical goods to the U.S. declines, the natural question arises: where will these goods go? The EU may be forced to raise tariffs on China, mirroring U.S. actions to protect its industries from an influx of discounted Chinese goods.

Initially, we will observe the effects in soft economic data, such as sentiment indices reflecting investor, industry, and consumer confidence, followed by drops in equity markets and, very likely, declining oil prices. This will eventually be followed by more tangible data showing reductions in employment, spending, investments, and overall economic activity.

Ref oil prices moving forward, we have recently adjusted our Brent crude price forecast. The widespread imposition of strict tariffs is expected to foster fears of an economic slowdown, potentially reducing oil demand. Macroeconomic uncertainty, particularly regarding tariffs, warrants caution regarding the pace of demand growth. Our updated forecast of USD 70 per barrel for 2025 and 2026, and USD 75 per barrel for 2027, reflects a more conservative outlook, influenced by stronger-than-expected U.S. supply, a more politically influenced OPEC+, and an increased focus on fragile demand.

___

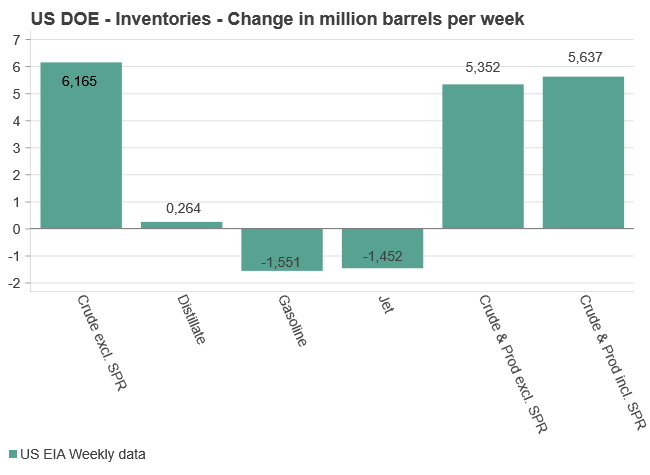

US DOE data:

Last week, U.S. crude oil refinery inputs averaged 15.6 million barrels per day, a decrease of 192 thousand barrels per day from the previous week. Refineries operated at 86.0% of their total operable capacity during this period. Gasoline production increased slightly, averaging 9.3 million barrels per day, while distillate (diesel) production also rose, averaging 4.7 million barrels per day.

U.S. crude oil imports averaged 6.5 million barrels per day, up by 271 thousand barrels per day from the prior week. Over the past four weeks, imports averaged 5.9 million barrels per day, reflecting a 6.3% year-on-year decline compared to the same period last year.

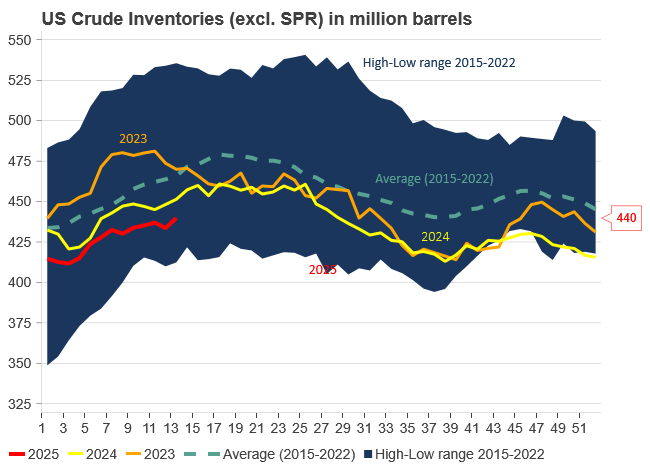

The focus remains on U.S. crude and product inventories, which continue to impact short-term price dynamics in both WTI and Brent crude. Total commercial petroleum inventories (excl. SPR) increased by 5.4 million barrels, a modest build, yet insufficient to trigger significant price movements.

Commercial crude oil inventories (excl. SPR) rose by 6.2 million barrels, in line with the 6-million-barrel build forecasted by the API. With this latest increase, U.S. crude oil inventories now stand at 439.8 million barrels, which is 4% below the five-year average for this time of year.

Gasoline inventories decreased by 1.6 million barrels, exactly matching the API’s reported decline of 1.6 million barrels. Diesel inventories rose by 0.3 million barrels, which is close to the API’s forecast of an 11-thousand-barrel decrease. Diesel inventories are currently 6% below the five-year average.

Over the past four weeks, total products supplied, a proxy for U.S. demand, averaged 20.1 million barrels per day, a 1.2% decrease compared to the same period last year. Gasoline supplied averaged 8.8 million barrels per day, down 1.9% year-on-year. Diesel supplied averaged 3.8 million barrels per day, marking a 3.7% increase from the same period last year. Jet fuel demand also showed strength, rising 4.2% over the same four-week period.

Analys

Brent on a rollercoaster between bullish sanctions and bearish tariffs. Tariffs and demand side fears in focus today

Brent crude rallied to a high of USD 75.29/b yesterday, but wasn’t able to hold on to it and closed the day at USD 74.49/b. Brent crude has now crossed above both the 50- and 100-day moving average with the 200dma currently at USD 76.1/b. This morning it is trading a touch lower at USD 74.3/b

Brent riding a rollercoaster between bullish sanctions and bearish tariffs. Biden sanctions drove Brent to USD 82.63/b in mid-January. Trump tariffs then pulled it down to USD 68.33/b in early March with escalating concerns for oil demand growth and a sharp selloff in equities. New sanctions from Trump on Iran, Venezuela and threats of such also towards Russia then drove Brent crude back up to its recent high of USD 75.29/b. Brent is currently driving a rollercoaster between new demand damaging tariffs from Trump and new supply tightening sanctions towards oil producers (Iran, Venezuela, Russia) from Trump as well.

’Liberation day’ is today putting demand concerns in focus. Today we have ’Liberation day’ in the US with new, fresh tariffs to be released by Trump. We know it will be negative for trade, economic growth and thus oil demand growth. But we don’t know how bad it will be as the effects comes a little bit down the road. Especially bad if it turns into a global trade war escalating circus.

Focus today will naturally be on the negative side of demand. It will be hard for Brent to rally before we have the answer to what the extent these tariffs will be. Republicans lost the Supreme Court race in Wisconsin yesterday. So maybe the new Tariffs will be to the lighter side if Trump feels that he needs to tread a little bit more carefully.

OPEC+ controlling the oil market amid noise from tariffs and sanctions. In the background though sits OPEC+ with a huge surplus production capacity which it now will slice and dice out with gradual increases going forward. That is somehow drowning in the noise from sanctions and tariffs. But all in all, it is still OPEC+ who is setting the oil price these days.

US oil inventory data likely to show normal seasonal rise. Later today we’ll have US oil inventory data for last week. US API indicated last night that US crude and product stocks rose 4.4 mb last week. Close to the normal seasonal rise in week 13.

-

Nyheter3 veckor sedan

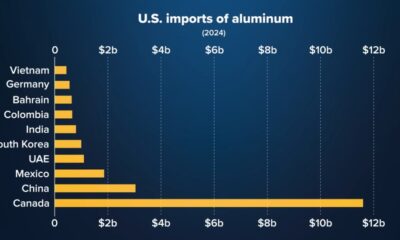

Nyheter3 veckor sedanUSA är världens största importör av aluminium

-

Analys4 veckor sedan

Analys4 veckor sedanOversold. Rising 1-3mth time-spreads. Possibly rebounding to USD 73.5/b before downside ensues

-

Analys3 veckor sedan

Analys3 veckor sedanCrude oil comment: Unable to rebound as the US SPX is signaling dark clouds on the horizon

-

Analys4 veckor sedan

Analys4 veckor sedanCrude oil comment: Not so fragile yet. If it was it would have sold off more yesterday

-

Nyheter3 veckor sedan

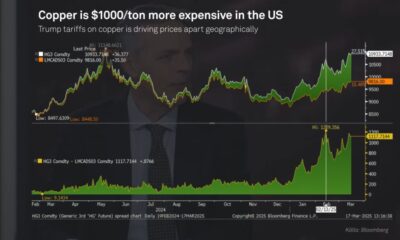

Nyheter3 veckor sedanPriset på koppar skiljer sig åt efter tariffer

-

Analys3 veckor sedan

Analys3 veckor sedanOil prices climb, but fundamentals will keep rallies in check

-

Analys2 veckor sedan

Analys2 veckor sedanCrude oil comment: Ticking higher as tariff-panic eases. Demand growth and OPEC+ will be key

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om råvarorna som behövs för batterier