Analys

SEB Jordbruksprodukter, 18 mars 2013

Prisfallet på spannmål har stannat av och såväl Chicago som Matif hade en av sina bättre veckor på länge. Sojabönorna med rapsfröet i släptåg gick åt motsatt håll, men båda håller sig ännu över sina respektive tekniska stödnivåer. Terminer på mjölkprodukterna smör och SMP steg på den tyska börsen Eurex. På tisdag får vi resultatet av Fonterras senaste auktion.

Prisfallet på spannmål har stannat av och såväl Chicago som Matif hade en av sina bättre veckor på länge. Sojabönorna med rapsfröet i släptåg gick åt motsatt håll, men båda håller sig ännu över sina respektive tekniska stödnivåer. Terminer på mjölkprodukterna smör och SMP steg på den tyska börsen Eurex. På tisdag får vi resultatet av Fonterras senaste auktion.

Den 28 mars är det dags för kvartalsstatistiken från det amerikanska jordbruksdepartementet. Klockan 17 den dagen presenteras uppdaterade siffror på ”prospective plantings” för vete och majs och lagerstatistiken per den första mars.

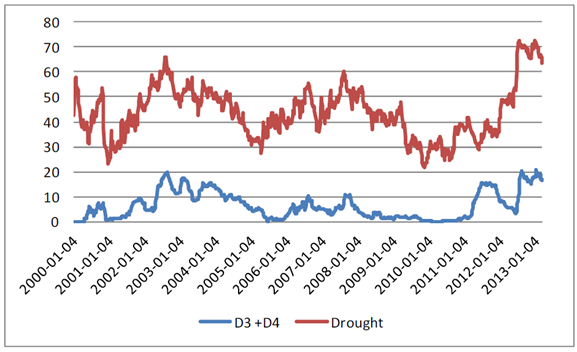

Odlingsväder

I veckan som gick regnade det i området kring Mississippi-floden, medan de västra delarna var fortsatt torra. Torkan släpper längs Mississippifloden och i östra USA och tränger ut torkan längre mot väster. Fortfarande är stora delar av USA torkdrabbat, men något mindre i veckans rapport. 63.6% av USA:s mark är torrare än normalt. I Juldagens rapport var det som värst med över 72% torrt. 16.5% av USA:s mark är fortfarande extremt eller exceptionellt torr. Även det är en minskning från maximum på över 19% som nåddes den sista januari.

Regn och kyla var på sina håll i USA så besvärande att sådden av majs hindrades. Europa fick nederbörd i veckan. Tidigare i år har Europa fått lite mindre nederbörd än normalt.

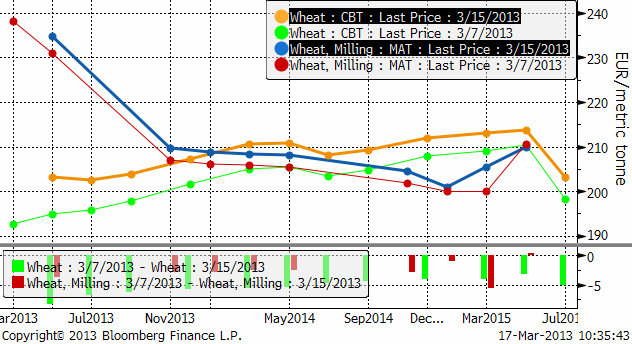

Vete

Priset på november (2013) steg upp mot 210-nivån i veckan. Det är ett avgörande läge, eftersom den här prisnivån just nu också är i den övre delen av den trendkanal nedåt som priset legat i sedan början av december när WASDE-rapporten fick marknaden på fall. När man är ute och talar med lantbrukare i Sverige får man höra följande: För det första är det ganska få som hann med att prissäkra på de höga prisnivåerna över 230 euro per ton som marknaden erbjöd mellan augusti och december. Den första stora prisuppgången 2007 var det nästan ingen som sålde eftersom man inte visste hur långt upp priset kunde gå. Vid nästa stora prisuppgång, 2010, prissäkrade man därför för tidigt, redan i september i många fall. Därför ångrade man sig när toppen noterades i februari 2011. Den här gången har man därför väntat – och missat toppen. Därför är det säkert många som kommer att passa på och sälja om priset rekylerar upp till – exempelvis – 220 euro per ton. Detta gör att uppgångar härifrån kan bli ganska begränsade, om inte utbudet i världen skadas allvarligt av försämrade odlingsförhållanden.

Jag tror att prisfallet de tre senaste månaderna är över och att vi får se lite ”sidledes” rörelse de närmaste veckorna. Intresse att prissäkra från lantbrukshåll finns om priserna är lite högre. Utvecklingen på vädret framöver blir viktigt.

Decemberkontraktet på CBOT hade en av sida bättre veckor, även den. Inte för att det är början på en prisuppgång, utan för att priset, som vi skrev förra veckan, kanske gått lite för långt ner lite för hastigt. Prisuppgången kommer alltså trots att det i veckan kom rapporter om ökande nederbörd och avtagande torka. Den enda tolkningen då är rimligen den, att priset gått ner lite för långt.

Terminskurvorna visar att alla terminer stigit. På Matif har alla löptider gått upp lika mycket. I USA har gammal skörd handlats upp mer än ny. Det är rimligt att detta sker, eftersom lagerkostnaderna minskar med minskande lager och att transporterna ut från USA kommer igång igen. Att vete blivit billigare än majs för gammal skörd bidrar också till att dra upp priset på vete.

Det har kommit en del statistik i veckan – som pekar åt olika håll. Franska Cocerals rapport indikerar högre priser. De tror att skörden i Frankrike blir bara något högre och 12 mt lägre i Storbritannien, där sådden var 25% mindre än normalt i höstas. Frankrike, som är EU:s största veteproducent beräknas bara öka skörden marginellt med 0.1 mt till 35.9 mt. Detta beror på att de största odlingsdistrikten Picardie och Centre fick mer än dubbelt så mycket nederbörd som normalt i december. FranceAgriMer estimerar att 66% av den franska veteskörden är i ”good” eller ”very good” condition per den 4 mars. Förra året samma tid var siffran 68%. Det är alltså nästan samma nivå.

Coceral estimerade den tyska skörden till 23.6 mt, vilket är på samma nivå som DRV (Deutsche Raiffeisenverband) också publicerade i veckan som gick. DRV pekade på att det hittills inte förekommit några övervintringsskador på grund av frost.

Coceral estimerade den tyska skörden till 23.6 mt, vilket är på samma nivå som DRV (Deutsche Raiffeisenverband) också publicerade i veckan som gick. DRV pekade på att det hittills inte förekommit några övervintringsskador på grund av frost.

Spanien, som förra året drabbades av torka, väntas i år producera normalt. Forna öststater väntas fortsätta öka produktionen. I förra veckans WASDE-rapport noterade vi också att den enda justering som USDA gjorde var att höja Litauens skörd med 500,000 ton. Det är en tydlig tendens.

”Soft Wheat” – skörden i EU tror Coceral blir 127.8 mt (+3.2 mt från förra året).

Strategie Grains som också rapporterade i veckan tror att samma skörd blir 131.6 mt. EU-kommissionen tror på ännu högre skörd, 132.1 mt.

Liksom förra veckan tror jag att de tre senaste månadernas prisfall på vete är över. Däremot tror jag inte på någon rask uppgång, utan mer på ”sidledes” rörelse medan marknaden tolkar de rapporter som kommer in – och lagerstatistiken som USDA publicerar den 28 mars. Ska man hålla koll på någonting särskilt är det om 210-nivån på Matif bryts på uppsidan. Det vore ett klart styrketecken om köparna lyckas ta hand om alla säljordrar som troligtvis anhopat sig där.

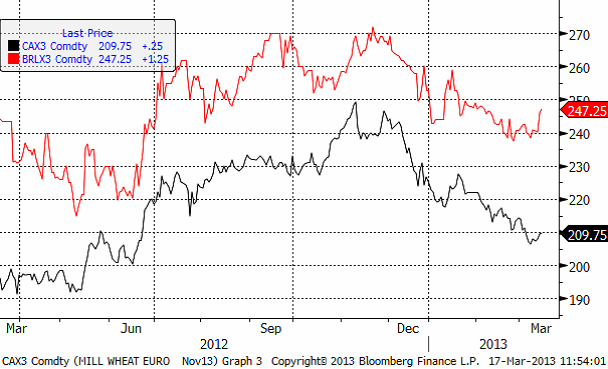

Maltkorn

Priset på maltkorn med leverans i november har visat mer styrka än kvarnvetet i veckan som gick. Priset steg från 240 till 247, medan kvarnvetet ”bara” steg några euro.

Majs

Majspriset (december 2013) fortsatte att stiga i veckan som gick. Priset gick upp till 561 cent – en nivå som dels ligger an mot den övre trendkanalen och dels är en nivå där uppgångar slutat tidigare. Marknaden står alltså nu under helgen och väger. Om priset håller sig på den här nivån får vi en någorlunda god bekräftelse på att prisfallet från december är över.

Veckovis etanolproduktion i minskade i veckan, men priset på etanol steg kraftigt. Vid årsskiftet handlades etanolen i 2.20 dollar per gallon och nu ligger den på 2.60. Detta sker samtidigt som oljepriset har fallit. Högre pris borde leda till högre produktion och högre efterfrågan på majs.

Vi har samma tolkning av marknaden som förra veckan. Prisfallet har troligtvis ebbat ut och priset bör röra sig ”sidledes”.

Sojabönor

Sojabönorna (november 2013) har till skillnad från majs, vete och maltkorn, handlats ner i veckan som stödet som jag skrivit om tidigare, på 1254 cent, har hållit. Novemberterminen stängde i fredags på 1261.

Skörden i Brasilien har kommit halvvägs. Bönderna har sålt 60% av skörden. Som jag skrev förra veckan är priserna inåt landet pressade på grund av den långsamma exporten. I Paranagua är väntan 75 dagar enligtFryer reports. Argentinska bönder har bara sålt 10% av skörden vilket är mindre än förra året då 30% sålt så här års. Argentina förklarades nästan i konkurs i en domstol i London häromveckan. Det finns därför en anledning att behålla sparkapitalet i den reala och säkra form som sojabönorna utgör.

I fredags publicerade NOPA (National Oilseed Processors Organisation) sin månadsvisa crush report. Den visar att sojabönslagret i USA äts upp i ett rasande tempo, samtidigt som världen får lov att vänta för att kunna få tag på de sydamerikanska bönorna.

Marknadsläget är oförändrat från förra veckan: I veckan som kommer får man hålla koll på om priset håller sig över det tekniska stödet vid 1254 eller om det bryts. Om det bryts vill vi vara korta sojabönor.

Raps

Rapspriset (november 2013) föll i torsdags rakt ner till det tekniska stödet på 415 euro per ton, men vände i fredags upp därifrån till 420, men stängde veckan på exakt 415 euro. Det var stora prisfall även i Winnipeg. Detta ”borde” inte ske ur ett fundamentalt perspektiv eftersom lagren är så små men sojabönorna sjönk och då kan inte rapsen gå sin egen väg.

Olyckligtvis lämnade vi förra veckan en negativ vy på rapsen till nuvarande neutrala. Om marknaden handlar ner priset under 415 går vi omedelbart över till negativ vy igen, annars håller vi fast vid det neutrala. Jag tror inte man bör vara lång raps, så har man raps som inte är prissäkrat bör man överväga att göra det.

Gris

Grispriset (Maj 13) vände ner igen, precis som vi skrev förra veckan. Prisuppgången i början på mars får vi än så länge betrakta som en rekyl mot den i det större perspektivet fallande trenden.

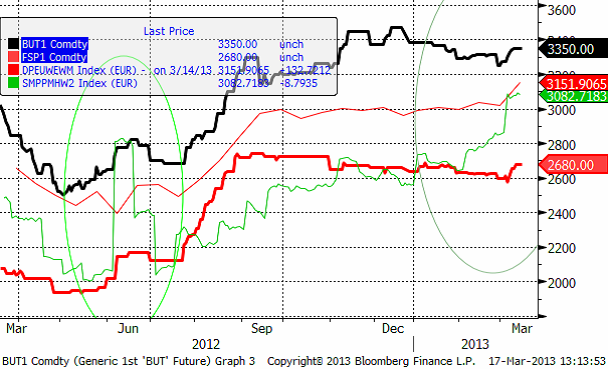

Mjölk

Resultatet för Fonterras auktion presenteras på tisdag. I februari började det priset stiga ordentligt, från 2600 euro per ton till 3082 euro per ton. Den senaste veckan har vi också sett att priserna på Eurex stigit något, men inte alls i samma utsträckning som Fonterra auktionens pris.

I kursdiagrammet nedan ser vi fyra kurvor, som förra veckan. Överst har vi smör i euro per ton, alla är i euro per ton. Den tunna röda linjen USDA:s notering för SMP i västra Europa. Den feta röda linjen är terminspriset på SMP på Eurex, som avser snittpriset på SMP i Tyskland, Holland och Frankrike. Den gröna linjen är Fonterras auktionspris på SMP.

SEB Commodities erbjuder ett litet ”prova-på” kontrakt som består av 0.5 ton Eurex-smör och 0.9 ton Eurex SMP. Ett paket som motsvarar 10 ton flytande mjölkråvara. Just nu är det underliggande värdet på ett sådant kontrakt drygt 33 000 kronor.

Den som vill följa priset på SMP på Eurex gör det via länken:

www.eurexchange.com/exchange-en/products/com/agr/14016/

Vi har säljrekommendation på mjölkterminer.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Tightening fundamentals – bullish inventories from DOE

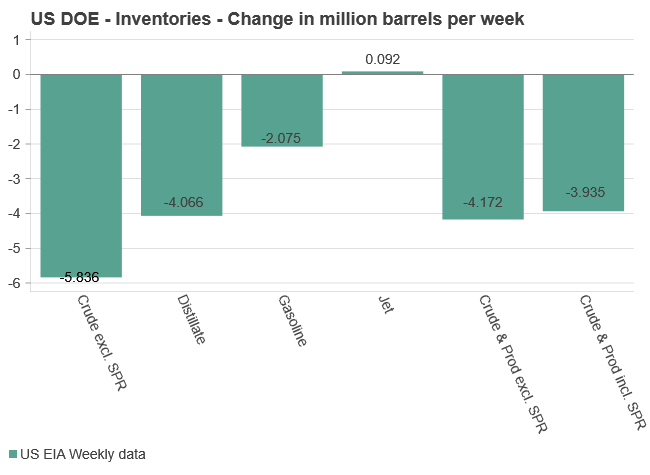

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

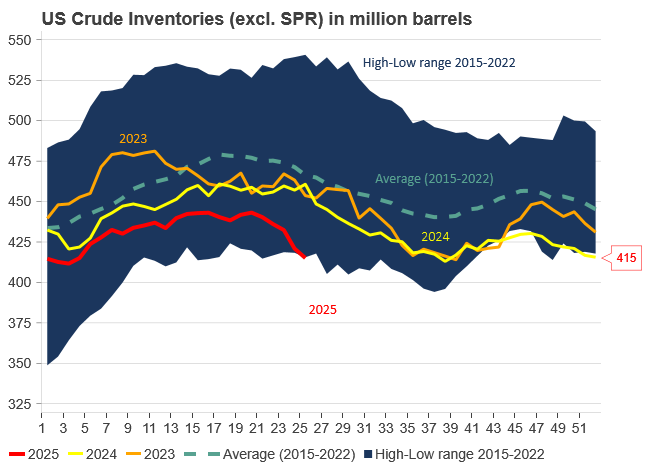

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras